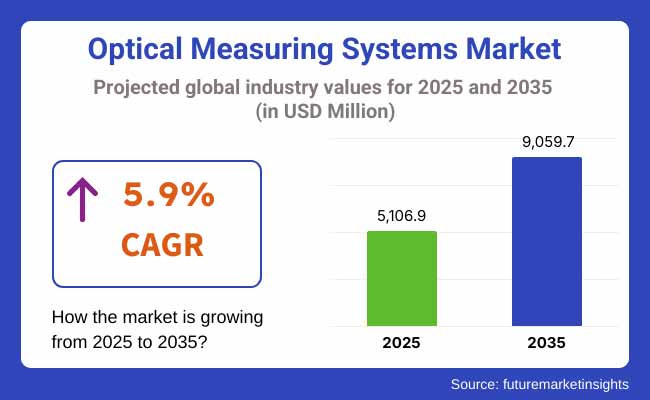

The optical measuring systems market is poised for steady growth from 2025 to 2035, fueled by advancements in precision measurement technologies, increasing adoption of automation, and growing demand for non-contact measurement solutions across various industries. The market is expected to expand from USD 5,106.9 million in 2025 to USD 9,059.7 million by 2035, reflecting a CAGR of 5.9% during the forecast period.

Optical measuring systems prove to be important components in industries like automotive, aerospace, electronics, healthcare, and manufacturing, which require extraordinary accuracy in measurements. Their non-destructive, high-speed, and accurate measurement functions characterize them as the ideal tools for quality control, 3D scanning, and metrology.

The markets growth is spurred by factors such as the surge in automation demand, miniaturization in electronics, and breakthroughs in optical sensor technology.

The rising popularity of Industry 4.0, digital manufacturing, and real-time monitoring solutions is accelerating the integration of laser scanners, interferometry, structured light systems, and photogrammetry-based measurement techniques into production processes. The deployment of 5G scalar, AI-controlled quality assurance, and roll-out of portable, high-definition measurement devices are also contributing towards market support.

The market expansion is facilitated with ventures which are increasing the focus on precision engineering, metrology intermittently and quality standards in both manufacturing and research.

North America stays in the forefront of the optical measuring systems market mainly because of its strong presence in aerospace, defense, and high-tech manufacturing. The United States and Canada are investing significantly in automated quality control, advanced metrology, and 3D measurement technologies.

The growing adoption of AI-assisted inspection systems and the development of the smart factory concept are behind the rise of optical measuring systems in industrial applications. The market growth of the region is also fueled by the presence of the top aerospace firms, semiconductor companies, and medical device firms.

Europe's optical measuring systems market is coped with strict quality control regulations, rapid automotive production upgrades, and robust plans for industrial automation policies. Countries like Germany, France and the UK are making great strides in metrology, robotics, and precision engineering, and consequently, demand high-efficiency optical measurement equipment.

The European Union's spotlight on sustainability and precision-driven production is propelling manufacturers to use high-accuracy measurement tools for defect detection, 3D imaging, and digital twin applications. The growth is also aided by the penetration of laser metrology and structured light scanning in industries such as automotive and aerospace.

The Asia-Pacific market is the fastest growing, sustained by rapid industrial growth, rising electronic production, and investment in the semiconductor and automotive sectors. Countries such as China, Japan, South Korea, and India are experiencing the increased demand for optical measuring systems in the fields of manufacturing, medical diagnostics, and research.

China's progress in smart manufacturing, AI-integrated quality control, and advanced metrology solutions drives market growth. Japan and South Korea's advanced technological status in semiconductor manufacturing, robotics, and precision optics is also aiding in market growth. India's ascending automotive and aerospace industries with technology adoption expansion directly create a market for optical measurement products.

The Middle East, Latin America, and Africa are the emerging markets for optical measuring systems which are supported by the interaction good program and the increase in medical imaging applications.

In Latin America, countries like Brazil and Mexico are investing in automated manufacturing and quality assurance technologies, increasing the need for non-contact optical measurement systems.

The Middle East is seeing growth in high-tech manufacturing and defense sector, which leads to increased adoption of laser interferometry and optical inspection tools. Africa industrial expansion and infrastructure development are also expected to create new opportunities for precision measurement solutions.

High Initial Costs & Integration Complexities

The high cost of advanced optical measuring systems and the complex integration into existing manufacturing workflows are key challenges. Small and medium-sized enterprises (SMEs) often struggle with the upfront investment and technical expertise required to implement these systems.

Limited Skilled Workforce

The adoption of high-precision optical measurement technologies requires skilled professionals for operation, calibration, and data analysis. A shortage of trained personnel in some regions can hinder market growth, particularly in developing economies.

Data Processing & Accuracy Limitations

While optical measuring systems provide high precision, challenges such as data processing delays, environmental interference (temperature, vibrations), and the need for frequent calibration can impact accuracy. Innovations in real-time data processing and AI-powered correction algorithms are addressing these concerns.

Integration of AI & Machine Learning in Optical Measurement

The rise of AI and machine learning in quality control and metrology presents a major growth opportunity. AI-powered image recognition, defect detection, and predictive analytics are enhancing the capabilities of optical measuring systems, improving accuracy and reducing errors.

Expansion in Medical & Healthcare Applications

The increasing use of optical measurement in medical diagnostics, bio photonics, and imaging technologies is expanding market opportunities. Optical measurement plays a crucial role in 3D scanning for prosthetics, laser-based surgeries, and biomedical research. The growing demand for high-precision imaging solutions in healthcare and pharmaceuticals will further boost adoption.

Rising Demand for Portable & Wireless Optical Measuring Systems

The development of compact, wireless, and portable optical measurement devices is opening new market opportunities. Industries are increasingly adopting handheld 3D scanners, laser measurement tools, and mobile photogrammetry systems for on-site inspections and real-time analysis.

The optical current transformer market has experienced significant advancements and adoption from 2020 to 2024, primarily driven by the increasing demand for precision measurement systems in power grids, substations, and industrial automation. These transformers offer advantages over conventional current transformers, including higher accuracy, lower weight, and enhanced safety. Their ability to operate efficiently in high-voltage environments and provide digital outputs has fueled adoption in electrical utilities and renewable energy systems.

With a growing emphasis on grid modernization, the market has seen increasing investments in smart grid infrastructure, digital substations, and high-voltage direct current (HVDC) transmission systems. Technological improvements in fiber optics and digital signal processing have further propelled the market forward.

Looking ahead, from 2025 to 2035, the market is expected to witness continuous growth driven by expanding renewable energy integration, smart grid expansion, and the rising need for precise power monitoring solutions. The adoption of optical current transformers will continue to increase as the power industry moves toward automation, data-driven operations, and energy efficiency improvements.

Market Shift Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Technological Evolution | Adoption of fiber-optic sensors and digital output systems. |

| Regulatory Changes | Compliance with IEC and IEEE standards for transformer accuracy and performance. |

| Application Trends | Expansion in high-voltage substations and industrial automation. |

| Market Growth Drivers | Demand for higher accuracy, safety, and lightweight transformer solutions. |

| Supply Chain and Investment Trends | Growth in manufacturing of fiber-optic components and sensors. |

| Market Shift | Growth Factors |

|---|---|

| Technological Evolution | Increased integration of AI-based analytics and real-time monitoring solutions. |

| Regulatory Changes | Stricter mandates for grid stability, cybersecurity, and environmental safety. |

| Application Trends | Greater deployment in smart grids, renewable energy networks, and electric vehicle (EV) charging infrastructure. |

| Market Growth Drivers | Increased investment in energy-efficient power systems and digital substations. |

| Supply Chain and Investment Trends | Expansion of localized production facilities to meet global demand. |

There is an Optical Measuring Systems Market in the USA that is growing rapidly due to the high use of precision measurement tools in aerospace, cars, and industrial manufacturing. The country is promoting automation and digital metrology solutions in the World Industry 4.0 program which is the main factor that is causing a move from contact measurement systems to non-contact optical measurement technologies like laser scanners, 3D optical sensors, and interferometers.

The Biden Administration through the CHIPS and Science Act is actively increasing the production of semiconductors that visualize chips and, in turn, the requirement for high precision measurement tools in the semiconductor fabrication and inspection processes is also increased. On top of this, the automobile and aerospace sectors, alongside the likes of Boeing, General Motors, and Tesla, keep on adopting optical CMMs and 3D vision systems to achieve better quality control and increased production capacity.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

The UK is experiencing significant gains in the field of optical measuring systems due to the nations focus on advanced manufacturing, quality assurance, and R&D of precision engineering. The automotive and aerospace industries, with important contributors such as Rolls-Royce, BAE Systems, and Jaguar Land Rover, are increasingly employing optical metrology to maintain their position in the market through efficiency and reduced errors.

The UK National Quantum Strategy alongside state support for photonics research serve to bolster the continuous development of optical measurement technologies. The upgrade of rail and defense sector infrastructure is also prompting the need for laser scanning and 3D optical measurement tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

The European Union’s Optical Measuring Systems Market is being propelled by strong industrial growth, automation, and regulatory compliance in manufacturing. Precision measurement is popular among the most dominant countries, such as Germany, France, and Italy, across the different industrial areas of automotive, aerospace, and electronics.

The Industry 5.0 paradigm is also pushing the humanistic automation and artificial intelligence (AI) metrology, spurring the requirement of optical inspection solutions in smart factories. The obligation of stringent ISO and CE certification standards in the region is also forcing the manufacturers to adopt the very latest high-accuracy optical measuring devices to meet the quality control requirements.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

With Japan being the main country in the field of high-precision manufacturing, robotics, and metrology solutions, the country is watching the Optical Measuring Systems Market carry on flourishing. The automotive industry involves companies such as Toyota, Honda, and Nissan as active players and is a huge help to the optical metrology's being adapted in assembly line inspections and component testing.

The semiconductor and electronics manufacturing sectors in Japan led by companies like Sony, Toshiba, and Renessa are advancing the integration of technologies such as 3D optical metrology and interferometry along with laser scanning systems with the tools used for microelectronics and circuit inspection.

The government's desire of laying out smart factories and projects for the new generation of measurement technologies are not only the factors for the demand of but also they are promoting the installation of AI-integrated optical measurement solutions in the field of industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The growth of the Optical Measuring Systems sector in South Korea is propelled by the strong manufacturing sector, semiconductor leadership, and fast pace of automation adaptation in the country. Samsung, SK Hynix, and LG Electronics are the main drivers for high-precision optical measurement solutions in the semiconductor fabrication and microelectronics field.

Simultaneously, South Korea's commitment to the smart factories, Industry 4.0, and automotive technology sector is boosting the demand for robotic optical inspection systems, 3D scanners, and precision laser measurement tools. The government's initiative to enhance local metrology R&D is also a big factor in the technological growth of the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Vertical Optimizers Lead Due to Their Versatility and High Accuracy

The vertical optimizers are the main measurement tools in factories needed for detailed measurement of components, surface profiles, and material thickness. Besides high-speed measurement capability with great accuracy, they are perfect for applications that involve strict quality control. Their feature to measure objects of different heights is practical and can also lay the ground for manual assembly.

Attributed to the growing shift towards automated production lines, with particular reference to the automotive and aerospace industries, the demand for vertical optimizers is aspiring the trend. The complementary devices' advancements, such as laser and digital imaging technologies, are infiltrating their measurement capabilities thus enhancing them further.

Horizontal Optimeters Gain Popularity in Specialized Measurement Applications

The critical nature of elongated or horizontally positioned objects in industrial applications has made horizontal optimeters essential for long shaft and pipe inspection. These systems are widely deployed in the aerospace and heavy engineering industries, which are also characterized by large-sized components requiring strict measurement and alignment.

The growing emphasis on quality assurance, in addition to compliance with international measurement standards, is a key factor in the spread of horizontal optimizers. Ascend altitude in optical technology such as multi-axis measurement is the other side of the coin begetting demand for this type of equipment in a variety of high-precision manufacturing settings.

Automotive Industry Drives Demand for High-Precision Measurement

The optical measuring system is the tool that the car-making industry uses the most. It is particularly useful to them for quality inspection, dimensional analysis, and assembly verification. It is well known that automotive components are becoming more complex and lightweight. This is precisely where optical measurement technologies come in handy at ensuring the fit and performance are accurate.

Applications such as chassis alignment, component scanning, and aerodynamic testing are accelerating the adoption of optical measuring systems. Besides, the industry is now aiming at zero emissions therefore the developments in electric and self-driving cars have ushered the way for the precise measurement of battery components and sensor integration which has in turn propelled the sector's growth.

Aerospace Sector Relies on Optical Measuring Systems for High-Accuracy Inspections

The manufacturers in the aerospace sector deal with extremely high precision when it comes to component making, assembling, and repair. Visual measuring systems are largely for inspection operations of turbine blades, fuselage structures, and composite materials. The system's advantage of allowing non-contact measurements is especially valued when it comes to delicate or complex components.

The advancements in 3D optical scanning and automated metrology solutions have made quality assurance in aerospace production much better. Due to the change in the aerospace industry from traditional materials toward lightweight ones and thus involving advanced manufacturing techniques like additive manufacturing, it is reckoned that the demand for optical measuring systems will escalate considerably.

| Company Name | Estimated Market Share (%) |

|---|---|

| Hexagon AB | 20-25% |

| Carl Zeiss AG | 15-18% |

| Nikon Metrology | 12-15% |

| Keyence Corporation | 10-14% |

| FARO Technologies, Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hexagon AB | Develops high-precision 3D optical measurement solutions, integrating AI and automation for industrial applications. |

| Carl Zeiss AG | Specializes in advanced metrology solutions, including coordinate measuring machines and optical scanning technology. |

| Nikon Metrology | Offers laser scanning and multisensor metrology solutions for aerospace, automotive, and manufacturing industries. |

| Keyence Corporation | Provides cutting-edge optical measurement devices with high-speed inspection and automation capabilities. |

| FARO Technologies, Inc. | Focuses on portable 3D measurement systems for quality control, reverse engineering, and precision analysis. |

Key Company Insights

Hexagon AB

As a leader in optical measuring systems, Hexagon AB offers state-of-the-art 3D scanning and metrology solutions tailored to industrial applications. The focus of the company lies in the integration of AI and automation for the enhancement of manufacturing efficiency and accuracy. Hexagon’s cutting-edge measurement systems are utilized in sectors such as aerospace, automotive, and electronics. Ongoing investments in R&D and digital solutions keep the company strong on the market, thus being a main driving force of innovation in the field of optical metrology.

Carl Zeiss AG

Carl Zeiss AG is a company that mainly develops metrology solutions of high precision that include coordinate measuring machines and modern optical scanners. The company is geared toward industries that need ultra-high accuracy such as medical devices, semiconductors, and aerospace. Zeiss has provided solutions in the method of measurement which are non-contact and exhibiting high performance besides its dedication to superior metrology, so it is a favored choice for the industries that are very concerned about quality and accuracy.

Nikon Metrology

Nikon Metrology provides the newest laser scanning, computed tomography (CT) scanning, and multi-sensor metrology systems. The company is an influential party in aerospace, automotive, and precision production, as it offers solutions for correct quality examination and component analysis. The main subject area of Nikon Metrology is high-resolution optical measurement, however, its recent move into automated systems demonstrates its active role in the industrial metrology field that is constantly changing.

Keyence Corporation

Keyence Corporation is famous for its creative high-speed optical measurement solutions. The company supplies automated inspection systems, precision laser measurement devices, and smart sensors that are specifically designed for industrial applications. The company Keyence is strongly focused on automation and the application of real-time data analysis to support the industries to keep the high production efficiency and quality control standards.

FARO Technologies, Inc.

FARO Technologies, Inc. is a company that has the portable 3D measurement and imaging solutions that are best suitable to the industries and are responsible for the real-time quality control and the reverse engineering. The company offers the solutions in the fields of manufacturing, construction, and forensics. FARO's constant dedication to innovation in the field of mobile optical measurement and its potential to deliver cost-effective and high-accuracy results enable FARO to keep growing and maintain its position in the market.

The market is segmented into Laser Scanners, Coordinate Measuring Machines (CMM), Profile Projectors, Optical Microscopes, and Interferometers.

The industry is divided into Hardware, Software, and Services.

The market is classified into 3D Optical Measuring Systems, Laser-Based Measuring Systems, and Vision-Based Measuring Systems.

The market caters to Quality Control & Inspection, Reverse Engineering, and Surface Analysis.

The report covers key sectors, including Automotive, Aerospace & Defense, Electronics & Semiconductor, Healthcare, Industrial Manufacturing, and Energy & Power.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The global optical measuring systems market is projected to reach USD 5,106.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.9% over the forecast period.

By 2035, the optical measuring systems market is expected to reach USD 9,059.7 million.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Light Beam, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Light Beam, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Light Beam, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Light Beam, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Light Beam, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Light Beam, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Light Beam, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Light Beam, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Light Beam, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Light Beam, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Light Beam, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Light Beam, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Light Beam, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Light Beam, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Light Beam, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Cold Joint Market Size and Share Forecast Outlook 2025 to 2035

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA