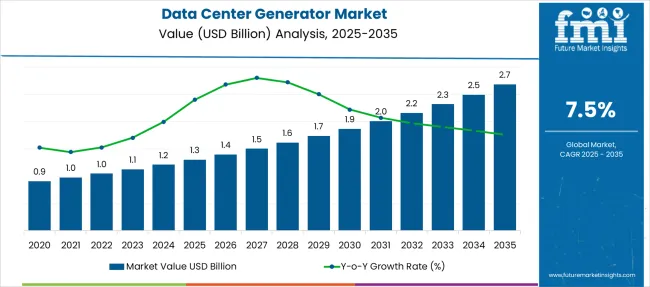

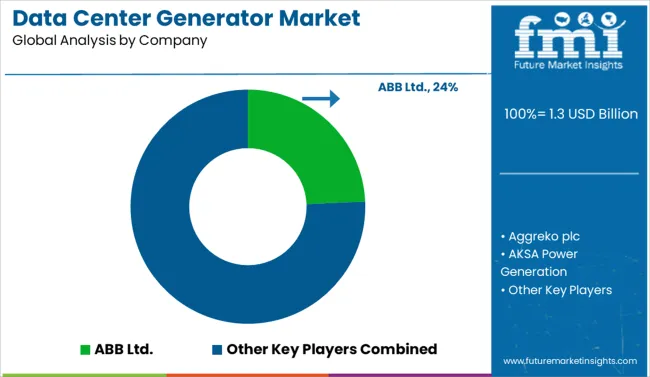

The Data Center Generator Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Data Center Generator Market Estimated Value in (2025 E) | USD 1.3 billion |

| Data Center Generator Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The data center generator market is expanding steadily due to rising global demand for uninterrupted data services, increasing reliance on cloud computing, and the rapid expansion of hyperscale and edge data centers. As digital infrastructure becomes mission critical, power reliability and redundancy have emerged as key operational priorities.

Data center operators are investing in high performance backup power systems to mitigate risks associated with grid instability and outages. Regulatory mandates and industry guidelines emphasizing uptime assurance and disaster recovery have further underscored the importance of generator systems.

Innovations in generator efficiency, automation integration, and hybrid energy configurations are enhancing adoption across both developed and emerging markets. With digital transformation initiatives accelerating across sectors including finance, healthcare, and e commerce, the need for resilient power infrastructure continues to drive growth across the data center generator landscape.

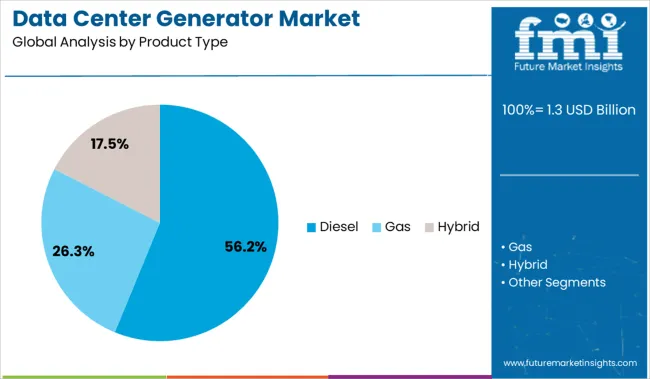

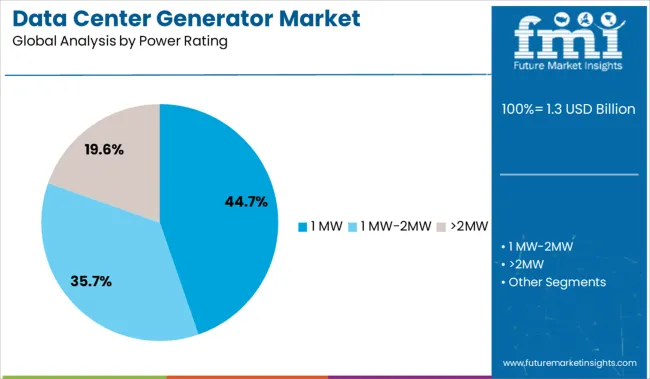

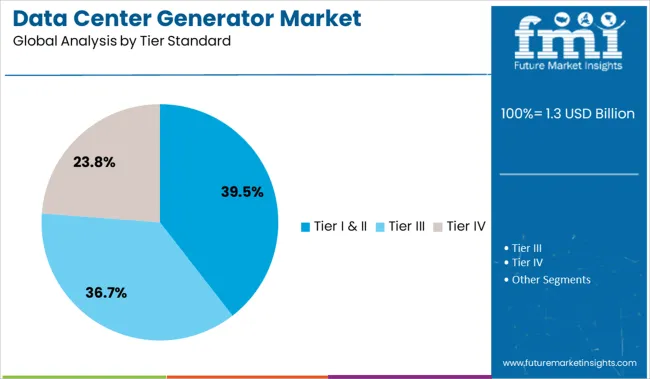

The data center generator market is segmented by product type, power rating, tier standard, cooling system, and end use and geographic regions. The data center generator market is divided by product type into Diesel, Gas, and Hybrid. In terms of power rating, the data center generator market is classified into 1 MW, 1 MW-2MW, and >2MW. Based on the tier standard, the data center generator market is segmented into Tier I & II, Tier III, and Tier IV. The cooling system of the data center generator market is segmented into Air-cooled generators and Liquid-cooled generators. By end use, the data center generator market is segmented into BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, IT & telecom, and Others. Regionally, the data center generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The diesel generator segment is expected to contribute 56.20 percent of the total revenue by 2025 within the product type category, making it the leading choice among data center operators. This preference is primarily attributed to diesel generators’ proven reliability, rapid start capability, and long operational lifespan under heavy load conditions.

These systems provide consistent backup power during extended outages, making them essential for maintaining service continuity in tiered and enterprise level data centers. Additionally, the global availability of diesel fuel and well established service infrastructure contribute to the segment’s continued dominance.

Despite the rise in sustainability initiatives, diesel generators remain integral to mission critical applications where performance and reliability take precedence over carbon considerations.

Within the power rating category, the 1 MW segment is anticipated to account for 44.70 percent of market revenue by 2025. This share reflects its suitability for supporting medium to large scale data center facilities that require scalable and modular backup power solutions.

The 1 MW configuration offers a balance between capacity and operational efficiency, making it an ideal fit for multi rack deployments and high density server environments. As colocation providers and hyperscale developers seek reliable and adaptable power architectures, the 1 MW range is emerging as a standard benchmark for backup infrastructure.

Its integration with load balancing and automation systems further reinforces its leadership in this category.

The tier I and tier II category is projected to hold 39.50 percent of total revenue within the tier standard segment by 2025, establishing its position as the most prominent standard level. This dominance is driven by increasing investments in small to medium sized data centers across developing regions, where demand for essential uptime and affordability align with these tier levels.

Operators in emerging markets are prioritizing cost effective infrastructure that ensures basic redundancy without the higher capital expenditure associated with tier III and tier IV facilities. Furthermore, the scalability and simplicity of tier I and II designs make them attractive for enterprises transitioning to digital operations or expanding regional data operations.

As internet penetration and digital service consumption grow, this segment continues to play a foundational role in shaping regional data center ecosystems.

Demand for data center generators is accelerating due to grid instability and increasing uptime standards. Sales of gas-based and hybrid generators are rising as operators prioritize fuel efficiency, emissions compliance, and scalable backup systems in hyperscale and edge deployments.

Demand for data center generators surged 18% in 2025, primarily driven by grid reliability concerns across North America and parts of Southeast Asia. Hyperscale operators are deploying redundant diesel generators rated above 2 MW to meet Tier III/IV power assurance. In Texas and Maharashtra, where brownouts impacted uptime SLAs, colocation firms added containerized gensets to ensure 100% failover capability. Peak-shaving functions now embedded in generator controllers reduced utility demand charges by 13%. Contracts are increasingly favoring dual-fuel units, with natural gas as the primary mode and diesel fallback, allowing 19% longer runtime autonomy. Generator fleet standardization has also trimmed maintenance downtime by 16%.

Sales of data center generators using natural gas and hybrid configurations rose 23% in 2025 as ESG compliance tightened globally. European colocation providers shifted away from diesel-only models, adopting low-NOx gas gensets to align with Scope 1 reduction targets. Modular gas units under 1.5 MW were widely deployed in urban edge sites where emission zoning limited diesel permits. In Japan and South Korea, hydrogen-ready backup generators entered pilot deployment stages, supported by government green-tech grants. Operators bundling battery storage with generators in a hybrid setup reported 27% faster transition to load post-failure. These cleaner alternatives are gaining share among future-proof data center designs.

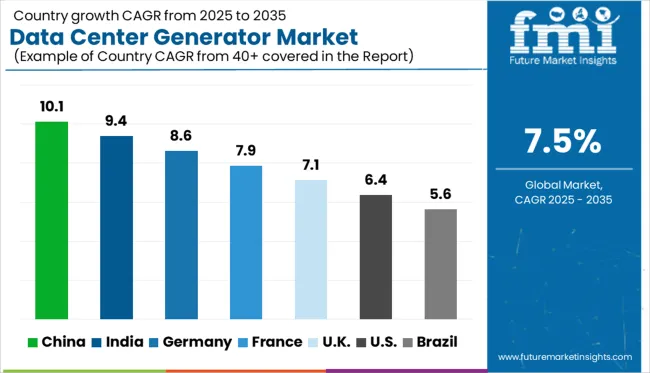

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global data center generator market is projected to grow at a CAGR of 7.5% between 2025 and 2035. China (BRICS) leads the momentum with a CAGR of 10.1%, surpassing the global average by 2.6 percentage points due to expanding hyperscale data center deployments and strong backup power mandates. India (BRICS) follows with a CAGR of 9.4% (+1.9 pp), driven by rapid digitization, data localization policies, and investments in Tier III and Tier IV facilities across major metros. Germany (OECD) registers 8.6% (+1.1 pp), where growth is supported by consistent upgrades to standby power infrastructure in colocation hubs. The UK posts a CAGR of 7.1% (–0.4 pp), reflecting modest activity in edge data centers and slower replacement cycles. The United States records a lower growth rate of 6.4% (–1.1 pp), impacted by sustainability concerns and a shift toward alternative energy backup systems. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to grow at a CAGR of 10.1% between 2025 and 2035, driven by surging hyperscale data center investments and power backup mandates. From 2020 to 2024, demand was centered around urban Tier I deployments. The next decade is expected to witness a shift toward Tier II cities, requiring scalable generator solutions.

India’s market is projected to expand at a CAGR of 9.4% from 2025 to 2035, supported by data center expansion in Mumbai, Chennai, and Hyderabad. Between 2020 and 2024, demand was led by colocation providers and telcos. Future demand will come from cloud and edge deployments requiring high-availability backup systems.

Germany is expected to register a CAGR of 8.6% during 2025–2035, owing to rising cloud infrastructure needs and grid stability concerns. From 2020 to 2024, growth stemmed from deployments in Frankfurt, Munich, and Hamburg. New investments are now targeting regional centers with decentralized energy models.

The UK market is set to grow at a CAGR of 7.1% from 2025 to 2035, driven by regulatory support and hyperscale capacity expansion. Between 2020 and 2024, demand was concentrated in London and South East England. In the years ahead, edge data centers and regional investments will create new opportunities.

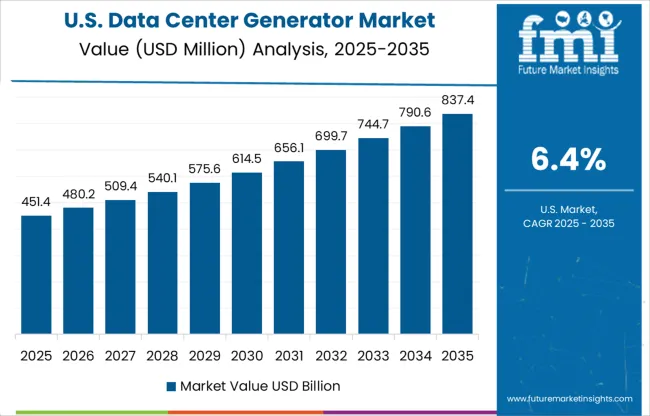

The USA market is forecast to grow at a CAGR of 6.4% from 2025 to 2035, with ongoing investments in cloud data centers and enterprise IT recovery infrastructure. From 2020 to 2024, demand came largely from major West Coast and Midwest tech hubs. Looking forward, modular and hybrid generator solutions will lead adoption.

Demand for data center generators is expanding steadily in 2025 as hyperscale, colocation, and edge deployments emphasize uninterrupted power assurance. ABB Ltd. holds a leading market share, driven by its robust portfolio of medium-voltage backup solutions optimized for mission-critical uptime. Cummins and Caterpillar remain strong contenders across North America and EMEA, offering Tier IV-compliant diesel and hybrid gensets.

Generac and KOHLER are targeting modular data centers with compact and scalable units. MTU Onsite Energy and Rolls-Royce are leveraging smart grid integration capabilities to support energy-resilient data hubs. Meanwhile, Mitsubishi, Yanmar, and Wärtsilä are accelerating uptake in Asia with LNG-fueled and low-emission generators. AKSA, Aggreko, and HIMOINSA continue to grow through flexible rental-based backup models serving high-growth edge computing corridors.

Recent Data Center Generator Industry News In June 2025, Cummins introduced the S17 Centum™, a groundbreaking 17 L engine-driven generator delivering up to 1 MW in a highly compact footprint. This solution meets the demands of urban and healthcare data centers with high power density and HVO fuel compatibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Diesel, Gas, and Hybrid |

| Power Rating | 1 MW, 1 MW-2MW, and >2MW |

| Tier Standard | Tier I & II, Tier III, and Tier IV |

| Cooling System | Air-cooled generators and Liquid-cooled generators |

| End Use | BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, IT & telecom, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Aggreko plc, AKSA Power Generation, Atlas Copco, Caterpillar Inc., Cummins, Inc., Doosan Corporation, Eurodiesel Services, Generac Power Systems, Inc., HIMOINSA, Ingersoll Rand, KOHLER, MITSUBISHI MOTORS CORPORATION, MTU Onsite Energy (Rolls-Royce Power Systems AG), Perkins Engines Company Limited, Piller (Langley Holdings plc), Rolls Royce plc., Siemens AG, Wärtsilä Corporation, and Yanmar Co., Ltd. |

| Additional Attributes | Dollar sales by generator type (diesel, gas, hybrid) and capacity tier, demand dynamics across hyperscale, colocation, edge‑site segments, regional trends in diesel dominance with rising natural gas uptake, innovation in HVO‑fuel and DCIM automation, environmental impact of emissions and generator testing protocols. |

The global data center generator market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the data center generator market is projected to reach USD 2.7 billion by 2035.

The data center generator market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in data center generator market are diesel, gas and hybrid.

In terms of power rating, 1 mw segment to command 44.7% share in the data center generator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA