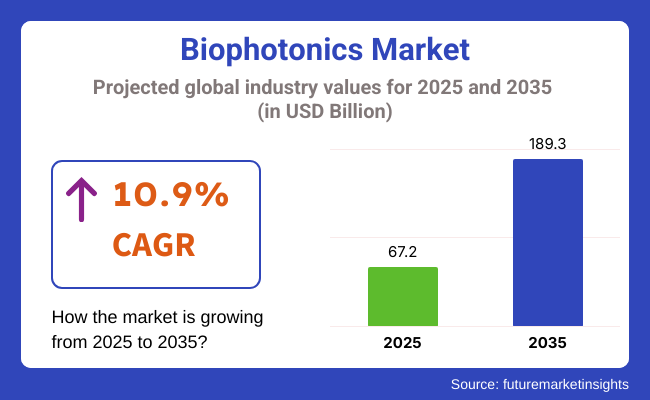

The global biophotonics market is estimated at USD 67.2 billion in 2025. By 2035, the market valuation is projected to grow to USD 189.3 billion at a CAGR of 10.9%. Increasing demand for non-invasive diagnostics and therapeutics has accelerated adoption of biophotonics across clinical and research applications.

Medical imaging remains the primary application area in biophotonics market. Advanced techniques such as fluorescence imaging and optical coherence tomography (OCT) are widely deployed in oncology and cardiovascular diagnostics. In January 2025, Carl Zeiss Meditec disclosed in its investor presentation that demand for photonic-based surgical visualization systems rose significantly across European and North American markets. This aligns with rising adoption of real-time, high-precision imaging in minimally invasive surgeries.

In March 2025, Hamamatsu Photonics issued a corporate statement reporting widespread deployment of its latest photomultiplier tubes (PMTs) in national cancer research centers in Japan and Germany. CEO Akira Hiruma noted, “Photon detection precision is fundamental to next-generation biosensing platforms, and our investment in hybrid PMT systems reflects that commitment.” Fluorescence-based cell diagnostics, powered by these innovations, are enabling early-stage cancer cell detection with single-molecule resolution.

Biophotonics is also transforming medical therapeutics industry through its contribution towards pharmaceutical research. Light-based spectroscopy, especially Raman imaging-a non-destructive technique using scattered light to map molecular structures-is now widely used in drug screening. A February 2025 press note from Bruker Corporation announced a 42% increase in orders for high-resolution Raman systems compared to Q1 2024. The company expanded its R&D facilities in Switzerland and Singapore to meet growing pharmaceutical client demand in Europe and Asia.

In 2024, the USA Food and Drug Administration approved four new biophotonic imaging devices for clinical cancer screening. This milestone led to faster hospital procurement cycles and broader institutional deployment. That same year, the German Federal Ministry of Education and Research allocated EUR 38 million toward a national biophotonics innovation initiative aimed at improving early diagnostic infrastructure.

An example includes the University Medical Center Hamburg-Eppendorf, which implemented Olympus Corporation’s confocal endomicroscopy systems in early 2025. The hospital cited improved accuracy in gastrointestinal diagnostics and a 23% reduction in biopsy procedures over six months. In its April 2025 update, Olympus confirmed growing adoption in China and India, linked to increasing investments in digital hospitals and public healthcare modernization.

Challenges such as high equipment costs and limited skilled personnel exist in the market. However, strategic collaborations, government funding, and continuous R&D are expected to offset these constraints. With growing application in precision diagnostics, biosensing, and drug discovery, the biophotonics market is well-positioned for sustained global expansion.

As researchers, healthcare providers, and diagnostic laboratories increasingly adopt optical-based solutions to improve noninvasive imaging, real-time molecular detection, and biodetection for biomedical applications, the see-through imaging and biosensors segments have a high share in the biophotonics market. Precision medicine, clinical diagnostics, and life sciences research are some of the key areas where these applications are gaining traction, leading to increased accuracy, enhanced patient outcomes, and optimized healthcare processes.

Transmission tomography imaging is one of the most disruptive applications of biophotonics, as it allows to visualize various internal biological structures, tissues, and cellular functions in a non-invasive way through optical techniques [1]. In contrast to established imaging modalities, see-through imaging takes advantage of biophotonic principles to noninvasively penetrate biological tissues while causing minimal damage, thus ensuring high-resolution and real-time diagnostic capabilities.

As clinicians look for advanced technologies providing disease detection, surgical guidance, and patient monitoring, there has been an increasing adoption of non-invasive imaging solutions in areas such as oncology, cardiology, and neurology, and see-through imaging technologies are being leveraged to fulfill this demand. Research shows biophotonic see-through imaging improves early-staged cancer detection, vascular imaging, and neural network mapping, which allows for improved clinical decision making and treatment planning.

Despite the fact that OCT is being used in other fields such as dermatology and cardiovascular imaging, the etiology of its demand in the market can be driven inherently, by its integration in ophthalmology. nhọrọ

Furthermore, advances in fluorescence and multiphoton imaging techniques have enhanced molecular contrast, tissue penetration depth, and optical sectioning, empowering scientists and clinicians to visualize intracellular structures, monitor cellular dynamics, and assess disease progression in unprecedented detail.

Biophotonic see-through imaging technology development for regenerative medicine and tissue engineering applications has also been propelled into adoption in stem cell research, biomaterial development, and organoid imaging, as scientists capitalize on optical platforms to explore areas such as tissue growth, cell differentiation processes, and biomolecular interactions within 3D environments.

Portable, handheld biophotonic imaging devices have facilitated point-of-care diagnostics and in-vivo monitoring in real-time, allowing to access to clinical insight non-invasively in remote healthcare settings, emergency care units, and home-based medical applications.

However, see-through imaging still faces challenges like the high cost of equipment, the complexity of interpreting images, and ambulatory device operators needing specialized training to perform accurate imaging. Nonetheless, new developments in AI-based image reconstruction, real-time deep learning analysis, and miniaturized imaging probes are enhancing the accessibility, affordability, and automation of see-through imaging, driving sustained market growth behind these solutions.

Researchers and healthcare providers are increasingly utilizing biophotonic biosensors for the sensitive and specific detection of biomolecules, pathogens, and chemical substances, leading to strong market adoption, particularly in medical diagnostics, infectious disease detection, and environmental monitoring. In biophotonic biosensors, one may take advantage of optical phenomena such as! Fluorescence, surface plasmon resonance (SPR), and Raman spectroscopy, making possible the highly sensitive label-free detection of biological and chemical analytes unlike classical approaches.

This trend towards impending chronic disease, endemic infectious diseases and global pandemics stimulate requirements towards biophotonic biosensors that enable point-of-care testing (POCT) and wearable biosensing technologies for early disease detection, remote patient monitoring and real-time health analytics. Diagnostic turnaround time is improved with more sensitivity for pathogen detection, reduced false-positive rates and improved clinical outcomes achieved with optical biosensing that earlier studies show.

Incorporating plasmonic nanoparticles, quantum dots, and photonic crystals, nanophotonic biosensors have facilitated the ideal biosensor performance, enabling ultrasensitive tracking of DNA, proteins, and biomarkers in small volumes. They will enable enhanced disease screening, personalized medicine, and early-stage cancer detection.

The biophotonic biosensor market growth has also been attributed to the rise of wearable health monitoring devices in the market, where AI-driven biosensors will be integrated into smartwatches, patches and implantable sensors, which will check glucose levels, oxygen saturation and cardiovascular biomarkers consistently, aiding in proactive health management.

The demand had also been further driven by the growing adoption of biophotonic biosensors for environmental and food safety monitoring, as the industries are deploying optical biosensing platforms to detect for pollutants, toxins, and microbial contaminants in water, air, and food samples. One of the applications allows better public health protection and regulatory compliance.

Although they have advantages for real-time sensing, challenges for biosensors include (i) variable detection accuracy (e.g., false positive rates) due to variability in biomolecule selection and biocompatibility (ii) complex to fabricate, and (iii) challenging to implement standardization in clinical and industrial applications. Nevertheless, the introduction of novel technologies, including AI-based methods of biosensor data processing, biophotonic lab-on-a-chip platforms, and molecular imaging-aided biosensor data analysis, are enhancing diagnostic accuracy, automation, and scalability, which will contribute to an ongoing growth trend for this market.

Two key drivers of this market are the in-vivo and in-vitro work segment, whereby the technology is being incorporated into live-cell imaging, molecular diagnostics, and therapeutic monitoring in the R&D environment, clinical, and biopharmaceutical setting.

The use of in-vivo biophotonics leads demand in the biophotonics market as real-time imaging is bringing a revolution in the medicine/nervous system applications

In-vivo biophotonics is one of the most promising technologies in medical imaging because it allows high-quality and non-invasive visualization of biological processes in living organisms with high spatial and temporal resolution. In-vivo biophotonics enables concurrent structural and functional imaging using optical techniques including multiphoton microscopy, optogenetics, and fluorescence lifetime imaging to investigate dynamic biological interactions in real-time, which is inaccessible using classical imaging modalities.

An increasing demand for in-vivo imaging in the fields of neuroscience, cancer research, and immunotherapy have accelerated the adoption of biophotonic in-vivo technologies, as scientists use live imaging techniques to study neural circuits, tumor microenvironments and the interaction between immune cells. In-vivo biophotonics has been shown to enhance functional brain mapping, improve the assessment of tumor response, and advance drug discovery campaigns.

AI-assisted in-vivo imaging analysis makes a great contribution to biological data interpretation, automated lesion detection, and real-time evaluation of therapeutic effect have been achieved; has broad prospects application value and a significant impact in preclinical and clinical research.

The use of in-vivo biophotonics in optogenetics and neurostimulation also has seen significant growth in recent years, which has in turn fuelled the demand in this market as scientists employ light-based techniques to stimulate targeted neurons, manipulate neural pathways and investigate brain function with unprecedented precision.

Although important throughout the field of live imaging, in-vivo biophotonics is limited in performance by shallow tissue penetration depth, signal scattering, and expensive equipment. Emerging innovations in near-infrared biophotonics, adaptive optics and multimodal imaging platforms are enhancing depth resolution, imaging sensitivity and real-time tracking capabilities, thereby guaranteeing a continuing market for in-vivo biophotonics.

Currently, in-vitro biophotonics has seen wide market uptake, especially in molecular diagnostics, cell-based assays, and high-throughput drug screening, as biophotonic laboratory technologies allow quick, sensitive, label-free detection of biomolecules, pathogens, and cellular activities. State-of-the-art in-vitro biochemical assays are based on conventional approaches; in contrast, burgeoning in-vitro biophotonics rely on optical modalities for analytical sensitivity and specificity, such as Raman spectroscopy or fluorescence resonance energy transfer (FRET) and total internal reflection fluorescence (TIRF) microscopy.

The growing need for fast clinical diagnostics, personalized medicine, and biomarker discovery has triggered the demand for in-vitro biophotonics since, hospitals and research institutes have been adopting optical diagnostic platforms to enhance disease diagnosis, therapeutic monitoring, and drug effectiveness analysis.

This have Zoled various aspects, such as the development of biophotonic microfluidic devices, lab-on-a-chip platforms, and AI integrated optical biosensors, significantly enhancing the multiplicity of in-vitro diagnostics exhibiting significant reduction in assay time, sample volume requirements, as well as lowering the cost of testing.

In-vitro biophotonics remains an essential tool for performing laboratory diagnostics, which comes with its own challenges including standardization problems, complicated data analysis and implementation into the existing diagnostic flow. But analysing the ever-increasing number of significant innovations in areas such as AI-based spectral analysis, machine-learning/server-free biophotonic imaging, and portable diagnostics capabilities makes it evident that ongoing efforts towards clinical accessibility, automation and cost-efficiency will keep pushing measurement market expansion for in-vitro biophotonics.

In 2023, North America held a market share of approximately 40.54% of the global biophotonics market. This leadership comes from improved health care infrastructures, large investments for research and development, and provident reimbursement policies. USA and Canada have participated, with a striking federal tranche to fund gene therapy and immunotherapy research in the USA

This will enable Europe to have a global market share in biophotonics systems market due to technology innovations alongside well- established healthcare systems. Germany, UK, and France were the leading countries in the market. However, even as the action of the international community is positive with regards to the need for sophisticated diagnosis and treatment, the solutions in biophotonics technology are now finding their way as the integration solution for global health challenges.

improvement in diagnostic/monitoring of the problems, for example, biophotonic imaging advancements, for example, optical coherence tomography, are utilized to build up and screen issues, for example, cardiovascular maladies and malignancy..

Some of the factors anticipated to propel the growth of the biophotonics market in the Asia Pacific region include high healthcare expenditure, increased research and development investments, and increasing awareness regarding the advanced diagnostic techniques in the region. Three main countries have lucrative opportunities that lead to mid-market players in the region of Japan, India and China.

This analytical report contains information on the United Kingdom, France, and Italy are expected to hold a distinct position in the Rigid Endoscopes market over the forecast period owing to the rapidly increasing prevalence of chronic disease (e.g. cancer, diabetes & cardiovascular diseases) in the pace which drive the demand for advanced diagnostic tools in this region.

Regulatory Hurdles

In medical device approvals and safety standards, the biophotonics industry is subject in particular to strict regulatory requirements. Adapting to changing regulatory environments in distinct jurisdictions complicates product development and market launch. Consequently, businesses invest time and resources in extensive testing, clinical trials, and certification processes necessary to comply with regulatory requirement.

High Development Costs

R&D capital for advanced biophotonics technologies demands large investment. High-end imaging equipment, laser systems, and biosensors can also have a high cost, which can be a barrier to widespread adoption, especially in price-sensitive markets. Access promotes the practice of cost-effective innovations in companies.

Limited Awareness & Adoption

Although there are advantages for biophotonics technology, its market is limited in some parts of the world because physicians and end-users cannot be aware of these benefits. Such awareness is vital to address this knowledge gap and promote the advantages of solutions based on biophotonics through training programs and educational initiatives.

Advancements in AI & Machine Learning

Recent Developments in Biophotonics in Medical Diagnostics with Artificial Intelligence (Ai) And Machine Learning Improved diagnostic accuracy and efficiency through AI-powered image analysis and automated screening and real-time data interpretation. Companies investing in AI-driven biophotonics solutions are likely to get competitive advantage.

Expanding Applications in Non-Medical Sectors

Healthcare continues to be the largest application area for biophotonics, but growth is also being seen in environmental monitoring, food safety and agricultural biotechnology. Biophotonics is effective when used to analyse biological samples with high precision, making it a useful technique in multiple industries.

Rising Demand for Point-of-Care Diagnostics

Portable biophotonics devices are in demand due to a rising focus on early disease diagnosis and home-based healthcare solutions. The development of innovative point-of-care diagnostics such as handheld optical imaging devices and biosensors will dominate the overall growth of the industry in the upcoming years.

The biophotonics space grew, changed, and matured significantly from 2020 to 2024 as researchers, healthcare providers, and technology developers applied investment to advanced optical technologies for diagnostics, treatment, and life sciences.

Advancements in the field of biophotonics has turned it into a necessary part of contemporary medical practice and biological investigation from increasingly requested non-invasive imaging and early disease diagnosis to precision medicine.

The intensified funding from governmental and non-governmental institutions enabled us to reduce these acquisition costs for optical imaging, spectroscopy, and laser-based treatment technologies-thereby promoting widespread applications of biophotonics in the clinics and research infrastructures through other harnessed factors.

Computer science/machine learning Models and algorithms, from AI Replay were applied to biophotonics solutions in upgrading diagnostic, therapeutic, and monitoring applications for patient and economic benefits for the health sector.

Optical coherence tomography (OCT), fluorescence imaging and Raman spectroscopy have gained prevalence in fields including dermatology, oncology, ophthalmology and neurology, enabling clinicians to detect disease with improved acuity and in earlier stages.

Apart from the rising instances of chronic diseases like cancer, cardiovascular diseases, neurodegenerative diseases, the increase in the number of biophotonics is also due to the requirement of real-time imaging and high-resolution imaging and biomolecular analysis.

The growing biophotonics market encouraged manufacturers to invent efficiency and miniaturization in devices made possible through laser technologies, photonic integration, and fiber optics. They also explored nanophotonics, quantum optics and biosensing technologies translated into the design of ultra-sensitive diagnostic tools for personalized medicine

Regulatory bodies shaped the market for a range of new biophotonics-based medical devices and diagnostic systems. These included the commercial launch of FDA-cleared optical imaging platforms, and the delivery of AI-enabled photonic diagnostics that expanded the scope of biophotonics in precision medicine.

Furthermore, cross-sector partnerships that involved stakeholders from academia, industry, and government accelerated the pathways for clinical translation and commercialisation of these next-generation biophotonics solutions to ensure they reach providers and patients quicker.

The next decade between 2025 and 2035 would bring about unimaginable advancements in biophotonics through AI, machine learning, machine vision and computational optics that will revolutionize biomedical imaging and diagnostics.

Team approach to biosensing to combine biophotonics with digital health, wearable biosensors and point-of-care testing will pave the way for seamless disease detection pathways with real time monitoring and predictive analytics for prompt patient intervention. Researchers will integrate biophotonics and lab-on-a-chip technologies for facilitating and cost-effective molecular diagnostics.

Advancements in nanophotonics and plasmonics will expand the role of ultrasensitive biosensing platforms in the detection of disease at the cellular and molecular level with unparalleled precision. A single-cell analysis, gene sequencing, and studying proteomics will be reshaped through photonic bio chips and quantum-enhanced imaging stretching the gulf of the unknown in terms of the future of personalized medicine.

Moreover, AI-based optical diagnostic and robotics-based biophotonics applications will boost healthcare automation being in the focus, as ones can reduce the range of human errors and enhance simultaneous outreach of healthcare services.

In particular, the nature of human contacts will improve significantly and cancers will never be the same as photodynamic therapy (PDT), photoimmunotherapy, optogenetics and the likes provide these non-invasive approaches receiving billions of investments from governments and private actors in biophotonics-based therapeutics.

The novel therapies from biophotonics combined with bioelectronic medicine will provide therapies based on the use of light to manipulate biological function that will ultimately enable a new frontier in regenerative medicine and neuromodulation.

The environmental sustainability concern will further affect the biophotonics market supported by researchers and manufacturers focusing on biodegradable photonic materials along with manufacturing processes contributing to eco-friendly practices to reduce the environmental footprint.

Thus there will always be a demand for very small and low power consuming biophotonics devices which will drive the research for energy-efficient laser technology and optical sensors for enhancing the domain of sustainability in medical and industrial practice.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | New optical imaging systems for diagnostics and therapeutics approved byFDA and regulatory agencies systems for diagnostics and therapeutics. |

| Technological Advancements | These include optical coherence tomography (OCT), fluorescence imaging, and Raman spectroscopy,all of which are widely used in clinical settings. |

| Industry Applications | The applications of biophotonics in oncology, ophthalmology, dermatology, andneurology were further broadened. |

| Environmental Sustainability | Researchers have investigated the use of bio-based photonic materialsfor the sustainable manufacturing of optical devices. |

| Market Growth Drivers | Rising development of optical imaging andlaser therapeutic further propelled the market growth. |

| Production & Supply Chain Dynamics | TitanPhotonics experienced manufacturing and R&D disruptions due to the pandemic supply chain problems. |

| End-User Trends | Healthcare solutions were built around non-invasive biophotonics technology for early stage disease detectionand monitoring. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations and standards ensure AI-powered and autonomous biophotonics devices meet safety and efficacy requirements. |

| Technological Advancements | AI-enhanced imaging, quantum optics, and nanophotonics drive next-generation diagnostic tools and personalized medicine. |

| Industry Applications | Integration of AI, robotics, and digital health technologies expands biophotonics use in regenerative medicine, neuroscience, and remote diagnostics. |

| Environmental Sustainability | Industry-wide shift toward eco-friendly biophotonics materials and low-energy laser technologies to reduce environmental impact. |

| Market Growth Drivers | Growth fueled by AI-driven optical diagnostics, wearable biosensors, and the expansion of biophotonics in non-medical applications. |

| Production & Supply Chain Dynamics | Regional supply chain diversification, sustainable photonics manufacturing, and increased automation enhance production efficiency. |

| End-User Trends | Surge in demand for portable, AI-powered, and home-based biophotonics diagnostics, enabling decentralized healthcare. |

The growth of the USA bio photonics market is due to the huge investments in biomedical research, rapid advancement in optical imaging technologies, and growing range of applications in diagnosing and treating diseases. The USA has a mature healthcare market; American companies leading the way in biotech, research and development, and medical devices are already investing in bio photonics-based applications.

The growing need for early disease detection & precision medicine has tremendously increase bio photonics adoption in medical imaging & diagnostics. Methods such as optical coherence tomography (OCT), fluorescence microscopy, and Raman spectroscopy have broad applications in cancer detection, ophthalmology, neurology, and cardiovascular imaging. In addition, the increasing prevalence of minimally invasive surgeries is propelling the demand for bio photonics-enabled surgical instruments.

The National Institutes of Health (NIH) and private research organizations are funding myriad studies that promote bio photonics, thereby fostering innovation in biosensors for detecting cancer, molecular imaging for therapeutic applications, and photonic therapeutics. Moreover, the increasing prevalence of chronic diseases, such as cancer, diabetes, and neurodegenerative disorders, is driving the demand for advanced optical diagnostic tools, which facilitate early disease identification and treatment monitoring.

In addition, the USA military and defense fields are also investing in bio photonics for bio sensing use cases, such as biological threat identification and wearable health tracking devices for military troops. Moreover, few budding research fields such as Nano photonics and ontogenetic are becoming pivotal factors in neurobiology and regenerative medicine, thereby aiding market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

The United Kingdom bio photonics market is expanding rapidly, adoption in medical diagnostics, bio sensing applications and regenerative medicine. The UK's active biotechnology field and government backed health research programs are fueling the development of bio photonics medical devices.

With the growing prevalence of chronic diseases such as eye diseases, cancer, and cardiovascular disorders, there is an increasing demand for advanced optical imaging techniques for example, fluorescence imaging, multiphoton microscopy, and optical coherence tomography (OCT). These technologies are transforming early disease detection and customized treatment strategies.

The UK hosts several top research institutions and bio photonics start-ups working on advanced optical biosensors and photonic-based therapeutic solutions. Organizational and government initiatives like the Biomedical Catalyst Program and funding from the UK Research and Innovation (UKRI) agency are further underlining the still growing focus on the adoption of bio photonics solutions in healthcare and life sciences.

Besides health care, bio photonics is finding use in environmental monitoring and agricultural biotechnology. Another area is optical biosensors for food and water contaminants, as well as flux-based imaging systems for monitoring crops and precision farming techniques.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.8% |

The European Union bio photonic market is expected to grow at a considerable rate during the forecast period owing to the large research environment, increasing healthcare expenditure, and increasing applications in medical diagnostics, bio sensing, and precision medicine. Thirdly, constitutions such as Germany, France, and Italy are leading the field of bio photonics research and commercialization, aided by government-funded innovation programs.

In its Horizon Europe programme the EU has also earmarked significant funding for bio photonics-related research, driving innovation in bioimaging, laser-based therapies, and wearable biosensors. Furthermore, the advancement of the European healthcare landscape towards early detection of diseases and personalized medicine has resulted in the rising uptake of optical diagnostics in oncology, ophthalmology, and neurology

Despite the concerns, demand for bio photonics is also growing in Europe, particularly in environmental monitoring and food safety applications. These optical biosensors are progressively employed for the in real-time detection of contamination, bacteria, and poisonous compounds in alimentary and water resources. Precision crop inspection is done with laser imaging technologies and is used for soil quality assessment in many agriculture settings.

In addition, the increase in smart medical devices in Europe, such as wearable photonic sensors for continuous health check-ups, is promoting the development of point-of-care diagnosing. Next-gen photonic technologies are being generated by Europe's leading firms and research institutions working hand in hand, with an eye towards sustainable market growth for the long-term.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.5% |

Technological advances in biomedical imaging, an increase being made in investments for healthcare research, and demand for early detection solutions are driving the Japanese bio photonics market. Japan is home to one of the best healthcare systems, and high government investment in precision medicine and regenerative therapies.

Japan has long been at the forefront of optical technology, the birthplace of groundbreaking next generation imaging and bio sensing systems from great companies like Olympus, Sony, and Nikon. AI is increasingly making its way into medical imaging systems used in radiology, oncology, and ophthalmology to improve the efficiency of biophotonics-based diagnostic methods.

Japan, owing to its aging population and increasing cases of chronic diseases, highly focusses on minimally invasive solutions for diagnostic and therapeutic approaches, thus boosting the growth of optical coherence tomography (OCT), fluorescence imaging and Raman spectroscopy. And the country’s robust semiconductor industry is helping develop advanced photonic chips for biosensors and lab-on-a-chip devices. There is an increasing trend observed in Japan regarding wearable photonics; here, bio smart sensing devices are incorporated into the healthcare system for remote patient monitoring, as well as for early disease detection.

Japan’s bio photonics market is expected to grow substantially as it invests in optical imaging technology, backed by strong governmental support for bio photonics R&D.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.3% |

Advancements in optical imaging technologies and increased investments in biomedical research and other healthcare innovations are some of the key factors driving the growth of the South Korea bio photonics market. Korea's largest electronics and healthcare companies, such as Samsung and LG, are investing heavily in advanced bio sensing and laser imaging solutions.

Rising demand for bio photonics-based diagnostic tools in oncology and neurology is propelling South Korea’s growing emphasis on personalized medicine. It’s also pushing wearable biosensors and artificial intelligence-powered optical imaging technologies to monitor health status in real time.

The players in the country are investing significantly in developing advanced photonic technologies, which may accelerate the growth of the South Korean bio photonics market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.4% |

The biophotonics market is growing due to the rising demand for sophisticated imaging, early disease diagnosis, and minimally invasive procedures across the medical sector. In particular, companies are using AI-powered optical imaging, photonic biosensing, and next-generation laser-based diagnostics to improve real-time biomedical analysis, enable precision medicine, and increase efficiency in drug treatment and delivery. This market offers an overview of global market players, including market leaders and specialized manufacturers focusing on photonics for development of technologies for fluorescence imaging, optical coherence tomography (OCT), laser therapy systems, and more.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific, Inc. | 12-17% |

| Carl Zeiss AG | 10-14% |

| Olympus Corporation | 9-13% |

| Hamamatsu Photonics K.K. | 7-11% |

| BD (Becton, Dickinson and Company) | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific, Inc. | Develops biophotonic biosensors, fluorescence imaging systems, and high-resolution spectroscopy solutions for biomedical research and clinical diagnostics. |

| Carl Zeiss AG | Specializes in advanced optical imaging systems, high-resolution confocal microscopy, and AI-powered biophotonic analysis. |

| Olympus Corporation | Manufactures next-generation optical coherence tomography (OCT) devices, multiphoton microscopy solutions, and bio-imaging platforms. |

| Hamamatsu Photonics K.K. | Provides photon detection technologies, laser-based biophotonic imaging, and near-infrared (NIR) spectroscopy systems. |

| BD (Becton, Dickinson and Company) | Offers flow cytometry solutions, single-molecule fluorescence detection, and biomedical laser applications for precision diagnostics. |

Key Company Insights

Thermo Fisher Scientific, Inc. (12-17%)

Thermo Fisher is the biggest player in the biophotonics market and provides biosensors, fluorescence imaging, and high-resolution spectroscopy technologies used in clinical and research applications. The company combines AI-based optical imaging to enhance disease detection.

Carl Zeiss AG (10-14%)

Carl Zeiss, whose focus is on the development of high-precision optical imaging systems as well as microscopy, has been a pioneer in confocal and multiphoton imaging for life sciences and medical research.

Olympus Corporation (9-13%)

Olympus' latest innovations in OCT and multiphoton microscopy solutions drive real-time biophotonic imaging that aim to unlock new potential in early disease detection and surgical navigation.

Hamamatsu Photonics K.K. (7-11%)

In addition, Hamamatsu is a driving force behind laser-based biophotonics, photodetector, and AI-boosted optical coherence imaging technologies, offering high sensitivity and accuracy for biomedical evaluations.

BD (Becton, Dickinson and Company) (5-9%)

BD has developed applications for real-time biophotonic analysis in clinical applications specializing in flow cytometry, fluorescence-based molecular diagnostics, and biomedical laser technologies.

Other Key Players (40-50% Combined)

A few photonics and biomedical imaging companies focus on next-gen optical biosensing, real-time in vivo imaging, and AI photonic analysis. These include:

The overall market size for Bio photonics Market was USD 67.2 Billion in 2025.

The Bio photonics Market is expected to reach USD 189.3 Billion in 2035

The demand for the bio photonics market will grow due to advancements in optical imaging technologies, increasing applications in healthcare and life sciences, rising demand for non-invasive diagnostics, and growing investments in biomedical research, driving the need for innovative photonic solutions.

The top 5 countries which drives the development of Bio photonics Market are USA, UK, Europe Union, Japan and South Korea.

In-Vivo and In-Vitro Technologies Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Application, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Application, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Application, 2023 to 2033

Figure 59: Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: MEA Market Attractiveness by Application, 2023 to 2033

Figure 119: MEA Market Attractiveness by End User, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA