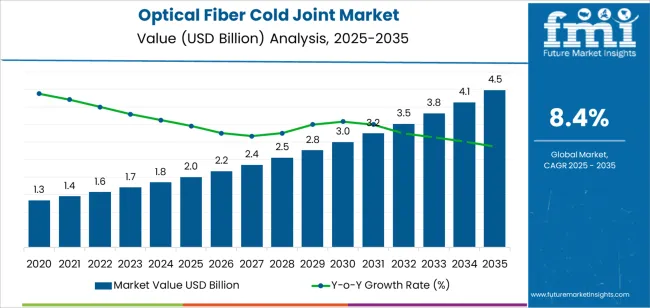

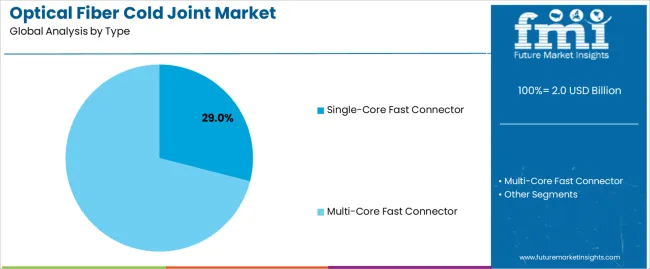

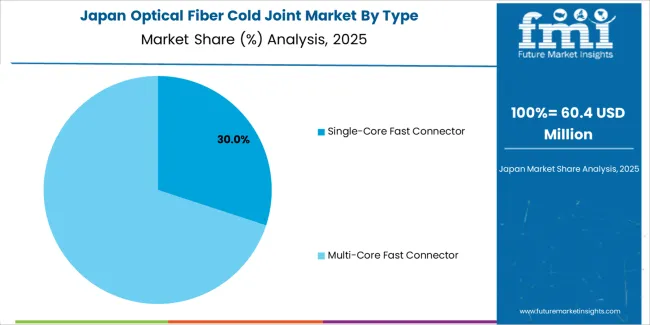

The optical fiber cold joint market expands from USD 2.0 billion in 2025 to USD 4.3 billion by 2035 at a CAGR of 8.4%, shaped primarily by segment-level demand patterns that determine installation scale, application fit, and network performance expectations. The single-core fast connector segment leads with 29.0% share, driven by its alignment with high-volume access-network requirements across FTTH, last-mile drops, and widespread maintenance activity. These units offer predictable insertion-loss performance, straightforward V-groove alignment, and rapid field assembly, making them the primary choice for telecom crews deploying subscriber lines, performing repairs, or enabling quick service activation without fusion splicing equipment. Multi-core fast connectors form the next key segment as dense fiber architectures grow in data-center interconnects, metro rings, and industrial networks requiring multi-fiber termination with reduced installation time and consistent optical behavior across cores.

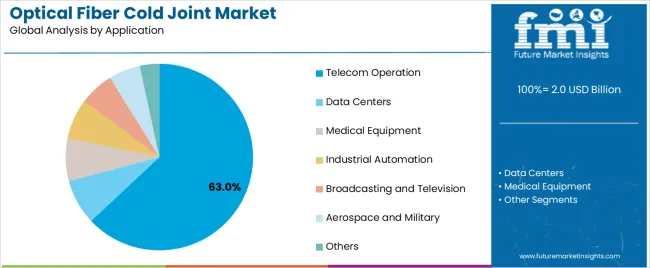

Application segmentation is dominated by telecom operations at 63.0%, reflecting heavy reliance on cold joints for distribution frames, cabinets, pole-mounted terminals, and drop-fiber routing. Telecom workflows demand connectors that minimize installation time, withstand outdoor environmental stressors, and maintain consistent insertion loss during widespread network buildout and restoration. Data centers are a fast-growing segment as operators adopt cold joints for modular cabinet interconnects, flexible routing, and rapid reconfiguration. Industrial automation, broadcasting, and military-grade communication applications require ruggedized joints with enhanced sealing, pull strength, and thermal stability.

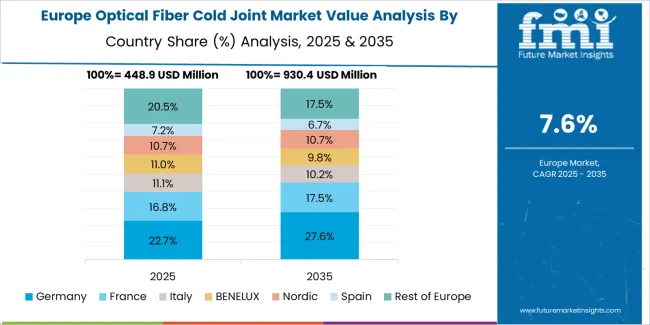

Asia Pacific leads global deployment, supported by large-scale broadband expansion programs and extensive fiber rollout across urban and rural corridors. North America and Europe maintain stable growth driven by data-center interconnection needs, fiber upgrades in transport networks, and ongoing modernization of legacy copper infrastructure. Through 2035, improved mechanical-splice precision, enhanced environmental sealing, and wider compatibility with high-bandwidth transmission standards are expected to sustain long-term market momentum.

Between 2025 and 2030, the Optical Fiber Cold Joint Market expands from USD 2.0 billion to USD 2.9 billion, reflecting strong momentum driven by rapid fiber-to-the-home (FTTH) penetration, increased 5G backhaul construction, and higher deployment of passive optical networks. Annual demand rises from approximately 2.1 billion to 2.9 billion cold-joint units, supported by large-scale rollouts in Asia-Pacific, Europe, and North America. Growth is reinforced by the shift toward low-loss, tool-free splice connectors that reduce installation time by 25-35 % compared with thermal fusion splicing. Network operators increasingly use cold joints in aerial, underground, and micro-duct installations, especially in last-mile extensions where speed, repeatability, and field reliability are critical.

From 2030 to 2035, the market increases from USD 2.9 billion to USD 4.3 billion, with unit deployment rising toward 3.9-4.3 billion units. Momentum accelerates as large telecom carriers transition to high-density fiber architectures to support data center interconnects, IoT backbones, and 8K streaming bandwidth requirements. Demand is further driven by cold-joint designs offering insertion loss below 0.3 dB, improved thermal stability across -40 °C to 70 °C, and enhanced pull-strength thresholds above 20 N. Emerging markets in South Asia, Africa, and South America contribute 15-18 % of incremental volume as broadband penetration advances. Replacement activity also strengthens, with network operators upgrading legacy splice points to reduce maintenance overhead and support higher service reliability targets exceeding 99.99 %.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.0 billion |

| Market Forecast Value (2035) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

Demand for optical fiber cold joints is rising as network operators expand fiber-to-the-home, data center interconnects, and industrial communication systems. Cold joints allow field technicians to splice fibers without fusion splicing equipment, reducing setup time and eliminating the need for high-temperature arc welding. Their mechanical alignment sleeves and precision-cut grooves support stable optical performance with low insertion loss, making them suitable for rapid repairs and last-mile installations. Telecom contractors favor cold joints for projects involving distributed access networks, aerial fiber drops, and restoration work where portability and speed are essential. Manufacturers refine ferrule tolerances, sealing structures, and fiber-retention mechanisms to maintain consistent optical performance across varying environmental conditions. These improvements strengthen adoption in both developing and established fiber markets.

Market growth is also supported by increased deployment of 5G base stations, smart-grid communication lines, and industrial automation networks requiring reliable, low-maintenance fiber links. Cold joints provide a cost-effective alternative when fusion splicing is impractical due to space limits or low installation volumes. Producers enhance environmental resistance through moisture-blocking gels, UV-resistant housings, and impact-tolerant enclosures suited for outdoor cabinets and utility infrastructure. Training programs and standardized installation kits improve field accuracy, reducing splice variability across technician skill levels. Although cold joints generally deliver higher loss than fusion splices, ongoing material and alignment advancements narrow this gap. Their flexibility, low capital requirements, and fast deployment continue to support steady demand across global telecommunications, utility, and industrial fiber-optic installations.

The optical fiber cold joint market is segmented by type, application, and region. By type, the market is divided into single-core fast connectors and multi-core fast connectors. Based on application, it is categorized into telecom operation, data centers, medical equipment, industrial automation, broadcasting and television, aerospace and military, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect installation conditions, fiber-routing complexity, and regional investment in communication infrastructure.

The single-core fast connector segment accounts for approximately 29.0% of the global optical fiber cold joint market in 2025, making it the leading type category. This position is supported by its suitability for rapid field installation, straightforward alignment, and compatibility with common single-mode fiber used in access networks. These connectors reduce splice time and eliminate the need for fusion splicing equipment, making them practical for technicians working on distribution frames, drop cables, and short-run repair tasks. Their structure allows predictable insertion loss and stable return loss when installed with standard cleaving tools.

Manufacturers refine ferrule accuracy, V-groove alignment, and internal clamping components to maintain repeatable performance across a wide temperature range. The segment sees strong adoption in North America and East Asia, where fiber-to-the-home deployment continues at scale and where operators require swift installation cycles for both new connections and fault restoration. Single-core fast connectors also serve as temporary restoration tools during network maintenance. The segment maintains its lead because it supports routine field work, aligns with widely used fiber types in last-mile networks, and offers installation convenience for crews operating under time constraints without specialized splicing equipment.

The telecom operation segment represents about 63.0% of the total optical fiber cold joint market in 2025, making it the dominant application category. This reflects the heavy reliance of telecom networks on fast connector solutions for access links, distribution points, maintenance activities, and service expansion. Cold joints support routine tasks such as subscriber drop installation, splitter frame adjustments, cabinet reconfiguration, and rapid restoration after cable damage. Telecom operators prioritize connectors that deliver consistent optical performance with minimal preparation time, enabling efficient field workflows across varied outdoor and indoor environments.

Manufacturers design connectors with stable mechanical retention, improved dust protection, and tolerance to repeated handling during rework procedures. Telecom fleets deploy cold joints in large quantities, creating recurring demand as networks expand through fiber-to-the-home, fiber-to-the-building, and 5G backhaul projects. Regions such as East Asia and South Asia continue substantial fiber rollout programs, while North America and Europe maintain steady replacement and upgrade cycles. Telecom operation remains the largest application category because it requires high-volume, rapid-installation solutions that reduce downtime and support continuous expansion of optical access infrastructure across dense and dispersed service areas.

The optical fiber cold joint market is expanding as network operators seek faster, cleaner and more flexible connection methods for fiber deployment. Cold joints enable splicing without heat, reducing the need for fusion equipment and allowing field technicians to work efficiently in confined or sensitive environments. Growth is supported by rising FTTH rollouts, data-center connectivity needs and expanding industrial fiber installations. Adoption is moderated by concerns regarding long-term insertion loss stability and performance variability across different field conditions. Manufacturers are refining connector materials, alignment mechanisms and protective sleeves to improve durability and repeatability in diverse installation scenarios.

Demand rises as telecom operators, utility networks and enterprise campuses accelerate fiber installation. Cold joints help reduce deployment time, making them useful during rapid rollouts or small-patch connections where fusion splicing is impractical. Field engineers rely on cold joints for repairs and upgrades on active lines, where minimal disruption is essential. As FTTH penetration increases across urban and rural areas, cold joint kits support distributed teams who require portable, easy-to-use connection methods that maintain acceptable signal performance without specialized equipment.

Adoption is constrained by concerns over higher insertion loss and potential reliability issues compared with fusion splices. Performance can vary depending on technician skill, environmental conditions and fiber cleanliness. Some operators avoid cold joints in long-haul or high-bandwidth networks due to stricter signal-quality requirements. Cost considerations emerge when large volumes of connectors are required, especially in dense fiber environments. Additionally, organizations that prioritize long-term durability may prefer fusion splicing for critical backbone or data-center applications, limiting cold joint use to specific scenarios.

Trends include improved alignment structures that reduce loss variability, more robust housing materials for outdoor and industrial use, and compact designs tailored for high-density patch environments. Tool-assisted cold-splice systems with guided alignment and contamination control are gaining traction to improve repeatability. Manufacturers are offering weather-resistant joints for aerial, underground and FTTx deployments. Growth in smart-city infrastructure and edge-network builds is increasing demand for quick-install solutions. As installation teams seek to minimize downtime, cold joints continue evolving toward simpler assembly, better sealing and more stable long-term performance.

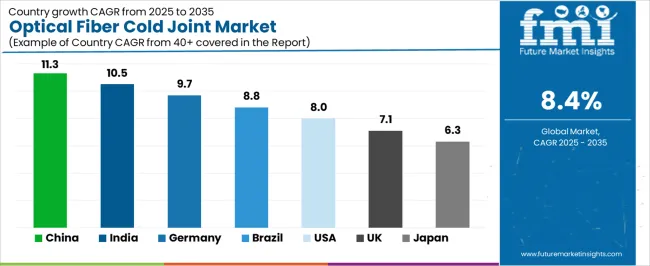

| Country | CAGR (%) |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| Brazil | 8.8% |

| USA | 8.0% |

| UK | 7.1% |

| Japan | 6.3% |

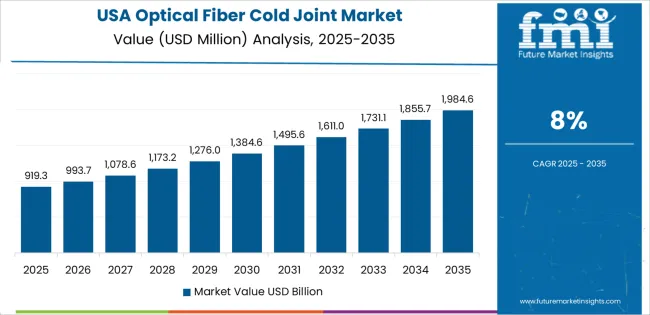

The Optical Fiber Cold Joint Market is expanding rapidly across global telecommunications sectors, with China leading at an 11.3% CAGR through 2035, driven by aggressive fiber-to-the-home deployment, 5G rollout, and rising adoption of quick-install, low-loss fiber joint solutions. India follows at 10.5%, supported by nationwide broadband expansion, digital infrastructure initiatives, and growing demand for cost-effective fiber installation technologies. Germany records 9.7%, reflecting advanced network modernization, high precision standards, and strong deployment of fiber in industrial and smart city applications. Brazil grows at 8.8%, benefiting from accelerating telecom upgrades and increasing rural fiber penetration. The USA, at 8.0%, remains a mature market focused on high-performance fiber connectivity and robust network reliability, while the UK (7.1%) and Japan (6.3%) emphasize efficient installation, miniaturized joint systems, and long-term service durability.

China is projected to grow at a CAGR of 11.3% through 2035 in the optical fiber cold joint market. Expanding fiber-to-home connections, rapid 5G rollout, and broader backbone upgrades increase the need for cold joint units that support fast field deployment. Manufacturers introduce compact housings, improved sealing technology, and alignment structures suited for dense construction activity. Telecom contractors adopt these joints to minimize installation delays across complex environments. Regional expansion of data centers reinforces demand for reliable protection. Market movement aligns with rising installation tasks across municipal networks, industrial corridors, and remote rural communication projects.

India is expected to rise at a CAGR of 10.5% through 2035 in the optical fiber cold joint market. Growth in fiber-access networks, expanding metro corridors, and increasing mobile-data usage stimulate continuous installation of joint components. Manufacturers offer durable housings, simplified splice holders, and moisture-resistant sealing. Service providers integrate cold joints into large-scale rollouts to maintain predictable workflows. Rising digital connectivity across tiered cities accelerates procurement. Contractors value units requiring minimal specialized equipment for field installation. Market expansion aligns with national programs promoting fiber connectivity and increasing service coverage across underserved regions.

Germany is forecast to grow at a CAGR of 9.7% through 2035 in the optical fiber cold joint market. Demand rises from municipal fiber projects, enterprise connectivity upgrades, and modern industrial network layouts. Manufacturers emphasize precise alignment, rugged impact protection, and temperature-stable materials. Network operators adopt cold joints for predictable performance and low-maintenance installation. Compliance with regional standards drives consistent product quality across national deployments. Expansion of industrial automation increases fiber routing, raising demand for sealed joints. Market progression supports continued digital transformation across regulated communication infrastructure.

Brazil is projected to increase at a CAGR of 8.8% through 2035 in the optical fiber cold joint market. Growth in fiber-based broadband, expanding communication coverage, and rising enterprise network upgrades support broader adoption. Manufacturers introduce corrosion-resistant shells, lightweight structures, and simplified installation mechanisms suitable for diverse climates. Telecom contractors integrate cold joints to speed deployment in remote and coastal regions. Regional programs promoting digital access encourage infrastructure upgrades. Market trends follow increasing adoption across long-distance routes, urban neighborhoods, and industrial sites requiring stable fiber protection solutions.

USA is projected to grow at a CAGR of 8.0% through 2035 in the optical fiber cold joint market. Broadband expansion, data-center growth, and rural fiber initiatives increase demand for durable joining solutions. Manufacturers design impact-resistant housings, secure locking mechanisms, and temperature-tolerant materials. Contractors use cold joints to reduce field labor time and maintain schedule reliability. Increasing installation density across urban corridors fuels recurring procurement. Federal infrastructure programs promote rural fiber routes requiring sealed protection. Market activity aligns with rising communication capacity needs across business districts, logistics hubs, and residential expansion zones.

UK markets are expected to rise at a CAGR of 7.1% through 2035 in the optical fiber cold joint market. Fiber-to-premises targets, regional broadband upgrades, and commercial network expansions support increased adoption. Manufacturers supply compact closure designs, secure sealants, and alignment guides suited to constrained installation spaces. Contractors integrate cold joints into cabinet links and outdoor distribution points. Local councils expand fiber routes supporting business and residential zones. Market progress aligns with growing demands for stable communication infrastructure across diverse urban and semi-rural regions.

Japan is projected to increase at a CAGR of 6.3% through 2035 in the optical fiber cold joint market. Dense urban layouts, expanding enterprise networks, and rising device connectivity support consistent demand. Manufacturers develop slim-profile housings, precision-fit splice holders, and secure environmental seals suited for confined locations. Contractors integrate cold joints for predictable performance in high-rise buildings and metro networks. Growth in smart-city applications increases fiber routing requirements. Market expansion aligns with higher demand for compact, reliable, and low-maintenance joining solutions supporting continuous communication across national regions.

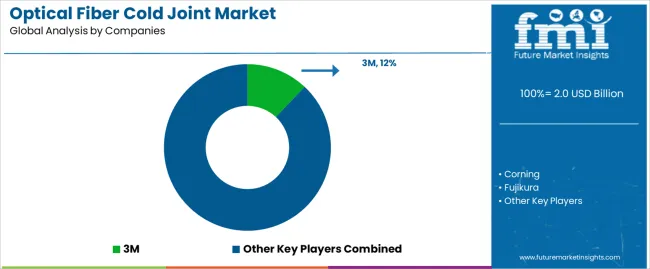

The global optical fiber cold joint market shows moderate concentration, shaped by manufacturers supplying field-installable splice and connector solutions for telecom, broadband, and data-center deployments. 3M, Corning, Fujikura, and Sumitomo hold strong positions with precision-engineered cold-splice technologies designed for low insertion loss, rapid installation, and stable optical alignment. Their products support large-scale FTTx rollouts, maintenance operations, and high-reliability enterprise networks. Combo and Jiangsu UNIKIT reinforce the mid-tier segment with cost-efficient cold joints suited for regional carriers and contractors seeking consistent installation performance. These suppliers help expand network coverage through solutions designed for varied outdoor and indoor conditions, where ease of use and repeatable splicing quality are central requirements.

Dongguan Qinying, Shenzhen JFOPT, Sopto, and Shenzhen Tengtian broaden China’s manufacturing base with scalable production and compatibility across common single-mode and multi-mode fibers. OUFU Optical Fiber and Ningbo Goshining Communication Technology support market diversity through connectors aimed at last-mile delivery, rapid field repairs, and high-volume installations. Competition across the market is influenced by mechanical alignment accuracy, retention strength, and long-term environmental stability. Strategic differentiation depends on low-loss optical performance, simplified field assembly, and compliance with evolving telecom standards. As global fiber deployment accelerates, manufacturers offering reliable, tool-efficient, and climate-resilient cold-joint solutions are positioned to strengthen long-term market adoption.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.0 billion |

| Type / Classification | Single-core fast connectors; Multi-core fast connectors |

| Application | Telecom operation, Data centers, Medical equipment, Industrial automation, Broadcasting & television, Aerospace & military, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | 3M, Corning, Fujikura, Sumitomo, Combo, Jiangsu UNIKIT, Dongguan Qinying, Shenzhen JFOPT, Sopto, Shenzhen Tengtian, OUFU Optical Fiber, Ningbo Goshining Communication Technology |

| Additional Attributes | Dollar sales by type & application; units shipped and average selling price (ASP); insertion loss distribution (mean, P95); environmental ratings (IP, temperature range); pull strength and mechanical retention metrics; installation time per joint; tool-required vs tool-free split; single vs multi-core density; warranty & MTBF; packaging/kit contents; field training & installer competency requirements; certification & test protocols; case studies and buyer decision drivers. |

The global optical fiber cold joint market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the optical fiber cold joint market is projected to reach USD 4.5 billion by 2035.

The optical fiber cold joint market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in optical fiber cold joint market are single-core fast connector and multi-core fast connector.

In terms of application, telecom operation segment to command 63.0% share in the optical fiber cold joint market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA