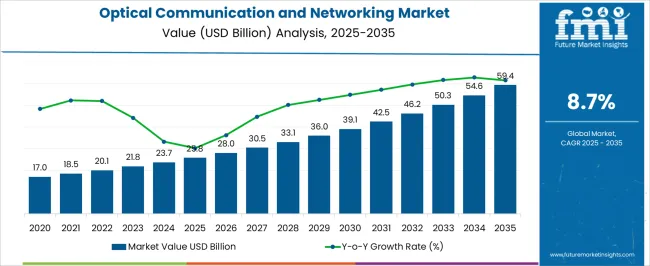

The optical communication and networking market, projected to grow from USD 25.8 billion in 2025 to USD 59.4 billion by 2035, demonstrates a compound annual growth rate (CAGR) of 8.7%. The market exhibits moderate growth volatility across the forecast period, with fluctuations in annual growth rates driven by technological advancements, regulatory developments, and changing demand dynamics.

Between 2025 and 2027, the market experiences stable growth, expanding from USD 25.8 billion to USD 28.0 billion. The growth rate during this phase is relatively consistent at around 8%, as demand for high-speed internet, 5G infrastructure, and advanced optical networks rises steadily across industries.

From 2027 to 2029, the market enters a phase of acceleration, growing from USD 28.0 billion to USD 33.1 billion. The growth rate volatility increases slightly, with annual growth reaching 10% in some years, driven by heightened investments in fiber-optic networks, cloud services, and data center infrastructure, as well as advancements in optical transceivers and networking components.

Between 2030 and 2035, the market experiences deceleration, reaching USD 59.4 billion by the end of the forecast period. The growth rate stabilizes at 6–8%, reflecting the maturity of the market as key regions deploy 5G and beyond. This phase sees reduced volatility, with steady demand from existing infrastructure upgrades and next-generation optical communication systems.

Data center operations encounter interconnection challenges as high-speed optical networking requires coordination between equipment rack deployment, cable management systems, and cooling infrastructure while managing signal integrity, power consumption, and maintenance accessibility. Network engineers work with facilities teams to establish fiber routing procedures while coordinating with equipment vendors about transceivers, multiplexing equipment, and monitoring systems that ensure both connectivity performance and operational reliability across varying traffic loads and service requirements.

Cross-functional coordination between network planning teams and construction operations creates ongoing dialogue about optical network architecture versus installation feasibility and cost optimization. Engineering departments work with field construction supervisors to evaluate fiber route options and equipment placement strategies while managing right-of-way considerations, underground installation procedures, and equipment housing requirements that affect both network design and deployment timelines across multiple project phases.

Service provider network operations experience maintenance complexity as optical systems require coordination between specialized testing equipment, spare parts inventory, and emergency response procedures while managing service level agreement compliance and customer impact assessment. Network operations centers coordinate with field technicians to establish fault detection and restoration procedures while working with customer service teams about outage communication and service credit management across diverse customer segments and service types.

Quick Stats for Optical Communication and Networking Market

| Metric | Value |

|---|---|

| Optical Communication and Networking Market Estimated Value in (2025 E) | USD 25.8 billion |

| Optical Communication and Networking Market Forecast Value in (2035 F) | USD 59.4 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The optical communication and networking market is witnessing sustained growth as enterprises and telecom operators increasingly transition toward high-speed, low-latency, and scalable communication infrastructures. The demand for faster data transmission, combined with the global rollout of 5G networks and the rise in hyperscale data centers, is accelerating the deployment of optical networking technologies. Advancements in photonic integration, signal modulation, and real-time optical switching have made it possible to manage escalating bandwidth requirements more efficiently.

Additionally, ongoing digital transformation across industries has heightened the need for secure and high-capacity connectivity, which is being fulfilled by evolving optical ecosystems. Governments and private sector stakeholders are investing in fiber optic networks to support future-ready digital economies, further boosting market growth.

The convergence of cloud computing, artificial intelligence, and edge data processing is also influencing the adoption of flexible, software-controlled optical solutions As a result, the market is expected to maintain a robust trajectory, shaped by evolving enterprise connectivity needs and continued innovation in optical technologies.

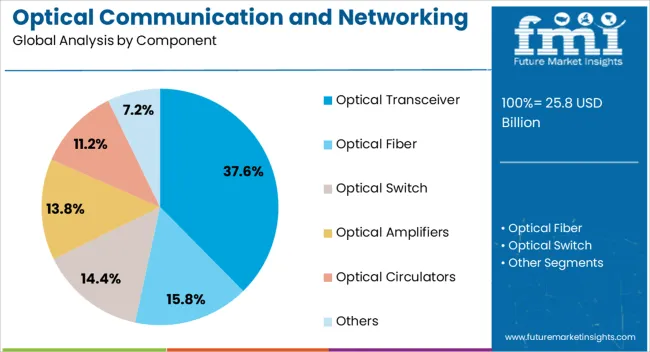

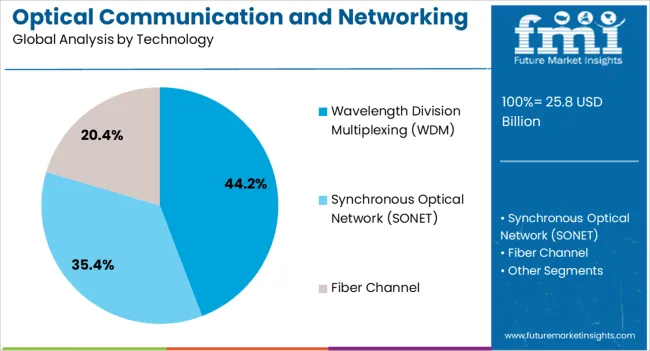

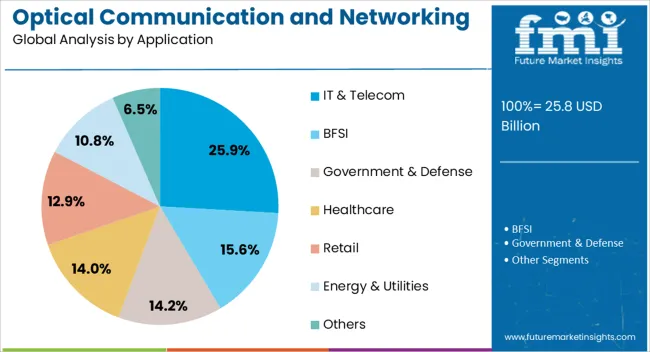

The optical communication and networking market is segmented by component, technology, application, and geographic regions. By component, optical communication and networking market is divided into Optical Transceiver, Optical Fiber, Optical Switch, Optical Amplifiers, Optical Circulators, and Others. In terms of technology, optical communication and networking market is classified into Wavelength Division Multiplexing (WDM), Synchronous Optical Network (SONET), and Fiber Channel. Based on application, optical communication and networking market is segmented into IT & Telecom, BFSI, Government & Defense, Healthcare, Retail, Energy & Utilities, and Others. Regionally, the optical communication and networking industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The optical transceiver segment is expected to account for 37.6% of the total revenue share in the optical communication and networking market in 2025, making it the leading component segment. The growth of this segment is being driven by the critical role optical transceivers play in enabling high-speed, high-density, and energy-efficient data transmission across optical networks.

These devices have become essential in bridging the gap between electrical and optical domains, particularly in data centers, metro networks, and long-haul systems. Enhanced demand for scalable network capacity and the increasing deployment of coherent optical modules have supported the widespread adoption of pluggable transceivers with higher transmission rates.

Technological advancements have also enabled cost reduction through improved integration, miniaturization, and power efficiency, further reinforcing their relevance in modern optical infrastructures Additionally, the rising preference for disaggregated networking equipment and open optical systems has contributed to the increasing uptake of standardized transceivers across both telecom and enterprise segments.

The wavelength division multiplexing technology segment is projected to capture 44.2% of the optical communication and networking market’s revenue share in 2025, reflecting its dominance in managing high data throughput. This leadership position is being supported by the ability of WDM technology to significantly increase the capacity of existing optical fiber networks without requiring additional physical infrastructure.

The growing need to transmit vast volumes of data over long distances, especially in backbone and metro networks, has positioned WDM as a foundational technology for modern optical systems. Its efficiency in separating optical signals by wavelength allows multiple channels to coexist on a single fiber, optimizing bandwidth usage and reducing latency.

The evolution of dense and coarse WDM variants has enabled tailored solutions for varying network loads, while improved tunability and spectral efficiency have made it a preferred option in scalable architectures As data demands continue to rise, WDM is expected to remain a central enabler in achieving efficient and future-proof network expansions.

The IT and telecom segment is estimated to hold 25.9% of the overall revenue share in the optical communication and networking market in 2025, establishing it as the dominant application segment. This growth is being propelled by the sector’s ongoing need for reliable, low-latency, and high-bandwidth communication to support massive data flows across core, metro, and access networks.

The deployment of 5G infrastructure, growth in fiber-to-the-home projects, and demand for seamless cloud connectivity have necessitated robust optical solutions that ensure scalability and high availability. Optical technologies are playing a pivotal role in enabling virtualized networks, cloud-native operations, and AI-driven network orchestration within telecom infrastructures.

Furthermore, hyperscale data center expansions and the adoption of software-defined networking in IT environments have underscored the importance of optical interconnects and transport networks As digital services continue to expand globally, the IT and telecom sector is anticipated to sustain high investment in optical communication frameworks to ensure resilient and future-ready connectivity.

The optical communication and networking market is experiencing significant growth, driven by the increasing demand for high-speed data transmission and the expansion of internet infrastructure. Optical networks, utilizing fiber-optic technology, offer superior bandwidth and reliability compared to traditional copper-based systems. This growth is further fueled by the proliferation of data centers, the rise of cloud computing, and the deployment of 5G networks, all of which require robust optical infrastructure to handle the escalating data traffic. As industries and consumers demand faster and more reliable internet services, the adoption of optical communication technologies is expected to continue its upward trajectory, positioning the market for sustained expansion in the coming years.

The increasing demand for high-speed internet services, driven by the proliferation of data-intensive applications such as video streaming, online gaming, and cloud computing, necessitates the deployment of advanced optical networks. Additionally, the rollout of 5G networks requires the establishment of high-capacity backhaul infrastructure, which is predominantly based on optical fiber technology. The expansion of data centers to support the growing volume of data and the need for efficient data transmission further drives the demand for optical communication solutions. Advancements in optical technologies, such as Wavelength Division Multiplexing (WDM), enable the transmission of multiple data streams over a single optical fiber, increasing the capacity and efficiency of optical networks.

Despite the promising growth prospects, the optical communication and networking market faces several challenges. The high cost of deploying optical fiber infrastructure, including the expenses associated with installation and maintenance, can be a significant barrier, especially in developing regions. Additionally, the complexity of integrating optical networks with existing legacy systems poses technical challenges, requiring substantial investment in research and development. The rapid pace of technological advancements necessitates continuous innovation to stay competitive, which can strain resources for companies operating in the market. Furthermore, regulatory hurdles and the need for standardization across different regions can impede the seamless deployment and interoperability of optical communication systems.

The development of next-generation optical technologies, such as silicon photonics and coherent optical systems, promises to enhance the performance and efficiency of optical networks. The increasing adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) in optical networks allows for more flexible and scalable network management, catering to the dynamic demands of modern applications. Moreover, the expansion of internet services in underserved regions offers significant growth potential for optical communication providers. Collaborations between telecom operators, technology providers, and governments can facilitate the deployment of optical infrastructure, bridging the digital divide and fostering economic development.

The integration of artificial intelligence (AI) and machine learning (ML) into optical networks enables intelligent traffic management, predictive maintenance, and enhanced network optimization. The shift towards edge computing and the Internet of Things (IoT) requires low-latency, high-bandwidth optical solutions to support real-time data processing and connectivity. Additionally, the growing emphasis on sustainability is driving the development of energy-efficient optical components and systems. The convergence of optical and wireless technologies, including the use of optical wireless communication (OWC) for short-range applications, is also gaining traction. These trends indicate a dynamic and evolving market, with continuous advancements driving the adoption and capabilities of optical communication technologies across various industries.

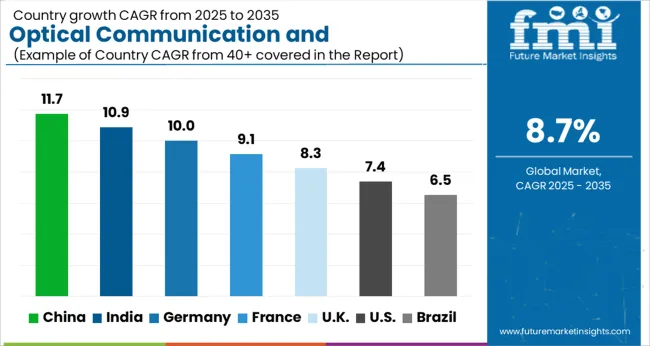

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

| USA | 7.4% |

| Brazil | 6.5% |

The global optical communication and networking market is projected to grow at a CAGR of 8.7% from 2025 to 2035. Among the key markets, China leads with a growth rate of 11.7%, followed by India at 10.9%, and France at 9.1%. The United Kingdom and the United States show more moderate growth rates of 8.3% and 7.4%, respectively. This growth is driven by the increasing demand for high-speed internet, 5G networks, and digital infrastructure. Emerging markets like China and India are experiencing faster growth due to their expanding telecommunications sectors, while developed markets such as the USA and the UK continue to experience steady demand driven by technological advancements and infrastructure upgrades. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global optical communication and networking market, growing at a projected CAGR of 11.7% from 2025 to 2035. The country’s rapid technological advancements in telecommunications and high-speed internet infrastructure are key drivers of this growth. China’s massive investments in 5G deployment, fiber-optic broadband networks, and smart city infrastructure are accelerating the demand for optical communication solutions. The ongoing digital transformation in industries such as manufacturing, healthcare, and transportation is increasing the need for robust networking solutions. As China continues to invest heavily in next-generation network technologies, the optical communication market is expected to see steady demand across various sectors, positioning the country as a global leader in the optical networking space.

The optical communication and networking market in India is projected to grow at a CAGR of 10.9% from 2025 to 2035. The growing adoption of high-speed internet and the expansion of 4G and 5G networks in urban and rural areas are key factors contributing to this growth. India’s focus on digital infrastructure, including the development of fiber-optic broadband and smart cities, is expected to further accelerate demand for optical communication solutions. The rise in internet penetration, coupled with the increasing need for high-speed, reliable data transfer, is expected to drive market expansion. With continued government initiatives and investments in technology, India’s optical communication market is poised for significant growth in the coming years.

The optical communication and networking market in France is expected to grow at a steady pace, with a projected CAGR of 9.1% from 2025 to 2035. The country’s investments in 5G networks, fiber-optic broadband infrastructure, and next-generation telecommunications technologies are driving demand for optical communication solutions. The commitment to expanding its digital infrastructure and improving connectivity across urban and rural areas further contributes to the market’s growth. As industries such as automotive, healthcare, and manufacturing continue to embrace digital transformation, the demand for high-speed, reliable optical communication networks will increase. With France’s ongoing focus on innovation and smart city development, the optical communication market is set for steady expansion.

The optical communication and networking market in the United Kingdom is projected to grow at a CAGR of 8.3% from 2025 to 2035. The UK’s strong focus on expanding 5G networks and high-speed internet connectivity is fueling the demand for optical communication solutions. As industries continue to adopt digital technologies and enhance their communication infrastructure, the need for efficient and reliable optical networking solutions will increase. The ongoing shift towards smart cities and the growing demand for cloud computing services are further accelerating market growth. As the UK continues to innovate in telecommunications and digital infrastructure, the optical communication market is set for steady growth, offering opportunities for both local and global players.

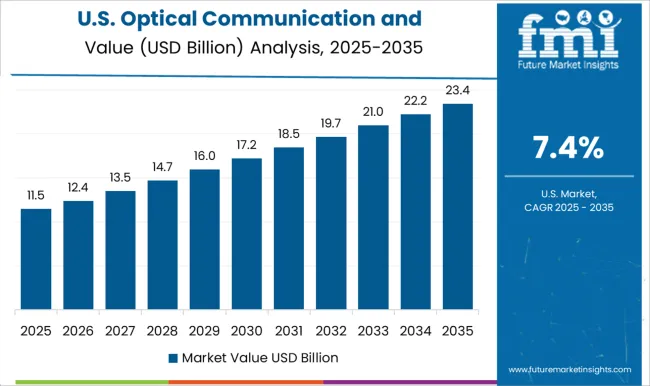

The optical communication and networking market in the United States is projected to grow at a CAGR of 7.4% from 2025 to 2035. The country’s strong demand for high-speed internet, 5G networks, and advanced telecommunications infrastructure is a significant driver of market growth. As industries such as healthcare, finance, and manufacturing continue to embrace digital technologies and data-intensive applications, the need for reliable, high-speed communication solutions will rise. The increasing adoption of smart city solutions and the expansion of fiber-optic networks will further boost the demand for optical communication technologies. The USA continues to lead in innovation, supporting the growth of the optical communication market with continuous investments in digital infrastructure.

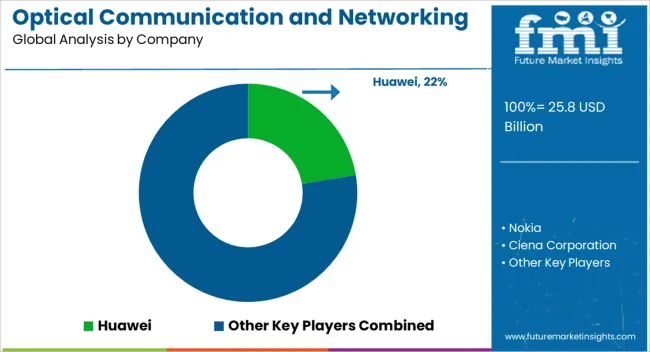

The optical communication and networking market is dominated by a group of global technology leaders providing high-speed, scalable, and energy-efficient networking solutions to meet the surging demand for broadband, 5G, cloud computing, and hyperscale data centers. The market is moderately consolidated, with major players competing through continuous innovation in fiber optics, wavelength division multiplexing (WDM), and software-defined networking (SDN) technologies.

Huawei Technologies Co. Ltd. leads globally with its comprehensive optical networking portfolio, supporting telecom operators and data centers with end-to-end transmission solutions, including DWDM, OTN, and optical access systems. Nokia Corporation maintains a strong market presence through its WaveFabric and WaveSuite platforms, designed to enhance 5G backhaul performance and cloud interconnectivity.

Ciena Corporation is a recognized leader in coherent optical technology and network automation, enabling scalable, high-capacity networks for global service providers. ZTE Corporation and FiberHome Telecommunication Technologies Co. Ltd. offer cost-efficient optical transmission solutions widely adopted across emerging telecom markets.

Fujitsu Limited and NEC Corporation focus on integrated optical systems and intelligent network management, providing robust, energy-efficient infrastructure for large-scale telecom and enterprise networks. Cisco Systems Inc. strengthens its position with optical transport and IP convergence solutions, while II-VI Incorporated and ADVA Optical Networking are key component and system suppliers driving advancements in optical transceivers, photonics, and open optical networking.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.8 Billion |

| Component | Optical Transceiver, Optical Fiber, Optical Switch, Optical Amplifiers, Optical Circulators, and Others |

| Technology | Wavelength Division Multiplexing (WDM), Synchronous Optical Network (SONET), and Fiber Channel |

| Application | IT & Telecom, BFSI, Government & Defense, Healthcare, Retail, Energy & Utilities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Huawei Technologies Co. Ltd., Nokia Corporation, Ciena Corporation, ZTE Corporation, Fujitsu Limited, Cisco Systems Inc., FiberHome Telecommunication Technologies Co. Ltd., NEC Corporation, II-VI Incorporated, ADVA Optical Networking |

| Additional Attributes | Dollar sales by product type (optical fiber, optical transceivers, optical switches, optical amplifiers) and end-use segments (telecom, data centers, enterprise networks, cloud services). Demand dynamics are driven by the increasing demand for high-speed internet, 5G infrastructure, and cloud computing services. Regional trends show strong growth in Asia-Pacific, North America, and Europe, fueled by investments in 5G networks, broadband infrastructure, and data center expansion. |

The global optical communication and networking market is estimated to be valued at USD 25.8 billion in 2025.

The market size for the optical communication and networking market is projected to reach USD 59.4 billion by 2035.

The optical communication and networking market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in optical communication and networking market are optical transceiver, optical fiber, optical switch, optical amplifiers, optical circulators and others.

In terms of technology, wavelength division multiplexing (wdm) segment to command 44.2% share in the optical communication and networking market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-Speed Connectivity – AI-Optimized Optical Networking

Packet Optical Networking Market

Package Shell for Optical Communication Modules Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Cold Joint Market Size and Share Forecast Outlook 2025 to 2035

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA