The Data-Driven Retail Solution Market is estimated to be valued at USD 28.1 billion in 2025 and is projected to reach USD 85.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

| Metric | Value |

|---|---|

| Data-Driven Retail Solution Market Estimated Value in (2025 E) | USD 28.1 billion |

| Data-Driven Retail Solution Market Forecast Value in (2035 F) | USD 85.9 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

The data-driven retail solution market is witnessing accelerated growth, fueled by the increasing reliance on advanced analytics, artificial intelligence, and cloud computing to improve customer experiences and optimize retail operations. Retailers are increasingly focusing on gaining real-time visibility into consumer behavior, inventory management, and sales forecasting, driving the adoption of data-centric platforms. The shift toward personalized shopping experiences and omnichannel engagement strategies is encouraging retailers to implement solutions that can analyze large datasets and deliver actionable insights.

Cloud deployment models are expanding accessibility, scalability, and cost efficiency, enabling both large enterprises and smaller retailers to leverage advanced capabilities without heavy infrastructure investments. The growing integration of IoT devices, mobile applications, and digital payment systems is further contributing to market expansion, as retailers seek to unify data streams into cohesive decision-making frameworks.

With rising competition and consumer expectations for seamless, personalized interactions, data-driven retail solutions are set to remain a critical enabler of growth As the retail industry continues its digital transformation, the market is expected to demonstrate strong momentum, underpinned by technological innovation and strategic investment in advanced data ecosystems.

The data-driven retail solution market is segmented by deployment mode, solution, vertical, and geographic regions. By deployment mode, data-driven retail solution market is divided into Cloud-Based and On-Premise. In terms of solution, data-driven retail solution market is classified into Retail customer intelligence, Customer relationship management, Collaboration tools, and Others. Based on vertical, data-driven retail solution market is segmented into Implementation Service, Consulting, and Integration. Regionally, the data-driven retail solution industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

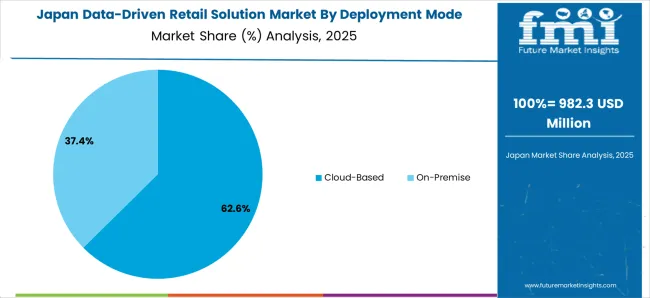

The cloud-based deployment mode segment is projected to hold 61.3% of the data-driven retail solution market revenue share in 2025, making it the dominant model. This leadership is being reinforced by the scalability, flexibility, and cost-effectiveness offered by cloud infrastructure, which allows retailers to process large volumes of data with minimal upfront investment. Cloud platforms enable real-time analytics, facilitating rapid decision-making and faster response to evolving consumer preferences.

The segment is gaining traction as retailers increasingly favor subscription-based models, reducing dependence on in-house IT infrastructure and allowing them to allocate resources more efficiently. Enhanced security measures, compliance frameworks, and data recovery capabilities offered by cloud providers are further strengthening adoption across regions.

The ability to seamlessly integrate with mobile platforms, IoT devices, and third-party applications makes cloud-based solutions attractive to both established retailers and emerging businesses As global retailers expand their digital operations and prioritize agility, the cloud-based model is expected to sustain its leadership by providing a future-ready framework for advanced retail intelligence.

The retail customer intelligence vertical is anticipated to account for 37.8% of the data-driven retail solution market revenue share in 2025, positioning it as a leading vertical. This dominance is being driven by the rising importance of customer-centric strategies in retail, as businesses seek to deliver hyper-personalized experiences and foster stronger brand loyalty. Advanced analytics tools enable retailers to capture insights on consumer purchasing behavior, shopping frequency, and preferences, allowing for more targeted promotions and optimized product assortments.

The integration of AI and machine learning models is enhancing the ability to predict demand patterns, personalize offers, and improve customer satisfaction levels. With competition intensifying across e-commerce and physical stores, retailers are prioritizing investments in intelligence platforms that help them differentiate their offerings and retain customers.

Additionally, regulatory support for data transparency and ethical use of customer information is creating trust, further encouraging adoption As consumers increasingly expect customized experiences, the retail customer intelligence vertical is set to expand as a cornerstone of digital retail strategies.

The implementation service segment is expected to represent 41.9% of the data-driven retail solution market revenue share in 2025, making it the leading service type. This dominance is being supported by the growing complexity of deploying advanced analytics, AI, and IoT-enabled retail solutions, which requires specialized expertise. Retailers are increasingly seeking implementation partners to integrate diverse systems, customize software platforms, and ensure seamless interoperability across omnichannel operations.

Implementation services also play a critical role in enabling retailers to adopt cloud-based and hybrid infrastructures without operational disruption. The ability to provide tailored solutions aligned with business objectives, such as improving store layouts, optimizing pricing strategies, and enhancing customer journeys, is driving demand for professional services. As retailers accelerate their digital transformation journeys, implementation support is ensuring that investments in data-driven platforms yield measurable outcomes.

Continuous upgrades, integration with emerging technologies, and support for regulatory compliance are further reinforcing the reliance on specialized service providers As a result, implementation services are expected to maintain their leadership position by enabling retailers to unlock the full potential of advanced data-driven solutions.

Data-driven retail solutions are those that measure everything in the company to evaluate the competitive landscape, improve operations, and create retail strategies that are both efficient and effective. For precise data analytics and channel selection optimization, data-driven retail solutions are utilized.

Market growth will be primarily driven by rising retail adoption of industry 4.0 and rising demand from the fast-moving consumer goods industry.

The market value will get a boost by the increasing use of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and augmented reality (AR), the widespread industrialization of the world, the increased use of data-driven retail solutions by retailers to personalize the experience of their customers, and the benefits of cloud computing and intelligent solutions.

The market’s expansion will be further facilitated by rising research and development expenditures and retailer awareness of the advantages of intelligent solutions and cloud computing.

Due to the increasing awareness of cloud computing & intelligent solutions, retailers are becoming more aware of the operational advantages of implementing smart solutions for retail processes and maintaining a cloud consumer base, two essential features of major data-driven retail solutions, the growth rate for the data-driven retail solution is estimated to be 11.8% for the forecast period.

The demand for retail solutions backed by associated and analysed data is being fuelled by the rapid improvements in tracing information from stored data is also major factor for increasing growth in the data-driven retail solutions.

North America had the largest market share for data-driven retail solutions market for the year 2025, with a market share of 23.3% which approximates to about USD 47,609.5 Million. While South Asia and Pacific is expected to be the fastest growing region with a CAGR of 12.2%.

Due to the increase of the internet uses and rising retail transactions in the United States and Canada, the current state of data-driven retail solutions in these regions suggests that North America is likely to leading on the global market.

The United States has the largest retail chain in the nation, it is assumed that the retail sector is one of the largest in the country. As a result, retailers are adopting and implementing cutting-edge technology in the data-driven retail solution due to the variety of features it offers, such as a competitive advantage to use analytical data for greater business intelligence, a user-friendly interface, and advanced security and safety compliance for retailer’s data.

Due to these factors US held the largest market share of 14.3%.

Companies and small retail businesses in India were encouraged to implement data-driven retail solutions that enhance the customer experience and engage them for a longer period of time as a result of the changing demands of consumers and the growing competition among retailers for customer loyalty.

This was made possible by the rapid digitization of retail and other industries in India. Therefore, India has the highest growth rate for data-driven retail solution of 13.4% in adoption and implementation.

There are several superior companies in Japan which provide data-driven retail solutions and services for building the cloud platform for data storage and customized CRM (Customer relationship management) software for businesses, retail industry and this software are cost effective as compared to other software build by other venders, so market in data-driven retail solutions.

A technology for managing a company's interactions with customers and potential customers is customer relationship management (CRM). It enhances business relationships for business growth and retailers are more likely to adopt and implement CRM software because it helps businesses stay connected to customers, streamline processes, and boost profitability.

As a result, this market segment is estimated to grow at the fastest CAGR of 15.7% over the forecast period.

The growth rate in cloud-based deployment is higher because it makes it easier for businesses and retailers to access, manage, and share data flawlessly, provides more personalized customer understandings, improves supply chains, and enables data-driven retailing decisions, It holds maximum CAGR of 13.5%.

Implementation services hold the highest CAGR of 12.2%, because the driving force behind the growth of online retail services is implementing data-driven solutions. A retailer driven by data examines the effectiveness of each marketing channel and business function. Because areas that aren't performing well can be improved, changed, or eliminated, this can help cut costs; this is the major factor for rapid implementation of data-driven retail solutions.

Some major players in data-driven retail solutions market are planning to build new software for shifting their storage servers from systematic server to cloud-based server, for faster accessibility of the data to their client without any technical disruptions.

| Country | CAGR |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| France | 12.4% |

| UK | 11.2% |

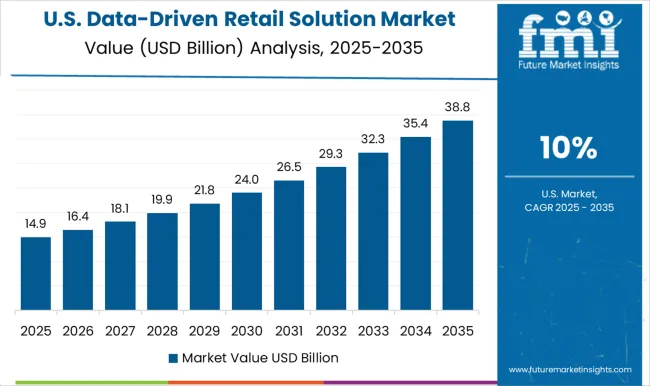

| USA | 10.0% |

| Brazil | 8.9% |

The Data-Driven Retail Solution Market is expected to register a CAGR of 11.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.9%, followed by India at 14.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.9%, yet still underscores a broadly positive trajectory for the global Data-Driven Retail Solution Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.6%. The USA Data-Driven Retail Solution Market is estimated to be valued at USD 10.6 billion in 2025 and is anticipated to reach a valuation of USD 27.7 billion by 2035. Sales are projected to rise at a CAGR of 10.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.3 billion and USD 964.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.1 Billion |

| Deployment Mode | Cloud-Based and On-Premise |

| Solution | Retail customer intelligence, Customer relationship management, Collaboration tools, and Others |

| Vertical | Implementation Service, Consulting, and Integration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ActionIQ, Inc., Data Driven Solutions (DDS), Solix Technologies, Inc., Hitachi Vantara Corporation, Sisense Inc., DecisionMines, Data Axle, Neustar, Inc., Infogroup, Oracle Corporation, Tata Consultancy Services Limited, Microsoft Corporation, Silentale, Wipro Limited, and IBM Corporation |

The global data-driven retail solution market is estimated to be valued at USD 28.1 billion in 2025.

The market size for the data-driven retail solution market is projected to reach USD 85.9 billion by 2035.

The data-driven retail solution market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in data-driven retail solution market are cloud-based and on-premise.

In terms of solution, retail customer intelligence segment to command 37.8% share in the data-driven retail solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA