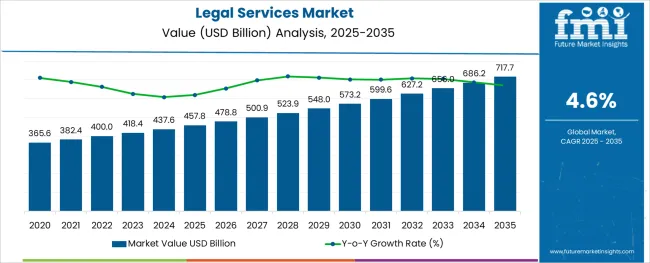

The Legal Services Market is estimated to be valued at USD 457.8 billion in 2025 and is projected to reach USD 717.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The legal services market is undergoing transformation driven by increasing demand for specialized legal counsel, cross-border compliance, and digital service delivery. As globalization intensifies, businesses are engaging legal firms for cross-jurisdictional tax planning, intellectual property protection, and dispute resolution. Technology adoption in legal operations is further enhancing transparency, efficiency, and client engagement through e-discovery tools, automated document review, and AI-based contract analytics.

The growing complexity of tax laws, data privacy regulations, and ESG mandates is driving reliance on expert legal advisors with sector-specific knowledge. Large firms are expanding service portfolios through strategic mergers and acquisitions while boutique providers are focusing on niche practices.

Additionally, clients are showing preference for hybrid legal delivery models that blend traditional counsel with on-demand digital platforms. The combination of cost-conscious clients, evolving compliance environments, and scalable legal technologies is expected to drive continued growth, especially in enterprise segments and specialized advisory services.

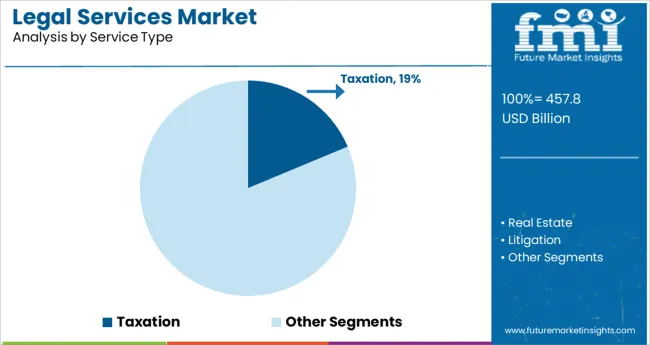

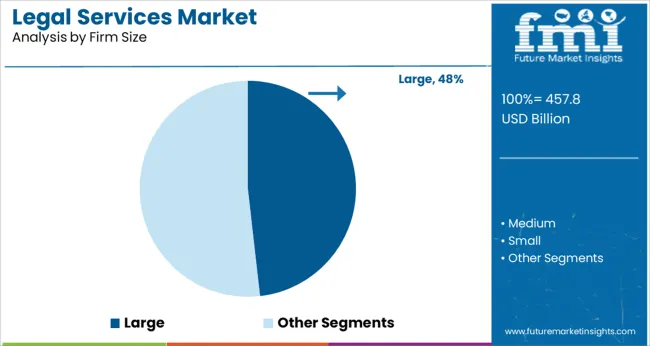

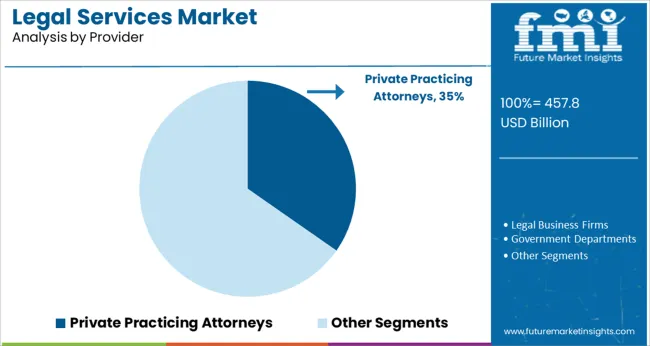

The market is segmented by Service Type, Firm Size, and Provider and region. By Service Type, the market is divided into Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, and Corporate. In terms of Firm Size, the market is classified into Large, Medium, and Small. Based on Provider, the market is segmented into Private Practicing Attorneys, Legal Business Firms, Government Departments, and Other Providers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Service Type, Firm Size, and Provider and region. By Service Type, the market is divided into Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, and Corporate. In terms of Firm Size, the market is classified into Large, Medium, and Small. Based on Provider, the market is segmented into Private Practicing Attorneys, Legal Business Firms, Government Departments, and Other Providers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The taxation segment is projected to account for 18.7% of the total revenue in the legal services market in 2025, making it one of the most critical service categories. This prominence is driven by increasingly complex international and domestic tax regulations, rising scrutiny from tax authorities, and corporate demand for strategic planning and dispute resolution.

Legal advisors specializing in taxation are being engaged to navigate changing transfer pricing frameworks, BEPS compliance, and digital economy taxation reforms. Enterprises are relying on legal counsel to manage tax risk, mitigate audit exposure, and align tax strategies with evolving regulatory landscapes.

Moreover, the integration of legal and financial advisory functions has amplified the importance of specialized taxation services. As businesses expand into new markets and tax regimes evolve rapidly, legal support for planning, litigation, and compliance is expected to remain a fundamental pillar of the overall legal services industry.

Large firms are expected to dominate the legal services market in 2025 with a 48.2% share of total revenue, underscoring their central role in handling high-value, complex legal matters. These firms are equipped with multidisciplinary teams, international reach, and the infrastructure to support large-scale corporate, financial, and regulatory engagements.

Clients seeking end-to-end legal solutions, from mergers and acquisitions to litigation and compliance, have increasingly turned to large firms for their depth of expertise and ability to handle cross-border issues. Investment in legal technologies, internal knowledge management systems, and global talent networks has further strengthened the capabilities of these firms.

Additionally, the ongoing consolidation in the legal industry is enabling large firms to expand their footprint across emerging jurisdictions, diversify their practice areas, and serve multinational clients with consistent quality. Their leadership in innovation, scale, and specialized service delivery is expected to sustain their market dominance.

Private practicing attorneys are anticipated to hold 34.7% of the total market revenue in 2025, securing their position as a key provider group within the legal services industry. Their dominance is supported by the continued demand for personalized legal counsel, flexibility in client engagement, and affordability relative to large firm billing structures.

Private practitioners serve a broad spectrum of legal needs ranging from individual representation and small business advisory to local dispute resolution and compliance assistance. They are often embedded in community legal ecosystems, making them accessible and responsive to localized legal requirements.

The rise of digital tools and legal platforms has empowered private practitioners to manage documentation, research, and client communication efficiently, enhancing service delivery and client satisfaction. As legal consumers increasingly seek cost-effective and specialized services, private practicing attorneys are expected to maintain a strong foothold in both generalist and niche practice areas.

Digitization and Widespread use of Cutting-Edge Technology to Boost the Market

Legal firms are exploring digitization in order to expedite their procedures. Adoption of technology like artificial intelligence, cloud computing, machine learning, and big data analytics aids in quicker documentation, proofreading, and resource management. This results in cost savings and improved operational efficiency.

These technologies can also match the rising demands of investors and clients by providing greater service delivery. Furthermore, growing legal regulations as well as heightened rivalry force businesses to invest in modern technology. Thus, increased digitalization and a trend toward automation are anticipated to drive the market of the legal services market throughout the forecast period.

Machine learning (ML) and artificial intelligence (AI) are advanced technologies that assist professionals in automating some activities and focusing their resources and time on critical legal tasks. These technologies enable organizations to design and assess contracts, as well as do document mining and due diligence.

Big data analytics is also expected to increase at a rapid pace. This has fueled the emergence of businesses like FiscalNote, Ravel Law, and InvestCEE Tanacsado Kft., which supply their clients with high-quality, technologically enhanced analytical insights.

The legal services industry is likely to be driven by an increase in transactional practices during the forecast period. Transactional practice involves corporate, tax, and real estate work, as well as mergers and acquisitions investigation, preparation, and evaluation of papers for people and businesses.

The multitude of mergers and acquisitions in several industries, including pharmaceutical, accounting, and technology, is expected to increase during the forecast period, owing to pharmaceutical companies seeking new possibilities to improve their product portfolios due to the patent expiration of popular drugs in 2025 to 2029.

One of the anticipated acquisitions is the purchase of Celgene, an American biotechnology company, by Bristol-Myers Squibb, a global biopharmaceutical company based in the United States, in order to create a leading biopharma company to address patients suffering from oncology, immunology, inflammation, and cardiovascular disease.

Another significant transaction was Vista Equity Partners' USD 717.7 billion purchase of Pluralsight, an online training course provider. In Saudi Arabia, the predicted increase in M&A activity may be linked to government measures to diversify the Kingdom's economy and loosen laws governing foreign direct investment, which are backed by Vision 2035 economic reform. The legal services industry is likely to be driven by an increase in M&A activity across sectors and nations.

Rising Prices as well as Shrinking Margins Impede the Global Legal Services Market Growth

Economic development will result in salary rises as well as a shortage of trained employees in a skilled labor-intensive industry such as legal services. These rising input prices will put pressure on legal services businesses aiming to safeguard profits while maintaining service quality.

According to an Altmanweil poll conducted in 2020, about 95.4% of law firms said that price competitiveness was a significant trend influencing the legal services market and harming their profit margins. Rising legal service expenses are projected to limit the legal services market's expansion.

ALSPs are rapidly appearing in the legal business. They are essentially in the law industry and offer a variety of everyday legal services to businesses and law firms. ALSPs handle a wide range of responsibilities for businesses, including document review, litigation, contract life cycle management, compliance, and legal entity management.

This improves the efficiency of law firms by allocating resources more wisely, resulting in cost savings. ALSPs also employ technology to accelerate the value chain in legal services. Thus, over the projection period, ALSPs will generate profitable chances for the expansion of legal services.

Based on services, the global legal services market can be segmented into taxation, real estate, litigation, bankruptcy, labor/employment, and corporate. Based on firm size, the worldwide legal services market can be segmented into large firms, medium firms, and small firms.

Based on the provider, the international legal services market can be segmented into private practicing attorneys, legal business firms, government departments, and others.

As per the analysis, on the basis of service type, the corporate segment led the market in 2024, accounting for more than 25% of worldwide sales. This large percentage is due to the advent of new sorts of financial transactions on business fronts.

Furthermore, the corporate category is forecasted to be the dominant service segment during the projection period from 2025 to 2035, as disputes over employee harassment, organizational discrimination audits, and copyright and patent infringement continue to soar. The amplifying demand for intellectual property-related services in the business sector is anticipated to drive the segment's expansion.

In 2024, the litigation segment had a significant revenue share as establishments continued to incur significant expenditures in their lawsuit management. Moreover, third-party legal finance and lawsuit funding service providers are gradually increasing their global capability and widening their jurisdiction range.

This has opened up a plethora of prospects for litigation service providers. The implementation of severe labor relations and intellectual property (IP) protection legislation in both developed as well as in emerging nations has contributed to an increase in demand for litigation services.

On the other hand, by firm size, the big firm division led the market in 2024, accounting for more than 36% of worldwide sales. This substantial percentage can be due to large enterprises' diverse variety of services.

For example, big firms handle the majority of judicial work, such as large-scale litigations, substantial corporate transactions, and criminal defense proceedings for companies in a variety of sectors. The amplifying demand for corporate and judicial services from big organizations is likely to boost the expansion of the large company category throughout the predicted period.

Similarly, medium- and small-sized legal services firms are expanding globally by recruiting attorneys and building offices overseas. These businesses generally target international clients to aid them in handling their legal needs.

They are also broadening their worldwide consumer base by offering high-end specialist services involving complicated transactions. As a result, the medium-firm and small-firm categories are expected to maintain a significant revenue share during the forecast period.

Geographically, North America led the market, accounting for more than 40% of worldwide legal service deployment. The United States has emerged as the market leader in North America. In 2024, increased assignment volumes among corporate legal departments in the United States can be linked to a high share of the North America area.

Because of the enormous presence of legal service providers, the United States has emerged as one of the major countries in the North American area. Furthermore, increased acquisitions and mergers in the North American region are projected to increase demand for legal services.

Additionally, the rise of the European legal services market during the forecast period between 2025 and 2035 can be attributed to a significant number of law professionals providing legal services to customers in countries such as Spain.

Aside from that, a large number of law firms in countries such as the United Kingdom and Germany are outsourcing their legal services to countries such as India and the Philippines in order to avoid incurring huge costs on legal services, which will propel market growth in the continent over the next decade.

On the other hand, due to the rapid adoption of regulatory and legal requirements, notably in China as well as India, Asia Pacific accounted for a substantial market share in 2024. For example, legal service providers in India have begun to offer sophisticated cross-border court services to their corporate clients, creating significant development potential for the nation.

Service providers like Venable LLP, Baker & McKenzie, and Allen & Overy LLP have also joined the Indian market, which is projected to enhance the market growth in the area in the future years.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States of America | 4.5% |

| United Kingdom | 4.4% |

| China | 4.3% |

| Japan | 4.2% |

| India | 4.3% |

Market participants are focused on increasing their consumer base and gaining a competitive advantage over their competitors. They are carrying out a number of strategic activities, including collaborations, mergers and acquisitions, partnerships, and the creation of new products and technologies. Among the main participants in the global legal services industry are:

Recent key developments among players are:

In November 2024, Clifford Chance LLP joined Green Map System, Inc., an independent non-profit organization to provide support and advice on the design and execution of the International Guarantee Trust Fund initiative to promote large-scale renewable energy installations.

| Report Attributes | Details |

|---|---|

| Growth Rate | 4.6% CAGR from 2025 to 2035 |

| Market Value in 2025 | USD 457.8 billion |

| Market Value in 2035 | USD 717.7 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Service Type, Firm Size, Provider, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Israel |

The global legal services market is estimated to be valued at USD 457.8 billion in 2025.

It is projected to reach USD 717.7 billion by 2035.

The market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types are taxation, real estate, litigation, bankruptcy, labor/employment and corporate.

large segment is expected to dominate with a 48.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Legal, Risk and Compliance Solution Market Forecast and Outlook 2025 to 2035

Legal AI Market Size and Share Forecast Outlook 2025 to 2035

Legal Process Outsourcing LPO Size Market Size and Share Forecast Outlook 2025 to 2035

LegalTech Market Analysis - Size, Share, and Forecast 2025 to 2035

AI-Driven Legal Transcription – Automating Legal Documentation

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA