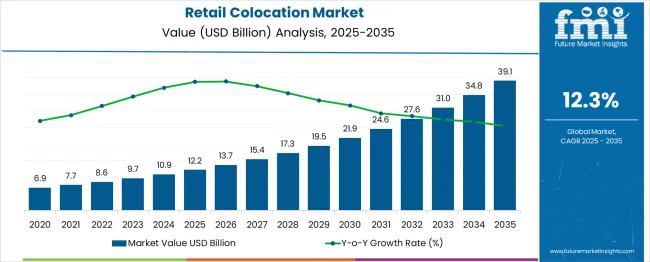

The Retail Colocation Market is estimated to be valued at USD 12.2 billion in 2025 and is projected to reach USD 39.1 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

The retail colocation market is witnessing consistent expansion, driven by rapid digital transformation, rising data center outsourcing, and increasing demand for edge computing capabilities. Organizations are shifting toward hybrid IT models to balance security, cost, and scalability, which has led to rising adoption of colocation services over traditional on-premises infrastructure.

Technological convergence, such as 5G rollout, IoT integration, and AI-driven workloads, is requiring more resilient and geographically distributed data infrastructure. Energy efficiency regulations, sustainability commitments, and the need for disaster recovery are encouraging enterprises to leverage shared data center facilities with advanced uptime certifications and power efficiency standards.

The market is also benefitting from increased investments in Tier III and Tier IV facilities, as well as growing reliance on cloud interconnection ecosystems. Looking forward, colocation is expected to remain pivotal to enterprise IT strategies as demand for low-latency access, data sovereignty, and modular scaling continues to rise globally.

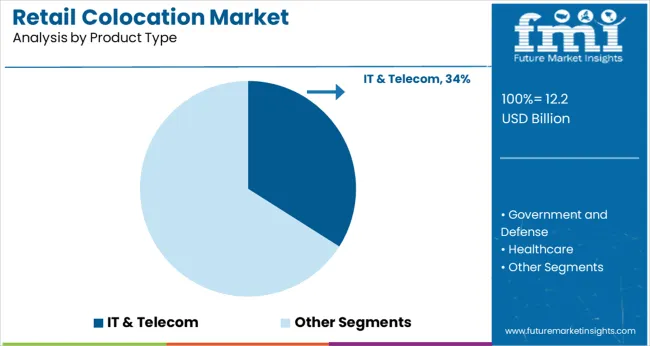

The market is segmented by Product Type and region. By Product Type, the market is divided into IT & Telecom, Government and Defense, Healthcare, Energy, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and region. By Product Type, the market is divided into IT & Telecom, Government and Defense, Healthcare, Energy, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The IT & telecom segment is projected to account for 34.0% of the overall revenue in the retail colocation market by 2025, making it the dominant product type. This segment's leadership is being driven by the exponential growth of data traffic from telecom operators and internet service providers, who require reliable, secure, and scalable infrastructure to host their network equipment and digital platforms.

The colocation model enables IT and telecom firms to maintain operational agility while reducing capital expenditure on infrastructure development. Growing demand for content delivery, streaming services, and mobile connectivity has further accelerated deployment in third-party data centers.

Additionally, compliance needs around latency, data residency, and network availability have reinforced the preference for colocated infrastructure over traditional facilities. With 5G deployments expanding and digital access widening across regions, the IT & telecom sector is expected to maintain a strong and sustained presence in the retail colocation ecosystem.

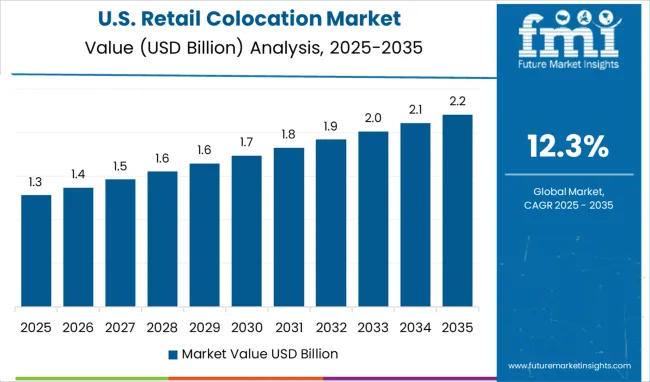

North America currently holds the largest share of 28.2% in the market due to the presence of IT giants that require the latest set of technological advancements. Concepts like big data and artificial intelligence have made it easier for end users to feed the data into these systems. The United States provides outsourced retail colocation services.

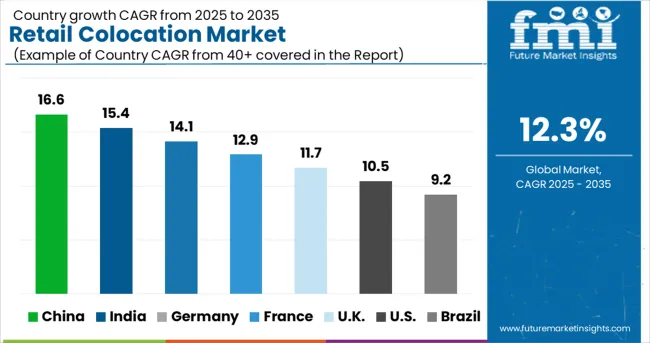

European countries have also increased investment in the IT industry. Brands that integrate with government programs and deliver the optimum level of operability to them. The exponential growth of economies in the Asia-Pacific region has boomed the IT sector in India. Companies are adopting retail colocation on short leases to help in delivering the right set of information. This expands the global retail colocation market size.

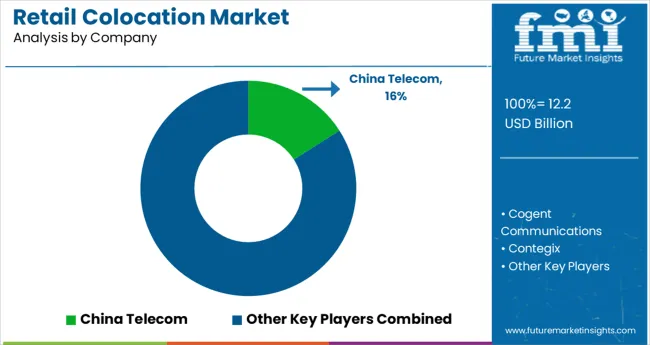

The key features of retail colocation integrating with IDC services gain traction in the market. The features involve professional hardware facilities, stable application services, and secure data transmission. Competitors try to form a one-stop solution for all retail colocation services. For example, China Telecom provides professional IDC service that provides high-quality and convenient services around the world. Furthermore, global customization and flexible response are other important features that key players tend to provide, including professional response teams and customized solutions for specific industries. Lastly, high-end safety modules to prevent data theft scenarios make the vendor company end user’s first choice.

The demand for retail colocation is on the surge as retail colocation has gained enormous interest in the past few decades due to the increasing adoption of cloud and IoT technologies. In addition, the rising adoption of retail colocation can be attributed to the growing need for enterprises to operate through technologies such as cloud and big data.

Business operational demands are spiking among enterprises to reduce capital & operational expenditure, manage network dynamics, control traffic flow, and scale up retail infrastructure efficiently, boosting the retail colocation market growth.

Retail colocation is a setup where enterprises lease part of a data center facility to meet their computing requirements, and the demand for retail colocation is soaring as it provides various services, including power, space, cooling, cabling, and support. The data center facility is hosted by a single vendor, and multiple end-users can access the services provided by the vendor.

The adoption of retail colocation is expected to be fuelled by the uninterrupted computing support of computing resources provided by it to enterprises. Moreover, retail colocation provides small and medium enterprises with security and flexibility, and due to this, the retail colocation market size is likely to expand during the forecast period.

The rise in the number of users opting for cost-effective and energy-efficient retail colocation solutions is anticipated to augur well for the retail colocation market's future trends.

Also, the spiking demand for retail colocation is also aided by the requirement for reliability, security, and scalability of infrastructure and growing data center complexities. Moreover, many retail colocation providers are being welcomed by the government to establish their facilities, and this is considered one of the major factors supporting the rapid adoption of retail colocation.

The retail colocation market size enlarges due to the fact that these solutions enable service providers to serve a sizable clientele base with staff, managed services, and on-site service. These services are typically obtained from organizations that don't deal with massive amounts of data, have no plans for expanding their data storage, only need a small amount of storage for a short time, and don't require large amounts of storage.

Additionally, this model enables organizations to spread out their data storage across multiple centers located across different states, provinces, and even entire nations, shaping the retail colocation market trends. On the flip side, the adoption trends of retail colocation are negatively affected by the high implementation cost of retail colocation services.

Retailers in the area are updating their websites to comply with the new business trends as a result of the sudden rise in online orders, contributing to the North American retail colocation market share of 28.2% in 2025.

Small retailers are concentrating on converting their physical stores to online stores, driving demand for affordable retail colocation services to meet their sparse IT needs, in turn, influencing the market in the region. The necessary platform for these developments is being provided by a number of software vendors, data center colocation vendors in the market landscape, and system integrators.

Small retailers with limited resources advocate for retail colocation services more and more in order to take advantage of the benefits of high-quality data center facilities at reasonable costs. Additionally, the expansion of the regional marketplace is being aided by rising e-trade sales in the United States, thereby improving the retail colocation market trends and forecasts.

By 2025, Europe is anticipated to capture a retail colocation market share of 23.8%, owing to digital transformation and business trends, such as contactless payments and online banking in the BFSI sector in Germany. In addition to providing their clients with services like mobile banking, e-passbooks, online transactions, etc., banks are transforming their conventional formats.

The growing need for better IT infrastructure is fuelled in part by the exploding amount of data, which is fostering the retail colocation market expansion.

According to research firm IDC, the global edge computing market is expected to reach USD 12.2 billion by 2025. This opens the door for a large number of edge computing start-ups to help companies looking to gather, secure, and process the massive amount of data being generated at the edge.

Colocation services are provided by a start-up platform, CyrusOne, for large data centers. Connectivity, disaster recovery, and managed services are all provided by the platform, founded in 2000. Colocation cabinets, colocation cages, and network connectivity are among the services it offers.

The start-up provides services to the retail, financial services, energy, healthcare, media and entertainment, and technology sectors. Added to that, it provides options for cloud deployment.

The prominent players in the retail colocations market are AT&T Inc., China Telecom, Cogent Communications, Contegix, CoreSite Realty Corporation, Cyxtera Technologies, Inc., Digital Realty Trust, Inc., Global Switch, and Internap. Interxion, NTT Communications Corporation, PhoenixNAP, Rahi Systems Inc, TeraGo Networks Inc., and Verizon are some other notable players in the market.

One of the recent developments in the retail colocation market is when Equinix, Inc. announced the opening of a data center in Melbourne, Australia, to meet demand from the government's smart city development plans and local customers' interconnection needs.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Industry, Region |

| Regions Covered | North America; Latin America; Europe; Eastern Europe; Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | AT&T Inc.; China Telecom; Cogent Communications; Contegix; CoreSite Realty Corporation; Cyxtera Technologies, Inc.; Digital Realty Trust, Inc.; Global Switch; Internap; Interxion; NTT Communications Corporation; PhoenixNAP; Rahi Systems Inc.; TeraGo Networks Inc.; Verizon |

| Customization | Available Upon Request |

The global retail colocation market is estimated to be valued at USD 12.2 billion in 2025.

It is projected to reach USD 39.1 billion by 2035.

The market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types are it & telecom, government and defense, healthcare, energy, manufacturing and others.

segment is expected to dominate with a 0.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA