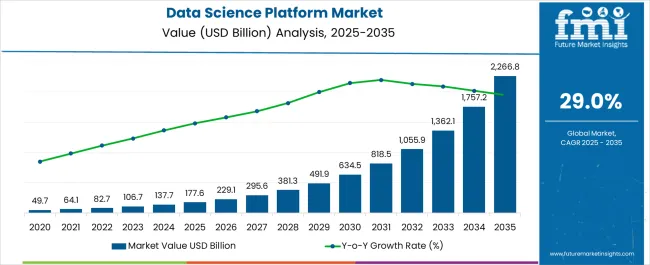

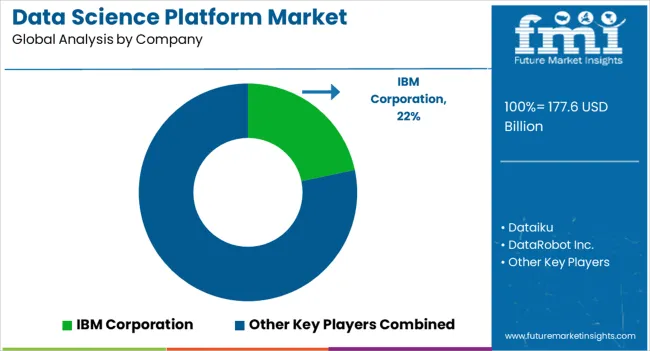

The data science platform market is estimated to be valued at USD 177.6 billion in 2025 and is projected to reach USD 2266.8 billion by 2035, registering a compound annual growth rate (CAGR) of 29.0% over the forecast period.

Chief data officers evaluate platform specifications based on algorithm library comprehensiveness, model deployment capabilities, and collaborative workflow support when establishing enterprise analytics infrastructure for predictive modeling, customer segmentation, and operational optimization applications. Platform selection involves analyzing computational scalability, data integration capabilities, and visualization tools while considering governance frameworks, security protocols, and compliance features necessary for enterprise data management. Procurement decisions balance subscription costs against productivity gains including reduced development time, improved model accuracy, and accelerated time-to-insight that influence organizational analytical maturity and competitive positioning.

Infrastructure deployment requires cloud-native architectures, distributed computing frameworks, and automated pipeline management systems that support massive dataset processing while maintaining performance consistency throughout varying analytical workloads and user concurrency levels. Operations coordination involves managing computational resource allocation, data pipeline scheduling, and model monitoring while maintaining platform availability and response time standards across diverse user groups and analytical projects. Quality assurance procedures address model validation, data lineage tracking, and result reproducibility that ensure analytical reliability while supporting regulatory compliance and audit requirements throughout enterprise analytics implementations.

Cross-functional coordination involves data scientists, machine learning engineers, and business stakeholders collaborating to optimize analytical workflows that balance model sophistication with business applicability while addressing specific use case requirements and organizational constraints. Platform implementation encompasses user training, governance establishment, and integration testing while coordinating with existing enterprise systems, data warehouses, and business intelligence tools. Training initiatives address platform navigation, algorithm selection, and model interpretation techniques essential for maximizing analytical productivity and ensuring proper platform utilization across organizational skill levels.

Technology advancement prioritizes automated machine learning capabilities, no-code development interfaces, and real-time analytics processing that democratize data science while reducing technical barriers for business users and citizen developers. Platform providers develop integrated development environments, pre-built algorithm libraries, and automated feature engineering tools that accelerate model development while maintaining professional-grade analytical capabilities. Innovation encompasses edge analytics deployment, federated learning support, and quantum computing integration that expand platform capabilities while supporting emerging analytical paradigms and computational architectures.

Innovation trends emphasize responsible artificial intelligence implementation, automated governance frameworks, and collaborative analytics environments that advance data science platforms while supporting ethical analytics deployment throughout enterprise applications requiring comprehensive analytical capabilities supporting business transformation and competitive advantage development across industries embracing data-driven decision making and artificial intelligence integration.

| Metric | Value |

|---|---|

| Data Science Platform Market Estimated Value in (2025 E) | USD 177.6 billion |

| Data Science Platform Market Forecast Value in (2035 F) | USD 2266.8 billion |

| Forecast CAGR (2025 to 2035) | 29.0% |

The data science platform market is experiencing robust expansion due to the rising adoption of artificial intelligence, machine learning, and advanced analytics across industries. Enterprises are leveraging these platforms to derive actionable insights, streamline operations, and accelerate decision making processes.

Growing data volumes from digital transformation initiatives and the increasing complexity of business environments are creating strong demand for scalable platforms. Advances in cloud infrastructure, open source integration, and automation capabilities are enhancing accessibility and reducing costs, making data science more widely applicable.

Regulatory focus on data governance and compliance is further pushing enterprises to adopt structured platforms that ensure transparency and traceability. The market outlook remains favorable as organizations continue to integrate predictive and prescriptive analytics into their operational strategies, driving efficiency and competitive advantage across multiple sectors.

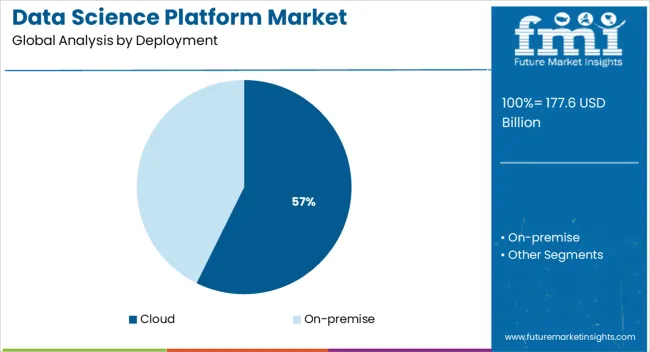

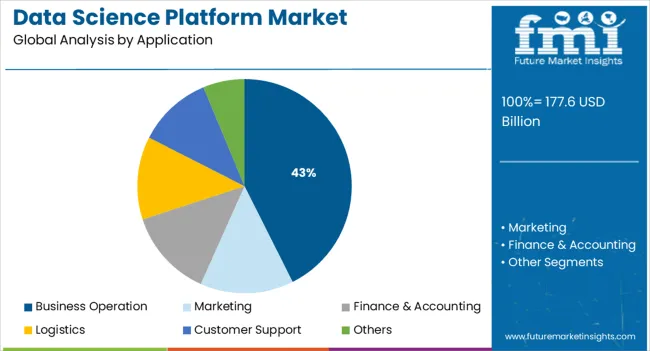

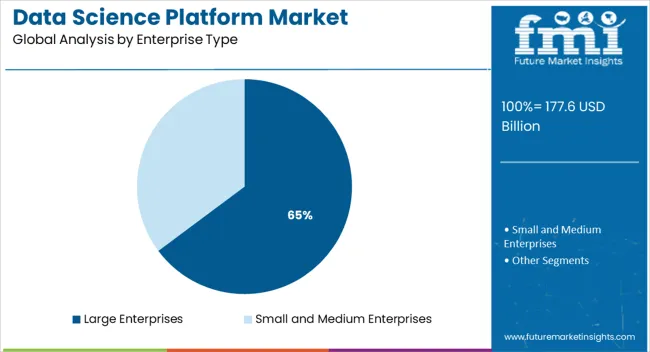

The market is segmented by Deployment, Application, Enterprise Type, and Industry and region. By Deployment, the market is divided into Cloud and On-premise. In terms of Application, the market is classified into Business Operation, Marketing, Finance & Accounting, Logistics, Customer Support, and Others. Based on Enterprise Type, the market is segmented into Large Enterprises and Small and Medium Enterprises. By Industry, the market is divided into BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Transportation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

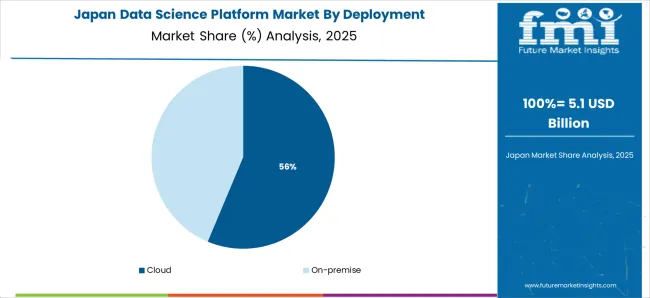

The cloud deployment segment is projected to account for 57.30% of total revenue by 2025 within the deployment category, positioning it as the leading segment. This dominance is attributed to the flexibility, scalability, and cost efficiency offered by cloud based platforms.

Enterprises are increasingly favoring cloud deployment to support collaborative workflows, real time data processing, and remote accessibility. The reduced need for infrastructure investment and the ability to scale resources on demand have further reinforced its adoption.

Security advancements and compliance certifications have also enhanced enterprise confidence in cloud platforms. As organizations continue shifting to hybrid and remote operating models, the reliance on cloud deployment is expected to strengthen further.

The business operation application segment is expected to hold 42.60% of market revenue by 2025, making it the leading application category. This growth is driven by the ability of data science platforms to optimize supply chains, streamline financial processes, and enhance workforce productivity.

Advanced analytics have been widely adopted to predict demand, detect anomalies, and automate repetitive processes, thereby improving operational efficiency. Enterprises are increasingly applying machine learning models to real time business operations to gain competitive advantages and reduce risks.

The integration of data science into business decision making processes has reinforced its position as the dominant application area.

The large enterprises segment is anticipated to capture 64.80% of market revenue by 2025 under the enterprise type category, making it the most prominent segment. This is due to the significant resources and infrastructure available for adopting advanced analytics and machine learning tools.

Large organizations are leveraging platforms to handle massive data sets, integrate predictive analytics into strategic planning, and meet compliance requirements. Their investment in in house teams and enterprise wide platforms has enabled faster innovation cycles and improved decision making accuracy.

Furthermore, large enterprises are at the forefront of deploying customized platforms that align with global operational needs, solidifying their leadership position in the market.

Data science platforms are being used by organizations including banks and financial institutions, healthcare providers, retail and e-commerce businesses, and even government and public organizations. Different organizations have come a long way to gather insights, make better decisions, and improve customer experiences.

Businesses are making significant investments in data science platforms to enhance consumer experiences, develop cutting-edge goods and services, and gain a competitive edge in the market. Companies are also investing in data science platforms to generate individualized customer experiences, understand customer behavior and trends, and increase customer loyalty.

To improve the companies' end-to-end data management and evaluation process, the players included new technology in their product offerings. For instance

The telecommunications sector is growing due to the active application of data science and machine learning. Telecom businesses utilize extensive communication networks and infrastructures to run with the full data flow. One of the most useful solutions is using data science tools to analyze and handle this data.

| Attributes | Details |

|---|---|

| Data Science Platform Market CAGR (2025 to 2035) | 29% |

| Data Science Platform Market Size (2025) | USD 106.74 billion |

| Data Science Platform Market Size (2035) | USD 1,362.09 billion |

When compared to the 25.2% CAGR recorded between 2020 and 2025, the data science platform business is predicted to expand at a 29.0% CAGR between 2025 and 2035. The average growth of the market is expected to be around 1.29x between 2025 and 2025.

| Year | Market Value |

|---|---|

| 2020 | USD 17.95 billion |

| 2020 | USD 64.14 billion |

| 2025 | USD 82.74 billion |

Short-term Growth (2025 to 2029): Due to the adoption of cloud-based products and services, as well as the targeting of developing and untapped areas for data science platforms, the market is predicted to rise rapidly.

Medium-term Growth (2035 to 2035): During this period, it is projected that the development of Big Data technology would be promising for the market.

Long-term Growth (2035 to 2035): Data science is no longer an optional expense for businesses undergoing digital transformation. Many businesses are being assessed to be using a data-driven approach in their operational environment, which encourages global demand.

The companies have publicly said that they want to regularly undertake model-driven campaigns in a number of their functional areas, including sales, operations, manufacturing, and human resources.

The pace of technological advancement has been hastened by more research and development spending. As a result, as there are more businesses, there is an increasing need for technology that boosts production and efficiency.

For corporate growth, modern data handling methods and solutions are crucial, and there is a high need for data science platforms, which makes it easier to train, create, scale, and deploy ML models.

There is a growing flow of data in both organized and unstructured formats as a result of the Internet of Things (IoT), social media, and multimedia. Data generated by humans and machines is expanding 10x faster than data generated by businesses.

Advanced analytics techniques are used by organizations, such as machine learning, streaming analytics, and predictive analytics. To create a machine learning model, technical proficiency and analytical thinking skills are required.

Many end users lack the workforce with the necessary technical knowledge and abilities, which impedes the market's expansion. Significant barriers to the industry's expansion include a lack of technology dependability, data security, and privacy issues, strict government rules and regulations, and high investment needs.

This technology's users need to upgrade their platforms frequently to keep up with new technologies and data resources, which is another issue limiting the market's expansion. The proliferation of data, a lack of analytical skills, and a lack of domain expertise are a few barriers in this sector.

Cloud-based deployment provides real-time data transfer that helps in improving services and business operations. Due to this, the cloud segment currently holds the leading data science platform market share and is anticipated to expand at the leading CAGR during the projection period.

The SAS Institute debuted its "SAS Viya" all-in-one platform on the Microsoft Azure market in September 2025. By enabling the cloud-based deployment of their product, they broadened their business model.

Over the projected period, the large enterprise is anticipated to lead the revenue share. The availability of a high percentage of IT budgets is expected to enhance the need for data science platforms in large enterprises.

The category of small and medium-sized businesses is anticipated to experience a high CAGR over the forecast period due to the growing adoption of digital platforms. SMEs are making investments in this platform to improve their customer support functions, which can aid in business growth.

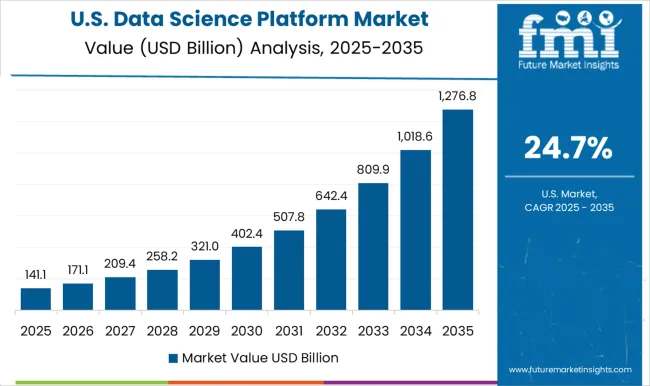

The data science platform sector in the United States was estimated to be worth USD 49.7 billion in 2020 and is anticipated to rise to USD 2266.8 billion by 2035. The market is expected to see a CAGR of 24.8% by 2035.

This rise is attributable to the rising importance of data-driven decision-making in the sector. The rising number of data science specialists and the rising requirement for data-driven decision-making among companies leads to high demand for data science platforms.

The expanding need for automated machine learning and the availability of open-source and cloud-based platforms are all contributing factors to the market's expansion.

The launch of a cloud-based data science platform was announced by the technology corporation Oracle in February 2024. The new platform's capabilities include shared projects, team security policies, audibility, reproducibility, and model catalogs.

| Attributes | Statistics |

|---|---|

| United Kingdom Market Value 2035 | USD 4.66 billion |

| United Kingdom Market Value 2025 | USD 1.64 billion |

| United Kingdom Market CAGR (2025 to 2035) | 11% |

The need for effective data storage and management solutions, as well as the rising demand for advanced data analytics and AI-driven solutions, are predicted to fuel this expansion. The expansion is also aided by the rise of IoT technologies and the increased use of smart devices.

Through the introduction of several programs, like the Digital Economy Network, which aims to assist businesses in maximizing the potential of data analytics, the United Kingdom government is also supporting the usage of data science platforms.

| Country | China |

|---|---|

| Market Value (2025) | USD 4.82 billion |

| Market Value (2035) | USD 78.65 billion |

| Market CAGR (2025 to 2035) | 28.9% |

| Country | India |

|---|---|

| Market Value (2025) | USD 1.27 billion |

| Market Value (2035) | USD 10.26 billion |

| Market CAGR (2025 to 2035) | 20.9% |

| Country | Japan |

|---|---|

| Market Value (2025) | USD 9.2 billion |

| Market Value (2035) | USD 22.85 billion |

| Market CAGR (2025 to 2035) | 8.6% |

This expansion is ascribed to the speedy uptake of data science platforms and technologies by businesses across. The market's expansion is being further fueled by the rising need for big data and predictive analytics technology. The government's attempts to encourage business adoption of AI are also anticipated to accelerate industry expansion.

Initiatives in the Indian Market

In terms of AI development and application, Japan is one of the top nations in the world. To help organizations quickly and effectively implement AI solutions and capitalize on the technology, firms like IBM and Microsoft have introduced platforms for AI-as-a-Service.

To improve data accessibility, Japan is also making use of open data platforms. Businesses can now access, analyze, and use data from a variety of sources thanks to platforms that have been launched by companies like Fujitsu and NTT Data.

The data science platform market is highly competitive, driven by rapid advancements in artificial intelligence, machine learning automation, and enterprise data analytics. IBM Corporation, Microsoft Corporation, and Oracle Corporation dominate the market through their comprehensive cloud-based data science ecosystems, integrating AI-powered analytics, scalable compute infrastructure, and enterprise-grade security. Their platforms enable end-to-end data workflows, from ingestion to model deployment, catering to industries such as finance, healthcare, and manufacturing.

Dataiku, DataRobot Inc., and Alteryx Inc. distinguish themselves with user-friendly, low-code data science environments that democratize machine learning for non-technical users while supporting advanced data scientists with automation and explainability tools. Their focus on augmented analytics and MLOps integration enhances productivity and accelerates time-to-insight for organizations pursuing digital transformation.

Databricks Inc. leads innovation with its unified analytics platform built on the Lakehouse architecture, enabling collaborative data engineering, analytics, and AI development. TIBCO Software Inc., The MathWorks Inc., and SAS Institute Inc. further strengthen market competitiveness through domain-specific analytics, simulation modeling, and statistical software optimized for research-intensive sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 177.6 billion |

| Deployment Types | Cloud, On-premise |

| Application |

Business Operation, Marketing, Finance & Accounting, Logistics, Customer Support, Others |

| Enterprise Types | Large enterprises, Small and medium enterprises (SMEs) |

| Industry | BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Transportation, Government and public sector, Energy, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Germany, France, United Kingdom, China, Japan, India, South Korea, Brazil, and 40+ countries |

| Key Companies Profiled |

IBM Corporation, Dataiku, DataRobot Inc., TIBCO Software Inc., Databricks Inc., The MathWorks Inc., SAS Institute Inc., Microsoft Corporation, Alteryx Inc., Oracle Corporation |

| Additional Attributes | Dollar sales by deployment, application, enterprise type, vertical and region, cloud share 57.3% in 2025, leading application business operation 42.6%, forecast CAGR 29% (2025–2035), rise of AutoML and MLOps, shortage of analytical skills and talent, data governance and compliance emphasis, startup ecosystem and competitive dynamics, partnerships and acquisitions, innovations in automated model marketplaces and safe data collaboration. |

The global data science platform market is estimated to be valued at USD 177.6 billion in 2025.

The market size for the data science platform market is projected to reach USD 2,266.8 billion by 2035.

The data science platform market is expected to grow at a 29.0% CAGR between 2025 and 2035.

The key product types in data science platform market are cloud and on-premise.

In terms of application, business operation segment to command 42.6% share in the data science platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center Market Forecast and Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA