The AI-Powered CRM Platform market is experiencing substantial growth, driven by the increasing adoption of artificial intelligence to enhance customer relationship management and improve business efficiency. Organizations are increasingly leveraging AI capabilities such as predictive analytics, sentiment analysis, and automated customer interaction handling to optimize sales, marketing, and support processes. The demand for personalized and real-time customer experiences is fueling adoption across multiple industries, while integration with existing enterprise systems ensures seamless workflow and data consistency.

Advancements in natural language processing and machine learning algorithms are enhancing CRM platform intelligence, enabling improved decision-making, customer retention, and operational efficiency. Additionally, businesses are under growing pressure to provide consistent service experiences while reducing operational costs, which further supports the shift toward AI-enabled solutions.

As the competitive landscape intensifies, AI-powered CRM platforms that deliver actionable insights, automate routine processes, and improve responsiveness are expected to dominate market growth The increasing investments in digital transformation initiatives and customer-centric strategies are also driving long-term expansion of the market.

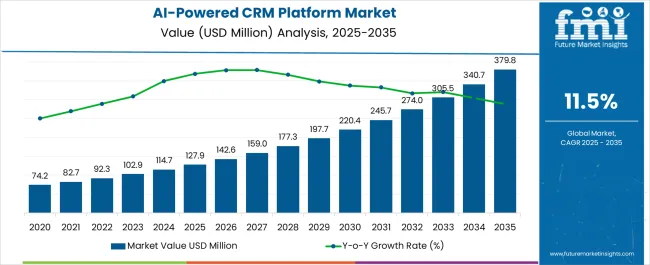

| Metric | Value |

|---|---|

| AI-Powered CRM Platform Market Estimated Value in (2025 E) | USD 127.9 million |

| AI-Powered CRM Platform Market Forecast Value in (2035 F) | USD 379.8 million |

| Forecast CAGR (2025 to 2035) | 11.5% |

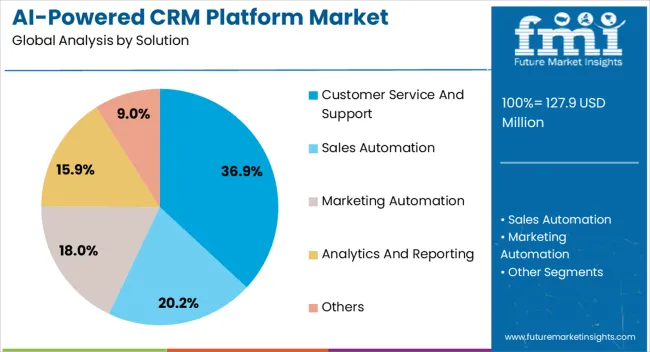

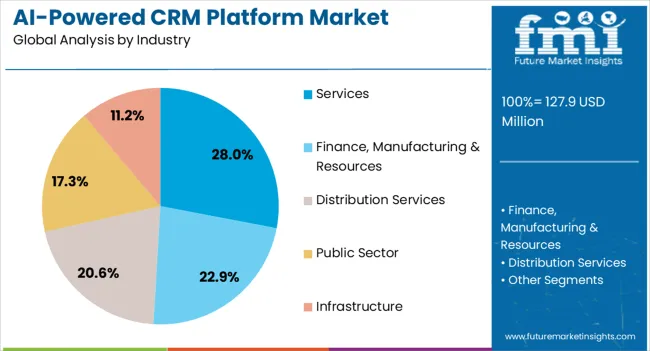

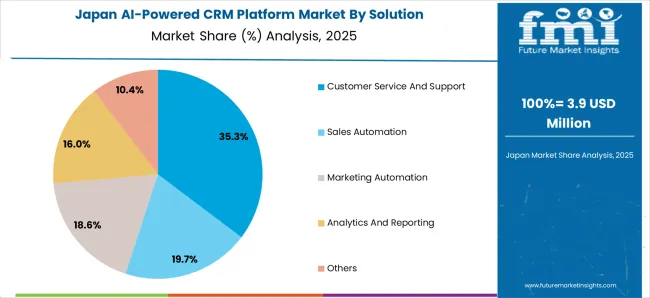

The market is segmented by Solution and Industry and region. By Solution, the market is divided into Customer Service And Support, Sales Automation, Marketing Automation, Analytics And Reporting, and Others. In terms of Industry, the market is classified into Services, Finance, Manufacturing & Resources, Distribution Services, Public Sector, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The customer service and support solution segment is projected to hold 36.9% of the market revenue in 2025, establishing it as the leading solution category. Growth in this segment is being driven by the need to improve customer engagement, satisfaction, and retention through automated and intelligent service delivery. AI-powered CRM platforms enable capabilities such as chatbots, automated ticket routing, sentiment analysis, and real-time issue resolution, reducing response times and improving operational efficiency.

Integration with analytics and reporting tools allows organizations to gain actionable insights into customer behavior, enabling proactive support strategies. The ability to handle high volumes of customer interactions without increasing resource requirements enhances cost efficiency. Enterprises across sectors are adopting AI-driven solutions to meet rising customer expectations, maintain brand loyalty, and ensure compliance with service standards.

Continuous improvements in AI algorithms, predictive capabilities, and multi-channel integration are further reinforcing adoption As companies increasingly prioritize customer-centric approaches and digital service transformation, the customer service and support solution segment is expected to maintain its leadership position in the market.

The services industry segment is anticipated to account for 28.0% of the market revenue in 2025, making it the leading industry category. Growth is being driven by the high reliance on AI-powered CRM platforms to manage customer interactions, improve service delivery, and optimize operational efficiency in service-oriented businesses. Organizations are leveraging AI to gain insights into customer behavior, predict service demands, and personalize engagement strategies.

Automated workflows and intelligent analytics enable enhanced decision-making, reduced response times, and improved client satisfaction. The integration of AI-powered CRM with industry-specific platforms ensures seamless operations and consistent service quality across multiple touchpoints.

Rising competition and the need to differentiate through superior customer experience are further fueling adoption in the services sector As enterprises increasingly focus on digital transformation, real-time data-driven strategies, and predictive customer engagement, the services industry segment is expected to remain a primary driver of market growth, supported by continued advancements in AI, automation, and multi-channel integration.

| Historical CAGR from 2020 to 2025 | 10.70% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 11.50% |

The historical CAGR of 10.70% helps the AI-powered CRM platform market jump from USD 74.2 million to USD 103.5 million from 2020 to 2025, respectively. This market advancement was subjected to the rising demand for e-commerce platforms.

The pandemic surged the demand for various e-commerce platforms, which required the assistance of artificial intelligence to resolve customers' queries. Hence, this was the fundamental surging factor.

Apart from this, the data management of numerous patients was essential as there was a significant surge in the number of patients being affected due to various diseases having similar symptoms. Integrating AI in CRM allowed medical institutions to classify and segregate patients under different categories to make their treatment easier.

However, the forecasted period relies more on the customer relationship of large-scale businesses. The remote operation of businesses emphasizes better customer interaction, encouraging enterprises to enhance customer comfort. Hence, integrating cutting-edge technology to improve response time drives the demand for AI-powered CRM platforms.

Apart from this, E-commerce platforms' constant growth is another market driver that generates demand for platforms, similar to the historical period.

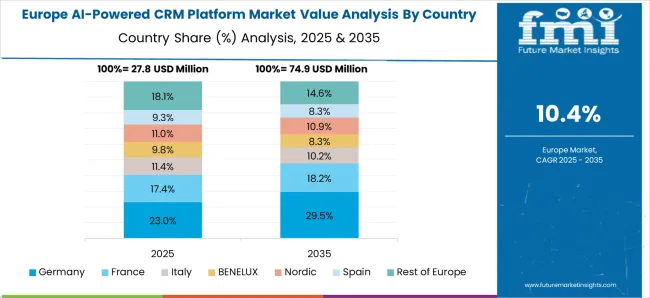

Technological advancements have helped different countries contribute heavily to the global AI-powered CRM platform market. The Asian and Pacific countries are leading the market as the end-user industry in these countries is growing. In addition, Australia and New Zealand lead all the countries by registering the highest growth rate in the forecasted period.

North America is another market that provides a wider landscape to the subject market. The developed technological infrastructure creates lucrative growth opportunities for the market.

Europe is another significant contributor, creating strong opportunities for many organizations to expand. Due to this, the growth rate of the market is increasing rapidly.

Forecast CAGRs from 2025 to 2035

| Countries | Forecast CAGR until 2035 |

|---|---|

| The United States of America | 8.40% |

| Germany | 5.00% |

| Japan | 4.30% |

| China | 12.00% |

| Australia and New Zealand | 15.00% |

| Category | Solution- Customer Service and Support |

|---|---|

| Market Share in 2025 | 36.90% |

| Market Segment Drivers |

|

| Category | Industry- Services |

|---|---|

| Market Share in 2025 | 28% |

| Market Segment Drivers |

|

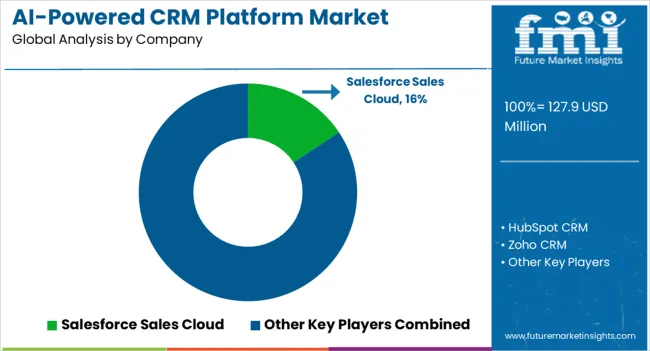

Different businesses play an active role in governing the competitive landscape. They clutter the market with their presence through various offerings, including products and services.

However, it is vital to differentiate the product portfolio for a new entrant to embark on its position. Also, market penetration must be focused so that a strong brand position can be established.

In the case of the existing key competitors, mergers and acquisitions, product development, innovation, and partnerships are key market expansion modes that yield a competitive niche. Further, diversifying the technology used in the product is another key approach to bolster the market position.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 114.7 million |

| Projected Market Valuation in 2035 | USD 340.6 million |

| Value-based CAGR 2025 to 2035 | 11.50% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million/billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Solution, Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | HubSpot CRM; Freshsales; Pipedrive; Zoho CRM; Zendesk Sell; ClickUp; Durable; C3.ai; Salesforce Sales Cloud; itransition |

The global ai-powered crm platform market is estimated to be valued at USD 127.9 million in 2025.

The market size for the ai-powered crm platform market is projected to reach USD 379.8 million by 2035.

The ai-powered crm platform market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in ai-powered crm platform market are customer service and support, sales automation, marketing automation, analytics and reporting and others.

In terms of industry, services segment to command 28.0% share in the ai-powered crm platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CRM Application Software Market Report – Forecast 2017-2022

Mobile CRM – AI-Enhanced Customer Engagement & Growth

Personal CRM Market Report - Growth & Forecast 2025 to 2035

AI-Powered PropTech CRM – Future of Real Estate Management

Salesforce CRM Document Generation Software Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Trends – Growth & Forecast through 2034

AIOps Platform Market Forecast and Outlook 2025 to 2035

Sales Platforms Software Market - Growth & Forecast 2034

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

RevOps Platform Market Insights – Growth & Forecast 2023-2033

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Trusted Platform Module (TPM) Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA