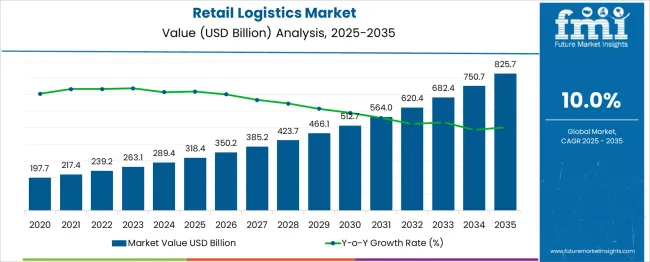

The Retail Logistics Market is estimated to be valued at USD 318.4 billion in 2025 and is projected to reach USD 825.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. During the early adoption phase (2020 to 2024), the market grows from 197.7 B to 289.4 B as innovators and early adopters deploy advanced logistics solutions. This period is characterized by pilot implementations of Hydraulic and Electric Hydraulic technologies, with EPS beginning to emerge in select smart material-handling applications.

The scaling phase (2025 to 2030) drives rapid growth from 318.4 B to 512.7 B, fueled by mass adoption, e-commerce expansion, and broader digitization of logistics operations. Hydraulic and Electric Hydraulic systems reach mainstream penetration, while EPS gains traction across automated and electric-assisted logistics solutions.

The consolidation phase (2030 to 2035) sees the market approach 825.7 B, with slower growth as major players consolidate, standards emerge, and incremental technology improvements dominate. In this phase, EPS and Electric Hydraulic technologies mature, Hydraulic systems optimize efficiency, and the focus shifts to integration, reliability, and cost optimization.

Mapping technology lifecycles, Hydraulic is mature, Electric Hydraulic transitions from early adoption to scaling, and EPS emerges during scaling and matures toward consolidation, reflecting a classic S-curve pattern of innovation, mass adoption, and eventual market stabilization.

| Metric | Value |

|---|---|

| Retail Logistics Market Estimated Value in (2025 E) | USD 318.4 billion |

| Retail Logistics Market Forecast Value in (2035 F) | USD 825.7 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The Retail Logistics market is witnessing strong growth as retailers increasingly prioritize efficient and technology-enabled supply chains to meet evolving consumer demands. The current landscape is being shaped by the rapid expansion of e-commerce, growing urbanization, and heightened customer expectations for faster and more transparent delivery. Industry publications and corporate announcements highlight that investments in automation, digitization, and sustainability initiatives are enhancing operational efficiency while reducing costs.

Press releases from logistics and retail companies emphasize the role of integrated logistics solutions in managing complex inventory flows and supporting omnichannel strategies. The future outlook remains positive, supported by continued innovation in last-mile delivery, warehouse management, and real-time tracking technologies.

Moreover, regulatory initiatives promoting sustainable transportation and infrastructure improvements are creating additional opportunities for growth. As retailers and logistics providers increasingly collaborate on data-driven solutions and resilient supply chains, the Retail Logistics market is expected to maintain its upward trajectory in the coming years.

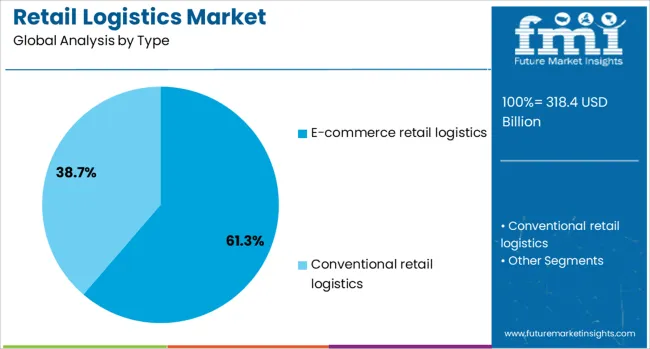

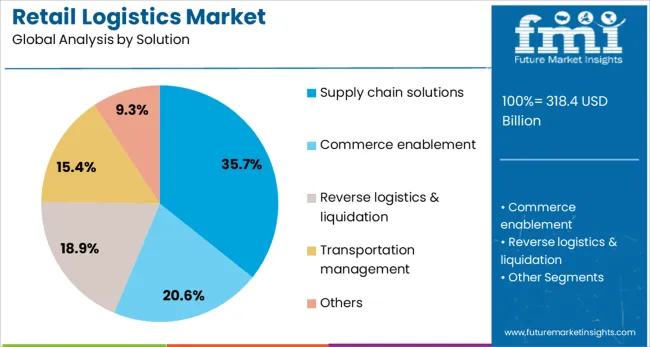

The retail logistics market is segmented by type, solution, mode of transport, and geographic regions. The retail logistics market is divided into E-commerce retail logistics and Conventional retail logistics. In terms of the solution, the retail logistics market is classified into Supply chain solutions, Commerce enablement, Reverse logistics & liquidation, Transportation management, and others.

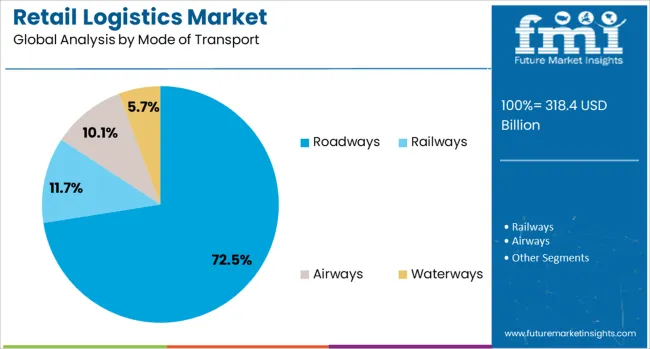

Based on the mode of transport, the retail logistics market is segmented into Roadways, Railways, Airways, and Waterways. Regionally, the retail logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The e-commerce retail logistics type is anticipated to account for 61.3% of the Retail Logistics market revenue share in 2025, making it the largest type segment. This leadership has been supported by the surge in online shopping fueled by digital transformation, smartphone penetration, and changing consumer behavior, as observed in company earnings calls and technology news reports.

The segment’s dominance has also been attributed to the need for agile and scalable logistics networks capable of handling high order volumes and diverse delivery requirements. Corporate statements indicate that retailers have increasingly invested in specialized warehousing, automated fulfillment centers, and robust last-mile delivery capabilities to support e-commerce growth.

Additionally, consumer preference for home delivery and flexible return policies has reinforced demand for advanced e-commerce logistics. These factors, combined with the continuous rise in cross-border online trade and integration of real-time tracking technologies, have secured the segment’s prominent position in the overall market.

The supply chain solutions segment is projected to hold 35.7% of the Retail Logistics market revenue share in 2025, positioning it as a critical solution segment. Its growth has been driven by increasing complexity in retail supply chains and the need for end-to-end visibility, as reported in corporate strategy presentations and industry journals.

Retailers have been observed to adopt comprehensive supply chain solutions to optimize inventory, reduce lead times, and improve demand forecasting accuracy. Statements from logistics providers highlight that supply chain solutions are enabling businesses to respond effectively to disruptions while maintaining service levels and cost efficiency.

The segment’s significance has been further enhanced by its role in supporting omnichannel retailing, where seamless coordination across physical and digital channels is essential. As companies continue to pursue sustainable and resilient supply chain strategies, the adoption of software-driven planning, execution, and analytics tools has reinforced the growth and relevance of this segment.

The roadways mode of transport is expected to capture 72.5% of the Retail Logistics market revenue share in 2025, making it the leading transport mode segment. This position has been attributed to the extensive road networks, flexibility in routing, and cost-effectiveness offered by road transport, as highlighted in transportation industry publications and corporate disclosures.

Roadways have been preferred for last-mile delivery and regional distribution due to their ability to reach diverse and remote areas efficiently. Company press releases indicate that investments in fleet modernization, route optimization technologies, and eco-friendly vehicles have improved the reliability and sustainability of road transport.

Furthermore, the segment’s dominance has been supported by its crucial role in meeting tight delivery timelines and facilitating the fast turnover of inventory demanded by modern retail operations. The resilience of road transport in responding to fluctuating demand and its integration with multimodal logistics strategies have further strengthened its leadership in the market.

The retail logistics market is expanding rapidly as e-commerce, omnichannel retailing, and consumer expectations for fast, reliable delivery continue to grow. Efficient warehousing, transportation, and inventory management solutions are critical for retailers to meet same-day and next-day delivery demands. Advanced logistics technologies, including real-time tracking, automated sorting, and route optimization, are improving operational efficiency and reducing costs. North America and Europe lead due to mature infrastructure and high adoption of modern retail practices, while Asia-Pacific is witnessing rapid growth driven by expanding e-commerce penetration and urban development. Retailers are investing in last-mile delivery solutions, cold chain management, and integrated supply chain platforms to enhance customer satisfaction. Market growth is further fueled by increasing demand for flexible delivery options, inventory visibility, and streamlined reverse logistics processes.

Consumers are demanding faster, more reliable, and transparent delivery services, pushing retailers to optimize logistics operations. Real-time tracking, flexible delivery windows, and convenient pick-up or drop-off points are becoming standard expectations. Seasonal peaks, promotions, and flash sales increase pressure on retail supply chains to maintain speed and accuracy. Efficient packaging, reduced damage rates, and timely communication improve customer satisfaction and loyalty. Retailers are adopting automated warehouses, smart sorting systems, and AI-powered demand forecasting to manage high order volumes. Reverse logistics, including returns and exchanges, is increasingly prioritized to meet consumer convenience standards. Retailers that can combine speed, accuracy, and transparency in delivery processes gain a competitive edge. Consumer-driven expectations are driving continuous investment in logistics infrastructure and operational efficiency.

Retail logistics providers are leveraging advanced technologies to enhance efficiency and accuracy. Automated guided vehicles, robotics, and warehouse management systems streamline operations and reduce labor dependency. AI and data analytics optimize route planning, inventory allocation, and demand forecasting. IoT-enabled sensors monitor shipments for real-time visibility, temperature control, and theft prevention. Cloud-based platforms integrate multiple logistics functions, enabling better coordination across suppliers, warehouses, and retailers. Contactless delivery solutions and mobile apps improve customer engagement. Innovations in packaging, labeling, and sorting reduce handling time and operational costs. Consistent investment in technology and process automation allows logistics providers to support high-volume, time-sensitive retail operations while minimizing errors and delays, positioning them as strategic partners for modern retail businesses.

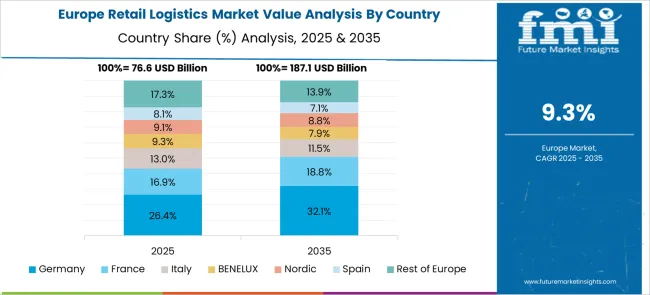

North America and Europe dominate the retail logistics market due to advanced infrastructure, mature retail ecosystems, and widespread adoption of technology-driven supply chains. Asia-Pacific is emerging rapidly, fueled by rising e-commerce penetration, urbanization, and increasing middle-class demand for online shopping convenience. Latin America and the Middle East are gradually expanding as retail infrastructure and delivery networks improve. Regional regulations, road networks, and warehousing capabilities influence logistics strategies. Retailers and third-party logistics providers tailor their operations according to local consumer behavior, population density, and urban planning. Collaboration with local delivery partners, investment in regional fulfillment centers, and adaptation to climate-specific storage and transportation requirements are key factors supporting regional growth. These dynamics collectively shape the global retail logistics market landscape.

Efficient supply chain management is critical to meet high demand and maintain profitability in retail logistics. Integration of transportation, warehousing, and inventory management ensures timely order fulfillment. Third-party logistics providers offer scalable solutions, enabling retailers to focus on core business operations. Challenges include traffic congestion, labor shortages, and seasonal fluctuations, which impact delivery performance. Strategic placement of fulfillment centers and distribution hubs reduces transit times and transportation costs. Collaboration between suppliers, manufacturers, and retailers enhances transparency and responsiveness. Advanced analytics help forecast demand and allocate resources effectively. Continuous monitoring of performance metrics, including on-time delivery rates and order accuracy, drives operational improvement. Retailers that optimize their logistics networks can improve efficiency, reduce costs, and deliver superior customer experiences, fueling market growth globally.

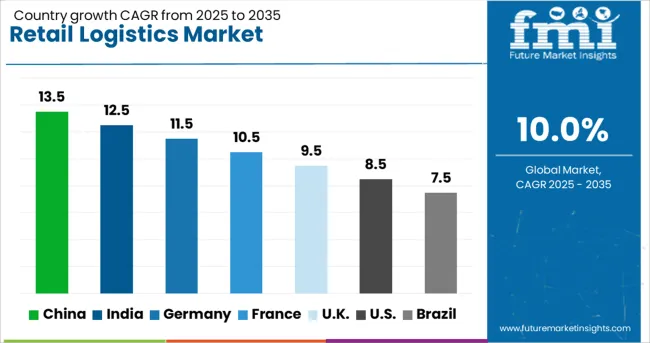

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The retail logistics market is expected to expand at a CAGR of 10.0%, driven by the increasing need for efficient supply chain operations and faster delivery solutions. China leads with 13.5% growth, supported by its large e-commerce ecosystem and investments in warehousing and transportation infrastructure. India follows at 12.5%, as organized retail and online shopping continue to grow rapidly. Germany records 11.5% growth, driven by advanced logistics networks and demand for timely product delivery. The UK shows 9.5% growth, reflecting improvements in distribution channels and fulfillment centers. The USA demonstrates 8.5% growth, supported by innovations in last-mile delivery and streamlined warehouse operations. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the retail logistics market with 13.5% growth. Rapid urbanization, expansion of e-commerce platforms, and increasing consumer demand drive market development. Compared to India, China benefits from advanced transportation networks, automated warehouses, and strong supply chain infrastructure. Integration of AI, IoT, and data analytics improves inventory management and delivery efficiency. Investment in cold chain logistics and last-mile delivery enhances competitiveness. Retailers are adopting omnichannel strategies to meet customer expectations for faster, reliable services. Government policies supporting infrastructure and digitalization further boost market expansion. Growing domestic consumption and international trade create opportunities for logistics service providers. Overall, China combines technology adoption, infrastructure investments, and e-commerce growth to dominate the retail logistics market.

Retail logistics market in India grows at 12.5%, driven by rising e-commerce adoption and organized retail expansion. Compared to Germany, India emphasizes cost-effective logistics solutions and regional distribution centers. Investments in warehousing, transportation, and cold chain systems improve supply chain reliability. Digital technologies like tracking systems and route optimization enhance operational efficiency. Growth in tier-2 and tier-3 cities creates new market opportunities. Government initiatives such as logistics parks and tax reforms support sector development. Retailers increasingly adopt last-mile delivery and real-time tracking to meet customer expectations. Rising online shopping and urban consumption trends strengthen demand for modern logistics services. Overall, India combines cost efficiency, digital adoption, and infrastructure development to sustain retail logistics growth.

Germany records steady growth at 11.5% in the retail logistics market. Advanced infrastructure, efficient transportation networks, and technology adoption enhance logistics operations. Compared to the United Kingdom, Germany emphasizes automation, robotics, and sustainable supply chain solutions. Growth in e-commerce, retail modernization, and international trade drives demand. Companies focus on reducing delivery time, optimizing routes, and improving warehouse efficiency. Sustainable practices such as electric delivery vehicles and green warehouses gain importance. Export opportunities and integration with European logistics networks support resilience. Overall, Germany combines technological innovation, sustainability, and strong infrastructure to maintain a stable retail logistics market.

The United Kingdom market grows at 9.5%, driven by e-commerce expansion and retail modernization. Compared to the United States, the UK emphasizes last-mile delivery optimization and sustainable logistics practices. Investment in smart warehouses, digital tracking systems, and automated distribution improves efficiency. Growth in online shopping and urban centers increases demand for timely deliveries. Retailers adopt omnichannel strategies to satisfy consumer expectations. Government support for transport infrastructure and green logistics promotes sector development. Increasing consumer awareness of eco-friendly delivery solutions encourages adoption of electric vehicles and sustainable packaging. Overall, the UK combines technological adoption, sustainability focus, and retail expansion to strengthen the retail logistics market.

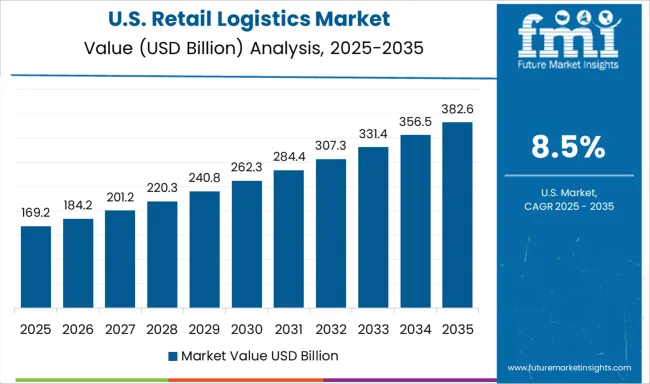

The United States advances at 8.5% in the retail logistics market. Expansion of e-commerce, omnichannel retail, and consumer expectations for fast delivery drive growth. Compared to China, the US focuses on technology-enabled logistics solutions, including route optimization, robotics, and data analytics. Investments in automated warehouses and cold chain systems enhance efficiency. Companies prioritize sustainability with electric delivery vehicles and green supply chains. Retailers adopt real-time tracking and predictive analytics to improve customer satisfaction. Growing domestic consumption and urban expansion create continuous demand for retail logistics services. Overall, the United States combines innovation, sustainability, and technology adoption to sustain retail logistics market growth.

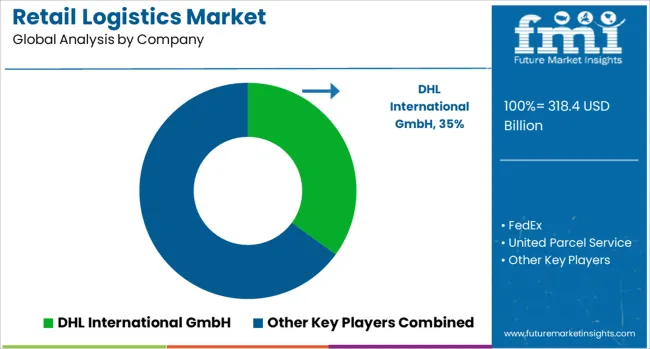

The retail logistics market is rapidly evolving with the growth of e-commerce, omnichannel retailing, and increasing demand for faster, more reliable delivery solutions. DHL International GmbH leads with a robust global network and advanced supply chain solutions, offering integrated services that optimize last-mile delivery and inventory management for retailers.

FedEx leverages technology-driven logistics solutions, including real-time tracking, automated warehousing, and express delivery services, catering to both large-scale and small-scale retail operations. United Parcel Service (UPS) emphasizes end-to-end supply chain management, combining transportation, warehousing, and fulfillment services to ensure timely delivery and reduced operational costs for retail clients.

XPO Logistics, Inc. focuses on innovative fulfillment solutions, leveraging data analytics, automation, and flexible transportation networks to streamline retail supply chains. DSV rounds out the competitive landscape by offering tailored logistics solutions, including freight forwarding, warehousing, and integrated retail distribution services across multiple geographies.

Competition in the retail logistics market is primarily driven by technological innovation, operational efficiency, and scalability, with leading suppliers differentiating through advanced tracking systems, omnichannel fulfillment capabilities, and strong global infrastructure.

The USA has ended the de minimis exemption for low-value imports from China and Hong Kong. As of August 29, 2025, all packages from these origins, regardless of value, are now subject to customs procedures and applicable duties. This change is expected to disrupt global retail logistics and e-commerce platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 318.4 Billion |

| Type | E-commerce retail logistics and Conventional retail logistics |

| Solution | Supply chain solutions, Commerce enablement, Reverse logistics & liquidation, Transportation management, and Others |

| Mode of Transport | Roadways, Railways, Airways, and Waterways |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL International GmbH, FedEx, United Parcel Service, XPO Logistics, Inc., and DSV |

| Additional Attributes | Dollar sales in the Retail Logistics Market vary by service type including warehousing, transportation, and inventory management, application across e-commerce, supermarkets, and specialty retail, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising online retail, demand for faster deliveries, and adoption of advanced supply chain technologies. |

The global retail logistics market is estimated to be valued at USD 318.4 billion in 2025.

The market size for the retail logistics market is projected to reach USD 825.7 billion by 2035.

The retail logistics market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in retail logistics market are e-commerce retail logistics and conventional retail logistics.

In terms of solution, supply chain solutions segment to command 35.7% share in the retail logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA