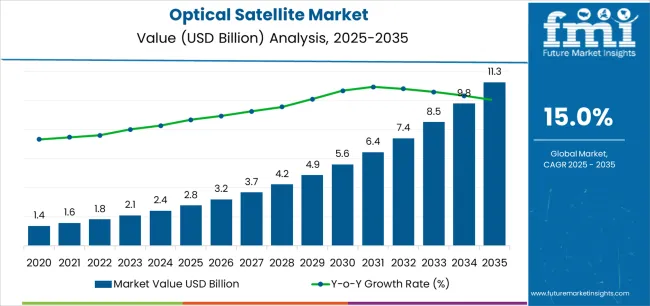

The Optical Satellite Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

The optical satellite market is expanding steadily, driven by the growing demand for high-resolution imagery, increased government and commercial investments in Earth observation, and advancements in optical payload technology. The current market environment reflects strong momentum from defense surveillance, environmental monitoring, and infrastructure mapping applications. Rapid miniaturization of satellite components and the emergence of low-cost launch solutions have significantly lowered entry barriers, enabling broader participation by private operators.

The proliferation of data analytics platforms and integration of optical imagery with AI and GIS systems have further enhanced operational efficiency and application diversity. The future outlook remains highly optimistic as governments emphasize climate monitoring, disaster management, and agricultural planning using optical satellite data.

Ongoing improvements in imaging precision, onboard data processing, and inter-satellite communication are expected to strengthen market competitiveness. Collectively, these factors position the optical satellite segment as a critical enabler of next-generation space-based data infrastructure.

| Metric | Value |

|---|---|

| Optical Satellite Market Estimated Value in (2025 E) | USD 2.8 billion |

| Optical Satellite Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The market is segmented by Size, Operational Orbit, Application, Component, and End User and region. By Size, the market is divided into Small, Medium, and Large. In terms of Operational Orbit, the market is classified into LEO and MEO/GEO. Based on Application, the market is segmented into Earth Observation and Communication. By Component, the market is divided into Imaging & Sensing Systems and Optical Communication Systems. By End User, the market is segmented into Commercial, Government, and Defence. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

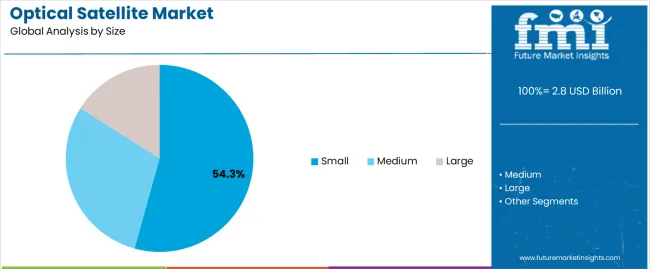

The small satellite segment leads the size category with approximately 54.3% share, reflecting its cost-effectiveness, shorter development cycles, and operational flexibility. The segment’s growth is fueled by the increasing adoption of small satellites for high-frequency imaging and rapid data collection missions.

Their ability to be deployed in constellations enhances temporal resolution and coverage, meeting the growing demand for near-real-time Earth observation data. Reduced launch costs and advancements in microelectronics have further democratized access to space, enabling startups and research organizations to participate actively in satellite imaging missions.

Additionally, small satellites provide scalability advantages, allowing incremental constellation expansion as demand increases. With ongoing miniaturization of sensors and communication systems, the small segment is expected to maintain its leadership as the preferred configuration for commercial and governmental optical satellite programs.

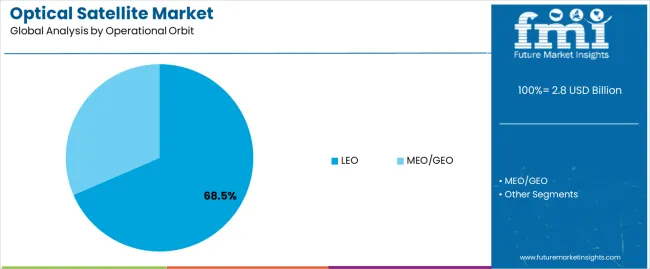

The low Earth orbit (LEO) segment dominates the operational orbit category, holding approximately 68.5% share. This dominance stems from the orbit’s proximity to Earth, which allows for high-resolution imaging, lower latency, and reduced signal degradation. Satellites in LEO can capture detailed imagery suitable for environmental monitoring, defense surveillance, and urban infrastructure analysis.

The cost advantages associated with shorter orbital distances have encouraged a proliferation of small satellite constellations, facilitating continuous global coverage. LEO’s suitability for optical payloads that require frequent revisit times enhances its importance in both governmental and commercial missions.

The segment benefits from advancements in attitude control and imaging stabilization technologies, which improve data quality and operational efficiency. With an increasing number of launches targeting LEO for Earth observation and communication integration, the segment is poised to sustain its leading position throughout the forecast horizon.

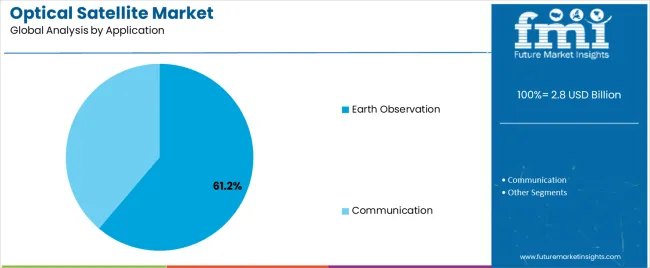

The Earth observation segment represents approximately 61.2% share of the optical satellite market, underscoring its critical role as the primary application area. This segment’s leadership is driven by rising global demand for geospatial intelligence in agriculture, defense, environmental management, and disaster response.

Optical imaging capabilities enable precise monitoring of surface changes, resource mapping, and infrastructure development, providing actionable insights for both government and commercial users. The proliferation of data analytics platforms and AI-driven interpretation tools has enhanced the utility and accessibility of Earth observation data.

Increased funding from national space agencies and private enterprises for mapping and monitoring programs further supports segment growth. With the continuing expansion of downstream analytics services and the integration of optical data with radar and hyperspectral inputs, the Earth observation segment is expected to remain the dominant driver of market demand in the coming years.

The scope for global optical satellite market insights expanded at a 20.3% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 15.8% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 20.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 15.8% |

Between 2020 and 2025, the global market experienced remarkable growth, expanding at an impressive CAGR of 20.3%. This robust expansion was driven by increasing demand for high-resolution satellite imagery across various industries, advancements in satellite technology, and growing investments in space exploration and Earth observation missions.

From 2025 to 2035, the market is projected to continue growing, albeit slightly slower, with a forecasted CAGR of 15.8%. Despite the deceleration in growth rate, the market is expected to maintain a strong upward trajectory, fueled by ongoing demand for satellite-based solutions, expanding applications of optical satellites in commercial and governmental sectors, and further advancements in satellite technology.

Factors such as increasing focus on sustainability, environmental monitoring, disaster management, and emerging trends like satellite constellation deployments and the integration of optical satellites with artificial intelligence are expected to contribute to market growth during the forecast period.

| Attributes | Details |

|---|---|

| Opportunities |

|

The table emphasizes the CAGRs in five pivotal countries, namely the United States, Japan, China, the United Kingdom, and South Korea.

South Korea is emerging as a dynamic and rapidly advancing market, expected to achieve significant growth with an impressive 18% CAGR by 2035. Renowned for its commitment to innovation, the country plays a pivotal role across various industries, showcasing a thriving economic landscape marked by continuous progress.

The substantial CAGR underscores a proactive approach to embracing and propelling advancements in the market, solidifying its position as a key contributor to the global industry. This highlights the dedication to sustainable practices, positioning South Korea as a notable player driving positive developments within the optical satellite sector globally.

| Countries | CAGRs from 2025 to 2035 |

|---|---|

| The United States | 16.1% |

| Japan | 17.5% |

| China | 16.7% |

| The United Kingdom | 17.1% |

| South Korea | 18% |

The United States employs optical satellite technology extensively for military and defense purposes, including reconnaissance, surveillance, and intelligence gathering. Additionally, it is utilized for agriculture, environmental monitoring, disaster management, urban planning, and infrastructure development.

Japan employs optical satellites for disaster management and mitigation due to its susceptibility to earthquakes, tsunamis, and other natural disasters. They are also used for agriculture, environmental monitoring, urban planning, and coastal surveillance.

China utilizes optical satellite technology for similar applications as other countries, including defense, disaster management, agriculture, and environmental monitoring.

The rapidly growing economy in China and urbanization drive the need for satellite imagery in infrastructure development and city planning.

The United Kingdom relies on optical satellite technology for defense and security, environmental monitoring, agriculture, and urban planning. It is also used in maritime surveillance due to the extensive coastline in the United Kingdom.

South Korea utilizes optical satellites for various applications, including defense and security, environmental monitoring, agriculture, urban planning, and infrastructure development. The commitment to innovation and technology in South Korea drives its extensive use of optical satellite imagery.

The table below provides an overview of the optical satellite landscape on the basis of size and operational orbit. Small is projected to lead the market size at a 15.6% CAGR by 2035, while LEO in the operational orbit category is likely to expand at a CAGR of 15.4% by 2035.

Small satellites are projected to lead the market size due to their cost-effectiveness and versatility.

Low Earth Orbit (LEO) in the operational orbit category is expected to expand primarily due to its advantages in providing high-resolution imagery and faster data transmission.

| Category | CAGRs from 2025 to 2035 |

|---|---|

| Small | 15.6% |

| LEO | 15.4% |

The dominance of small satellites in market size signifies a shift towards miniaturization and cost-effectiveness in satellite technology. Small satellites offer advantages such as lower manufacturing and launch costs and increased agility and flexibility in mission deployment. These factors drive their adoption across various applications, including Earth observation, communication, and remote sensing.

LEO satellites, on the other hand, are positioned closer to Earth, enabling higher-resolution imaging and faster data transmission compared to satellites in higher orbits.

The projected growth of LEO satellites reflects increasing demand for real-time data and imagery across agriculture, defense, and environmental monitoring industries. Advancements in launch vehicle technology and the emergence of satellite mega-constellations contribute to the proliferation of LEO satellites.

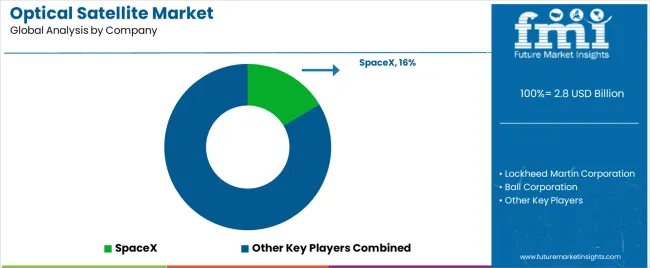

The competitive landscape of the optical satellite market is characterized by several key players competing for market share and dominance. Established companies and emerging entrants engage in strategic initiatives to gain a competitive edge in this rapidly evolving industry.

Leading players in the market focus on technological innovation to enhance satellite capabilities, such as improving image resolution, increasing data processing speed, and expanding satellite coverage. Additionally, these companies invest in research and development to develop advanced satellite systems and solutions that cater to the diverse needs of customers across industries.

Partnerships and collaborations with government agencies, research institutions, and commercial organizations are common strategies market players use to expand their market reach and gain access to new technologies and resources. Moreover, mergers and acquisitions are prevalent as companies seek to strengthen their market position and enhance their product portfolios.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 2.4 billion |

| Projected Market Valuation in 2035 | USD 10.4 billion |

| CAGR Share from 2025 to 2035 | 15.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Size, Operational Orbit, Application, Component, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | SpaceX; Lockheed Martin Corporation; Ball Corporation; Airbus Defence and Space; L3Harris Technologies Corporation; EchoStar Satellite Services; Hughes Network Systems; Eutelsat; Arqiva; Telesat |

The global optical satellite market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the optical satellite market is projected to reach USD 11.3 billion by 2035.

The optical satellite market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in optical satellite market are small, medium and large.

In terms of operational orbit, leo segment to command 68.5% share in the optical satellite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA