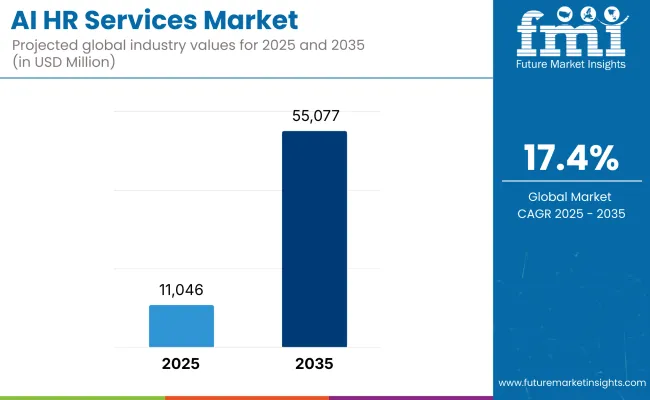

The Global AI HR Services Market is expected to record a valuation of USD 11,046 million in 2025 and USD 55,077 million in 2035, with an increase of USD 44,031 million, which equals a growth of 398% over the decade. The overall expansion represents a CAGR of 17.4% and a ~5X increase in market size.

Global AI HR Services Market Key Takeaways

| Metric | Value |

| Market Estimated Value in (2025E) | USD 11,046 million |

| Market Forecast Value in (2035F) | USD 55,077 million |

| Forecast CAGR (2025 to 2035) | 17.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 11,046 million to USD 24,665 million, adding USD 13,619 million, which accounts for 30.9% of the total decade growth. This phase records steady adoption in BFSI, healthcare & life sciences, and manufacturing, driven by the need for automation and compliance. Talent Acquisition & Recruitment dominates this period as it caters to over 27% of enterprise applications requiring large-scale AI-driven hiring solutions.

The second half from 2030 to 2035 contributes USD 30,412 million, equal to 69.1% of total growth, as the market jumps from USD 24,665 million to USD 55,077 million. This acceleration is powered by widespread deployment of predictive workforce analytics, AI-based employee engagement systems, and integrated L&D platforms in global enterprises. Machine Learning & Predictive Analytics captures a larger share above 33% by the end of the decade. Software-led analytics and cloud platforms add recurring revenue, increasing the software services share beyond 40% in total value.

From 2020 to 2024, the Global AI HR Services Market grew from USD 7,500 million to USD 10,300 million, driven by strong adoption in talent acquisition and cloud-based HCM platforms. During this period, the competitive landscape was dominated by integrated HR software providers controlling nearly 50% of revenue, with leaders such as Workday, Oracle, and SAP focusing on enterprise-scale AI-enabled HCM suites.

Competitive differentiation relied on platform integration, predictive analytics capabilities, and compliance management, while standalone AI tools were often deployed as niche solutions rather than full-suite offerings.

Service-based models began gaining traction, contributing more than 15% of the total market value by 2024. Demand for AI HR Services will expand to USD 11,046 million in 2025, and the revenue mix will shift as software and analytics services grow to over 40% share. Traditional HCM leaders face rising competition from AI-first companies offering bias detection, conversational AI for employee engagement, and predictive workforce planning.

Major HR tech vendors are pivoting to hybrid models, integrating AI analytics and cloud-based workflows to retain relevance. Emerging entrants specializing in AI-based candidate experience, AR/VR onboarding, and industry-specific AI HR platforms are gaining share. The competitive advantage is moving away from pure platform functionality toward ecosystem integration, scalability, and recurring revenue streams.

Advances in AI algorithms and cloud platforms have improved recruitment accuracy and speed, allowing for more efficient workforce management across diverse industries. Talent Acquisition & Recruitment has gained popularity due to its suitability for high-volume hiring, automated candidate matching, and bias detection. The rise of predictive analytics technology has contributed to enhanced decision-making and real-time workforce planning. Industries such as BFSI, healthcare, and manufacturing are driving demand for AI HR solutions that integrate seamlessly with existing HCM workflows.

Expansion of AI-enabled onboarding, engagement, and performance management processes has fueled market growth. Innovations in conversational AI, workforce sentiment analysis, and AI-based L&D platforms are expected to open new application areas. Segment growth is expected to be led by BFSI in end-user industries, Talent Acquisition in service type categories, and Machine Learning & Predictive Analytics in technology types due to their scalability, precision, and adaptability.

The market is segmented by end-user industry, service type, technology type, and region. End-user industries include BFSI, healthcare & life sciences, manufacturing, retail & e-commerce, IT/ITeS & software, telecom & media, energy, utilities & mining, transportation, logistics & aviation, public sector & government, education, hospitality & travel, pharma & biotech, construction & real estate, agriculture & food processing, and non-profit & NGOs.

Service type categories encompass talent acquisition & recruitment, onboarding automation & employee experience portals, performance management & continuous feedback systems, learning & development, employee engagement & wellbeing analytics, workforce planning & predictive analytics, compliance & risk management, and payroll & benefits optimization. Technology types include machine learning & predictive analytics, natural language processing (NLP), computer vision, generative AI, and robotic process automation. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

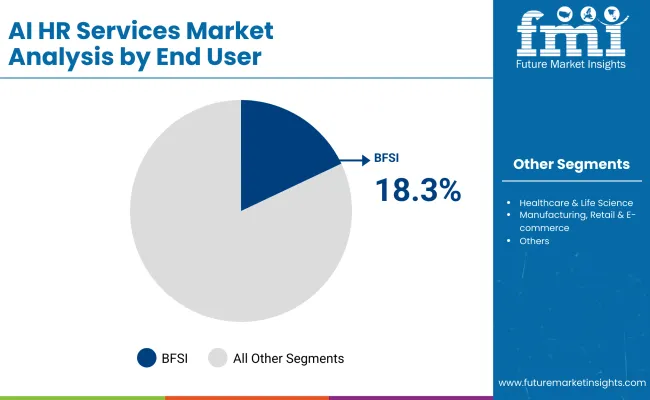

| End User Industry Segment | Market Value Share, 2025 |

|---|---|

| BFSI | 18.3% |

| Others | 81.7% |

The BFSI segment is projected to contribute 18.3% of the Global AI HR Services Market revenue in 2025, maintaining its lead as the dominant end-user category. This is driven by ongoing demand for AI-driven compliance hiring, large-scale workforce planning, and risk-based talent analytics. BFSI organizations have been among the earliest adopters of AI HR tools to ensure regulatory adherence while improving operational efficiency.

The segment’s growth is also supported by the sector’s emphasis on bias detection, fraud risk mitigation in hiring, and predictive performance analytics for critical roles. As AI adoption deepens in banking and insurance, providers are integrating advanced machine learning models into recruitment and employee engagement platforms. The BFSI segment is expected to retain its position as the backbone of AI HR adoption globally.

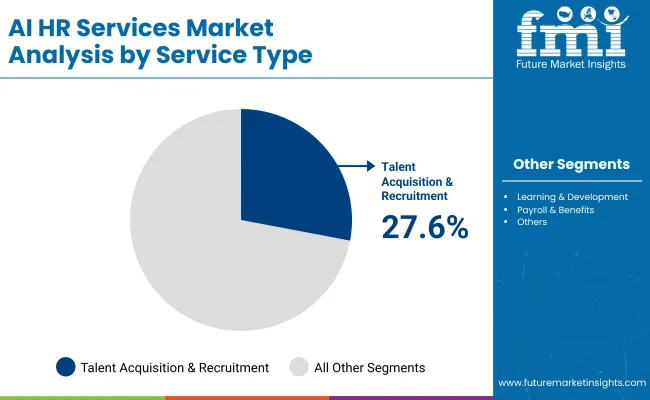

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Talent Acquisition & Recruitment | 27.6% |

| Segment | 72.4% |

The Talent Acquisition & Recruitment segment is forecasted to hold 27.6% of the market share in 2025, led by its application in high-volume hiring, automated candidate screening, and predictive fit scoring. This service type is favored for its ability to reduce time-to-hire, improve candidate matching accuracy, and remove repetitive manual screening tasks. Its integration with AI chatbots, ATS platforms, and bias-mitigation algorithms has facilitated widespread adoption in enterprise recruitment operations.

The segment’s growth is bolstered by advancements in natural language processing and machine learning that improve resume parsing and candidate ranking. As industries increasingly require faster and more data-driven hiring decisions, Talent Acquisition & Recruitment is expected to continue its dominance in the market.

| Technology Type Segment | Market Value Share, 2025 |

|---|---|

| Machine Learning & Predictive Analytics | 33.8% |

| Segment | 6 6.2% |

The Machine Learning & Predictive Analytics segment is projected to account for 33.8% of the Global AI HR Services Market revenue in 2025, establishing it as the leading technology type. This technology is preferred for its ability to deliver predictive workforce insights, attrition risk scores, and optimized talent deployment based on historical and real-time data. Its suitability for large-scale HR data processing and compatibility with both standalone AI tools and integrated HCM suites has made it popular across BFSI, healthcare, manufacturing, and IT/ITeS.

Developments in algorithmic modeling and cloud-based AI platforms have enhanced accuracy, speed, and scalability, enabling better workforce planning and strategic decision-making. Given its balance of predictive power and adaptability, Machine Learning & Predictive Analytics is expected to maintain its leading role in the Global AI HR Services Market.

Drivers

Regulatory-Driven AI Deployment in BFSI and Healthcare

In BFSI, AI is being used to ensure that hiring, background checks, and training records meet compliance requirements under strict audit environments. In healthcare, credential verification and license renewals for clinical staff are increasingly automated with AI HR tools to meet HIPAA and local regulatory timelines. This creates a continuous demand cycle as regulations evolve, forcing updates and expansion of AI systems. Vendors that can embed explainable AI into compliance workflows are gaining a competitive advantage in these sectors.

Shift from Role-Based to Skills-Based Workforce Models

AI HR services are enabling organizations to break down job roles into granular skill units and match them dynamically with project needs. This approach supports faster reskilling and redeployment of employees in industries undergoing rapid technological change. The model also enables cross-border talent allocation in global enterprises without needing to redefine organizational structures. As remote work normalizes, AI-driven skills mapping is becoming a foundation for global workforce optimization.

Restraints

Algorithmic Bias and Litigation Risk

Bias in AI recruitment algorithms has been linked to discriminatory hiring outcomes, sparking legal action and public scrutiny. Enterprises face brand and financial risks if deployed systems cannot provide transparent, bias-free decision-making. This is prompting some companies to slow down procurement and pilot AI systems in limited functions before enterprise-wide rollout. Vendors are under pressure to offer bias audit tools and certification to maintain buyer confidence.

Integration Bottlenecks with Legacy HRMS

Organizations with heavily customized or outdated HR management systems often find it challenging to integrate modern AI solutions. The problem is particularly acute in industries with long IT replacement cycles, like manufacturing and public services. These integration challenges not only delay implementation timelines but also inflate project costs, deterring mid-sized enterprises from adoption. Vendors that can offer modular, API-driven integration are more likely to penetrate these segments.

Key Trends

Rise of AI-Driven Workforce Wellbeing Platforms

Enterprises are using AI to track sentiment in employee communications, monitor engagement levels, and flag potential burnout risks. This has become especially relevant in high-stress sectors such as healthcare, customer service, and financial trading floors. Integration with wearable devices and health apps is enabling proactive wellbeing interventions. This trend is also feeding into corporate ESG commitments by linking wellbeing metrics to sustainability and governance goals.

Integration of AI HR Services into ESG and DEI Reporting

Companies are embedding AI HR analytics into sustainability dashboards to track diversity and inclusion targets in real time. In Europe, this is becoming a compliance necessity under expanding non-financial reporting rules. Automated DEI reporting reduces manual effort and improves accuracy in disclosures to regulators and investors. This trend is also driving a new wave of partnerships between AI HR vendors and ESG data platforms.

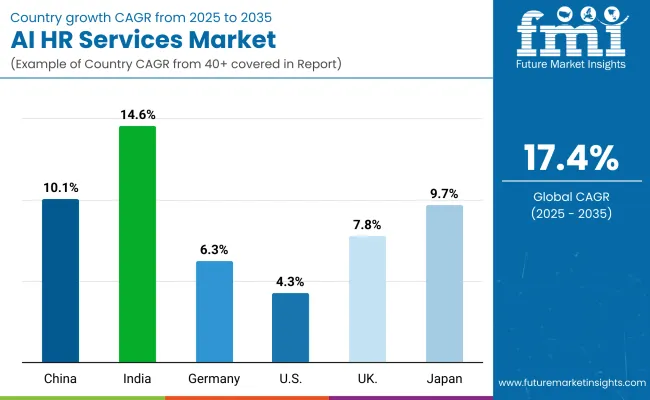

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 10.1% |

| India | 14.6% |

| Germany | 6.3% |

| USA | 4.3% |

| UK | 7.8% |

| Japan | 9.7% |

The Global AI HR Services Market shows a pronounced regional disparity in adoption speed, strongly influenced by regulatory mandates, digital transformation maturity, and AI readiness in HR infrastructure. Asia-Pacific emerges as the fastest-growing region, anchored by India at 14.6% CAGR and China at 10.1% CAGR. This acceleration is driven by large-scale digital workforce transformation programs, rapid adoption of AI-powered learning platforms, and government-backed mandates for skill development and compliance automation.

China’s regulatory framework promoting AI-driven upskilling in manufacturing, BFSI, and public administration further accelerates adoption of AI HR services for workforce planning and employee engagement. India’s trajectory reflects rising integration of AI HR tools among large IT services exporters and manufacturing hubs, supporting both domestic talent development and export-oriented service delivery.

Europe maintains a stable growth profile, led by Germany at 6.3% CAGR and the UK at 7.8% CAGR, supported by stringent labor compliance frameworks, skill certification requirements, and enterprise investment in predictive workforce analytics. High penetration of AI-enabled HCM suites and strong uptake in BFSI and manufacturing keep Europe competitive with Asia-Pacific, particularly in adoption for compliance tracking, employee wellbeing analytics, and hybrid work enablement.

North America shows moderate expansion, with the USA at 4.3% CAGR, reflecting maturity in large enterprise adoption and a slower pace of market share growth compared to Asia-Pacific. Growth in North America is more service-driven, with increasing demand for AI-enabled learning and development, DEI compliance analytics, and cloud-native employee engagement platforms rather than pure process automation. Japan, with a CAGR of 9.7%, stands out in Asia for its focus on AI HR applications in aging workforce management, employee reskilling, and manufacturing productivity optimization.

| Year | USA AI HR Services (USD Miilion) |

|---|---|

| 2025 | 2363.84 |

| 2026 | 2815.94 |

| 2027 | 3354.51 |

| 2028 | 3996.08 |

| 2029 | 4760.35 |

| 2030 | 5670.79 |

| 2031 | 6755.36 |

| 2032 | 8047.37 |

| 2033 | 9586.47 |

| 2034 | 11419.94 |

| 2035 | 13604.07 |

The AI HR Services Market in the United States is projected to grow at a CAGR of 4.3%, led by increased investment across BFSI, healthcare, and IT services. BFSI alone accounts for 21.4% of the USA market in 2025 (USD 506.84 million), driven by compliance automation and predictive workforce planning. Enterprise-wide adoption of AI HR platforms is also rising in healthcare for credential management and in technology firms for skills-based talent deployment. Demand for analytics-driven employee engagement and integrated DEI compliance reporting is creating opportunities for SaaS-based platform providers.

The AI HR Services Market in the United Kingdom is expected to grow at a CAGR of 7.8%, supported by applications in public sector workforce planning, financial services compliance, and hybrid workforce engagement. Large banking institutions have accelerated usage of AI-driven recruitment and bias detection tools to improve hiring quality and meet fairness mandates. Government departments and universities are integrating AI HR platforms for talent development and compliance reporting. The corporate sector is adopting predictive analytics for succession planning and retention risk management.

India is witnessing rapid growth in AI HR Services, which is forecast to expand at a CAGR of 14.6% through 2035. A sharp increase in deployments across tier-1 and tier-2 cities is being driven by large IT services providers and manufacturing clusters. Enterprises are leveraging AI HR services for high-volume recruitment, AI-powered learning programs, and employee wellbeing analytics. Educational institutions and vocational training centers are integrating AI into skill development curricula.

| Countries | 2025 |

|---|---|

| China | 12.3% |

| India | 5.2% |

| Germany | 11.2% |

| USA | 21.4% |

| UK | 9.2% |

| Japan | 8.1% |

| Countries | 2035 |

|---|---|

| China | 13.4% |

| India | 6.2% |

| Germany | 10.1% |

| USA | 24.7% |

| UK | 8.1% |

| Japan | 7.2% |

The AI HR Services Market in China is expected to grow at a CAGR of 10.1%. This momentum is driven by smart workforce transformation programs, large-scale AI learning and development initiatives, and competitive innovation by domestic HR tech firms. Learning & Development is a leading service type in China, reflecting strong corporate and government investment in upskilling. Affordable AI HR platforms from local providers are enabling adoption across SMEs, education, and government bodies.

| End User Industry Segment | Market Value Share, 2025 |

|---|---|

| BFSI | 21.2% |

| Others | 78.8% |

The AI HR Services Market in the USA is valued at USD 2,363.84 million in 2025, with BFSI leading at 21.2% (USD 501.13 million), followed by other industries collectively accounting for 78.8% (USD 1,862.71 million). The dominance of BFSI is due to its heavy reliance on AI-driven recruitment, fraud risk assessment in hiring, and advanced workforce analytics. The USA BFSI sector’s compliance-heavy hiring environment favors AI tools for background checks, skill validation, and predictive employee retention models.

AI-driven HR systems are also crucial for managing large, distributed workforces, ensuring efficiency, and meeting regulatory obligations. As digital banking and fintech services expand, AI-enabled talent management platforms will see stronger demand, especially in specialized roles like cybersecurity and quantitative analytics. Other industries, while diverse, are adopting AI HR services for cost optimization, workforce planning, and real-time performance analytics, further fueling market growth.

| Service Segment | Market Value Share, 2025 |

|---|---|

| Learning & Development | 26.7% |

| Others | 73.3% |

The AI HR Services Market in China is valued at USD 1,358.70 million in 2025, with Learning & Development leading at 26.7% (USD 362.21 million).This reflects China’s aggressive upskilling initiatives in AI, robotics, and automation-focused industries. L&D services powered by AI enable real-time skill gap assessments, adaptive learning paths, and performance trackingcritical in China’s rapidly transforming industrial and tech ecosystem.

The government’s emphasis on digital talent development, combined with corporate re-skilling programs, drives adoption. Other segmentsincluding recruitment, employee engagement, and HR analyticsremain vital, particularly in manufacturing, e-commerce, and technology sectors undergoing automation and global expansion. As China’s talent demand diversifies, AI HR services will be integral to sustaining workforce competitiveness.

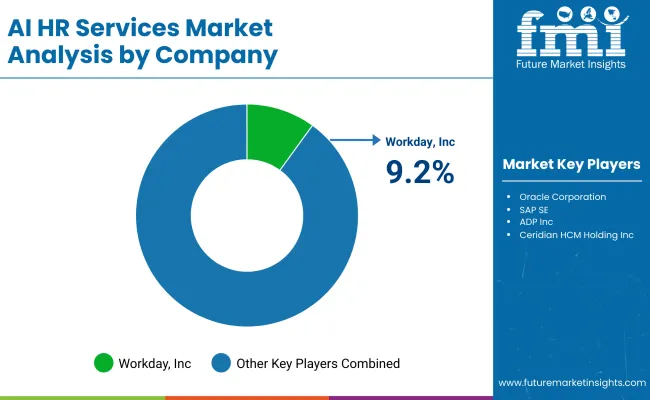

The Global AI HR Services Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Global technology leaders such as Workday, Inc., Oracle Corporation, and SAP SE hold significant market share, driven by integrated AI capabilities, predictive workforce analytics, and deep alignment with enterprise HCM systems. Their strategies increasingly emphasize bias detection, AI-powered skills mapping, and end-to-end talent lifecycle management for industries like BFSI, healthcare, and manufacturing.

Established mid-sized players, including UKG Inc., Ceridian HCM Holding Inc., and Cornerstone OnDemand, Inc., cater to the demand for scalable cloud-based HR solutions with AI-enhanced modules. These companies are accelerating adoption through flexible deployment models, configurable workflows, and integration with learning management platforms, making them highly relevant for employee engagement, L&D, and compliance management.

Specialized providers such as Eightfold AI, Inc., HireVue, Inc., and Phenom People, Inc. focus on application-specific AI solutions for talent acquisition, candidate experience enhancement, and workforce planning. Their strength lies in AI model specialization, rapid innovation cycles, and the ability to address unique industry needs rather than purely competing on global scale. Competitive differentiation is shifting away from core HR process automation toward integrated ecosystems that include predictive analytics, AI-driven employee wellbeing tools, and subscription-based service models with embedded DEI and ESG reporting capabilities.

Key Developments in Global AI HR Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 11,046 million |

| Service Type | Talent Acquisition & Recruitment, Onboarding Automation & Employee Experience Portals, Performance Management & Continuous Feedback Systems, Learning & Development, Employee Engagement & Wellbeing Analytics, Workforce Planning & Predictive Analytics, Compliance & Risk Management, Payroll & Benefits Optimization |

| Technology Type | Machine Learning & Predictive Analytics, Natural Language Processing, Computer Vision, Generative AI, Robotic Process Automation |

| End-User Industry | BFSI, Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, IT/ ITeS & Software, Telecom & Media, Energy, Utilities & Mining, Transp ortation, Logistics & Aviation, Education, Pharma & Biotech |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Workday, Inc., Oracle Corporation, SAP SE, ADP, Inc., Ceridian HCM Holding Inc., UKG Inc., Cornerstone OnDemand, Inc., IBM Corporation, Eightfold AI, Inc., HireVue, Inc., iCIMS, Inc., Phenom People, Inc., Talview, Inc., Harver B.V., SmartRecruiters, Inc. |

| Additional Attributes | D ollar sales by service type and end-user industry, adoption trends in compliance automation and AI-driven workforce planning, rising demand for AI-based talent acquisition and learning platforms, sector-specific growth in BFSI, healthcare, and manufacturing, technology adoption segmentation, integration with ESG/DEI compliance analytics and cloud HCM suites, regional trends influenced by digital transformation mandates, and innovations in machine learning, NLP, and generative AI applications in HR. |

The Global AI HR Services Market is estimated to be valued at USD 11,046 million in 2025.

The market size for the Global AI HR Services Market is projected to reach USD 55,080 million by 2035.

The Global AI HR Services Market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key service types in the Global AI HR Services Market are Talent Acquisition & Recruitment, Learning & Development, Workforce Planning & Predictive Analytics, and Employee Engagement & Wellbeing Analytics.

In terms of end-user industry, the BFSI segment will command an 18.3% share in the Global AI HR Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

AI in Oil and Gas Market Forecast and Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA