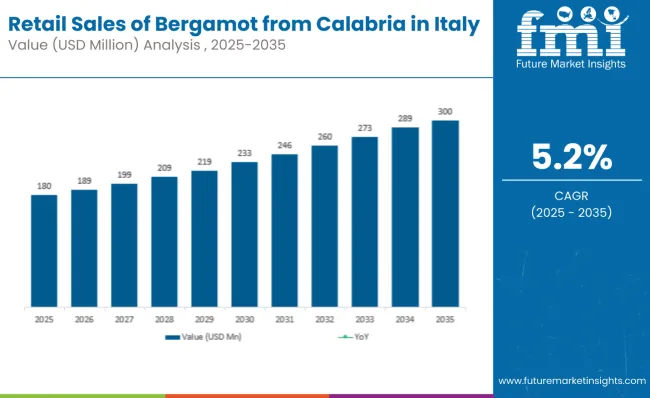

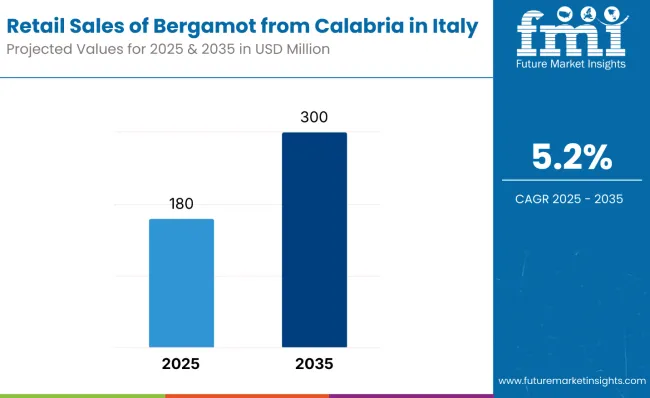

Sales of bergamot from Calabria in Italy are estimated at USD 180 million in 2025, with projections indicating a rise to USD 300 million by 2035, reflecting a CAGR of approximately 5.24% over the forecast period. This growth reflects both a broadening consumer base and increased per capita consumption in key Italian regions.

The rise in demand is linked to shifting culinary preferences, growing awareness of artisanal food products, and evolving premium ingredient trends. By 2025, per capita consumption in leading Italian regions such as Lombardy, Lazio, and Sicily averages between moderate to high levels, with projections showing continued growth through 2035.

Lombardy leads among Italian regions, expected to generate USD 69 million in bergamot sales by 2035, followed by Lazio (USD 42 million), Sicily (USD 48 million), Emilia-Romagna (USD 30 million), and Veneto (USD 28.5 million).

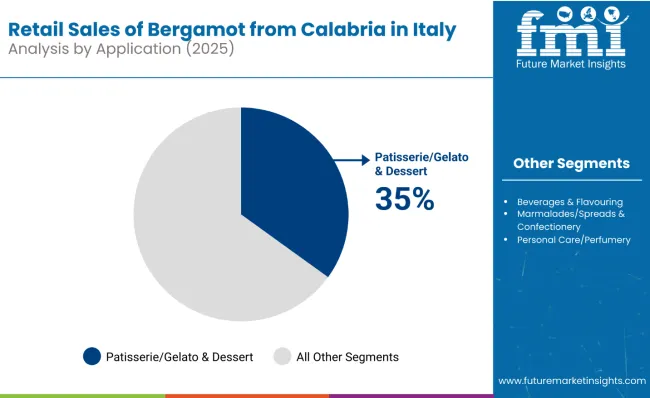

The largest contribution to demand continues to come from pâtisserie, gelato & desserts applications, which are expected to account for 37% of total sales by 2035, owing to strong culinary traditions, premium positioning, and artisan baker adoption. By distribution channel, hypermarkets and supermarkets represent the dominant retail format, responsible for 41% of all sales in 2035, while gourmet and specialty retail channels are expanding their presence.

Consumer adoption is particularly concentrated among culinary professionals and quality-conscious households, with regional culinary heritage and premium positioning emerging as significant drivers of demand. While price remains a consideration, the premium nature of Calabrian bergamot maintains strong value perception. Regional demand patterns show Lombardy maintaining leadership position, while Emilia-Romagna demonstrates the strongest growth trajectory at 6.36% CAGR. Distribution strategies continue evolving, with online and direct sales gaining traction alongside traditional retail channels.

The bergamot from Calabria segment in Italy is classified across several categories. By application, the key segments include pâtisserie, gelato & desserts, beverages & flavourings (including tea and tonics), marmalades, spreads & confectionery, personal care and perfumery retail SKUs, and aromatherapy and home fragrance products.

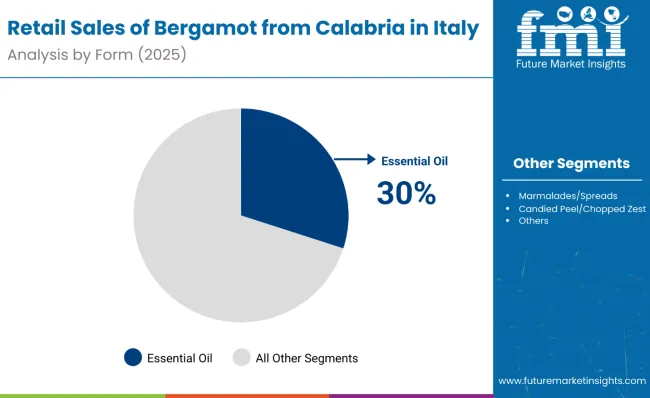

By form, the segment spans essential oil consumer packs, juice concentrate & flavour extracts, marmalades and spreads, candied peel and chopped zest, and other value-added products such as creams and syrups. By distribution channel, the segment covers hypermarkets and supermarkets, gourmet and specialty retail, pharmacies and parapharmacies, online and direct sales, and convenience stores. By geography, regions such as Lombardy, Lazio, Sicily, Emilia-Romagna, and Veneto are key contributors, along with coverage across all Italian regions.

Pâtisserie, gelato & desserts applications are projected to dominate sales by 2035, supported by strong culinary traditions, artisan adoption, and premium dessert trends. Other applications such as beverages, personal care, and confectionery serve distinct consumer needs with steady growth trajectories.

Bergamot from Calabria is available in various forms tailored to different applications and consumer preferences. Juice, concentrate & flavour extracts are expected to become the leading form segment by 2035, reflecting growing demand from food and beverage manufacturers seeking authentic citrus flavouring solutions.

Bergamot from Calabria reaches consumers through diverse retail channels reflecting both traditional shopping patterns and evolving consumer preferences. While hypermarkets and supermarkets maintain the largest share, gourmet and specialty retail channels are expanding their presence, supported by premium positioning and artisanal appeal.

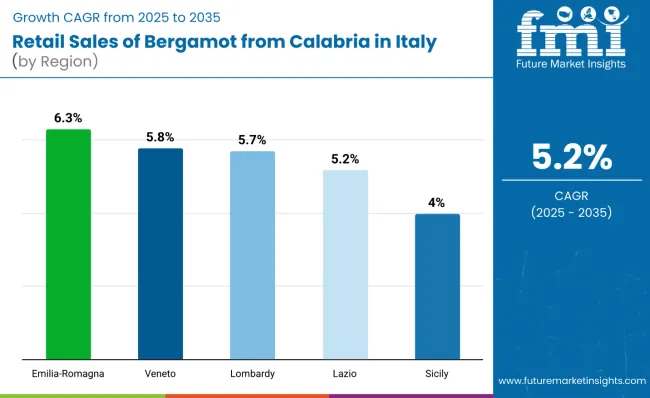

Regional demand for bergamot from Calabria varies across Italian regions, reflecting local culinary traditions, income levels, and distribution networks. Lombardy maintains the largest absolute sales volume, while Emilia-Romagna demonstrates the highest growth rate, indicating regional diversification of demand patterns.

| Region | CAGR (2025 to 2035) |

|---|---|

| Emilia-Romagna | 6.36% |

| Veneto | 5.80% |

| Lombardy | 5.71% |

| Lazio | 5.24% |

| Sicily | 4.01% |

Regional growth patterns for bergamot from Calabria reflect varying adoption rates and consumer preferences across Italian regions. Emilia-Romagna leads in growth rate despite smaller absolute volumes, while Lombardy maintains market leadership through consistent expansion from a larger base.

Between 2025 and 2035, demand for bergamot from Calabria is projected to expand across all major Italian regions, but growth rates vary based on culinary development, retail expansion, and local consumer adoption patterns. Emilia-Romagna leads with the highest CAGR of 6.36%, driven by the region's sophisticated culinary culture, high concentration of artisan food producers, and growing appreciation for premium Calabrian ingredients among professional chefs and specialty food manufacturers.

Veneto follows with 5.80% CAGR, supported by strong tourism-driven demand, expanding restaurant sector, and increasing adoption of bergamot in regional specialties and artisan production. The region benefits from established distribution networks and growing consumer awareness of premium citrus applications.

Lombardy, while demonstrating moderate 5.71% growth, maintains its position as the largest absolute consumer due to high population density, superior purchasing power, and extensive retail infrastructure. The region's growth is driven by consistent expansion across both professional culinary applications and consumer retail segments.

Lazio matches the national average at 5.24% CAGR, reflecting steady demand growth supported by Rome's significant restaurant and hospitality sectors, tourism-related culinary applications, and established consumer preferences for quality ingredients.

Sicily shows the most conservative growth at 4.01% CAGR, indicating market maturity and established consumption patterns. However, the region maintains steady demand due to cultural familiarity with citrus products and regional culinary traditions that incorporate bergamot flavours.

The competitive environment features a mix of traditional family-owned Calabrian producers and established Italian specialty food distributors. Authentic sourcing and quality certifications remain decisive success factors, with leading suppliers maintaining direct relationships with Calabrian growers while expanding distribution reach across Italian regions.

Traditional Calabrian producers maintain the most authentic positioning in the segment. Family-owned operations with multi-generational bergamot expertise offer direct-sourced essential oils, concentrates, and value-added products, emphasizing PDO certification and traditional extraction methods. These producers typically serve both artisan food manufacturers and discerning consumers through specialty retail channels.

Established Italian specialty food distributors leverage broad distribution networks to place Calabrian bergamot products across hypermarkets, gourmet stores, and professional culinary channels. These distributors often maintain exclusive sourcing relationships with select Calabrian producers while offering consistent supply and logistics capabilities.

Artisan food manufacturers in regions like Emilia-Romagna and Lombardy have developed direct sourcing relationships with Calabrian producers, incorporating bergamot into premium confectionery, gelato, and beverage applications. These manufacturers often emphasize the Calabrian provenance in their marketing while serving both retail and foodservice channels.

Private label programs at major Italian retailers have introduced bergamot-based products at accessible price points, though with varying degrees of authentic Calabrian sourcing. These programs typically focus on essential oil consumer packs and marmalade applications.

Regional specialty retailers, particularly in high-income areas, maintain curated selections of premium Calabrian bergamot products, emphasizing quality, authenticity, and artisan production methods. These retailers often serve as bridges between traditional producers and quality-conscious consumers.

Key Developments

| Attribute | Details |

|---|---|

| Study Coverage | Italian sales and consumption of bergamot from Calabria from 2025 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (sales), regional share percentages, application percentages |

| Geography Covered | All Italian regions with focus on Lombardy, Lazio, Sicily, Emilia-Romagna, Veneto |

| By Application | Pâtisserie /gelato & desserts, Beverages & flavourings , Marmalades/spreads & confectionery, Personal care/perfumery, Aromatherapy/home fragrance |

| By Form | Essential oil, Juice/concentrate & flavour extracts, Marmalades/spreads, Candied peel/chopped zest, Other value-added products |

| By Distribution Channel | Hypermarkets/Supermarkets, Gourmet/Specialty retail, Pharmacies/ Parapharmacies , Online/direct, Convenience & other |

| Metrics Provided | Sales (USD), Regional share, CAGR (2025-2035), Share by segment |

| Competitive Landscape | Producer profiles, distribution strategies, regional presence |

| Forecast Drivers | Regional demand trends, application expansion, premium positioning, distribution growth |

By 2035, total Italian sales of bergamot from Calabria are projected to reach USD 300 million, up from USD 180 million in 2025, reflecting a CAGR of approximately 5.24%.

Pâtisserie, gelato & desserts hold the leading share, accounting for approximately 37% of total sales by 2035, followed by beverages & flavourings and personal care applications.

Emilia-Romagna leads in projected growth, registering a CAGR of 6.36% between 2025 and 2035, due to strong culinary culture and artisan food producer adoption.

Hypermarkets and supermarkets remain the dominant sales channel (41% share by 2035), while gourmet and specialty retail channels are growing rapidly, reaching 25% share by 2035.

Juice, concentrate & flavour extracts are projected to become the leading form by 2035 with 31% share, driven by food and beverage manufacturer adoption and artisan producer demand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Retail Signage Market

Retail Digital Signage Market

India Retail Mineral Turpentine Oil Market Growth – Trends & Forecast 2024-2034

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Vending Machine Suppliers

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Europe Retail Paper Bag Market Trends – Growth & Forecast 2023-2033

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA