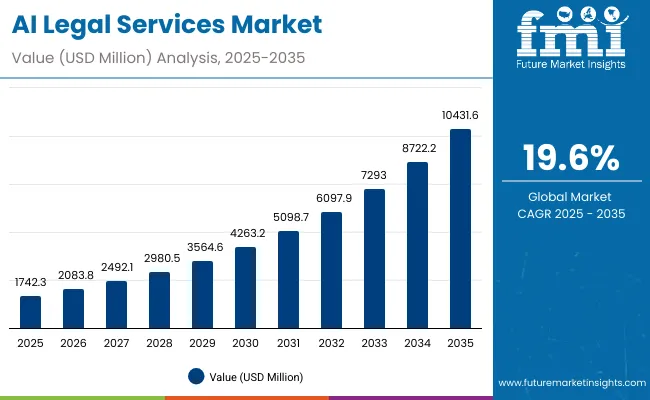

The Global AI Legal Services Market is expected to record a valuation of USD 1,742.3 million in 2025 and USD 10,431.6 million in 2035, with an increase of USD 8,689.3 million, which equals a growth of ~499% over the decade. The overall expansion represents a CAGR of 19.6% and a ~6X increase in market size.

Global AI Legal Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,742.3 million |

| Market Forecast Value in (2035F) | USD 10,431.6 million |

| Forecast CAGR (2025 to 2035) | 19.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,742.3 million to USD 4,263.2 million, adding USD 2,520.9 million, which accounts for ~29% of the total decade growth. This phase records steady adoption in Legal Research & Analytics, Contract Lifecycle Management, and E-Discovery & Document Review, driven by the need for efficiency in legal workflows. Natural Language Processing & Generative AI dominates this period as it caters to over 40% of AI deployments requiring advanced document understanding, drafting, and summarization.

The second half from 2030 to 2035 contributes USD 6,168.4 million, equal to ~71% of total growth, as the market jumps from USD 4,263.2 million to USD 10,431.6 million. This acceleration is powered by widespread deployment of enterprise AI copilots, RAG-powered legal research, and automation of compliance and litigation support across global law firms, corporate legal departments, and public sector agencies.

Managed AI legal services and cloud-delivered legal AI platforms together capture a larger share above 50% by the end of the decade. Subscription-based analytics, compliance monitoring, and CLM automation add recurring revenue, increasing the service share beyond 50% in total value.

From 2020 to 2024, the Global AI Legal Services Market grew from an emerging stage to a multi-billion-dollar technology-driven sector, driven by software- and service-led adoption. During this period, the competitive landscape was dominated by major legal tech platforms controlling a large portion of revenue, with leaders such as Thomson Reuters and LexisNexis focusing on legal research, case analytics, and content access integration. Competitive differentiation relied on accuracy, content coverage, and workflow integration, while managed services were still in a nascent phase, contributing less than 15% of the total market value.

Demand for AI-driven legal services will expand to USD 1,742.3 million in 2025, and the revenue mix will shift as AI-powered software and managed services grow to over 50% share. Traditional legal tech leaders face rising competition from digital-first players offering LLM-based drafting, automated compliance, and AI-assisted litigation tools. Major incumbents are pivoting to hybrid models, integrating analytics, workflow automation, and enterprise copilots to retain relevance.

Emerging entrants specializing in cloud-native compliance tools, contract automation, and semantic legal search are gaining share. The competitive advantage is moving away from standalone AI features toward ecosystem strength, scalability, governance, and recurring revenue models.

Advances in NLP and generative AI have transformed legal workflows, enabling faster research, automated contract drafting, and compliance risk detection. AI-powered Legal Research & Analytics has gained popularity due to its suitability for rapid case law retrieval, predictive legal insights, and summarization. The rise of LLM-powered assistants has contributed to enhanced efficiency and decision-making capabilities. Law firms, corporate legal departments, ALSPs, and public sector agencies are driving demand for AI solutions that integrate seamlessly into existing legal and operational workflows.

Expansion of automation in e-discovery, compliance monitoring, and litigation support has fueled market growth. Innovations in cloud-based AI legal platforms, integrated CLM systems, and multilingual legal document review are expected to open new application areas. Segment growth is expected to be led by Law Firms in end users, Natural Language Processing & Generative AI in technology, and Legal Research & Analytics in service types due to their centrality in the legal process.

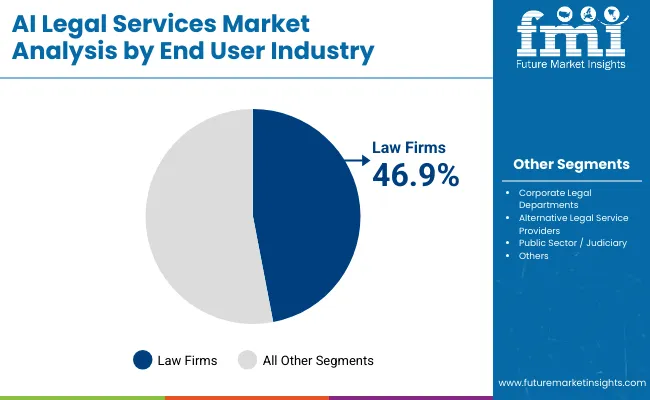

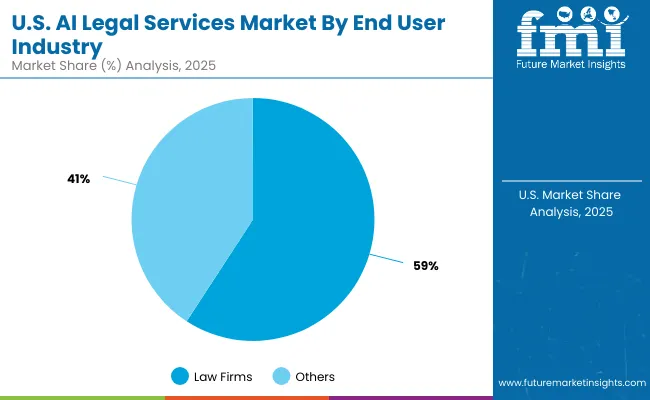

The Global AI Legal Services Market is segmented by end user industry, service type, and technology. In end user industry, Law Firms hold the largest share at 46.9% in 2025, driven by strong uptake of AI for legal research, drafting, and case analytics. Tier 1 firms lead adoption, followed by Tier 2 and boutique practices. Corporate Legal Departments form the second-largest group, with large enterprises adopting AI faster than mid-sized teams and SMEs.

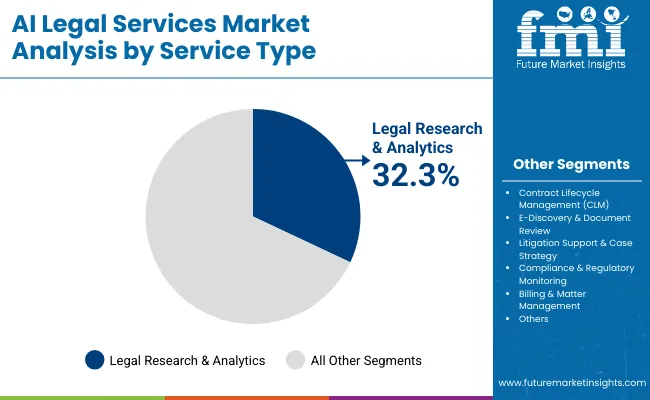

ALSPs are expanding their AI capabilities for contract review and compliance services, while Public Sector and Judiciary agencies are beginning to integrate AI into court systems and regulatory tracking. By service type, Legal Research & Analytics dominates with 32.3% in 2025, supported by demand for AI-powered legal search, predictive analytics, and summarization tools. Contract Lifecycle Management (CLM) follows, with use cases in drafting, review, and compliance checks.

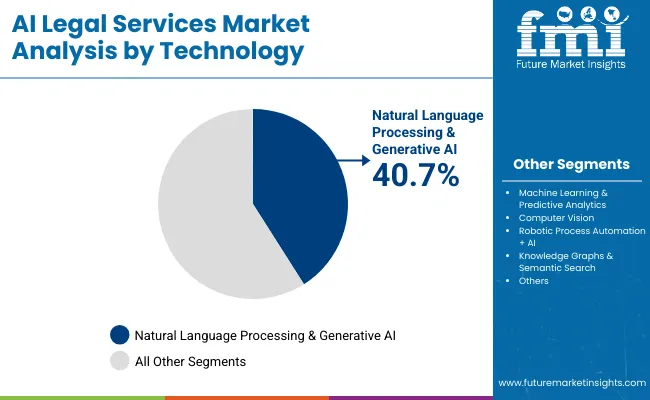

E-Discovery & Document Review benefits from predictive coding, translation, and evidence identification, while Litigation Support, Compliance & Regulatory Monitoring, and Billing & Matter Management represent smaller but growing areas. In technology, Natural Language Processing & Generative AI leads with 40.7% in 2025, powering document summarization, drafting, and conversational assistants. Machine Learning & Predictive Analytics ranks second, followed by Computer Vision, Robotic Process Automation + AI, and Knowledge Graphs & Semantic Search, which are gaining traction for document processing, workflow automation, and advanced search capabilities.

| End User Industry Segment | Market Value Share, 2025 |

|---|---|

| Law Firms | 46.9% |

| Others | 53.1% |

The Law Firms segment is projected to contribute 46.9% of the Global AI Legal Services Market revenue in 2025, maintaining its lead as the dominant end user category. This is driven by high adoption of AI for legal research, contract review, and litigation strategy among Tier 1 and Tier 2 firms. Large law firms are prioritizing investments in AI-powered tools to improve efficiency, reduce research time, and enhance client service delivery.

Growth in this segment is also supported by the integration of generative AI and machine learning into existing workflows, enabling automated document summarization, predictive case analytics, and clause standardization. As corporate clients demand faster turnaround times and greater cost transparency, law firms are leveraging AI to remain competitive. The segment is expected to retain its position as the primary driver of AI legal services adoption through the forecast period.

| Technology Segment | Market Value Share, 2025 |

|---|---|

| Natural Language Processing & Generative AI | 40.7% |

| Others | 59.3% |

The Natural Language Processing & Generative AI segment is forecasted to hold 40.7% of the Global AI Legal Services Market share in 2025, driven by its critical role in document drafting, summarization, and conversational legal assistants. These capabilities enable faster legal research, improved accuracy in case preparation, and more efficient handling of high-volume documentation. Advancements in large language models and domain-specific training for legal contexts are enhancing output quality, reducing error rates, and enabling multilingual processing. As legal professionals increasingly integrate generative AI into core operations, this technology is expected to remain at the forefront, underpinning a wide range of AI legal applications.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Legal Research & Analytics | 32.3% |

| Others | 67.7% |

The Legal Research & Analytics segment is projected to account for 32.3% of the Global AI Legal Services Market revenue in 2025, establishing itself as the leading service type. This segment benefits from growing demand for AI-powered legal search, case law retrieval, predictive analytics, and knowledge management systems. These solutions help legal teams quickly identify relevant precedents, assess case outcomes, and synthesize large volumes of information. The adoption of AI in research and analytics is also enhancing compliance monitoring and risk assessment. With the continued expansion of legal datasets and the need for rapid, accurate insights, Legal Research & Analytics is expected to maintain its leading role in the market over the coming years.

Drivers

Shift from Point Tools to Enterprise-Integrated AI Legal Platforms

Law firms and corporate legal departments are moving away from standalone AI products toward integrated platforms that embed AI across research, contract lifecycle, compliance, and litigation support. This unified approach reduces tool-switching, enables cross-workflow data sharing, and delivers stronger ROI, particularly for Tier 1 firms managing high-volume, multi-jurisdictional matters. As procurement teams prioritize platform consolidation, vendors offering modular but integrated solutions are winning larger, multi-year contracts.

Adoption of Domain-Specific Large Language Models (LLMs) Trained on Proprietary Legal Corpora

Vendors are building LLMs fine-tuned on jurisdiction-specific statutes, case law, and legal commentary. These domain-specific models outperform general-purpose AI in accuracy and compliance, driving adoption in regulated environments like financial services, IP law, and government legal offices where precision is critical. Their ability to deliver explainable outputs and align with professional conduct rules is accelerating uptake among risk-conscious legal teams.

Restraints

Fragmentation of Legal Data Sources and Limited Interoperability

Many AI tools still struggle to integrate with legacy case management systems, billing platforms, and jurisdiction-specific databases. This lack of interoperability creates workflow bottlenecks and limits the scalability of AI solutions across multinational law firms. The problem is compounded when vendors rely on proprietary formats, making cross-platform collaboration more complex and costly.

High Cost of Customization and Compliance Readiness for Multi-Jurisdictional Deployment

Rolling out AI legal services in multiple countries often requires costly customization to meet local privacy laws, bar regulations, and data residency rules. This significantly increases time-to-value for global firms and can deter smaller practices from adoption. Additionally, the lack of standardized certification for AI legal tools in many jurisdictions forces firms to shoulder the compliance validation burden themselves.

Key Trends

Rise of AI-Augmented Alternative Legal Service Providers (ALSPs)

ALSPs are leveraging AI for large-scale document review, contract abstraction, and compliance monitoring, enabling them to undercut traditional law firms on cost and delivery time. This is reshaping client sourcing strategies, particularly for repeatable, high-volume legal tasks. As ALSPs mature technologically, their service portfolios are expanding into higher-margin advisory and analytics roles traditionally reserved for law firms.

Embedding AI Assistants into Client-Facing Legal Portals

Firms are integrating AI-driven chat interfaces into client portals to provide instant status updates, explain legal procedures, and surface relevant documents. This is transforming client engagement models and differentiating firms in competitive markets, especially in corporate law and M&A advisory. In many cases, these assistants are becoming the primary client touchpoint for routine queries, freeing lawyers to focus on high-value tasks.

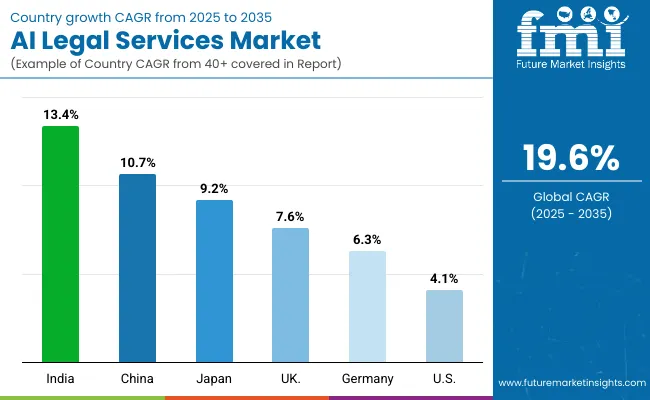

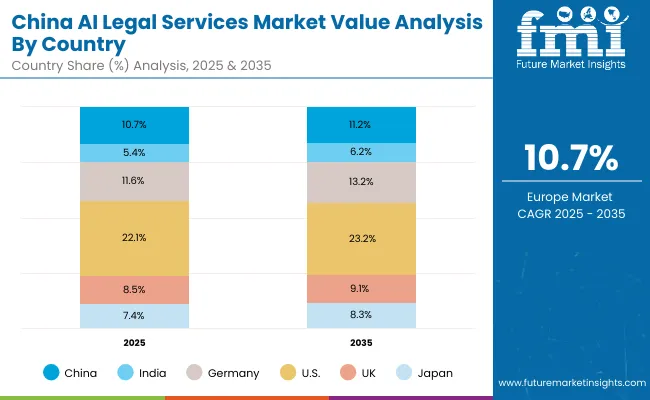

The global AI Legal Services Market shows clear regional variation in adoption speed, influenced by the maturity of legal technology ecosystems, regulatory frameworks, and digital transformation priorities in legal services. Asia-Pacific emerges as the fastest-growing region, anchored by India at 13.4% CAGR and China at 10.7%.

India’s trajectory is driven by the rapid modernization of corporate legal departments, increasing use of AI for contract lifecycle management in multinational outsourcing hubs, and the expansion of legal tech startups offering subscription-based AI platforms. China’s growth reflects strong integration of AI into smart court initiatives, large-scale government-led digital justice programs, and rapid adoption of domain-specific LLMs trained on Chinese statutes and case law.

Europe maintains a balanced growth profile, led by the UK at 7.6% and Germany at 6.3%. Growth in these countries is supported by strict compliance mandates under the EU AI Act, high digital readiness among law firms, and strong demand for AI-powered compliance and risk management tools in heavily regulated sectors such as finance, healthcare, and manufacturing. UK-based law firms are early adopters of AI-powered legal research and predictive litigation analytics, while Germany’s corporate legal departments are leveraging AI for multilingual contract review and cross-border compliance.

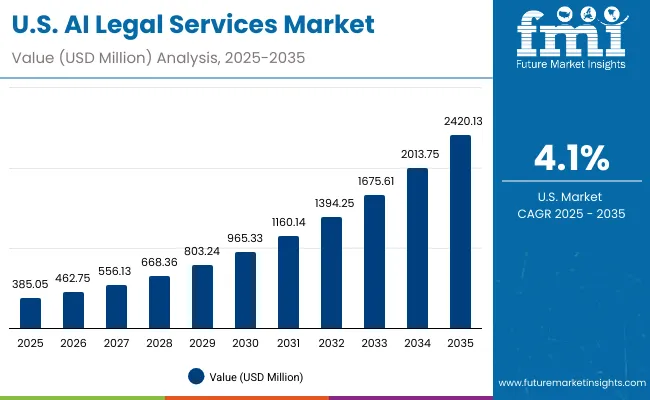

North America shows steady but more mature market expansion, with the USA at 4.1% CAGR. The USA retains the largest global market share but its slower growth rate reflects high market penetration among large law firms and corporate legal teams. Growth is increasingly service-driven, with emphasis on managed AI legal services, cloud-native legal platforms, and client-facing AI assistants rather than initial technology adoption. Japan stands out in Asia with a 9.2% CAGR, driven by government-backed legal digitalization programs, a surge in AI pilot projects among corporate counsel, and increasing use of AI in IP law and patent filings to enhance speed and accuracy.

The AI Legal Services Market in the United States is projected to grow at a CAGR of 4.1%, led by strong adoption among large law firms, corporate legal departments, and public sector agencies. Large-scale integration of AI into legal research, contract management, and litigation strategy is driving recurring revenue streams for leading platforms. ALSPs in the USA are also scaling AI-driven document review and compliance services for cost-conscious clients. In-house legal teams are increasingly adopting AI copilots and semantic search tools to improve turnaround times and support cross-border compliance requirements.

The AI Legal Services Market in the United Kingdom is expected to grow at a CAGR of 7.6%, supported by strong uptake in legal research automation, predictive litigation analytics, and compliance monitoring. Magic Circle and top-tier regional firms are deploying LLM-based drafting and knowledge management tools to maintain competitive advantage. Public sector investment in AI-powered court systems and regulatory tracking is also driving demand. Cross-sector legal needs in finance, healthcare, and energy are fueling adoption of multilingual AI solutions.

India is witnessing rapid growth in the AI Legal Services Market, which is forecast to expand at a CAGR of 13.4% through 2035. Mid-sized law firms and corporate legal teams in tier-2 cities are increasingly investing in AI solutions due to competitive pricing and cloud-based delivery models. Legal tech startups are offering subscription-based AI research tools, contract automation, and compliance monitoring tailored to the Indian regulatory framework. Government e-court initiatives are accelerating adoption in the public sector.

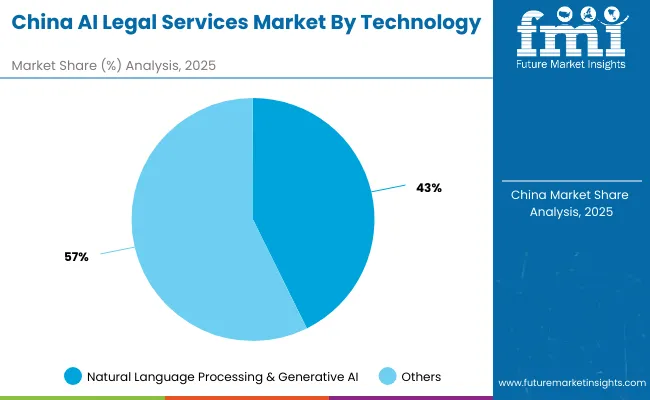

The AI Legal Services Market in China is expected to grow at a CAGR of 10.7%, among the fastest globally. This growth is fueled by smart court rollouts, city-level legal digitalization programs, and competitive innovation by domestic AI vendors. State-owned enterprises and large private companies are implementing AI-driven compliance monitoring, contract review, and dispute resolution tools. Local tech firms are developing LLMs trained on Chinese statutes and case law, improving output accuracy for domestic users.

| End User Industry Segment | Market Value Share, 2025 |

|---|---|

| Law Firms | 59.2% |

| Others | 40.8% |

The AI Legal Services Market in the United States is valued at USD 385.05 million in 2025, with Law Firms leading at 59.2%, followed by Others at 40.8%. The dominance of law firms is a direct outcome of the USA legal sector’s maturity and high willingness to invest in AI-powered solutions for legal research, litigation support, and contract lifecycle management. Top-tier firms are embedding generative AI into internal knowledge systems, enabling faster client advisory, improved case preparation, and predictive analytics for litigation outcomes.

This leadership positions law firms as the primary drivers of AI legal innovation in the country, with growing adoption of AI copilots, semantic search, and multilingual document review. Corporate legal departments and ALSPs are expanding at a steady pace, but the law firm segment continues to account for the largest revenue share due to larger budgets and more complex case requirements. Over the next decade, platform integration and managed AI services are expected to further solidify law firms’ position as the central growth engine of the USA market.

| Technology Segment | Market Value Share, 2025 |

|---|---|

| Natural Language Processing & Generative AI | 42.7% |

| Others | 57.3% |

The AI Legal Services Market in China is valued at USD 186.43 million in 2025, with Natural Language Processing & Generative AI leading at 42.7%, followed by other technologies at 57.3%. The strength of this segment is fueled by large-scale deployment of LLMs trained on Chinese statutes, case law, and administrative regulations, making them highly effective for domestic legal research, compliance monitoring, and judgment drafting in smart courts.

Government-backed legal digitalization programs are accelerating the integration of NLP-driven AI tools into court systems and public legal services, while top Chinese law firms and corporate legal departments are adopting AI assistants for multilingual document processing and automated risk assessments. As AI technology matures and integrates with compliance automation, the NLP & Generative AI segment is expected to expand its role in both public sector initiatives and private sector legal operations.

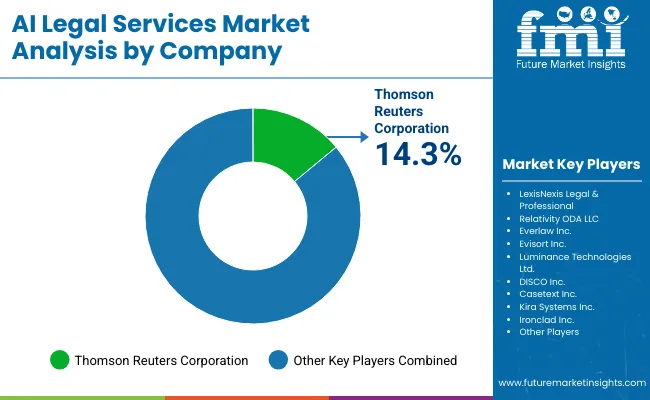

The AI Legal Services Market is moderately fragmented, with global leaders, regional innovators, and niche-focused providers competing across multiple service and technology areas. Thomson Reuters Corporation, holding a 14.3% global value share in 2025, leads the market through its integrated suite of AI-powered legal research, analytics, and contract lifecycle management platforms.

Its strategy emphasizes large language model (LLM) integration, cloud-native collaboration tools, and predictive analytics tailored for litigation and compliance. Other significant playersincluding LexisNexis Legal & Professional, Relativity ODA LLC, and Luminance Technologies Ltd.are focusing on combining natural language processing with workflow automation, enabling law firms and corporate legal departments to achieve faster case preparation, document review, and regulatory monitoring.

Specialized providers such as Evisort Inc., Casetext Inc., and ContractPod Technologies Ltd. are targeting high-growth niches like AI-driven contract drafting, clause extraction, and semantic search. Their ability to offer domain-specific models, API integrations, and flexible deployment options positions them as strong contenders in targeted segments. Competitive differentiation in this market is shifting from standalone software or technology capabilities toward fully integrated legal ecosystemscombining AI assistants, knowledge graphs, compliance dashboards, and subscription-based legal services that scale across diverse client needs.

Key Developments in Global AI Legal Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,742.3 million |

| End User Industry | Law Firms: Tier 1, Tier 2, Boutique & Specialized Practices; Corporate Legal Departments: Large enterprises, Mid-sized corporate teams, SMEs; Alternative Legal Service Providers ; Public Sector / Judiciary: Courts & tribunals, Government legal offices, Regulatory agencies |

| Service Type | Legal Research & Analytics, Co ntract Lifecycle Management, E-Discovery & Document Review, Litigation Support & Case Strategy, Compliance & Regulatory Monitoring, Billing & Matter Management |

| Technology | Natural Language Processing & Generative AI, Machine Learning & Predictive Analytic, Computer Vision, Robotic Process Automation + AI, Knowledge Graphs & Semantic Search |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thomson Reuters Corporation, LexisNexis Legal & Professional, Relativity ODA LLC, Everlaw Inc., Evisort Inc., Luminance Technologies Ltd., DISCO Inc., Casetext Inc., Kira Systems Inc., Ironclad Inc., ContractPod Technologies Ltd., Lawgeex Technologies Ltd., Onit Inc., Lexion Inc., ThoughtRiver Ltd. |

| Additional Attributes | Dollar sales by technology (Natural Language Processing & Generative AI, Others), dollar sales by service type (Legal Research & Analytics, Others), dollar sales by end-use industry (Law Firms, Others), adoption trends in AI-driven legal research and contract review, increasing use of generative AI for litigation support, sector-specific growth in law firms and corporate legal departments, integration with cloud-based and API-driven platforms, regional trends influenced by legal digitization policies, innovations in NLP models, document automation, and AI-assisted compliance solutions. |

By Technology:

The global AI Legal Services Market is estimated to be valued at USD 1,742.3 million in 2025.

The market size for the AI Legal Services Market is projected to reach USD 10,431.6 million by 2035.

The AI Legal Services Market is expected to grow at a 19.6% CAGR between 2025 and 2035.

The key end user industry in the AI Legal Services Market is Law Firms.

In terms of technology, Natural Language Processing & Generative AI is expected to command 40.7% share in the AI Legal Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal AI Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

AI Tutoring Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Air Ambulance Services Market Size and Share Forecast Outlook 2025 to 2035

AI Consulting Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Airline A-la-carte Services Market Analysis by Product Type, Carrier Type and Region from 2025 to 2035

The Car Detailing Services Market is segmented by service type and region from 2025 to 2035.

AI In Government And Public Services Market Size and Share Forecast Outlook 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Managed Blockchain Services Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

Intellectual Property Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Franchising and Distribution Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA