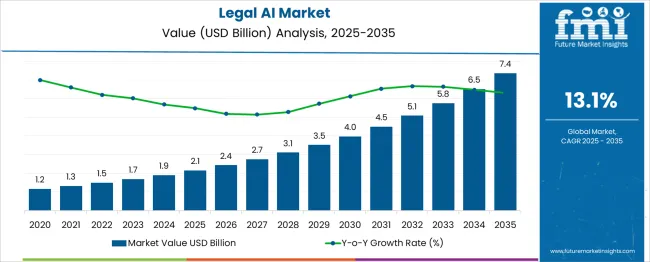

The Legal AI Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 13.1% over the forecast period. A peak-to-trough analysis, considering historical data from 2020, identifies USD 1.2 billion in 2020 as the trough, reflecting early-stage adoption primarily in e-discovery and document review. From this point, the market expanded to USD 1.7 billion by 2023 and USD 2.1 billion in 2025, driven by growing reliance on predictive analytics for litigation, contract lifecycle management, and compliance automation.

The projected peak of USD 7.4 billion by 2035 represents a 6.2x multiplier from the trough, underscoring a robust compounding effect. Incremental growth accelerates post-2028 as generative AI integration, natural language processing for legal research, and AI-driven risk assessment become standardized across law firms and corporate legal departments. The second half of the forecast period (2030–2035) contributes nearly USD 3.4 billion, or 64% of total gains, indicating strong back-weighted momentum. This trajectory shows that firms investing early in scalable AI platforms, cloud-based legal analytics, and integrated compliance solutions will outperform competitors as legal AI transitions from optional innovation to a critical operational necessity.

| Metric | Value |

|---|---|

| Legal AI Market Estimated Value in (2025 E) | USD 2.1 billion |

| Legal AI Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

The legal AI market occupies a rapidly expanding niche across several technology and professional service categories. In the legal technology (LegalTech) market, AI-driven solutions contribute 18–20%, as tools for contract analytics, e-discovery, and legal research gain adoption. Within the enterprise artificial intelligence and cognitive services market, legal AI represents 3–4%, since AI applications span multiple verticals, including healthcare, finance, and retail.

In the document and content management software market, its share is 6–7%, supported by AI-powered document review, summarization, and clause extraction tools that improve workflow efficiency. Across the regulatory compliance and risk management solutions market, legal AI accounts for 8–9%, reflecting its role in compliance automation, risk assessment, and monitoring of evolving legal frameworks. Within the professional services automation and legal operations market, its share reaches 10–12%, as law firms and corporate legal teams integrate AI for billing optimization, predictive case outcomes, and workload forecasting.

Growth in this space is driven by rising pressure on law firms and legal departments to reduce costs, improve accuracy, and accelerate contract turnaround times. Innovations in natural language processing, predictive analytics, and generative AI for drafting are reshaping service delivery, positioning legal AI as a transformative force in modern legal operations and compliance ecosystems.

The legal AI market is undergoing a significant transformation as law firms, corporate legal departments, and service providers increasingly integrate artificial intelligence into workflows to enhance efficiency, accuracy, and compliance. The adoption is being driven by rising legal complexities, cost pressures, and the need for rapid document review and analysis.

AI technologies are enabling automation of repetitive tasks, improved decision-making, and better risk mitigation, thereby improving operational performance. Future growth is expected to be fueled by advancements in machine learning, greater acceptance of AI-assisted tools by regulatory bodies, and the rising volume of digital data to be processed.

Strategic investments, competitive differentiation, and evolving client expectations are paving the way for sustained innovation and broader deployment of AI solutions within the legal sector.

The legal AI market is segmented by deployment model, technology, application, end use and, geographic regions. By deployment model of the legal ai market is divided into Solution and Services. In terms of technology, the legal AI market is classified into Natural language processing, Machine learning, Robotic process automation, generative AI, and Others. Based on the application of the legal AI market, it is segmented into Contract lifecycle management, Legal research and case law analysis, E-discovery, Compliance and risk management, Document review and analysis, and Others. By end use, the legal AI market is segmented into Law firms, Corporations and in-house legal teams, Government and public sector, and Legal service providers and consultants. Regionally, the legal AI industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

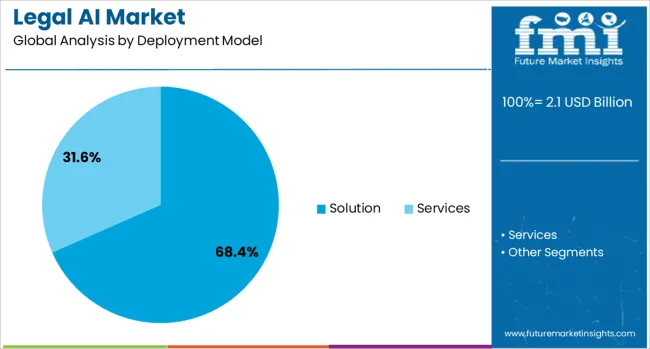

When segmented by deployment model, the solution subsegment is projected to account for 68.40% of the total market revenue in 2025, making it the leading subsegment. This dominance is being supported by the increasing demand for packaged AI-powered legal software that integrates seamlessly with existing systems while offering scalability.

Solution offerings are being preferred due to their ability to deliver out-of-the-box functionalities, lower implementation complexities, and reduced time-to-value compared to customized or infrastructure-heavy alternatives. Organizations are leveraging these solutions to improve document automation, legal research, and contract analytics with minimal disruption to current operations.

Enhanced usability, vendor support, and compliance-readiness are further reinforcing confidence in solution-based deployments, ensuring their position as the most adopted approach within the market.

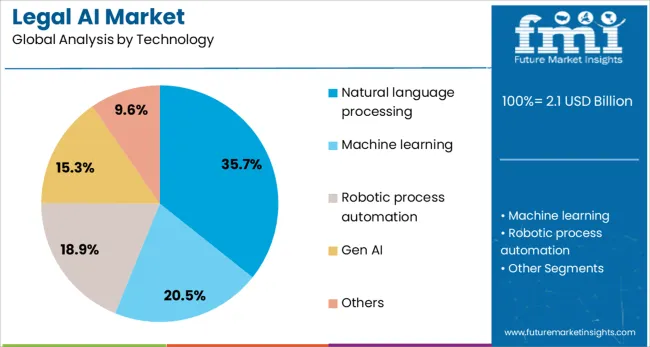

Segmented by technology, natural language processing is expected to contribute 35.7% of the total market revenue in 2025, emerging as the leading technology segment. This leadership is being driven by the critical role of NLP in enabling AI systems to understand, interpret, and generate human language, which is central to legal processes.

NLP capabilities are being deployed to extract key information from unstructured legal texts, automate contract reviews, and facilitate intelligent search across vast document repositories. Its ability to comprehend context, detect nuances, and improve over time through machine learning is making it indispensable for tasks requiring legal reasoning and compliance checks.

The growing sophistication of NLP models and their increasing integration with other AI tools are solidifying their value proposition, driving widespread adoption across legal use cases.

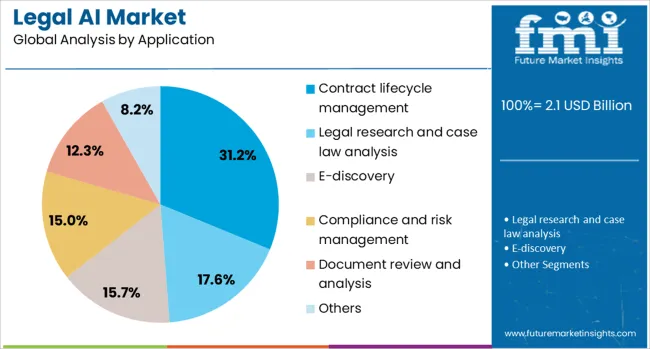

When segmented by application, contract lifecycle management is anticipated to hold 31.2% of the market revenue in 2025, establishing itself as the foremost application area. This prominence is being attributed to the high demand for streamlining contract creation, negotiation, execution, and compliance monitoring within legal and corporate environments.

AI-driven contract lifecycle management is being embraced to reduce risks, accelerate turnaround times, and ensure regulatory adherence throughout the contract process. The automation of clause extraction, risk flagging, and performance tracking is delivering measurable efficiencies and cost savings.

Increased organizational focus on governance and transparency, along with the complexity of managing large volumes of contracts across jurisdictions, is further amplifying the appeal of AI-powered solutions in this application, maintaining its leadership in the market.

Legal AI refers to artificial intelligence tools designed to support legal tasks such as document review, contract analysis, case research, and regulatory compliance. These systems are deployed by law firms, corporate legal departments, litigation support services, and regulatory agencies. Demand is driven by pressure to reduce turnaround time, improve accuracy, and manage large volumes of legal documents. Vendors offering platforms featuring natural language processing, secure data handling, and configurable workflows have been well positioned. Tools that enable faster review, consistent outcome quality, and cost-efficiency continue to influence adoption decisions among legal professionals and corporate counsel.

Growth in the legal AI market has been supported by rising workloads and the need to minimize document processing time in legal departments and law firms. Tasks such as contract drafting, due diligence, and discovery review have placed pressure on manual processes. AI tools offering rapid extraction of clauses, accurate metadata tagging, and consistent risk assessment have reduced turnaround and improved consistency. Rising complexity in compliance and regulatory filings has reinforced reliance on automated research and review tools. Demand for platforms that integrate with existing case management systems and support secure collaboration has further driven deployment. Efficiency-focused budgets have been allocated to solutions that enhance productivity while maintaining quality.

Expansion has been restrained by concerns over client data confidentiality, as legal documents often contain sensitive or privileged information. Ensuring privacy and adherence to legal professional standards has required encryption, audit trails, and strict access control. Inaccurate clause identification or misclassification of contract terms by AI tools has reduced user trust in some implementations. Variability in legal language and regional jurisdictional differences has posed challenges in model training and localization. High implementation cost and integration complexity with legacy systems have slowed adoption in smaller firms. Regulatory attention regarding AI transparency and accountability has led to additional vetting and validation requirements before deployment.

Opportunities are emerging in custom AI solutions tailored for specific practice areas such as intellectual property, employment law, or mergers and acquisitions. Integration of legal AI into broader professional service offerings such as managed contract review, litigation support, or compliance audits is expanding service scope. Partnerships between AI vendors and legal process outsourcing firms allow bundled solutions supporting high-volume document workflows. Subscription models offering tiered access to language models and analytics tools offer predictable cost options. Development of tools that support multilingual contract analysis and cross-border regulatory compliance is increasing. Demand for AI-powered knowledge bases and risk scoring dashboards is growing among corporate legal teams seeking data-driven decision support.

Adoption of AI platforms featuring continuous learning capabilities has increased, enabling models to refine performance from internal feedback and historical data. Integration with case management systems, document repositories, and email platforms has become more prevalent, supporting streamlined legal workflows. Tools supporting collaborative review and version control with audit logs are being prioritized. The use of explainable AI features that justify clause suggestions and classification decisions has become a key requirement. Emerging demand has been seen for toolkits that support contract drafting guidance, template generation, and QuickCheck-style compliance summaries. Vendor platforms offering modular upgrades, integration APIs and secure hosting options have shaped product road maps and legal practice adoption patterns.

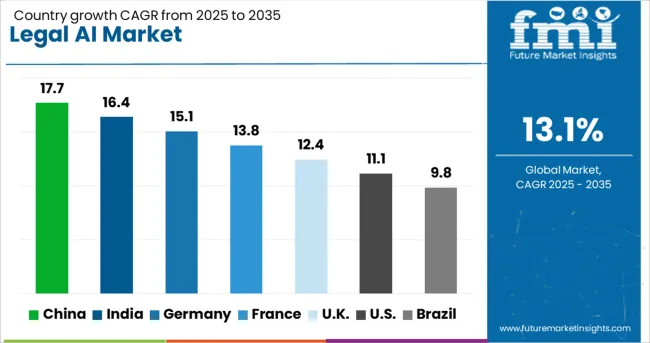

| Country | CAGR |

|---|---|

| China | 17.7% |

| India | 16.4% |

| Germany | 15.1% |

| France | 13.8% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

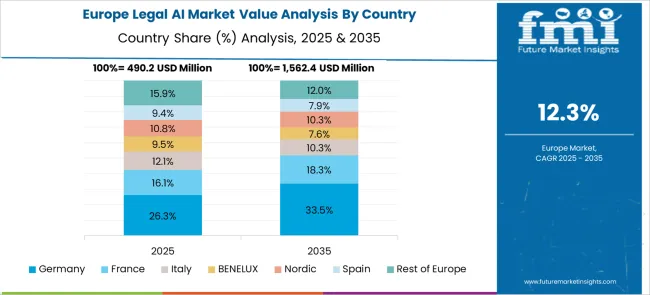

The legal AI market is projected to expand at a CAGR of 13.1% between 2025 and 2035, driven by demand for predictive analytics, automated contract review, and real-time legal research tools. China leads with 17.7% CAGR, driven by technology-enabled legal process automation in corporate law. India follows at 16.4%, supported by digitalization in legal documentation and compliance for financial services. Among OECD economies, Germany posts 15.1%, emphasizing AI-powered litigation analytics and risk assessment for large enterprises. France records 13.8%, with strong focus on contract lifecycle management solutions, while the United Kingdom grows at 12.4%, driven by adoption of AI-based e-discovery platforms and legal compliance tools. The report covers over 40 countries, with detailed insights for five profiled below.

China is projected to achieve a 17.7% CAGR, driven by widespread use of AI-based legal automation across corporate and regulatory environments. Enterprises and law firms are deploying contract analytics platforms and compliance monitoring tools to reduce operational delays. Natural language-based search systems are improving case research efficiency, while predictive litigation solutions are gaining adoption for complex dispute management. The rise in intellectual property disputes and cross-border trade agreements is pushing demand for advanced legal analytics. Partnerships between legal technology vendors and domestic cloud providers are strengthening scalability for high-volume data processing.

India is expected to grow at a 16.4% CAGR, supported by digitalization in legal workflows and compliance-driven sectors. AI-powered contract lifecycle solutions are reducing review timelines and improving accuracy in banking and insurance operations. Sentiment-based litigation analysis and automated document classification tools are being widely adopted for case preparation. The legal process outsourcing industry is fueling demand for platforms handling multi-jurisdictional compliance. Collaborations between legal tech startups and enterprise clients are creating AI-enabled ecosystems for end-to-end legal management.

Germany is forecast to expand at a 15.1% CAGR, driven by the implementation of predictive analytics and AI-powered litigation platforms. Corporate legal teams rely on integrated solutions combining risk modeling with historical case data for strategic planning. Compliance-heavy sectors such as finance and automotive are accelerating the adoption of automated document review tools for audits and due diligence. AI-based contract drafting systems and real-time transaction monitoring are streamlining M&A activities. Cloud-hosted platforms are being deployed to ensure secure data handling under strict privacy frameworks.

France is projected to grow at a 13.8% CAGR, driven by the adoption of AI-based tools in contract lifecycle management and regulatory investigations. Enterprises use machine learning platforms for clause extraction and risk scoring in complex agreements. Law firms integrate workflow automation systems for intellectual property tracking and dispute resolution. Demand for e-discovery platforms is rising, particularly for compliance in multinational corporations. Vendors are investing in secure, multilingual tools to address cross-border legal challenges.

The United Kingdom is projected to post a 12.4% CAGR, supported by growing demand for e-discovery platforms and AI-driven legal research tools in corporate litigation. Law firms are adopting case law analytics solutions to predict judicial outcomes and reduce litigation risks. AI-enabled compliance platforms are gaining traction among financial institutions to manage regulatory complexity post-Brexit. Virtual legal assistants integrated with document automation software are improving operational efficiency in large legal practices. Investments in secure, cloud-based legal databases provide scalability and data protection for remote and hybrid law firm models.

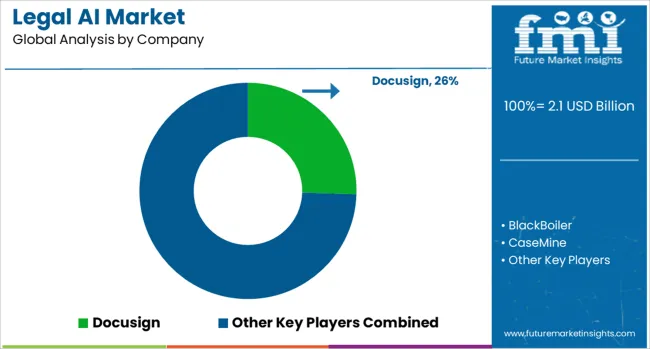

The legal AI market is rapidly expanding with key players such as Docusign, BlackBoiler, CaseMine, Casetext, ContractPodAi, CosmoLex Cloud, Everlaw, Icertis, iManage, and Kira Systems, each addressing different segments of legal technology including contract lifecycle management, predictive analytics, and intelligent legal research. Docusign dominates contract management through AI-driven e-signature and document automation capabilities, while Icertis offers advanced contract lifecycle solutions integrating machine learning for compliance and risk management. Kira Systems leads in contract review automation, leveraging natural language processing (NLP) for clause extraction and due diligence.

Casetext and CaseMine focus on AI-assisted legal research and case analysis, providing predictive insights and smart brief generation for law firms and corporate legal departments. BlackBoiler specializes in contract negotiation automation with AI-driven markup capabilities, reducing turnaround time for repetitive agreements. Everlaw and CosmoLex Cloud target litigation management and practice management software, integrating analytics, e-discovery, and document collaboration tools. ContractPodAi differentiates itself through end-to-end contract automation powered by AI, catering to enterprises seeking scalable legal operations.

Competitive differentiation is driven by accuracy in legal language interpretation, ease of integration with existing workflows, and regulatory compliance across jurisdictions. High entry barriers exist due to the complexity of legal data sets, need for domain expertise, and stringent data privacy regulations. Future growth will be fueled by rising demand for AI in contract analytics, litigation prediction, and compliance monitoring, with innovation focused on generative AI for drafting, cognitive search, and blockchain-enabled smart contracts. Vendors integrating AI with cloud, security, and workflow automation will secure a strong competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Deployment Model | Solution and Services |

| Technology | Natural language processing, Machine learning, Robotic process automation, Gen AI, and Others |

| Application | Contract lifecycle management, Legal research and case law analysis, E-discovery, Compliance and risk management, Document review and analysis, and Others |

| End Use | Law firms, Corporations and in-house legal teams, Government and public sector, and Legal service providers and consultants |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Docusign, BlackBoiler, CaseMine, Casetext, ContractPodAi, CosmoLex Cloud, Everlaw, Icertis, iManage, and Kira Systems |

| Additional Attributes | Dollar sales by solution type (contract management, legal research, e-discovery, litigation analytics) and end-user application (law firms, corporate legal departments, government agencies), with demand driven by increasing case complexity, cost control measures, and digital transformation of legal workflows. Regional trends highlight strong adoption in North America and Europe due to mature legal systems and high compliance requirements, while Asia-Pacific shows rapid uptake among corporate legal teams. Innovation trends include AI-powered document summarization, predictive litigation outcomes, and integration of voice-enabled legal assistants for improved efficiency in legal service delivery. |

The global legal ai market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the legal ai market is projected to reach USD 7.4 billion by 2035.

The legal ai market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in legal ai market are solution, _on-premises, _cloud-based , services, _consulting services, _support services and _others.

In terms of technology, natural language processing segment to command 35.7% share in the legal ai market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Legal, Risk and Compliance Solution Market Forecast and Outlook 2025 to 2035

Legal Process Outsourcing LPO Size Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

LegalTech Market Analysis - Size, Share, and Forecast 2025 to 2035

AI-Driven Legal Transcription – Automating Legal Documentation

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA