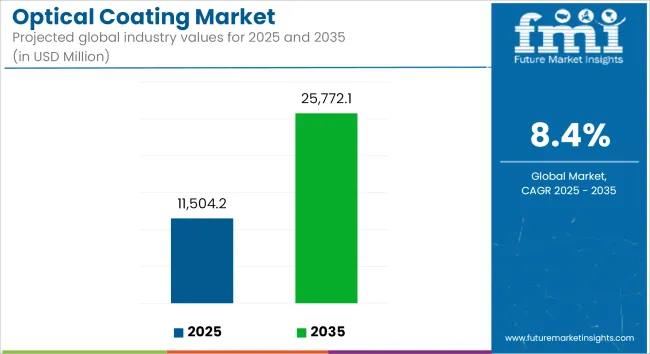

The global optical coatings market is estimated to be valued at USD 11,504.2 million in 2025 and is forecast to grow to USD 25,772.1 million by 2035, advancing at a CAGR of 8.4% during the forecast period. Growth is primarily driven by the rising use of coated optics in consumer electronics, photovoltaics, automotive, aerospace, and healthcare sectors, where enhanced light transmission, glare reduction, and durability are critical.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 11,504.2 Million |

| Market Value (2035F) | USD 25,772.1 Million |

| CAGR (2025 to 2035) | 8.4% |

The optical coatings market is benefiting from notable advancements in display and imaging technologies, especially in consumer electronics, where touchscreens, AR/VR headsets, and high-performance displays rely heavily on anti-reflective and glare-reducing coatings. The expansion of solar energy and 5G infrastructure is increasing demand for specialized coatings that improve light transmission and signal clarity.

In automotive and aerospace, optical coatings enhance the performance of sensors, LiDAR, and lighting systems by boosting sensor accuracy and reducing reflection losses. Other applications in healthcare (endoscopes, imaging systems) and construction (energy-efficient glazing) are also contributing to the market’s rapid expansion.

Regionally, Asia-Pacific leads in adoption due to its strong manufacturing base in electronics and rapid infrastructure development, with North America and Europe following due to high investment in R&D and regulatory support for energy-efficient technologies.

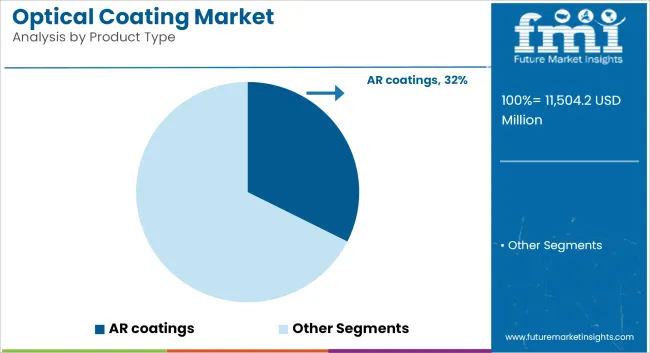

Anti-reflective (AR) coatings are expected to dominate the optical coatings market with a 32.4% share in 2025 and are projected to grow at a CAGR of approximately 8.2% through 2035. These coatings enhance light transmission and eliminate unwanted reflections, thereby improving optical clarity and visual performance.

Their growing demand in smartphones, eyeglasses, solar panels, camera lenses, and high-resolution display systems underscores their versatile applications. The increased integration of AR coatings into AR/VR devices, wearables, and OLED displays further supports market expansion. In the solar sector, these coatings help improve energy efficiency by reducing light reflection losses, making them valuable for photovoltaic modules.

The trend toward sleek, energy-efficient consumer gadgets and smart wearables continues to elevate demand. As manufacturers push for higher screen brightness, thinner form factors, and better energy use, AR coatings offer a proven, scalable solution. Technological advances in multi-layer coatings and nanostructured surfaces are also boosting adoption across end-use industries..

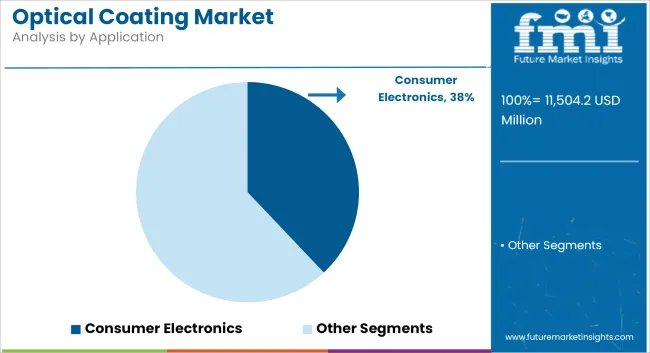

The consumer electronics segment is expected to account for 38% of optical coatings demand in 2025, growing at an 8.5% CAGR through 2035. The segment’s prominence is powered by the proliferation of smartphones, tablets, laptops, wearables, and AMOLED/OLED displays-technologies that prioritize anti-glare, scratch resistance, and optical fidelity. Rapid adoption of AR/VR, foldable screens, and high-resolution cameras boosts coatings demand. Asia-Pacific remains the strongest regional contributor due to strong electronics manufacturing in China, South Korea, Japan, and India.

Cost Sensitivity and Process Complexity

Another key challenge in the optical coating market is finding a balance between cost-effectiveness and performance. Production costs thus have to rise since such high-precision coatings require advanced deposition techniques, high-vacuum environments, and meticulous quality control typically used in aerospace, semiconductor, and laser optics.

So small players may not be able to take on such advanced tactics. The technicality of ensuring the adhesion, durability, and uniformity of the coating across complex geometries is also another challenge to tackle specifically when scaling up for mass production.

AR/VR, Photonics, and Renewable Energy Boom

Emerging high-growth sectors offer substantial opportunities. A core driver for this booming AR/VR market, which needs lightweight and optically clear coatings for headsets and smart glasses. Likewise, the rise of photonic chips, LiDAR sensors, and autonomous navigation systems is boosting the demand for beam splitters,filters, and anti-glare coatings.

When it comes to solar energy, advances in optical coatings are allowing for higher efficiency, as well as durability in harsh climates. Additionally, the emergence of smart windows and energy-efficient buildings creates an entirely new landscape for multifunctional and responsive optical coatings.

In the USA, the optical coating market is rapidly growing owing to growing demand for in defence optics, consumer electronics and advanced photonics applications. They have strong R&D investments on the end-user side, especially for anti-reflective, high-reflective, and filter coatings utilized in imaging systems, LiDAR, and semiconductors.

Oversight from the Environmental Protection Agency (EPA) helps ensure that the coating processes one employs are compliant, while the National Institute of Standards and Technology (NIST) assist with innovation and standardization.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.6% |

In the United Kingdom, growing need for optical coatings in medical imaging, aerospace, and telecom applications are propelling the assignee market. With government-backed technology hubs, the country is betting on photonics innovation to encourage the adoption of advanced thin-film coating technologies in the market.

Manufacturing sustainability and increasing deployment of precision optics in healthcare are further fueling penetration in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.3% |

The market in Europe is anticipated to grow due to the strong adoption for application in automotive sensors, augmented reality (AR), and solar energy systems. new product development is being heavily oriented due to stringent EU regulations for eco-friendly coating materials and emission control.

Germany, France, and the Netherlands are all big contributors, driven by around solid demand for industrial automation and high-performance lenses.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.4% |

Consumer electronics, high-end cameras and semiconductor lithography make Japan an important hub for the optical coating market. Its established optics manufacturing sector, supported by innovations in nano-coatings and precision layering technologies, reinforces its global leadership.

First, the regulatory compliance (e.g., METI: Ministry of Economy, Trade and Industry) and the continuous research and development (R&D) of photonic materials improve the product's performance and market scope.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.4% |

The South Korea optical coating market will continue to grow as the electronics and display industries remain robust. Application of anti-reflective and protective coatings in OLED panels, optical sensors, and automotive vision systems, among others, is a growing demand.

In addition, government initiatives supporting domestic innovation in precision optics and epistemic manufacturing policies aimed at export further push market progress.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.5% |

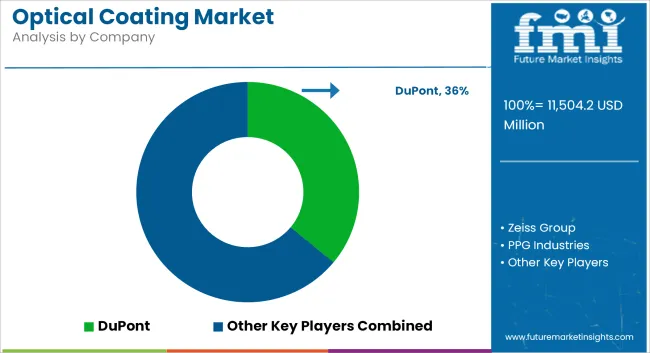

The global optical coatings market with top players such as DuPont, Zeiss Group, PPG Industries, Nippon Sheet & Glass, Inrad Optics, EssilorLuxottica, Optosigma Corporation, Hoya Corporation, Reynard Corporation shaping industry dynamics through technological innovation and strategic collaborations.

These companies are heavily investing in research and development to enhance product performance while meeting emerging environmental regulations. Key trends driving competitive differentiation include the development of multi-layer, nano-structured, anti-fingerprint, hydrophobic, and low-VOC coatings. These innovations address growing needs across automotive HUDs, solar panels, advanced optics, and medical imaging systems.

Manufacturers are also optimizing coatings for improved durability, light control, and wavelength selectivity. The competitive landscape is being reshaped by regional expansions in Asia-Pacific and North America, where industrialization, consumer demand, and government initiatives are boosting investment.

Sustainability goals are compelling players to adopt green chemistries and recyclable substrates. Partnerships with OEMs and electronics manufacturers are critical for staying ahead, with smart coatings and energy-efficient applications emerging as strategic growth avenues.

The overall market size for the optical coating market in 2025 is projected to be approximately USD 11,504.2 Million.

The optical coating market is estimated to reach around USD 25,772.1 Million by 2035, indicating substantial growth over the decade.

Key drivers include the increasing demand for high-quality optical components in consumer electronics, telecommunications, aerospace and defense, and solar energy. Technological advancements in deposition techniques and the rising adoption of renewable energy technologies are also major contributors.

The leading regions contributing to the optical coating market are Asia-Pacific, North America, and Europe. Asia-Pacific dominates the market, driven by industrial growth and infrastructure expansion in countries like China and India.

The anti-reflective coatings segment is expected to lead due to its wide application in reducing glare and improving transmission in optical devices across various sectors.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA