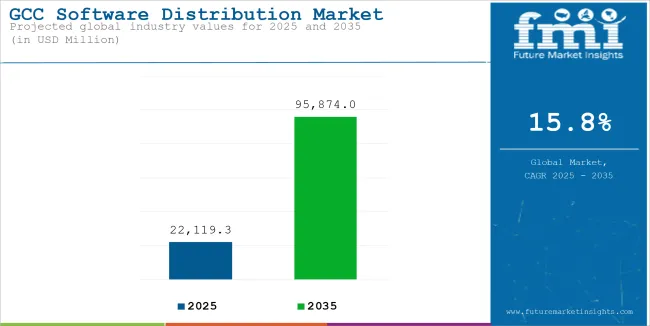

The GCC software distribution market is poised for significant growth in the coming decade, driven by rapid digital transformation, increased adoption of cloud computing, and expansion in key industry verticals such as BFSI, healthcare, and retail. The market is projected to reach USD 22,119.3 million in 2025 and will continue expanding at a CAGR of 15.8%, reaching USD 95,874.0 million by 2035.

| Attributes | Values |

|---|---|

| Estimated GCC Market Size in 2025 | USD 22,119.3 million |

| Projected GCC Market Size in 2035 | USD 95,874.0 million |

| Value-based CAGR from 2025 to 2035 | 15.8% |

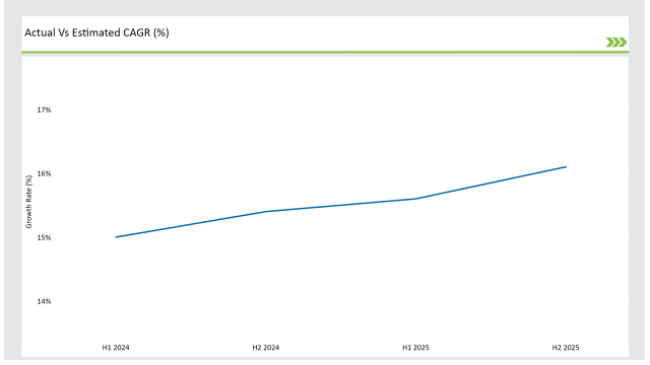

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 15.0% (2024 to 2034) |

| H2 2024 | 15.4% (2024 to 2034) |

| H1 2025 | 15.6% (2025 to 2035) |

| H2 2025 | 16.1% (2025 to 2035) |

According to the CAGR of software distribution market in the GCC region over semi-annuals-focusing on studies done up till 2023- the market from an external view shows scalability. The increase in H2 2024 (15.4%) representation by 40 BPS from H1 2024 (15.0%) implies a stronger demand, whereas the slight decline in H1 2025 (15.6%) by 20 BPS signals short-term stabilization. Growth returned in H2 2025 (16.1%), a sign that investments in cloud-based solutions and enterprise software resumed.

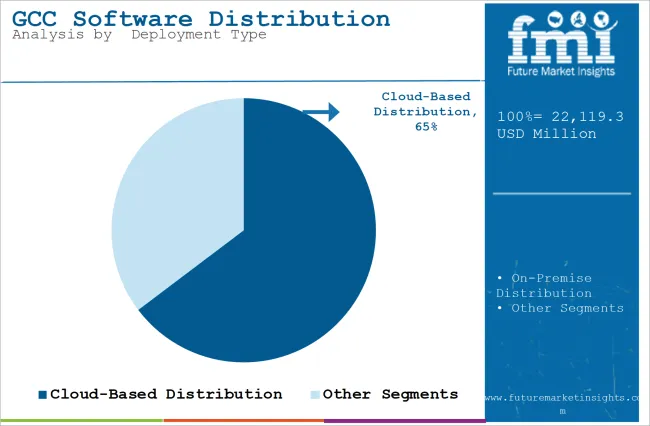

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based Distribution | 64.7% |

| On-Premise Distribution | 35.3% |

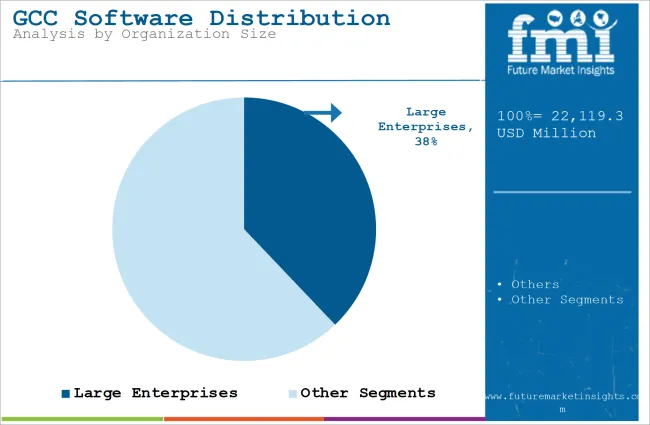

| Organization Size | Market Share (2025) |

|---|---|

| Large Enterprises | 37.9% |

| Others | 62.1% |

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Oracle opens a new cloud region in Saudi Arabia to meet growing demand. |

| Oct-24 | Microsoft Azure expands partnerships with UAE-based enterprises. |

| Mar-24 | SAP collaborates with Qatar's financial institutions to enhance digital banking. |

| Sep-24 | Bahrain launches a national AI strategy, increasing demand for AI-driven software distribution. |

| Dec-23 | The UAE announces a new cybersecurity framework, boosting demand for security software solutions. |

Cloud-Based Distribution Accelerating Market Growth

BFSI Sector Leading Digital Transformation

Expansion of Smart Cities and IoT Boosting Demand

Cybersecurity and Compliance Driving Software Adoption

| Countries | CAGR |

|---|---|

| Saudi Arabia | 18.5% |

| UAE | 17.6% |

| Rest of GCC | 13.9% |

Saudi Arabia's software distribution sector is expanding under Vision 2030 as the nation has been making all its efforts towards modernization and digitalization across all sectors. Government-backed initiatives such as the National Digital Transformation Programme are driving demand for cloud-based software solutions, enterprise applications, and cybersecurity software.

The rapid adoption of AI, IoT and big data analytics fuels the expansion in SaaS (Software-as-a-Service) and software enterprise distribution. As Kingdom also focus on smart cities and e-government services, the need of IT solutions and licensed software increases. Lastly, there is an increasing need for stable software distribution channels offered to global software vendors to lock into regional partnerships, especially with the emerging e-commerce and fintech ecosystem in Saudi Arabia.

The cloud-first approach of the UAE coupled with its robust IT infrastructure and growing pace of business digitalization makes the UAE’s software distribution market flourishing. Dubai and Abu Dhabi are regional tech hubs for global software vendors and SaaS providers. With startups and SMEs increasing significantly year on year and support from government-backed initiatives like Dubai Future Foundation and Abu Dhabi Hub71, the demand for affordable, scalable software solutions is skyrocketing.

These industries do not operate without licensed software and cloud-based platforms to perform their duties, making it a critical enabler for the growing fintech, e-commerce and logistics sectors. Moreover, the UAE’s focus on cybersecurity regulations and the implementation of AI-powered digital services are driving the need for secure software distribution networks across various industries.

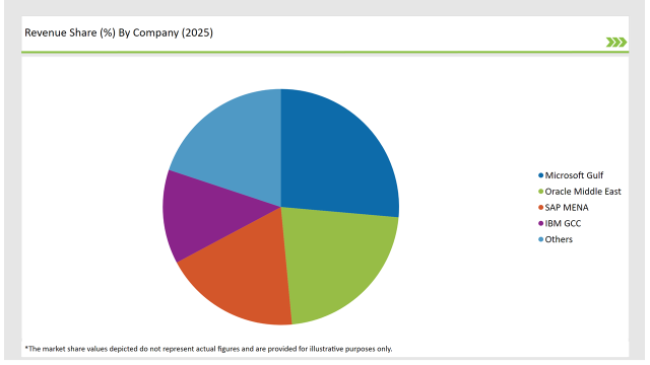

| Vendors | Market Share (2025) |

|---|---|

| Microsoft Gulf | 26.4% |

| Oracle Middle East | 22.3% |

| SAP MENA | 18.7% |

| IBM GCC | 12.9% |

| Others | 19.9% |

The market will grow at a CAGR of 15.8% from 2025 to 2035.

The industry will reach USD 95,874.0 million by 2035.

Key drivers include cloud adoption, digital transformation in BFSI and healthcare, and increased cybersecurity regulations.

Saudi Arabia and the UAE lead in software adoption due to their advanced digital infrastructure and enterprise growth.

The major players include Microsoft Gulf, Oracle Middle East, SAP MENA, and IBM GCC, among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GCC Countries Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

GCC Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food & Beverage Market Size and Share Forecast Outlook 2025 to 2035

GCC Natural Gas Market Size and Share Forecast Outlook 2025 to 2035

GCC Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

GCC Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GCC Medical Gloves Market Trends - Growth, Demand & Forecast 2025 to 2035

GCC Countries Coated Fabrics Market Size, Share, Trends, and Forecast 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

GCC Automotive Turbocharger Market Trends – Growth, Demand & Forecast 2025–2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

GCC Green and Bio-based Polyol Market Trends – Growth, Demand & Forecast 2025–2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

GCC Barite Market Trends – Growth, Demand & Forecast 2025–2035

GCC 1,4-Diisopropylbenzene Market Report – Trends, Demand & Industry Forecast 2025–2035

GCC Yacht Charter Service Market Analysis – Trends & Forecast 2025 to 2035

GCC Flare Gas Recovery System Market Report – Trends, Demand & Industry Forecast 2025–2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA