The coated fabrics market in the GCC (Saudi Arabia, UAE, Kuwait, Oman, Qatar, Bahrain) is projected to grow from USD 620 million in 2025 to USD 925 million by 2035, expanding at a CAGR of 4.1% over the forecast period. Among the GCC countries, Saudi Arabia is anticipated to be the largest market due to its sizable industrial and automotive sectors, while the UAE is expected to register the fastest growth owing to its expanding construction and infrastructure investments.

Growth in the GCC coated fabrics market is being driven by sustained demand from the automotive, construction, and industrial protective clothing sectors. The region's robust infrastructure development programs, such as Saudi Vision 2030 and large-scale real estate projects across the UAE and Qatar, are fueling demand for durable, weather-resistant fabrics. Additionally, rising automotive production and aftermarket upholstery needs are driving the uptake of coated fabrics.

However, market growth is moderately restrained by fluctuating petrochemical feedstock prices, which impact raw material costs. An emerging trend is the shift toward PU- and silicone-based coatings, which offer improved breathability and environmental compliance, particularly in high-temperature GCC environments. Industry players are actively investing in localizing production, enhancing fire-retardant and antimicrobial properties, and forming partnerships with original equipment manufacturers (OEMs) and public infrastructure agencies.

Between 2025 and 2035, the GCC coated fabrics market is expected to experience steady yet measured growth, primarily driven by public sector megaprojects and evolving safety regulations. As governments tighten standards around fire safety and building codes, demand for coated textiles with certified performance standards is likely to rise. Furthermore, with increasing tourism and hospitality investments, there will be greater use of coated fabrics in furniture, wall coverings, and outdoor applications. The market will also be shaped by regional manufacturing expansion, reduced dependency on imports, and a gradual shift toward eco-friendly coating technologies.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 620 million |

| Projected Value (2035F) | USD 925 million |

| Value-based CAGR (2025 to 2035) | 4.1% |

The GCC coated fabrics market is segmented based on application and material. By application, the key segments include commercial tents, furniture, industrial, protective clothing, and transportation. By material, the market is categorized into polymer coated and rubber coated fabrics.

The GCC coated fabrics market, when segmented by application, reveals five major end-use categories: commercial tents, furniture, industrial, protective clothing, and transportation. Among these, the transportation segment is expected to lead in both market share and growth rate during the forecast period, driven by rising demand for coated textiles in automotive seat covers, truck tarpaulins, and interior trim applications. Ongoing investments in public and private transport infrastructure, coupled with vehicle fleet expansions in Saudi Arabia and the UAE, are expected to sustain momentum in this segment.

Protective clothing is emerging as another fast-growing category, especially in sectors like oil & gas, construction, and manufacturing. Strict workplace safety norms and government mandates around flame-resistant and chemical-resistant gear are pushing demand for durable, coated materials. The industrial segment is projected to grow steadily, supported by the expansion of manufacturing hubs and warehouse facilities across GCC nations. In contrast, furniture and commercial tents are expected to witness more modest growth.

Demand for furniture-grade coated fabrics is closely tied to real estate trends and hospitality refurbishments, while commercial tents cater to event infrastructure, military use, and labor accommodations-sectors with cyclical and project-dependent procurement patterns.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Transportation | 5.00% |

In the GCC coated fabrics market, segmentation by material includes polymer coated and rubber coated fabrics. Polymer coated fabrics are expected to remain the dominant and fastest-growing material category throughout the 2025 to 2035 forecast period. This is largely due to their widespread usage across applications such as automotive interiors, protective clothing, tents, and industrial covers. These fabrics offer superior water resistance, flexibility, UV protection, and cost-effectiveness-features that make them highly suited to the GCC’s harsh climate conditions.

Rubber coated fabrics, on the other hand, are typically reserved for niche industrial applications where higher levels of abrasion resistance, chemical protection, and airtightness are required. Their usage is more common in oil & gas hoses, seals, and protective barriers. However, due to higher costs and heavier weight, rubber-coated variants are not as extensively adopted across mainstream applications. As a result, their growth is expected to remain relatively subdued in comparison to polymer-coated counterparts.

| Material Type | CAGR (2025 to 2035) |

|---|---|

| Polymer Coated | 4.30% |

The growth of the GCC coated fabrics market is primarily driven by the region’s infrastructure development boom, expanding automotive sector, and increasing worker safety regulations. Mega-projects such as Saudi Vision 2030, UAE’s Etihad Rail, and Qatar’s smart city initiatives are boosting demand for durable, weather-resistant, and flame-retardant coated textiles in construction, transport, and public infrastructure.

Additionally, the rising demand for automotive upholstery and interior trims is supporting volume growth. Government-backed industrial diversification and rising awareness of workplace safety are also pushing adoption in protective clothing and industrial covers.

Despite strong demand fundamentals, the market faces constraints such as volatile raw material prices-particularly PVC and polyurethane-due to their reliance on petrochemical feedstocks. This price instability makes long-term procurement planning difficult for manufacturers. Moreover, limited local manufacturing capabilities across some GCC nations result in import dependencies, increasing lead times and costs. Environmental concerns around traditional coatings, especially PVC, may also limit growth unless sustainable alternatives are widely adopted.

Several emerging trends are shaping the GCC coated fabrics market. There is growing interest in eco-friendly coating technologies, such as water-based PU and silicone coatings, driven by both regulatory push and end-user preference for low-emission materials. Smart fabrics with antimicrobial or self-cleaning properties are gaining traction, particularly in healthcare and hospitality.

The localization of production is also becoming a strategic priority, with several players investing in regional coating facilities to reduce import reliance and meet GCC-specific performance standards. Additionally, there's a visible move toward multi-layer composites for enhanced strength and versatility in extreme desert conditions.

Saudi Arabia is the largest market for coated fabrics in the GCC, accounting for a significant share due to its large-scale infrastructure investments and expansive industrial base. With flagship initiatives like Vision 2030, NEOM, and The Line, the country is creating sustained demand for durable coated materials in construction tarpaulins, commercial tents, and transport interiors. The government’s continued push to diversify the economy beyond oil has resulted in increased activity in logistics, manufacturing, and public infrastructure-all of which require coated textiles for insulation, protection, and structural applications.

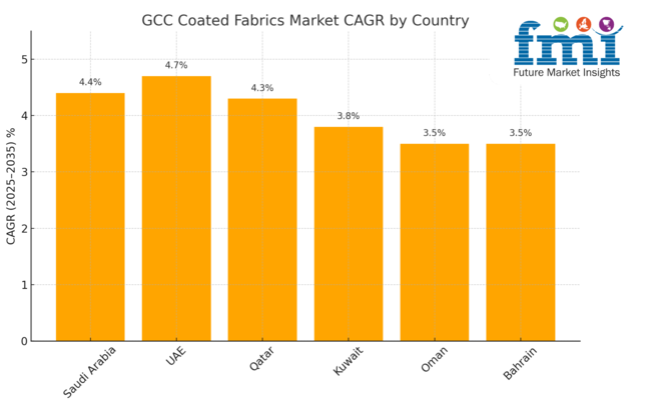

The automotive sector, particularly the aftermarket for seat covers and interiors, also contributes strongly to coated fabric demand. Additionally, Saudi Arabia’s large oil & gas sector is a major user of protective clothing made with coated materials that offer chemical and flame resistance. Between 2025 and 2035, the coated fabrics market in Saudi Arabia is expected to grow at a CAGR of 4.4%, reflecting steady and broad-based consumption growth.

The UAE is projected to be the fastest-growing coated fabrics market in the GCC, supported by a strong pipeline of construction, hospitality, and transport projects. Demand for coated fabrics is particularly high in Dubai and Abu Dhabi, where world-class infrastructure projects continue to attract foreign investment. Post-Expo 2020 developments, ongoing metro and road expansions, and premium real estate refurbishments are fueling usage of coated textiles in awnings, furniture, and transit seating.

In the automotive sector, a rising number of luxury and commercial vehicles have increased demand for interior coated fabric components. The UAE is also seeing increased usage of coated fabrics in marine applications, especially in ports, yachts, and offshore facilities. Additionally, high tourism and hospitality turnover is creating cyclical demand for coated textiles in hotels and resorts for both functional and aesthetic uses. The market in the UAE is forecast to expand at a CAGR of 4.7% between 2025 and 2035.

Qatar’s coated fabrics market continues to expand, driven by the post-World Cup infrastructure utilization and continued investment in transport and public facilities. The Doha Metro, Hamad Port, and upgrades in stadiums and accommodations are contributing to demand for weather-resistant and fire-retardant coated textiles. The construction of labor camps, event facilities, and urban mobility solutions has led to rising use of commercial tents and industrial-grade coverings.

The Qatari government’s commitment to building a diversified, high-standard infrastructure has pushed both public and private sectors to adopt international safety and performance standards, thus increasing demand for certified coated fabrics in protective clothing and industrial environments. The healthcare and hospitality sectors are also adopting antimicrobial and easy-to-clean coated surfaces. While relatively smaller in size compared to Saudi Arabia or the UAE, Qatar’s market is growing at a healthy pace with a projected CAGR of 4.3% from 2025 to 2035, indicating strong, targeted demand.

Kuwait’s coated fabrics market is characterized by moderate but steady growth, driven by gradual industrial recovery and infrastructure renovation projects. While it does not match the scale of Saudi Arabia or the UAE, Kuwait has shown increasing adoption of coated fabrics in oil & gas protective gear, transport interiors, and temporary structures like commercial tents. The country’s long-standing focus on hydrocarbon production ensures consistent demand for flame-resistant and chemical-resistant materials, particularly in protective clothing and industrial equipment covers.

Kuwait’s plans to upgrade its logistics and industrial zones are likely to create additional demand for coated fabrics in warehousing, storage, and vehicle fleet support. However, the pace of growth is tempered by bureaucratic delays in public projects and limited private sector diversification. The CAGR for Kuwait’s coated fabrics market is forecast at 3.8% during the 2025 to 2035 period, reflecting a market that is growing cautiously but is backed by consistent end-use sectors.

Oman’s coated fabrics market is relatively small but stable, primarily driven by port modernization, industrial expansion, and marine applications. The country’s major ports-Duqm and Sohar-require coated textiles in warehouses, marine tarpaulins, and offshore safety gear. Additionally, Oman’s focus on logistics and transshipment infrastructure has created niche demand for coated fabrics in cargo handling and protection. In the domestic sector, ongoing investments in tourism and hospitality, especially in eco-resorts and outdoor accommodation, are supporting demand for coated materials in furniture, tents, and upholstery.

However, the market faces challenges such as slower real estate growth and lower project volume compared to its larger neighbors. Despite this, government-driven diversification and improved transport infrastructure are supporting stable demand. From 2025 to 2035, the Omani coated fabrics market is projected to grow at a CAGR of 3.5%, driven by its maritime economy and selective infrastructure investments.

Bahrain, while the smallest coated fabrics market in the GCC, maintains steady demand across construction, events, and hospitality sectors. The country’s strong financial services industry supports commercial real estate, driving need for coated textiles in furniture, partitions, and public spaces. Bahrain also hosts numerous cultural and sporting events, which creates cyclical demand for temporary structures and coated tents. Additionally, the government has made investments in modernizing public housing, hospitals, and schools, which indirectly contributes to demand for flame-retardant and easy-clean coated fabrics.

The industrial sector, though limited, requires protective materials for workers and equipment-particularly in aluminum smelting and logistics handling. Given its smaller project scale and import dependency, Bahrain’s market is growing modestly. The expected CAGR from 2025 to 2035 is 3.5%, reflecting a balanced outlook supported by selective infrastructure development and refurbishments in the built environment.

In this report, Tier 1 players refer to globally recognized coated fabric manufacturers with broad product portfolios, vertically integrated operations, and established distribution across the GCC. Tier 2 players include regional manufacturers and large importers with focused offerings and localized distribution strength. Tier 3 players are niche or specialized firms, often catering to specific segments such as protective clothing or marine applications.

The GCC coated fabrics market is moderately fragmented, with a mix of global multinationals and regionally embedded suppliers. While international players dominate the polymer-coated fabric category due to their technical expertise and economies of scale, several local and regional firms are gaining ground, especially in niche applications like tent fabrics, truck covers, and oilfield safety gear. Imports continue to fulfill a significant portion of the demand, particularly in Bahrain and Oman, where local production capacities are limited.

However, countries like Saudi Arabia and the UAE are witnessing an increasing shift toward localized production, with new coating lines being commissioned to meet rising demand and reduce logistical lead times.

Tier 1 players largely steer innovation and compliance standards in the market. They supply to high-volume applications such as automotive interiors, public transport, and building materials. Their dominance is maintained through strategic partnerships with OEMs, multi-country distribution agreements, and investments in fire-retardant, antimicrobial, and UV-resistant coatings. That said, Tier 2 and Tier 3 players play a vital role in catering to price-sensitive buyers and quick-turnaround orders, especially for event infrastructure and industrial equipment covers.

Recent strategic moves in the region highlight the growing interest in sustainability, localization, and customization. For example, Serge Ferrari introduced a new range of recyclable composite membranes used in tensile structures across UAE hospitality projects. Saint-Gobain has expanded its technical textile offerings into Middle Eastern construction.

Mehler Texnologies, a Freudenberg brand, continues to supply architectural and mobility-grade PVC-coated materials across GCC ports and transit hubs. Meanwhile, regional players are investing in green coating technologies to comply with increasingly strict emission and safety regulations, especially in Saudi Arabia and Qatar.

| Attributes | Details |

|---|---|

| Market Size (2025E) | USD 620 million |

| Market Size (2035F) | USD 925 million |

| CAGR (2025 to 2035) | 4.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Base Year | 2024 |

| Segments Covered | By Application: Commercial Tents, Furniture, Industrial, Protective Clothing, Transportation By Material: Polymer Coated, Rubber Coated |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Key Companies Analyzed | Serge Ferrari, Saint-Gobain, Mehler Texnologies, and leading regional manufacturers |

| Report Coverage | Market sizing, segment-wise analysis, country-level insights, competitive landscape, and forecasts |

On the basis of Application, the GCC Coated Fabrics Market is categorized into commercial tents, furniture, industrial, protective clothing, transportation, and others.

On the basis of Material, the GCC Coated Fabrics Market is categorized into polymer coated, rubber coated, and others.

The GCC coated fabrics market is expected to reach USD 925 million by 2035, up from USD 620 million in 2025, expanding at a CAGR of 4.1% during the forecast period.

Saudi Arabia leads the GCC coated fabrics market due to its large-scale infrastructure projects, industrial activity, and high automotive demand.

Key applications include transportation, protective clothing, industrial covers, commercial tents, and furniture upholstery, with transportation being the largest and fastest-growing segment.

Polymer-coated fabrics dominate the GCC market because of their durability, cost-efficiency, and broad usage across industrial, construction, and automotive sectors.

Demand is driven by infrastructure megaprojects, rising safety regulations, growth in automotive interiors, and localized manufacturing investments across Saudi Arabia, UAE, and Qatar.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GCC Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food & Beverage Market Size and Share Forecast Outlook 2025 to 2035

GCC Natural Gas Market Size and Share Forecast Outlook 2025 to 2035

GCC Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

GCC Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GCC Medical Gloves Market Trends - Growth, Demand & Forecast 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

GCC Automotive Turbocharger Market Trends – Growth, Demand & Forecast 2025–2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

GCC Green and Bio-based Polyol Market Trends – Growth, Demand & Forecast 2025–2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

GCC Barite Market Trends – Growth, Demand & Forecast 2025–2035

GCC 1,4-Diisopropylbenzene Market Report – Trends, Demand & Industry Forecast 2025–2035

GCC Yacht Charter Service Market Analysis – Trends & Forecast 2025 to 2035

GCC Flare Gas Recovery System Market Report – Trends, Demand & Industry Forecast 2025–2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Active Spoiler Market Trends – Growth, Demand & Outlook 2025-2035

GCC Special Interest Tourism Market Report – Trends, Innovations & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA