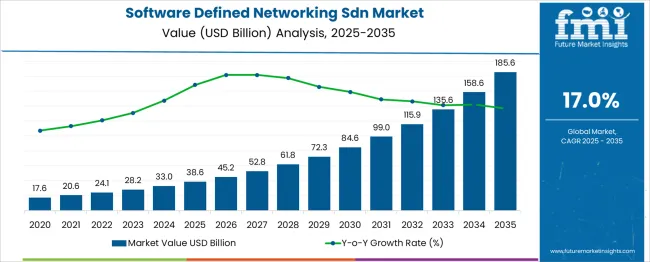

The Software-Defined Networking SDN Market is estimated to be valued at USD 38.6 billion in 2025 and is projected to reach USD 185.6 billion by 2035. The CAGR of 17.0% underscores robust expansion, but a closer examination of the year-on-year data reveals clear breakpoint patterns in growth velocity. From 2025 to 2028, the market advances from USD 38.6 billion to USD 61.8 billion, reflecting steady but moderate increments averaging around USD 5.4 billion annually. This phase suggests early adoption and gradual integration of SDN technologies across industries.

The breakpoint becomes apparent around 2029 when the market value crosses USD 72.3 billion. From 2029 to 2035, the growth accelerates sharply, with annual increments rising from approximately USD 7.6 billion to over USD 27 billion between 2034 and 2035. This acceleration highlights increasing enterprise deployment and technology maturity. Between 2031 and 2035, the market surges from USD 99 billion to USD 185.6 billion, marking the steepest growth phase.

This period accounts for nearly 47% of the total market expansion over ten years, indicating a critical inflection point where adoption shifts from early majority to mainstream penetration. The breakpoint analysis thus reflects a dual-phase growth pattern, with initial steady progression followed by a marked acceleration from 2029 onward, signaling intensifying demand and technological advancements within the SDN market.

| Metric | Value |

|---|---|

| Software-Defined Networking SDN Market Estimated Value in (2025 E) | USD 38.6 billion |

| Software-Defined Networking SDN Market Forecast Value in (2035 F) | USD 185.6 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The software defined networking (SDN) market is experiencing sustained growth due to increasing demand for network agility, automation, and scalable cloud-native infrastructure. Enterprises and service providers are investing in SDN to decouple network hardware from control logic, allowing centralized programmability and simplified operations.

The adoption of virtualization technologies and rising data center traffic are prompting a shift toward software-centric network architectures. Additionally, growing reliance on hybrid cloud environments, containerized workloads, and multi-tenant architectures is amplifying demand for network segmentation, dynamic provisioning, and policy-driven traffic control.

Industry momentum is also supported by 5G rollouts, edge computing expansion, and heightened emphasis on cybersecurity through micro-segmentation. The SDN ecosystem is expected to evolve with increased vendor interoperability, open APIs, and AI-powered network analytics to ensure greater flexibility and resilience in digital infrastructure.

The software-defined networking SDN market is segmented by component, end use, and geographic regions. The component of the software-defined networking SDN market is divided into Solutions and Services. In terms of end use, the software-defined networking SDN market is classified into Telecom service providers and enterprise cloud service providers. Regionally, the software-defined networking SDN industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

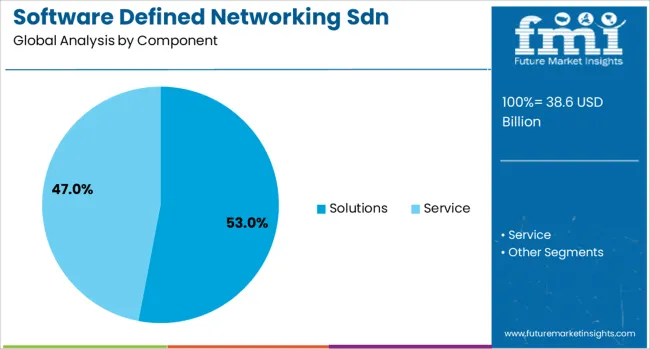

Solutions are projected to contribute 53.0% of total revenue in the software-defined networking market by 2025, making them the leading component segment. The widespread deployment of SDN controllers, orchestration platforms, and policy enforcement software is driving this segment’s dominance.

These tools offer dynamic control over traffic routing, bandwidth allocation, and virtual network functions, which are essential in modern, cloud-driven environments. Organizations are prioritizing these solutions to streamline infrastructure management, reduce network complexity, and enable real-time visibility.

The capability to integrate seamlessly with cloud orchestration tools and support multi-vendor environments has further reinforced adoption. As digital transformation accelerates across sectors, scalable and interoperable SDN solutions are being positioned as core enablers of flexible, secure, and automated networking.

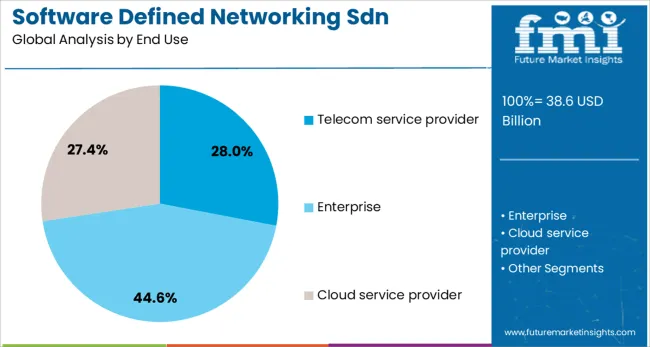

Telecom service providers are expected to account for 28.0% of the overall market revenue in 2025, making them the largest end-use segment in the SDN market. This leadership is being shaped by the sector’s need to modernize legacy infrastructure and reduce operational expenditure while managing massive data volumes and complex user demands.

SDN enables telecom providers to build programmable networks that support dynamic service provisioning, traffic optimization, and network slicing—key capabilities required for 5G and next-gen broadband services. The migration to virtualized network functions (VNFs) and software-defined WANs has accelerated SDN implementation across carrier-grade networks.

Additionally, regulatory pressure to improve the quality of service and customer experience is pushing telecom operators to adopt SDN for real-time analytics, faster provisioning, and centralized policy control. As telecom networks evolve into intelligent, service-oriented architectures, SDN is expected to remain a foundational technology.

The software defined networking market has been expanding rapidly as enterprises and service providers seek to enhance network flexibility, scalability, and operational efficiency. Network virtualization, centralized management, and dynamic traffic control have been enabled through SDN architectures that decouple the control plane from the data plane. Growing adoption of cloud computing, data center expansion, and increasing demand for bandwidth-intensive applications have driven deployment. SDN has facilitated simplified network provisioning, rapid service innovation, and cost optimization. Integration with automation tools and orchestration platforms has further accelerated adoption across telecom, enterprise, and hyperscale cloud environments.

Operational efficiency has been improved significantly through the centralized control and programmability offered by SDN solutions. Network administrators have leveraged centralized controllers to automate configuration, policy enforcement, and fault management across diverse network devices. This has reduced manual intervention, minimized configuration errors, and shortened deployment cycles. Dynamic network resource allocation and load balancing have optimized bandwidth utilization. The use of open APIs and programmable interfaces has enabled seamless integration with third-party applications and software-defined infrastructure components. Enterprises managing hybrid networks have benefited from unified visibility and control, enhancing troubleshooting and performance monitoring. These capabilities have been critical in supporting evolving network demands and service-level agreements.

Network virtualization has played a central role in SDN’s market growth by enabling the abstraction of physical resources into logical networks. Virtualized network overlays have supported multi-tenant environments, isolated network segments, and rapid provisioning of new services without physical reconfiguration. SDN controllers have facilitated the creation, modification, and deletion of virtual networks through software commands, supporting agile infrastructure strategies. This approach has been essential for cloud data centers and service providers managing elastic workloads and dynamic traffic patterns. Virtual network functions (VNFs) and network function virtualization (NFV) technologies have been integrated with SDN to further enhance service flexibility and cost efficiency. The ability to orchestrate complex network topologies programmatically has driven innovation in network design and deployment models.

The integration of SDN with emerging technologies such as 5G, edge computing, and artificial intelligence has expanded its application scope and value proposition. SDN has enabled network slicing in 5G environments, allowing operators to allocate dedicated resources for different use cases and service levels. Edge computing deployments have leveraged SDN for localized traffic management and reduced latency. AI-driven analytics and automation have been incorporated to predict network congestion, optimize routing, and enable self-healing capabilities. This fusion of technologies has supported the development of intelligent, adaptive networks capable of meeting the performance and security requirements of modern digital services. Collaborative efforts between SDN vendors, telecom operators, and cloud providers have accelerated innovation and deployment cycles.

Security considerations have been integral to the evolution of SDN architectures, with enhanced policy enforcement and threat detection capabilities embedded within the control framework. SDN controllers have been utilized to implement dynamic access controls, micro-segmentation, and anomaly detection across the network fabric. Centralized management has allowed real-time monitoring and rapid response to security incidents, reducing attack surfaces. Integration with security information and event management (SIEM) systems has facilitated comprehensive threat intelligence sharing. Challenges related to controller vulnerabilities and distributed denial-of-service (DDoS) attacks have been addressed through redundant architectures and advanced authentication protocols. The ability to programmatically enforce security policies aligned with organizational compliance requirements has positioned SDN as a foundational technology for secure, agile network infrastructures.

| Country | CAGR |

|---|---|

| China | 23.0% |

| India | 21.3% |

| Germany | 19.6% |

| France | 17.9% |

| UK | 16.2% |

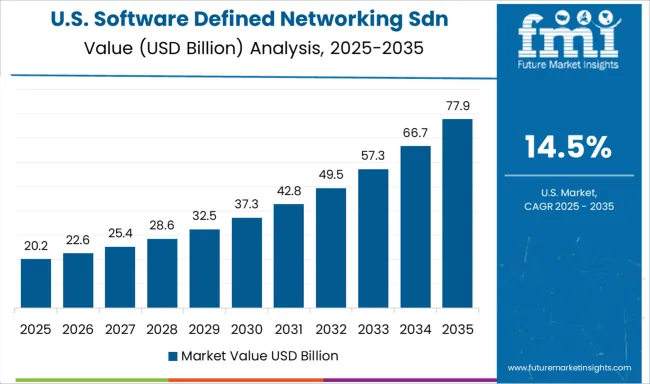

| USA | 14.5% |

| Brazil | 12.8% |

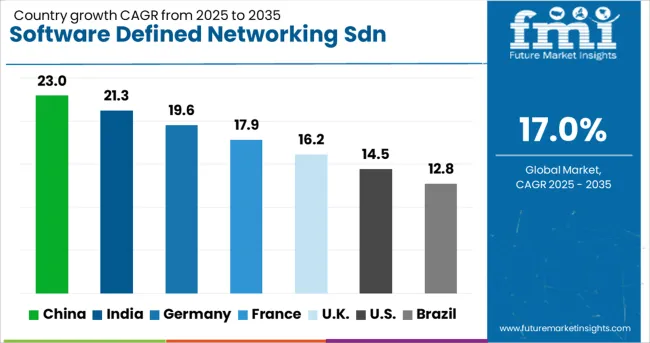

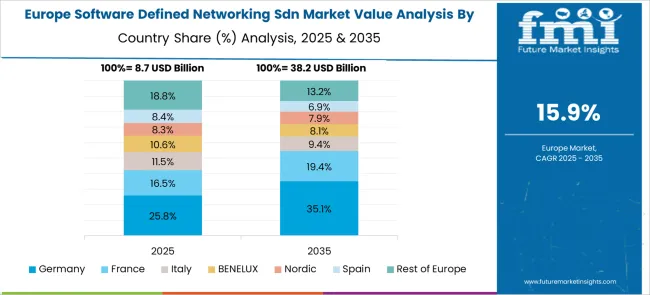

The software defined networking SDN market is expected to grow at a CAGR of 17.0% between 2025 and 2035, driven by rising demand for network agility, centralized management, and enhanced security features. China leads with a 23.0% CAGR, supported by rapid digital transformation initiatives and large-scale cloud infrastructure deployments. India follows at 21.3%, fueled by growing adoption in IT services and telecom sectors. Germany, at 19.6%, benefits from strong industrial automation and enterprise networking upgrades. The UK, projected at 16.2%, sees growth from data center modernization and software-defined infrastructure. The USA, at 14.5%, reflects steady demand from enterprise IT and government network enhancements. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecast to register a CAGR of 23.0% between 2025 and 2035 in the SDN market, fueled by rapid digital transformation initiatives in telecommunications and manufacturing industries. State-backed technology firms are advancing programmable network infrastructures to support 5G deployment and smart factory operations. Companies like Huawei and ZTE have prioritized integration of SDN controllers with AI-driven analytics to optimize network traffic and reduce operational expenditures. Data centers across coastal economic zones are undergoing SDN-enabled upgrades to improve scalability and cloud interconnectivity. The government’s focus on enhancing network resilience is also supporting the deployment of multi-domain SDN architectures.

India is expected to grow at a CAGR of 21.3% in the coming decade driven by increasing demand for network virtualization in IT services and cloud platforms. Leading service providers including Tata Communications and Wipro have integrated SDN frameworks into enterprise networking solutions to reduce latency and improve bandwidth utilization. Expansion of data center infrastructure in metropolitan regions is creating high demand for software-defined networking tools that support dynamic traffic orchestration. The government’s Digital India campaign has accelerated adoption in public sector networks and education institutes aiming for centralized network control and agility.

Germany is poised to register a CAGR of 19.6% with industries such as automotive manufacturing, logistics, and finance driving SDN integration for secure and flexible networking. SDN solutions are increasingly used to automate traffic flows and support virtualized network functions compliant with data protection standards. Key players such as Siemens and Deutsche Telekom are pioneering modular SDN platforms with embedded security orchestration. German enterprises are focusing on reducing network downtime and simplifying management through intent-driven automation within SDN environments. The rise of Industry 4.0 initiatives has further propelled SDN adoption across industrial campuses.

The United Kingdom is anticipated to achieve a CAGR of 16.2% as SDN becomes core to telecom infrastructure modernization and enterprise network security. Telecom operators and cloud service providers have prioritized programmable network layers to improve customer experience and enable real-time network slicing. SDN platforms supporting compliance with GDPR and NIS Directive are gaining traction among service providers and government agencies. Enhanced traffic monitoring and policy enforcement through SDN have become critical in healthcare and banking sectors. The integration of SDN with network function virtualization (NFV) is accelerating with joint deployments in metropolitan data centers.

The United States is expected to grow at a CAGR of 14.5% driven by adoption in hyperscale cloud providers, government agencies, and enterprise IT modernization projects. Companies such as Cisco, Juniper Networks, and VMware are expanding SDN offerings focused on scalability and automation. The market growth is supported by integration of SDN with AI for predictive network management and zero-trust security architectures. Financial services and technology sectors are early adopters, leveraging SDN for dynamic workload balancing and enhanced data center interconnectivity. Investments in edge computing have further stimulated demand for flexible software-controlled networking solutions.

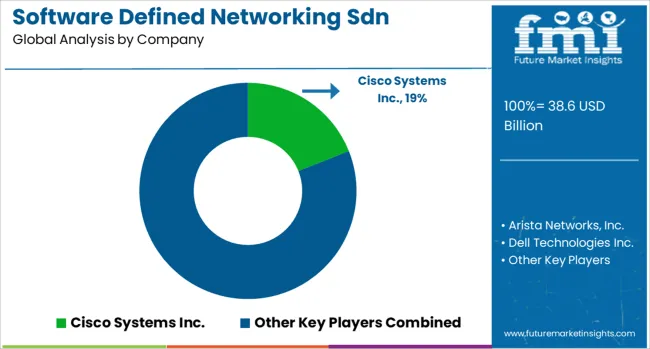

The competitive landscape of the software defined networking market is shaped by a mix of established networking giants and specialized vendors that are advancing programmable, policy driven, and cloud integrated network solutions. Cisco remains a dominant leader with its Application Centric Infrastructure and DNA Center, maintaining a stronghold across enterprise and telecom segments.

Juniper Networks, now under Hewlett Packard Enterprise, has bolstered its influence with Mist AI and Contrail platforms, allowing deeper automation and multicloud orchestration. VMware plays a central role with its NSX product line, catering to enterprises transitioning to hybrid cloud models.

Huawei and Nokia are leveraging SDN in large scale telecom rollouts, with strong presence in Asia and Europe, often supported by integration with 5G infrastructure. Smaller innovators such as Arista Networks, Pluribus Networks, and Big Switch Networks continue to compete by focusing on simplified deployment, open standards, and enhanced visibility.

Strategies across the landscape involve expanding AI driven automation, integrating SDN into edge and cloud platforms, and providing vertical centric offerings in finance, healthcare, and government. Competition is expected to intensify as enterprises demand flexibility, service providers move toward network slicing, and open source ecosystems reduce reliance on proprietary models. This fragmentation keeps innovation at the forefront.

Strategies in the SDN market are focused on building automation centric, scalable, and secure network ecosystems that can handle the increasing complexity of multi cloud and edge environments. Large vendors such as Cisco, Juniper, and HPE are investing heavily in acquisitions and partnerships to expand their SDN portfolios, as seen in HPE’s recent acquisition of Juniper to combine SDN with AI driven operations.

A parallel strategy involves the deep integration of SDN with 5G and upcoming 6G deployments, where service providers aim to deliver programmable network slices and low latency connectivity tailored for industrial, automotive, and IoT applications. Vendors are also prioritizing open source collaboration and standards alignment through projects like OpenDaylight and initiatives from the Open Networking Foundation, reducing vendor lock in and appealing to enterprises seeking flexible architectures.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.6 Billion |

| Component | Solutions and Service |

| End Use | Telecom service provider, Enterprise, and Cloud service provider |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems Inc., Arista Networks, Inc., Dell Technologies Inc., Hewlett Packard Enterprise Company (HPE), Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), Intel Corporation, Oracle Corporation, VMware, Inc., and ZTE Corporation |

| Additional Attributes | Dollar sales by solution type and deployment model, demand dynamics across data centers, enterprise networks, and service providers, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in network virtualization, orchestration platforms, and security integration, environmental impact of network energy consumption and hardware lifecycle, and emerging use cases in 5G network slicing, edge computing, and cloud-native service delivery. |

The global software-defined networking SDN market is estimated to be valued at USD 38.6 billion in 2025.

The market size for the software-defined networking SDN market is projected to reach USD 185.6 billion by 2035.

The software-defined networking SDN market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in software-defined networking SDN market are solutions, _physical network infrastructure, _sdn controller, _sdn application, service, _professional service and _managed service.

In terms of end use, telecom service provider segment to command 28.0% share in the software-defined networking SDN market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

High-Speed Connectivity – AI-Optimized Optical Networking

Multi-Cloud Networking Market Forecast Outlook 2025 to 2035

Intent-Based Networking IBN Market Size and Share Forecast Outlook 2025 to 2035

Time Sensitive Networking TSN Market Size and Share Forecast Outlook 2025 to 2035

Packet Optical Networking Market

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Virtual Dispersive Networking (VDN) Market Growth – Trends & Forecast 2025 to 2035

Software Defined Video Networking Market

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Multi-Cloud SDN Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA