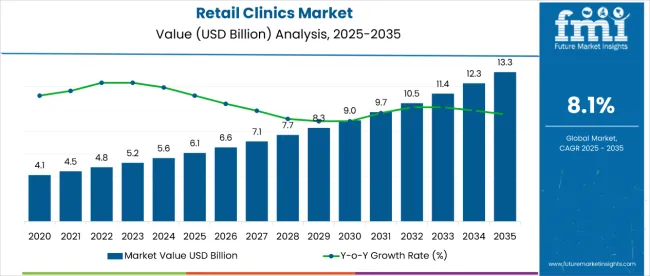

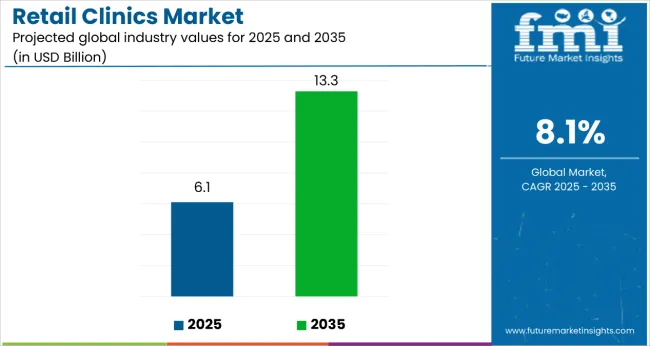

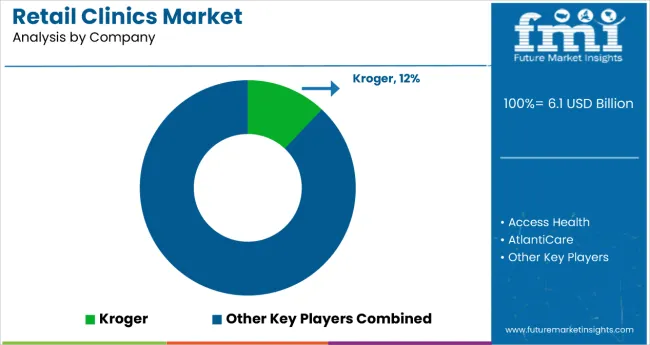

The retail clinics market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 7.2 billion during this period. This reflects a 2.18 times growth at a compound annual growth rate of 8.1%. The market evolution is expected to be driven by increasing adoption of retail-owned retail clinics, expanding presence of hospital-owned retail clinics, and the growing role of drug stores and retail pharmacy settings as key distribution channels.

By 2030, the market is likely to reach USD 9.1 billion, generating USD 3 billion in incremental value during the first half of the decade. The remaining USD 4.1 billion is expected between 2030 and 2035, suggesting a back-loaded growth pattern driven by rising adoption of retail clinics across Asia-Pacific and North America, expansion of outpatient care, and growing preference for convenient access to healthcare services.

Companies such as AtlantiCare, Aurora Quick Care, Target Brands Inc., Kroger, Wellness Express, and Walgreens Boots Alliance are strengthening their competitive positions through expansion of clinic networks, integration of digital health solutions, and investments in preventive care services. R&D and operational efforts are being directed toward improving point-of-care diagnostics, vaccination delivery, and patient experience. Regulatory compliance, quality of care, and cost-effectiveness will continue to define the market’s trajectory and competitive dynamics across both developed and emerging regions.

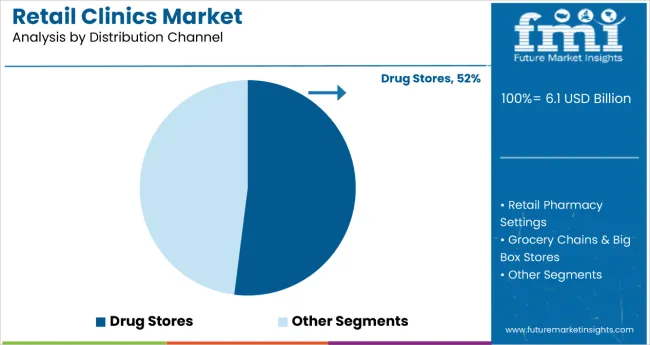

The market holds a strong position across its parent industries, reflecting its rising adoption in primary care services, urgent care services, telemedicine, pharmacy services, and health & wellness services. Within the primary care services category, retail clinics are contributing notably as convenient outpatient care providers, with their share estimated at about 40%. In the urgent care market, their share is estimated to be 25%, supported by growing demand for non-emergency immediate care. Within pharmacy services, clinics integrated into drug stores account for 52% of the distribution channel, while retail pharmacy settings follow as the second-largest channel. Across telemedicine and health & wellness services, retail clinics are expanding their offerings, reflecting both the increasing need for accessible healthcare and the growing adoption of preventive care programs.

The market is driven by rising consumer demand for convenient and affordable healthcare, the increasing prevalence of chronic diseases, and shortages of primary care physicians. Innovations are observed in point-of-care diagnostics, telehealth integration, and mobile health solutions. Developments include strategic expansions and partnerships in North America, Asia-Pacific, and Europe to enhance clinic coverage. Trends show a shift toward preventive care and virtual healthcare services, with retail clinics increasingly leveraging technology and wellness programs, while cost-effectiveness and convenience continue to define their market positioning and competitive advantage.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 6.1 billion |

| Projected Value (2035F) | USD 13.3 billion |

| CAGR (2025 to 2035) | 8.1% |

Retail clinics’ unique ability to provide convenient, affordable, and accessible healthcare across multiple settings is driving their adoption. Their functional advantages make them indispensable for primary care, urgent care, and preventive health services, where speed, efficiency, and patient experience are critical.

Rising demand for accessible healthcare services is further propelling market growth, supported by increasing chronic disease prevalence, shortage of primary care physicians, and consumer preference for convenient outpatient care. Technological advancements in point-of-care diagnostics, telehealth integration, and digital health management are enhancing service quality, safety, and patient engagement.

Expanding healthcare infrastructure, strategic partnerships with retail chains, and government initiatives supporting outpatient care are strengthening the market outlook. As providers and patients increasingly prioritize cost efficiency, convenience, and service reliability, retail clinics continue to gain traction. With companies focusing on innovation, expansion, and integrated care solutions, the market is expected to witness steady growth across North America, Europe, and Asia-Pacific.

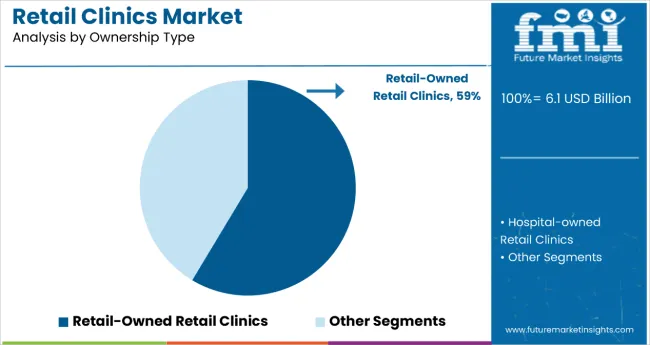

The market is segmented by application, distribution channel, ownership type, and region. By application, the market is categorized into point-of-care diagnostics, clinical chemistry & immunoassays, vaccinations, and others. Based on distribution channel, the market is segmented into retail pharmacy settings, drug stores, and grocery chains & big box stores. In terms of ownership type, the market is bifurcated into hospital-owned retail clinics and retail-owned retail clinics. Regionally, the market spans across North America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Latin America, and the Middle East & Africa.

The retail-owned retail clinics segment holds a dominant position with 59% of the market share in the ownership type category, driven by convenience, accessibility, and integration within retail environments. These clinics are extensively located inside pharmacies, supermarkets, and big-box stores, providing outpatient care, vaccinations, preventive screenings, and basic health services with consistent quality and efficiency.

Retailers prefer the retail-owned model because it leverages existing foot traffic, reduces infrastructure costs, and enhances customer engagement. It has become indispensable for national and regional chains seeking standardized healthcare service delivery and improved operational efficiency.

Ongoing investments in digital health platforms, patient management systems, and streamlined workflows are enhancing service delivery and patient experience. As demand for convenient, community-based healthcare grows across urban and semi-urban areas, the retail-owned segment is expected to retain its leadership by enabling scalable, technology-driven, and patient-centric clinic operations.

The drug stores segment dominates the distribution channel category with 52% of the market share, reflecting the growing trend of integrating retail clinics within established pharmacy chains. Drug stores provide a strategic platform for retail clinics to offer convenient access to outpatient care, vaccinations, chronic disease management, and preventive screenings, all in one location.

Retailers favor drug store integration because it leverages existing foot traffic, increases patient acquisition, and reduces infrastructure costs compared to standalone clinics. Additionally, partnerships with national pharmacy chains enable standardized service delivery, electronic record sharing, and streamlined prescription management, which improves patient experience and operational efficiency.

The drug store segment is expected to maintain leadership due to ongoing expansion in urban and semi-urban areas, rising consumer preference for one-stop healthcare, and growing investments in digital health solutions. Innovative service offerings such as telehealth integration and wellness programs further strengthen this segment’s competitive advantage.

In 2024, the global retail clinics market witnessed robust growth, with North America accounting for the largest share, followed by Asia-Pacific, which is seeing rapid expansion. Applications include point-of-care diagnostics, vaccinations, clinical chemistry testing, and preventive health screenings. Providers are increasingly integrating telehealth services, electronic health records (EHR), and mobile health platforms to improve patient engagement and operational efficiency. Convenience, cost-effectiveness, and accessibility continue to support widespread adoption, particularly in urban and semi-urban areas. Digital integration and streamlined services are enabling retail clinics to serve as an alternative to traditional primary care and urgent care facilities.

Rising Demand for Accessible and Preventive Healthcare Drives Adoption The increasing prevalence of chronic diseases, shortage of primary care physicians, and consumer preference for convenient, walk-in healthcare services are major drivers. Retail clinics are increasingly deployed in drug stores, retail pharmacy chains, and grocery stores, enabling one-stop access to diagnostics, vaccinations, and minor procedures. Expansion of healthcare infrastructure, partnerships between retail chains and healthcare providers, and government support for outpatient care are further fueling growth. Consumer awareness of preventive health and early diagnosis is pushing clinics to adopt technology-enabled, patient-centric solutions, strengthening their market position.

Operational Challenges and Regulatory Considerations Restrain Growth Market growth faces challenges due to regulatory compliance, quality-of-care standards, and integration with broader healthcare systems. In some regions, licensing requirements, healthcare reimbursement policies, and staffing regulations limit rapid expansion. Competition from traditional clinics, hospitals, and telemedicine platforms also pressures margins. Additionally, maintaining service quality while scaling operations and investing in technology infrastructure can increase operational costs. These restraints drive retail clinics to focus on standardized service protocols, partnerships, and innovative care delivery models to balance cost, compliance, and patient satisfaction while sustaining growth.

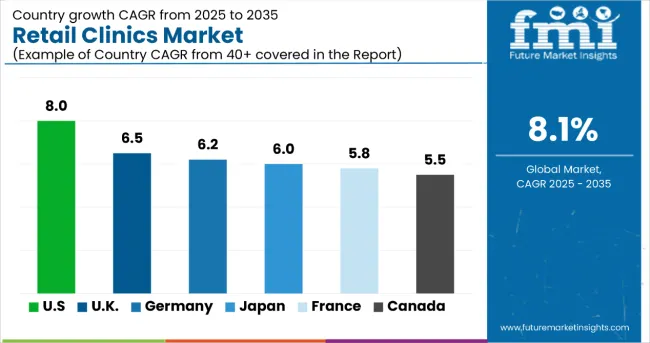

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.0% |

| UK | 6.5% |

| Germany | 6.2% |

| Japan | 6.0% |

| France | 5.8% |

| Canada | 5.5% |

The retail clinics market shows varied growth trajectories across the top six countries. The USA leads with the highest projected CAGR of 8.0% from 2025 to 2035, driven by widespread adoption of walk-in clinics, integration with pharmacy chains, and advanced telehealth services. The UK follows at 6.5%, supported by government initiatives promoting outpatient care. Germany (6.2%) and Japan (6.0%) exhibit steady growth due to urban healthcare demand and preventive care awareness. France (5.8%) and Canada (5.5%) experience moderate expansion, reflecting gradual adoption and regulatory considerations. These differences highlight regional variations in healthcare infrastructure, consumer preferences, and technology adoption.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

The retail clinics market in the USA is projected to expand at a CAGR of 8.0% from 2025 to 2035, driven by high consumer demand for convenient, walk-in healthcare services, integration with pharmacy chains, and telehealth adoption. Major players Walgreens Boots Alliance is expanding operations, improving accessibility and operational efficiency. Growth is supported by increasing preventive care awareness and rising outpatient visits across urban and suburban areas.

Key Statistics:

Revenue from retail clinics in the UK is expected to grow at a CAGR of 6.5% from 2025 to 2035, supported by government initiatives to reduce hospital burden and promote outpatient care. Clinics focus on primary care, chronic disease management, and preventive screenings, often integrated within pharmacies and community health centers. Increasing patient preference for accessible and cost-effective care is driving new clinic openings, while technology adoption improves efficiency and patient experience.

Key Statistics:

Sales of the retail clinics in Germany are projected to grow at a CAGR of 6.2% from 2025 to 2035, driven by urban healthcare demand and preventive care awareness. Clinics provide point-of-care diagnostics, minor procedures, and vaccination services, serving both insured and private patients. Expansion is supported by partnerships with pharmacies and private healthcare providers to enhance accessibility and reduce hospital load.

Key Statistics:

Revenue from retail clinics in Japan is expected to grow at a CAGR of 6.0% from 2025 to 2035, driven by an aging population and rising demand for outpatient services. Clinics offer point-of-care diagnostics, minor treatments, and preventive health services, often integrated into pharmacies and urban retail spaces. Investments in digital appointment scheduling and telehealth are enhancing patient convenience and clinic efficiency.

Key Statistics:

Demand for retail clinics in France is projected to grow at a CAGR of 5.8% from 2025 to 2035, with growth concentrated in urban centers and premium pharmacy chains. Clinics provide diagnostics, vaccinations, and minor outpatient procedures, aligned with government initiatives promoting preventive care. Adoption is moderate due to regulatory standards and integration challenges with public healthcare facilities.

Key Statistics:

The retail clinics market in Canada is expected to grow at a CAGR of 5.5% from 2025 to 2035, fueled by urban healthcare demand and the need for convenient outpatient services. Clinics provide point-of-care diagnostics, vaccinations, and preventive health programs, often integrated with drug stores and retail chains. Expansion is supported by partnerships with national pharmacy chains and technology adoption to streamline patient care.

Key Statistics:

The Retail Clinics Market is expanding rapidly as healthcare systems worldwide prioritize accessibility, affordability, and convenience in primary and preventive care. Retail clinics—typically located within pharmacies, supermarkets, and retail chains—offer walk-in medical services for minor illnesses, vaccinations, and wellness screenings. Growth is being fueled by increasing healthcare consumerization, the rising prevalence of chronic conditions, and the need to reduce pressure on hospitals and emergency departments through cost-efficient outpatient care models.

Major players such as CVS Health Corporation, Walgreens Boots Alliance Inc., and Walmart Inc. dominate the global retail clinic landscape through extensive nationwide networks integrated with pharmacy services and telehealth capabilities. CVS Health’s MinuteClinic and Walgreens’ Healthcare Corner continue to expand their service portfolios, offering chronic disease management, women’s health, and virtual consultations. Walmart Health combines retail convenience with full-service medical and dental offerings, targeting underserved communities with transparent, fixed-price care.

The Kroger Co. and Target Brands Inc. are leveraging partnerships with healthcare providers to expand in-store clinic footprints, focusing on preventive care and family wellness. Rite Aid Corporation and Aurora Health Care are integrating digital scheduling, electronic health records (EHR), and coordinated care models to enhance patient continuity and experience. NextCare Urgent Care and Concentra Inc. bridge the gap between urgent care and retail health, offering occupational health and acute care services with extended hours and multi-state coverage.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 6.1 billion |

| Application | Point-of-Care Diagnostics, Clinical Chemistry & Immunoassays, Vaccinations, and Others (Preventive Care, Minor Procedures, and Health Screenings |

| Distribution Channel | Retail Pharmacy Settings, Drug Stores, and Grocery Chains & Big Box Stores |

| Ownership Type | Hospital-owned Retail Clinics and Retail-owned Retail Clinics |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled |

CVS Health Corporation, Walgreens Boots Alliance Inc., Walmart Inc., The Kroger Co., Target Brands Inc., AtlantiCare, Aurora Health Care, Rite Aid Corporation, NextCare Urgent Care, Concentra Inc. |

| Additional Attributes | Dollar sales by application and clinic type; regional demand trends; competitive landscape; patient preferences for preventive vs. acute care; telehealth integration; service innovation; technology adoption enhancing operational efficiency |

The global retail clinics market is estimated to be valued at USD 6.1 billion in 2025.

The market size for retail clinics is projected to reach USD 13.3 billion by 2035.

The retail clinics market is expected to grow at an 8.1% CAGR between 2025 and 2035.

Retail-owned retail clinics are projected to lead in the retail clinics market with 59% market share in 2025.

In terms of distribution channel, drug stores are projected to command 52% share in the retail clinics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA