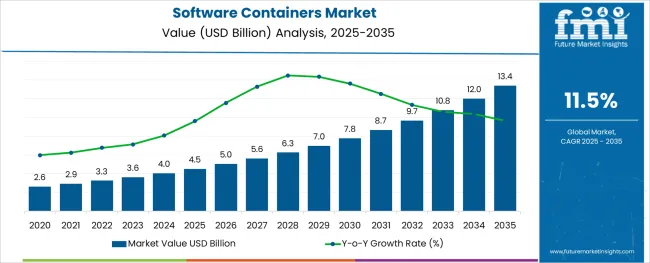

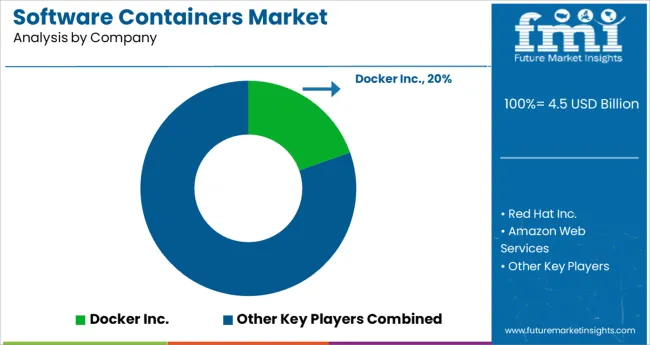

The Software Containers Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

The software containers market is experiencing rapid evolution as organizations prioritize agility, scalability, and efficient resource utilization in application development and deployment. Demand has surged due to the widespread shift toward microservices architecture and cloud-native application strategies. Containers are enabling consistent runtime environments across development, testing, and production, reducing deployment friction and accelerating time to market.

The adoption of Kubernetes orchestration, DevOps practices, and continuous integration and delivery pipelines has further entrenched containers as a cornerstone of modern IT infrastructure. Enterprise focus on portability across hybrid and multi-cloud environments is encouraging investment in standardized container platforms.

Meanwhile, open-source innovations and support from major cloud providers are fostering an ecosystem conducive to expansion. Looking forward, as cybersecurity, observability, and compliance become integral to container management, investments in robust container lifecycle tools are expected to unlock new efficiencies and expand market footprint across sectors.

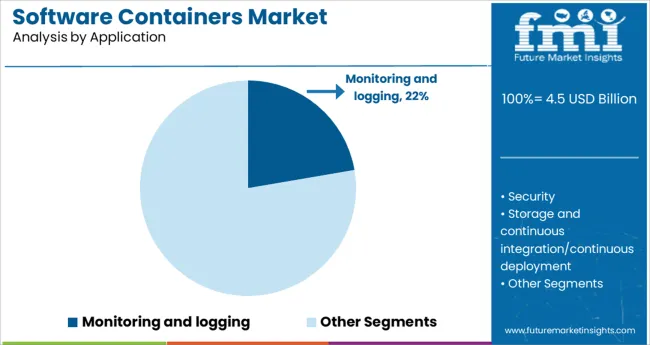

The market is segmented by Application and region. By Application, the market is divided into Monitoring and logging, Security, Storage and continuous integration/continuous deployment, Management and orchestration, Networking and data management services, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Application and region. By Application, the market is divided into Monitoring and logging, Security, Storage and continuous integration/continuous deployment, Management and orchestration, Networking and data management services, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Monitoring and logging is anticipated to account for 22.3% of the software containers market revenue in 2025, making it a leading application area within the segment. The dominance of this segment is attributed to the growing complexity of containerized environments, where dynamic scaling and service interdependencies demand real-time observability. Organizations are increasingly prioritizing visibility into container performance, application health, and infrastructure behavior to ensure reliability and uptime.

Centralized logging and distributed tracing tools are being integrated directly into container workflows, enabling proactive issue resolution and system optimization. Security and compliance initiatives are also contributing to demand, as audit trails and runtime metrics are essential for governance in regulated environments.

Cloud-native observability platforms tailored for containers are being deployed at scale, supporting performance benchmarking, anomaly detection, and SLA adherence. These capabilities have established monitoring and logging as a strategic necessity, positioning the segment for continued growth and investment.

The adoption of software containers has been on a rising trajectory. With cloud computing becoming more mainstream, companies are rapidly adopting software containers to improve the overall efficiency of the application.

As all application files and necessary infrastructure are kept in one location and can be deployed consistently across any environment, software containers also offer cost savings by lowering hardware expenses, spiking the demand for the same. The inclination of market players toward software containers can also be owed to the fact that they provide consistency in the environment, swaying the adoption trends of software containers.

The market is also positively influenced by the track of different versions of application code, which can help inspect the difference between several versions. On the flip side, one of the major challenges dwindling the software containers market size is persistent storage which occurs when containers running databases are used in production setups.

Furthermore, the software containers market is likely to dip on account of networking issues related to software containers.

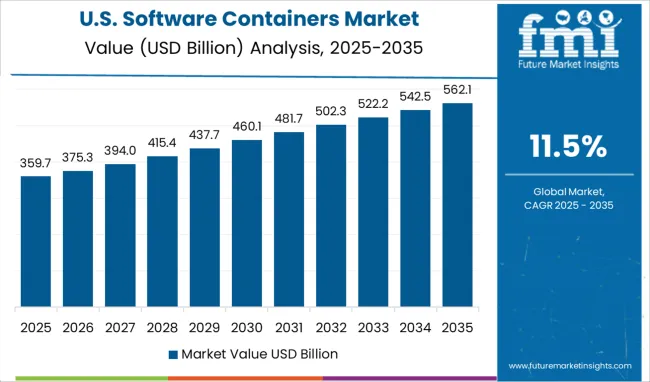

By 2025, North America is anticipated to dominate with a software containers market share of 27.3%.

Due to the aggressive adoption of cloud-native technologies in the area by vendors, as well as their cooperation with other technology providers, the USA significantly contributed to the market revenue.

For instance, Google Inc. partnered with hybrid cloud data services provider NetApp to gain high-performance and cloud-native storage capabilities.

In order to provide a brand-new, fully-managed cloud solution, Red Hat, Inc. and Atos Managed OpenShift (AMOS), a provider of digital services, announced their partnership.

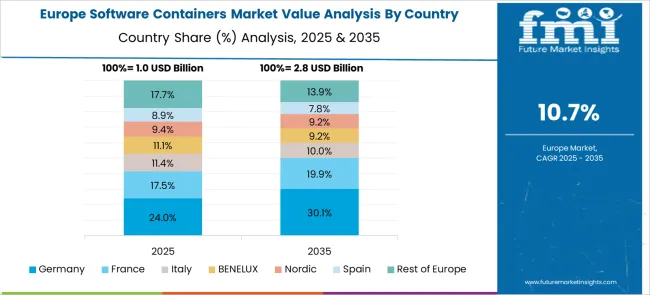

Due to the increasing preference of businesses for containers to update their IT infrastructure, the UK application container technology market is anticipated to lead the Europe market share of 19.4% in 2025.

The UK is anticipated to experience the fastest growth over the forecast period as a result of supportive government initiatives to encourage the adoption of cloud-based solutions.

Numerous cloud and data centre service providers are establishing cloud centres in Europe as a result of the strict regulations for the protection of data belonging to businesses operating in the European Union (EU). As a result, local businesses have accelerated their adoption of software containers to deploy their applications in the cloud effectively.

Software development has experienced a contagious level of excitement and innovation ever since Docker launched in 2013. Enterprises, IT professionals, start-ups, developers, members of the open-source community, ISVs, the largest public cloud vendors, and every tool in the software stack have all expressed support.

A sizable investment has also been made in the software containers market by Canonical, a start-up best known for its distribution of Ubuntu Linux. Canonical has focused its most inventive efforts on creating LXD, a container platform that supports different use cases.

The market is moderately competitive and one of the major software containers market trends prevailing is mergers and acquisition.

Recent trends in the software containers market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 11.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Application, Region |

| Regions Covered | North America; Latin America; Asia Pacific; The Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled |

Docker Inc.; CoreOS; Codenvy, Inc.; Google Inc.; Microsoft Corporation; Amazon Web Services; IBM Corporation; Red Hat, Inc.; VMware |

| Customization | Available Upon Request |

The global software containers market is estimated to be valued at USD 4.5 billion in 2025.

It is projected to reach USD 13.4 billion by 2035.

The market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types are monitoring and logging, security, storage and continuous integration/continuous deployment, management and orchestration, networking and data management services and others.

segment is expected to dominate with a 0.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

3PL Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA