AI in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

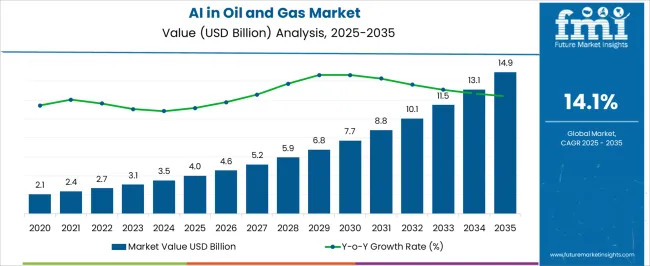

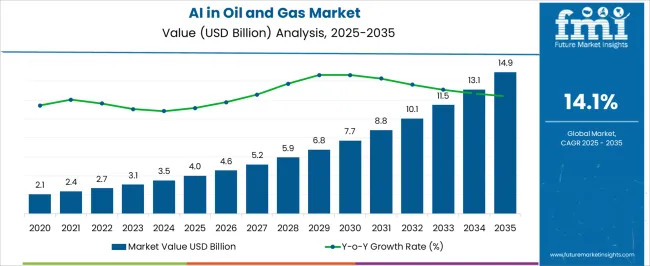

The AI in Oil and Gas Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

The AI in oil and gas market is growing rapidly, driven by the industry’s focus on operational efficiency, predictive maintenance, and cost optimization amid volatile energy prices. Artificial intelligence technologies are increasingly being deployed to analyze vast data volumes from drilling, production, and refining operations, enabling smarter decision-making and process automation.

The current market is characterized by expanding digital transformation initiatives across upstream, midstream, and downstream sectors, supported by rising investment in data-driven technologies. AI-driven solutions are improving asset performance, reducing downtime, and optimizing resource allocation.

As companies pursue sustainable operations and carbon reduction, AI applications are being extended to energy management and environmental monitoring. With the integration of machine learning, IoT, and advanced analytics, the market is poised for continuous expansion across exploration, production, and operational optimization domains.

Quick Stats for AI in Oil and Gas Market

- AI in Oil and Gas Market Industry Value (2025): USD 4.0 billion

- AI in Oil and Gas Market Forecast Value (2035): USD 14.9 billion

- AI in Oil and Gas Market Forecast CAGR: 14.1%

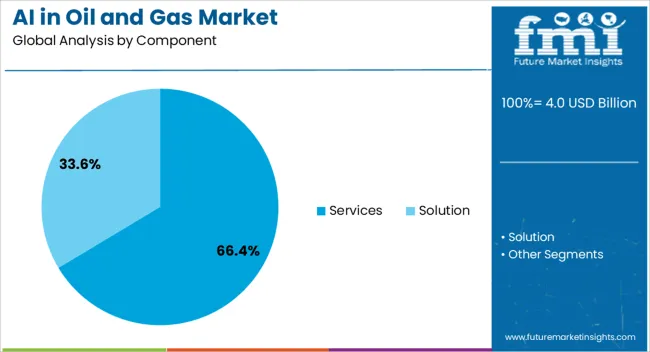

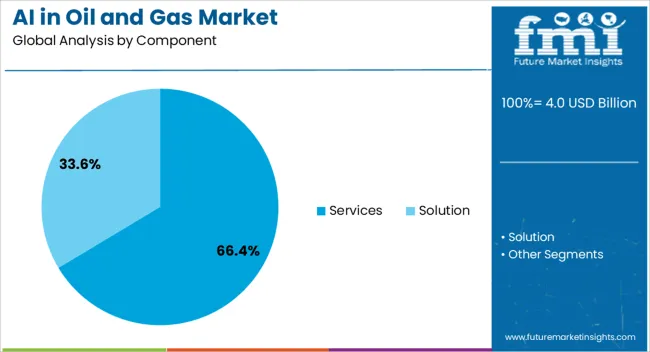

- Leading Segment in AI in Oil and Gas Market in 2025: Services (66.4%)

- Key Growth Region in AI in Oil and Gas Market: North America, Asia-Pacific, Europe

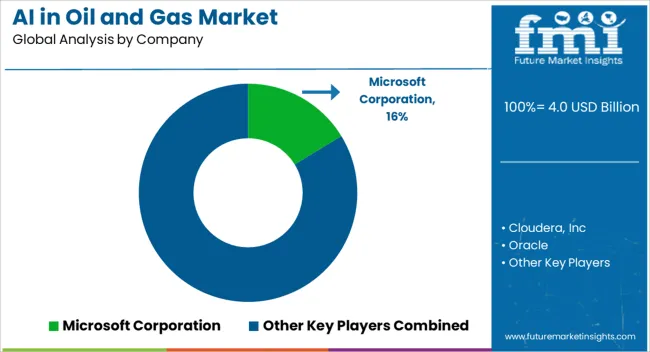

- Top Key Players in AI in Oil and Gas Market: Microsoft Corporation, Cloudera, Inc, Oracle, Google LLC, FuGenX Technologies Pvt. Ltd, Intel Corporation, Cisco Systems, Inc, IBM, NVIDIA Corporation, C3.ai, Inc

| Metric |

Value |

| AI in Oil and Gas Market Estimated Value in (2025 E) |

USD 4.0 billion |

| AI in Oil and Gas Market Forecast Value in (2035 F) |

USD 14.9 billion |

| Forecast CAGR (2025 to 2035) |

14.1% |

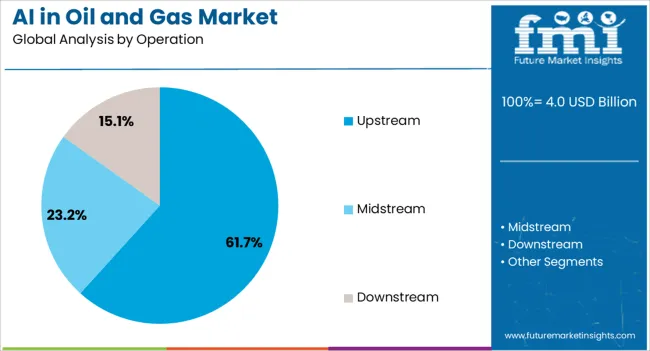

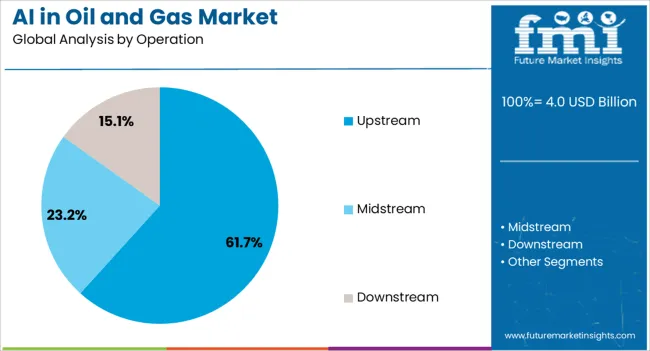

Segmental Analysis

The market is segmented by Component and Operation and region. By Component, the market is divided into Services and Solution. In terms of Operation, the market is classified into Upstream, Midstream, and Downstream. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Services Segment:

The services segment dominates the component category, accounting for approximately 66.40% share. This leadership is driven by the growing need for consulting, implementation, and maintenance services that enable energy companies to deploy AI solutions efficiently.

Service providers assist in data integration, model development, and customization for specific operational needs across the oil and gas value chain. The segment’s growth is reinforced by rising demand for cloud-based AI deployment and predictive analytics services that enhance decision accuracy and asset reliability.

With increasing reliance on third-party expertise to manage complex AI systems, the services segment is expected to retain its dominant share, supported by continuous investments in digital infrastructure and workforce training.

Insights into the Upstream Segment:

The upstream segment leads the operation category with approximately 61.70% share, reflecting the highest adoption of AI technologies in exploration and drilling activities. AI applications are improving reservoir modeling, seismic data interpretation, and drilling optimization, leading to higher productivity and reduced non-productive time.

Predictive maintenance and automated decision-making capabilities are enhancing safety and cost efficiency in field operations. The segment also benefits from integration with IoT and remote sensing technologies, providing real-time insights into asset performance.

With ongoing exploration projects and increased pressure to optimize production from mature fields, the upstream segment is expected to remain the primary driver of AI adoption in the oil and gas sector.

Emerging Opportunities in the AI in Oil and Gas Market

- AI is being used in the oil and gas industry in exploration, and production is expected to create significant opportunities in the market. For example, it can analyze seismic data to identify potential oil and gas reserves with greater accuracy and speed than traditional methods. This allows companies to make better decisions about where to drill and how to extract resources from the ground.

- By analyzing data from sensors and other sources, AI can help companies predict when equipment is likely to fail and schedule maintenance accordingly. This reduces downtime and maintenance costs and can also improve safety by reducing the risk of equipment failure.

- AI can help companies improve safety by identifying potential hazards and risks before they occur. The use of AI in the oil and gas industry offers numerous opportunities for companies to improve their operations, reduce costs, and improve safety. As the technology continues to advance, we can expect to see even more innovative applications of AI in the industry.

Factors Restraining the Demand for AI in Oil and Gas Solutions

- The lack of data quality and availability is an ongoing challenge in the market. For AI algorithms to work effectively, they require large amounts of high-quality data. The oil and gas industry, however, has historically struggled with data silos, incomplete datasets, and a lack of standardization.

- Oil and gas exploration and production involve a wide range of processes, from drilling and reservoir modeling to refining and distribution. Each of these processes generates a massive amount of data, making it difficult for AI models to work across the entire value chain.

- The deployment of AI in the oil and gas industry requires significant investment in infrastructure, hardware, and software. This can be a barrier for many companies, particularly the new entrants, who can be short of such resources and investments.

AI in Oil and Gas Industry Analysis by Top Investment Segments

The Solution Segment Dominates the Market

| Attributes |

Details |

| Component |

Solution |

| Market CAGR From 2025 to 2035 |

13.8% |

- There is an increasing demand for AI in data science solutions that can optimize operations and reduce costs. AI-powered solutions can help predict equipment failures, optimize production, and minimize downtime.

- They can also improve safety by identifying potential hazards and taking corrective actions. AI solutions can help in automating routine tasks and assist in decision-making processes. These benefits have led to an increase in the adoption of AI-powered solutions in the oil and gas industry.

The Upstream Segment Dominates the Market by Operation

| Attributes |

Details |

| By Operation |

Upstream |

| Market CAGR from 2025 to 2035 |

13.6% |

- The upstream is critical to the industry as it identifies new oil and gas reserves, increases production, and maintains existing fields.

- Companies in this segment are constantly investing in new technologies, including AI, to improve exploration and production efficiency, reduce greenhouse emissions, and enhance asset economic life. Moreover, companies are applying advanced analytics and gas-lift efficiency to improve productivity and equipment maintenance.

Analysis of Top Countries Manufacturing, Certifying, and Operating AI in Oil and Gas Solutions

| Countries |

CAGR from 2025 to 2035 |

| The United States |

14.5% |

| The United Kingdom |

15.7% |

| China |

13.4% |

| Japan |

15.4% |

| South Korea |

12.3% |

Increasing Need for Cost-Cutting and Improve Efficiency in the United States

- The oil and gas industry in the United States is facing increased pressure to improve efficiency and reduce costs while also ensuring worker safety and environmental responsibility. Artificial intelligence (AI) has emerged as a key solution to these challenges, leading to an increasing demand for AI in the industry.

- The shale boom has led to an increase in production, which has put pressure on companies to improve their operations in the United States. AI can help companies optimize production and reduce costs, enabling them to remain competitive in the market. Moreover, AI can help companies preserve and transfer this knowledge to the next generation of workers.

Rising Awareness Regarding Carbon Emission in the United Kingdom Driving Growth

- With the increasing energy demand in the United Kingdom, the industry is constantly looking for ways to improve efficiency and reduce costs. AI-powered systems can analyze large volumes of data, identify patterns, and make predictions that help optimize production, reduce downtime, and improve safety.

- The United Kingdom has been investing heavily in AI research and development, making it a hotbed for innovation in the field. The country has a well-established network of universities, research centers, and startups pushing AI's boundaries. This has led to the creation of cutting-edge AI technologies that are now being applied to the oil and gas industry.

- Increasing awareness of the need to reduce carbon emissions. AI-powered systems can help optimize operations and reduce waste, leading to a more sustainable and environmentally friendly industry.

The Rapid Growth of the Tech Industry in Advancin the Market of AI in Oil and Gas in China

- The country is one of the leading consumers of oil and gas in the world, which means that there is significant interest in finding ways to improve the efficiency and safety of these operations. AI can help achieve these goals by optimizing production processes, predicting equipment failures, and improving safety protocols.

- The Chinese government has been actively promoting the development and adoption of AI technologies, recognizing their potential to transform various industries, including oil and gas. This has resulted in increased investment and research in the field, as well as the creation of favorable policies and regulations.

- The rapid growth of China's tech industry has led to the emergence of several AI startups that are focused on developing solutions for the oil and gas sector. These companies are leveraging China's vast data resources and expertise in machine learning to create innovative tools and applications that can improve the performance and profitability of oil and gas operations.

Need to Optimize Energy Production and Management in Japan

- The oil and gas industry in Japan is a significant contributor to the country's economy, accounting for a large share of its domestic energy supply. In recent years, there has been a growing demand for AI technology in the oil and gas sector as Japan seeks to improve its energy efficiency and reduce carbon emissions.

- The need to optimize energy production and management is raising the demand for AI-powered solutions that can help identify patterns and trends in data from oil and gas fields, enabling companies to make more informed decisions about where to drill, how to extract resources, and when to invest in new infrastructure.

- AI can also be used to monitor equipment performance, detect potential failures, and improve maintenance planning, which can help reduce downtime and increase productivity. Moreover, AI-powered algorithms can help identify patterns and trends in data from oil and gas fields, enabling companies to make more informed decisions about where to drill, how to extract resources, and when to invest in new infrastructure.

Rising Government Initiatives Toward Technological Advancement in South Korea

- South Korea is known for its technological advancements and innovation. The government has been promoting the development and adoption of AI technology in various industries, including oil and gas.

- Many companies in South Korea are already using AI-powered solutions for upstream, midstream, and downstream operations. The growing need for better safety measures is driving the demand for AI in the sector, as it can help prevent accidents and improve the overall safety of workers and the environment.

- South Korea has been a significant player in the oil and gas market for several decades. Therefore, the country is investing in AI to improve its competitiveness in the industry.

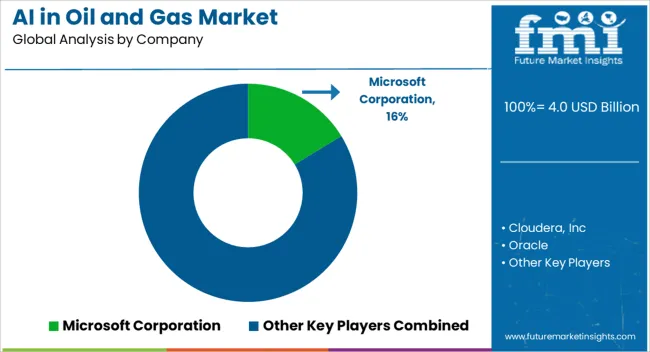

Leading Suppliers in the AI in Oil and Gas Sector

Many companies are investing in AI technologies to optimize their operations, reduce costs, and improve safety. Companies are investing heavily in AI-powered solutions that can analyze data from sensors and other sources to improve efficiency and reduce downtime.

Additionally, there are many startups and smaller companies that are developing innovative AI solutions for the oil and gas industry. Overall, the market is moderately competitive, with many players vying for a significant share.

Recent Developments

- In 2025, Oil and Gas Holding Co. (no holding) and AIQ teamed up to bring digital solutions and artificial intelligence into their upstream operations. This collaboration helps nogaholding improve its operational efficiency by utilizing advanced AI technologies provided by AIQ.

- In 2025, C3 AI launched the C3 Generative AI Product Suite, which includes the C3 Generative AI for Enterprise Search as its first product. The suite also offers advanced transformer models, making it easier for businesses to use AI throughout their value chains. This suite has pre-built AI applications for various industries, including the oil and gas sector, to speed up transformation efforts across different business functions.

Key Market Players

- FuGenX Technologies Pvt. Ltd

- Microsoft Corporation

- IBM Corp.

- Google LLC

- Intel Corporation

Top Segments Studied in the AI in Oil and Gas Market

By Component:

By Operation:

- Upstream

- Midstream

- Downstream

By Region:

- North America

- Latin America

- East Asia

- South Asia

- Europe

- Oceania

- The Middle East and Africa

Frequently Asked Questions

How big is the AI in oil and gas market in 2025?

The global AI in oil and gas market is estimated to be valued at USD 4.0 billion in 2025.

What will be the size of AI in oil and gas market in 2035?

The market size for the AI in oil and gas market is projected to reach USD 14.9 billion by 2035.

How much will be the AI in oil and gas market growth between 2025 and 2035?

The AI in oil and gas market is expected to grow at a 14.1% CAGR between 2025 and 2035.

What are the key product types in the AI in oil and gas market?

The key product types in AI in oil and gas market are services and solution.

Which operation segment to contribute significant share in the AI in oil and gas market in 2025?

In terms of operation, upstream segment to command 61.7% share in the AI in oil and gas market in 2025.