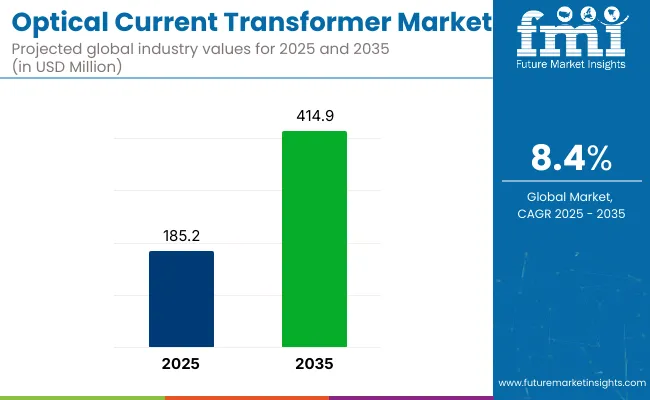

The global optical current transformer market is valued at USD 185.2 million in 2025 and is poised to be worth USD 414.9 million by 2035, reflecting a CAGR of 8.4%. Factors such as rapid deployment of smart grid networks, modernization of substations, and rising electricity demand are expected to significantly drive market growth.

Additionally, the increasing adoption of fiber-optic sensing for safe, accurate, and real-time current measurement is set to support long-term expansion. Countries including the United States and China are projected to lead in terms of both market share and investment.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 185.2 million |

| Projected Value (2035) | USD 414.9 million |

| CAGR (2025 to 2035) | 8.4% |

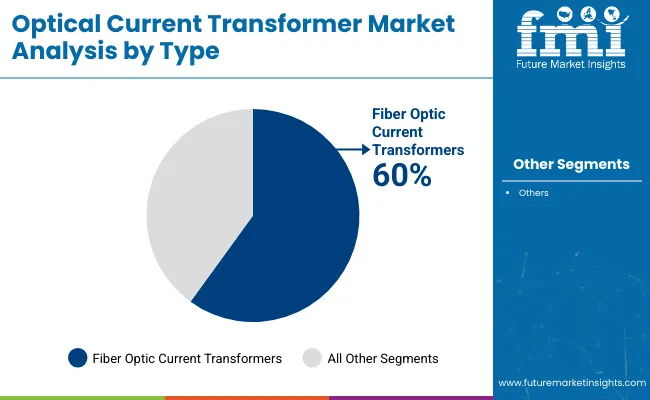

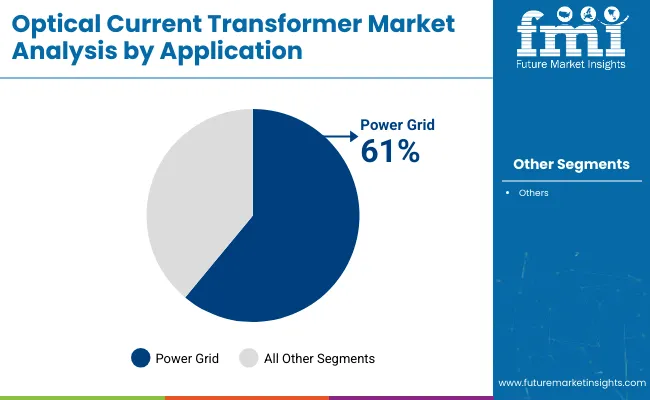

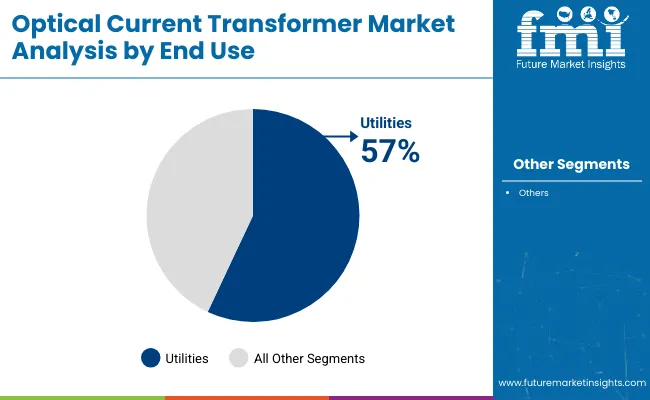

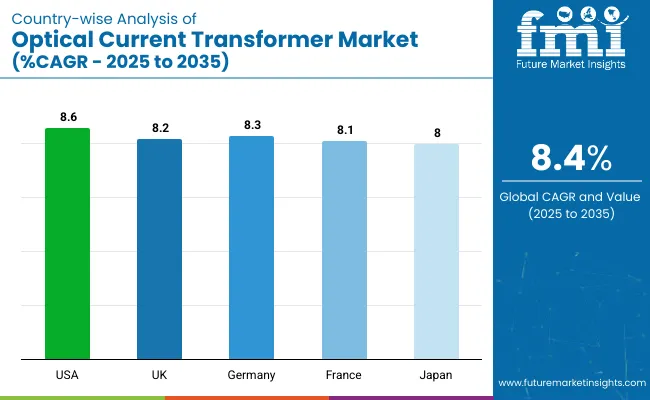

The USA is anticipated to account for the largest market share due to ongoing grid modernization projects and federal incentives promoting renewable integration. Germany is anticipated to witness growth at a CAGR of 8.3%, due to the expansion of renewable power facilities. Fiber optic current transformers (FOCTs) are likely to account for 60% of the market share in 2025. Based on application, the power grid segment accounts for 61% share. In terms of end use, the utilities segment registers 57% share.

Companies such as Siemens AG and GE Grid Solutions are likely to experience strong profitability due to increasing demand for real-time monitoring and precision-based current measurement solutions in digital substations. Conversely, smaller firms and utilities in cost-sensitive regions may struggle with adoption, primarily due to high initial capital investments and integration challenges with legacy infrastructure. Developing regions such as parts of Latin America and Africa may face slower adoption rates due to limited modernization budgets and a lack of awareness regarding OCT benefits.

The long-term outlook remains optimistic as demand accelerates for IoT-enabled monitoring, predictive maintenance, and resilient power infrastructure. Rising renewable energy deployment, offshore wind projects, and AI-enabled fiber-optic sensing technologies are expected to unlock significant market opportunities. Additionally, increasing R&D investments and collaborations between utility companies and technology providers are likely to shape product innovation and affordability across markets.

The global optical current transformer market is segmented on the basis of type (fiber optic current transformer, hybrid optical current transformer), by installation (gas insulated switchgear (GIS), air insulated switchgear (AIS), transformer installations), by voltage rating (low voltage (up to 1kV), medium voltage (1kV-69kV), high voltage (69kV-230kV), and extra high voltage (above 230kV)), by application (power grid, industrial applications, renewable energy integration), by end use (utilities, industrial, renewable energy, commercial infrastructure), and by region (North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa).

Fiber optic current transformers (FOCTs) are projected to dominate the market with a 60% share in 2025. Their high precision, compactness, and electromagnetic immunity make them ideal for modern applications such as smart grids, HVDC lines, and offshore renewable projects. The shift toward digital substations and the demand for interference-free measurement further position FOCTs as the most preferred choice among utilities and industrial power transmission operators globally.

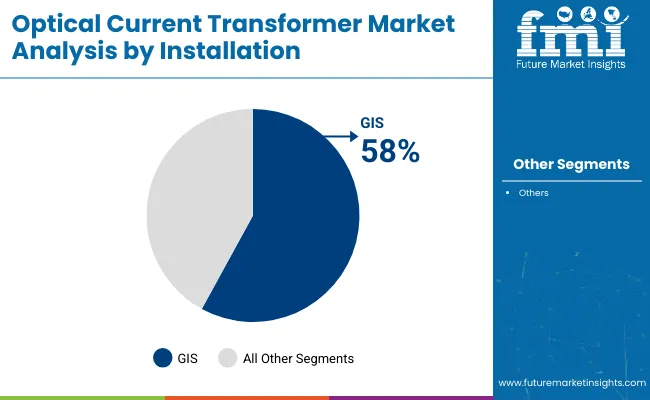

Gas Insulated Switchgear (GIS) installations are expected to account for 58% of the market due to their compact footprint and operational safety in densely populated areas. As urbanization increases and land availability becomes constrained, utilities prefer GIS installations integrated with OCTs for their efficiency and reduced maintenance needs. These switchgears are particularly favored in smart city developments and high-rise power distribution projects where space and reliability are critical.

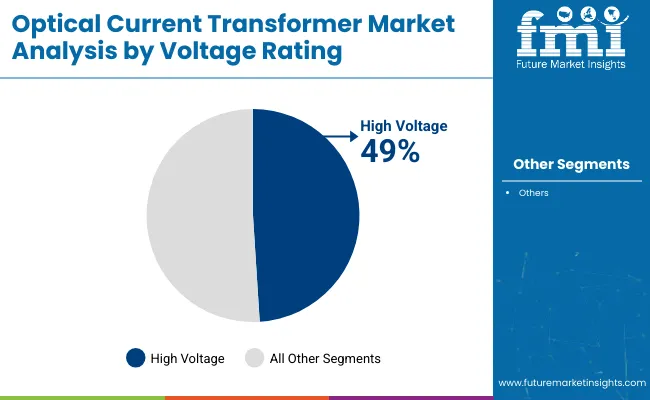

High voltage (69kV-230kV) applications are anticipated to capture a 49% market share, driven by the ongoing expansion of national transmission grids and industrial infrastructure. OCTs in this voltage class are valued for their ability to perform accurate current sensing across long-distance, high-capacity lines. Their integration into HVDC and renewable interconnection projects is accelerating, especially in regions focused on reducing transmission losses and modernizing aging energy systems with smart monitoring technologies.

Power grid applications are projected to hold a dominant 61% share, primarily due to large-scale investments in grid automation and modernization. OCTs are extensively installed across substations to ensure precise current monitoring, enable fault diagnostics, and enhance system resilience. With the integration of renewable energy and distributed energy resources, the need for real-time current measurement in transmission and distribution networks continues to grow, boosting the role of OCTs in grid stability.

The utilities segment is expected to retain a leading 57% market share, supported by aggressive investment in smart grid rollouts, substation automation, and energy transition strategies. Optical current transformers offer utilities accurate and safe alternatives to traditional current sensing in mission-critical environments. Their adoption is also being driven by regulatory pressure to reduce energy losses and integrate AI-powered monitoring systems for improved grid efficiency and long-term operational sustainability.

Recent Trends in the Optical Current Transformer Market

Key Challenges Impacting Market Growth

The optical current transformer market in the USA is expected to grow at a CAGR of 8.6% between 2025 and 2035. Growth is being driven by robust federal infrastructure plans, smart grid implementation, and utility-scale renewable energy integration. OCT deployment is increasing across HVDC networks and modern substations, supported by government incentives and digital grid upgrades under programs like the Inflation Reduction Act and the GRIP initiative.

In the UK, the market for optical current transformers is projected to expand at a CAGR of 8.2% from 2025 to 2035. Substantial investments in offshore wind energy and digital grid projects are accelerating OCT adoption. Regulatory frameworks such as the RIIO-2 model and national carbon-neutrality targets are compelling utilities to transition toward smart, accurate, and interference-free current measurement systems integrated into high-voltage transmission upgrades.

The optical current transformer market in Germany is poised to grow at a CAGR of 8.3% through 2035. Government-backed energy transition programs and the expansion of renewable power facilities are driving adoption. OCTs are increasingly utilized in high-voltage grid interconnection projects as part of Germany’s Energiewende agenda, which focuses on grid reliability, digital monitoring, and low-loss transmission across the country’s evolving electricity network.

The optical current transformer market in France is expected to witness a CAGR of 8.1% in the optical current transformer market between 2025 and 2035. The country is modernizing its transmission grid as it phases out older infrastructure and ramps up renewable energy capacity. OCTs are favored for their safety, precision, and compact design, particularly in urban substations and wind energy transmission lines.

The optical current transformer market in Japan is forecasted to grow at a CAGR of 8.0% over the forecast period. The country’s commitment to achieving carbon neutrality by 2050, along with large-scale smart grid deployments, has led to increased OCT installations. Utilities such as TEPCO and Kansai Electric are upgrading their networks with fiber-optic technologies to enhance disaster resilience and grid performance, particularly for high-speed rail and urban energy systems.

The optical current transformer (OCT) supplier landscape is moderately consolidated, with the presence of global players, such as ABB, Siemens, GE Grid Solutions, Arteche, and NR Electric, capturing a significant share. Competition is primarily driven by innovation (fiber‑optic sensing, digital integration), strategic partnerships (utilities, grid automation firms), and expansion into smart grid markets.

Tier-one companies are focused on offering superior accuracy, compactness, and IoT-ready OCT solutions at a competitive price. Partnerships with utilities and grid operators enable the co-development of digital substation systems. Meanwhile, R&D investments are concentrated on hybrid OCTs and magnetic-fiber technologies to boost bandwidth and reduce costs.

Recent Optical Current Transformer Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 185.2 million |

| Projected Market Size (2035) | USD 414.9 million |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volumes in units sold |

| By Type | Fiber Optic Current Transformer (FOCT), Hybrid Optical Current Transformer |

| By Installation | GIS (Gas Insulated Switchgear), AIS (Air Insulated Switchgear), Transformer Installations |

| By Voltage Rating | Low Voltage (Up to 1kV), Medium Voltage (1kV-69kV), High Voltage (69kV-230kV), Extra High Voltage (Above 230kV) |

| By Application | Power Grid, Industrial Applications, Renewable Energy Integration |

| By End Use | Utilities, Industrial, Renewable Energy, Commercial Infrastructure |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | ABB Ltd., Siemens AG, GE Grid Solutions, Arteche Group, NR Electric Co., Ltd., Yokogawa Electric Corporation, Schweitzer Engineering Laboratories (SEL), Nissin Electric Co., Ltd., Pfiffner Instrument Transformers Ltd., Trench Group |

| Additional Attributes | Dollar sales by value, segment share analysis, country-wise analysis by region |

The market is segmented into Fiber Optic Current Transformer (FOCT) and Hybrid Optical Current Transformer.

The industry is divided into GIS (Gas Insulated Switchgear), AIS (Air Insulated Switchgear), and Transformer Installations.

The market is classified into Low Voltage (Up to 1kV), Medium Voltage (1kV-69kV), High Voltage (69kV-230kV), and Extra High Voltage (Above 230kV).

The market caters to Power Grid, Industrial Applications, and Renewable Energy Integration.

The report covers key sectors, including Utilities, Industrial, Renewable Energy, and Commercial Infrastructure.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The optical current transformer market is valued at USD 185.2 million in 2025.

The market is projected to grow at a CAGR of 8.4% between 2025 and 2035.

By 2035, the market is expected to reach USD 414.9 million.

The USA is the fastest-growing country, registering a CAGR of 8.6% during the forecast period.

Key players include ABB Ltd., Siemens AG, GE Grid Solutions, Arteche Group, and NR Electric Co., Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA