The Optical Character Recognition Market is estimated to be valued at USD 16.3 billion in 2025 and is projected to reach USD 60.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

The Optical Character Recognition (OCR) market is experiencing strong growth, driven by the increasing need for automation in document processing, data extraction, and business workflow optimization across various industries. Organizations are adopting OCR technologies to digitize paper-based documents, invoices, forms, and contracts, thereby improving operational efficiency and reducing manual labor. Advanced OCR solutions integrating artificial intelligence, machine learning, and natural language processing are enhancing accuracy, enabling real-time data capture, and supporting complex multilingual text recognition.

The growing emphasis on digital transformation, regulatory compliance, and secure record-keeping is further accelerating adoption. Businesses are leveraging OCR technologies to reduce processing errors, optimize customer experience, and gain actionable insights from structured and unstructured data sources.

The market is also benefiting from increased deployment in cloud-based and mobile environments, allowing scalable, accessible, and cost-effective implementations As organizations continue to pursue efficiency, automation, and data-driven decision-making, the OCR market is positioned for sustained expansion, with innovations in AI-powered recognition and intelligent document processing shaping future growth opportunities.

| Metric | Value |

|---|---|

| Optical Character Recognition Market Estimated Value in (2025 E) | USD 16.3 billion |

| Optical Character Recognition Market Forecast Value in (2035 F) | USD 60.7 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

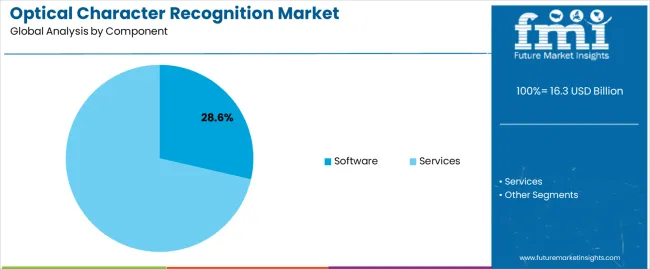

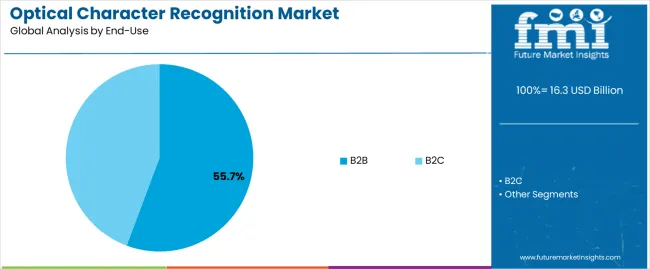

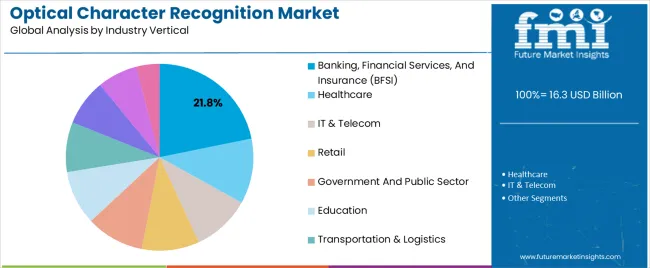

The market is segmented by Component, End-Use, and Industry Vertical and region. By Component, the market is divided into Software and Services. In terms of End-Use, the market is classified into B2B and B2C. Based on Industry Vertical, the market is segmented into Banking, Financial Services, And Insurance (BFSI), Healthcare, IT & Telecom, Retail, Government And Public Sector, Education, Transportation & Logistics, Media & Entertainment, Hospitality, and Others (Manufacturing, Construction). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to hold 28.6% of the market revenue in 2025, establishing it as the leading component type. Growth in this segment is being driven by the increasing reliance on OCR software for document digitization, data extraction, and workflow automation. Software solutions provide flexibility for integration with enterprise systems, including content management, customer relationship management, and business intelligence platforms.

AI-powered capabilities, including intelligent text recognition, handwriting analysis, and real-time data validation, enhance accuracy and operational efficiency. The adoption of cloud-based OCR software enables scalable deployments, remote accessibility, and cost-effective maintenance. Organizations are leveraging software solutions to improve compliance, reduce manual intervention, and accelerate processing times.

Continuous improvements in software algorithms, user interfaces, and interoperability with legacy systems are reinforcing its market leadership As enterprises increasingly pursue digital transformation strategies, the OCR software segment is expected to maintain its leading position, supported by advancements in automation, artificial intelligence, and enterprise integration.

The B2B end-use segment is anticipated to account for 55.7% of the market revenue in 2025, making it the largest end-use category. Growth is being driven by the adoption of OCR technologies to automate document-heavy processes in industries such as banking, finance, insurance, logistics, and legal services. These organizations require high-volume, accurate, and secure data capture to maintain compliance, optimize operational efficiency, and enhance customer service.

OCR enables automated extraction of information from invoices, contracts, forms, and correspondence, reducing manual errors and processing time. Integration with enterprise resource planning, customer relationship management, and business intelligence platforms supports analytics-driven decision-making.

The need for secure, auditable, and fast document processing in B2B operations continues to reinforce the adoption of OCR As businesses focus on automation, digital transformation, and cost efficiency, the B2B segment is expected to remain the primary driver of market growth, supported by scalable software solutions and AI-powered intelligent document processing.

The BFSI industry vertical segment is projected to hold 21.8% of the market revenue in 2025, establishing it as a key contributor to overall OCR adoption. Growth in this segment is being driven by the high volume of documents, forms, and records processed daily, which require efficient digitization and data extraction.

OCR enables automated processing of loan applications, account opening forms, invoices, and compliance documents, reducing manual labor, improving accuracy, and accelerating turnaround times. Advanced solutions integrating AI and machine learning facilitate secure, real-time data capture and validation, which enhances operational efficiency and regulatory compliance.

Organizations in BFSI are increasingly leveraging OCR to streamline back-office operations, enhance customer service, and reduce costs associated with document handling and storage As financial institutions focus on digital transformation, automation, and enhanced customer experience, the BFSI segment is expected to remain a leading vertical, driving OCR market growth through continued technology adoption and innovation.

Key companies are integrating OCR with artificial intelligence (AI) and machine learning (ML) technologies to provide better service to customers. They are also striving to broaden the use of OCR in education to digitize learning materials.

Increasing demand for data extraction in the financial and banking industries is set to propel growth. At the same time, rapid digitization and automation of industries worldwide are estimated to aid demand.

Rising penetration of legal services for effective contract review and document analysis is anticipated to push growth of optical character recognition (OCR) systems. They are integrating chatbots to improve customer service and extract data.

A few other companies are collaborating with renowned mobile app developers to create OCR-enabled mobile applications. They are also broadening their production lines for rapid production documentation and maintenance.

Growing demand for cloud-based OCR solutions and use of OCR in healthcare & legal services are creating new opportunities for companies. Integration of OCR with robotic process automation (RPA) to allow for more efficient operations.

OCR integration with robotic process automation (RPA) to allow for more efficient operations is gaining impetus. It is also being integrated with augmented reality and virtual reality technologies. In addition, high demand for IoT devices for real-time data processing and analysis is pushing the global market.

However, the high development costs of OCR systems are set to act as a hindrance to market growth. Complexity in handling layouts, fonts, and languages can also create challenges for leading firms.

Increasing data accuracy and privacy concerns amid growing cases of cyberattacks are compelling companies to reconfigure the features of their solutions. They are focusing on mitigating security risks associated with sensitive data processing. Also, a lack of technical knowledge to operate document scanning software solutions would act as another challenge.

From 2020 to 2025, the optical character recognition market experienced a CAGR of 9.5%, reaching a size of USD 9,391.34 million in 2025. It is projected to attain a value of USD 39,733.4 million by 2035.

| Historical CAGR (2020 to 2025) | 9.5% |

|---|---|

| Historical Valuation (2025) | USD 9,391.34 million |

From 2020 to 2025, digitization initiatives increased in sectors such as healthcare, finance, and government. These further LED to a high need to extract and process data more efficiently. Also, increasing automation of document management pushed sales in the text recognition market.

Factors such as the adoption of cloud-based OCR solutions for scalability and accessibility and integration of OCR with AI and ML technologies augmented the market. These helped to improve accuracy and spur demand for simplified data management & compliance.

Future Forecast for Optical Character Recognition Market

Looking ahead, the optical character recognition industry is expected to rise at a CAGR of 14.8% from 2025 to 2035. The forecast period is anticipated to show accelerated growth pushed by the integration of OCR with other technologies, such as natural language processing (NLP) and robotic process automation (RPA).

The market is anticipated to witness innovation in areas such as real-time OCR, improved accuracy, and multilingual support. These are set to cater to a wide range of industries, including healthcare, finance, law, and government.

Semi-annual Market Update

| Particular | Value CAGR |

|---|---|

| H1 | 13.7% (2025 to 2035) |

| H2 | 13.2% (2025 to 2035) |

| H1 | 14.2% (2025 to 2035) |

| H2 | 14.6% (2025 to 2035) |

The section below showcases the CAGRs and values of the significant countries present in the optical character recognition market. By scrutinizing themes from qualitative data of the market, the United States and China emerge as hot topics.

| Countries | Value-based CAGR (2025 to 2035) |

|---|---|

| United States | 15.1% |

| China | 14.8% |

The United States optical character recognition market is set to hold a share of 79.2%, equating to about USD 29,013 million by 2035. It is anticipated to rise at a CAGR of 15.1% through 2035.

The United States has a mature optical character recognition (OCR) industry. It is attributed to the high demand from sectors such as banking, healthcare, law, and government.

In the banking industry, OCR technology supports processes by automating data processing, improving data accuracy, and enhancing efficiency. Healthcare organizations are using OCR technology to digitize patient information, streamline workflows, and ensure compliance. It is set to be a leading OCR system market trend.

Law firms rely on OCR to efficiently digitize legal documents and process contracts. and capture cases. Additionally, government agencies use OCR to organize public records digitally, improve data management, and refine public services. Strong demand across multiple industries reinforces the country’s position as a key consumer of OCR solutions.

China’s optical character recognition market is projected to rise at a CAGR of 14.8% during the forecast period. The country is anticipated to be valued at USD 3,270.25 million by 2035.

Growth is mainly attributed to significantly increasing investments in AI and related technologies. Booming technology industry in emerging areas of China is particularly promoting the adoption of solutions with OCR capabilities.

China’s optical character recognition (OCR) market is growing rapidly pushed by high adoption in key sectors such as e-commerce, banking, and logistics. Similarly, logistics companies benefit from OCR’s ability to streamline fleet tracking systems, reduce errors, and increase supply chain visibility.

The section below showcases the top segments in the global optical character recognition market, including component, end-use, and industry vertical. The software segment in terms of components is set to rise at 16.3% CAGR through 2035. Based on end-use, the B2B segment is projected to witness a CAGR of 15.9% through 2035. Analysis of OCR technology industry is set to enable potential clients to invest in the ideal segment.

Market Growth Outlook by Component

| Component | Value CAGR (2025 to 2035) |

|---|---|

| Software | 16.3% |

| Services | 10.6% |

Growing need to digitize and reduce the dependence on physical documents to save cost, energy, and time has aided development of the software segment. Integrating OCR software with robotic process automation (RPA) and enterprise content management (ECM) systems increases its value proposition.

Integration makes it a top choice for organizations looking to optimize workflows and boost productivity. Due to these factors, the software segment held a dominant market share of 55.4% in 2025.

Market Growth Outlook by End-use

| End-use | Value CAGR (2025 to 2035) |

|---|---|

| B2B | 15.9% |

| B2C | 6.0% |

Companies are increasingly digitizing their operations. It is propelling demand for OCR solutions to efficiently manage and process large amounts of documents & data.

B2B companies tend to consume multiple complex data processes, such as payments, contracts, and documentation, to improve efficiencies. B2B organizations often have high budgets. Hence, they focus on process efficiencies and manual errors that can be significantly reduced with advanced OCR solutions.

Such solutions feature machine learning and natural language processing. These allow the B2B segment to rise at a CAGR of 15.9% over the forecast period.

Market Growth Outlook by Industry Vertical

| Industry Vertical | Value CAGR (2025 to 2035) |

|---|---|

| Banking, Financial Services, and Insurance (BFSI) | 16.4% |

| Healthcare | 6.3% |

| IT & Telecom | 5.1% |

| Retail | 6.6% |

| Government and Public Sector | 5.2% |

| Education | 5.2% |

| Transportation & Logistics | 7.1% |

| Media & Entertainment | 6.9% |

| Hospitality | 4.1% |

| Others (Manufacturing, Construction) | 6.6% |

Growth in the BFSI industry is attributed to increasing use of OCR for automating time-consuming tasks and optimizing performance. It would also be utilized for data entry and credit card & document scanning to transform the data into a computerized format.

As the BFSI industry is heavily regulated, complying with stringent document management and data security requirements becomes mandatory. OCR solutions provide advanced capabilities such as data encryption, editing, and audit trails. These are essential to ensure compliance and data security. The segment is projected to rise at a CAGR of 16.4% over the forecast period.

Key players are focusing on providing customized optical character recognition solutions to meet the specific needs of their clients. They establish extensive agreements and connections with stakeholders to offer high-speed, low-latency connectivity to their customers.

Companies are investing in research & development to discover sophisticated solutions that deliver improved performance, security, and scalability. Strategic partnerships and collaborations are essential in the OCR market.

Key Developments in the Field of Optical Character Recognition

The global optical character recognition market is estimated to be valued at USD 16.3 billion in 2025.

The market size for the optical character recognition market is projected to reach USD 60.7 billion by 2035.

The optical character recognition market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in optical character recognition market are software, _desktop-based ocr, _mobile-based ocr, _cloud-based ocr, services, _consulting services, _implementation and integration and _outsourcing.

In terms of end-use, b2b segment to command 55.7% share in the optical character recognition market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA