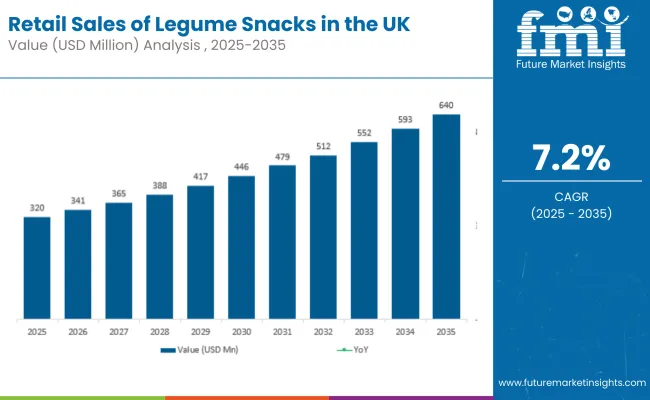

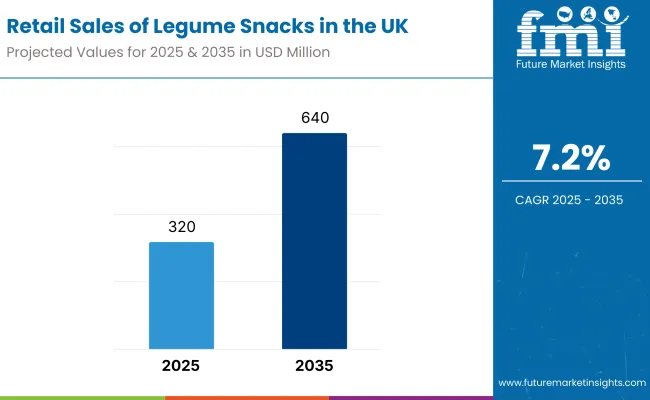

Sales of legume snacks in the United Kingdom are estimated at USD 320 million in 2025, with projections indicating a rise to USD 640 million by 2035, reflecting a CAGR of approximately 7.2% over the forecast period. This growth reflects both a broadening consumer base and increased per capita consumption across key urban centres. The rise in demand is linked to shifting dietary preferences, growing awareness of plant-based nutrition, and evolving snacking trends.

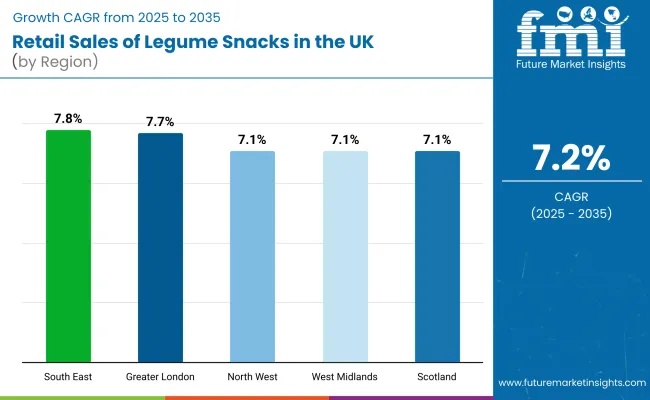

Greater London leads regional consumption, expected to generate USD 128 million in legume snack sales by 2035, followed by South East (USD 102.4 million), North West (USD 76.8 million), West Midlands (USD 64 million), and Scotland (USD 57.6 million). The top five regions collectively represent 67% of total sales, with Greater London and South East showing the strongest growth momentum.

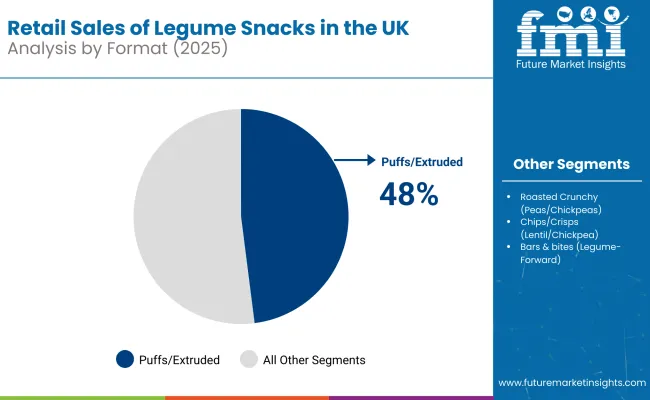

The largest contribution to demand continues to come from puffs and extruded legume snacks, which are expected to account for 50% of total sales by 2035, owing to strong shelf presence, appealing textures, and broad consumer acceptance. By distribution channel, supermarkets and hypermarkets represent the dominant retail format, responsible for 55% of all sales in 2035, though online channels are expanding rapidly from 6% to 10% share.

Consumer adoption spans health-conscious millennials, fitness enthusiasts, and plant-forward families seeking convenient protein-rich alternatives to traditional crisps and nuts. Regional preferences vary, with London consumers favoring premium chickpea varieties, while northern regions show stronger demand for familiar pea-based formats.

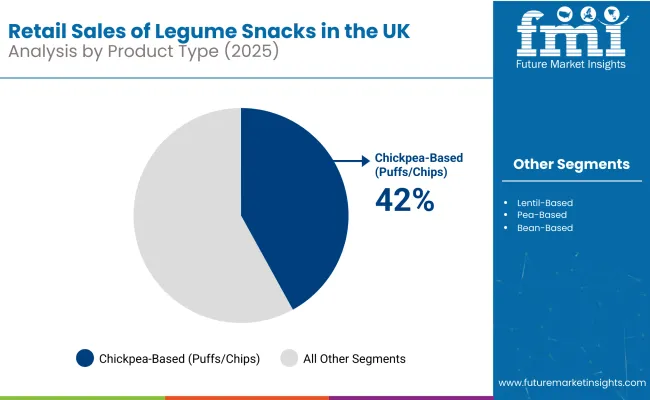

The legume snacks segment in the UK is classified across several categories. By product type, key varieties include chickpea-based puffs and chips, lentil-based snacks, pea-based crunchy formats, bean-based options, and mixed legume blends. By format, the segment spans puffs and extruded products, roasted crunchy varieties, chips and crisps, and bars with legume-forward formulations.

By distribution channel, sales occur through supermarkets and hypermarkets, discounters, convenience stores, online platforms, and health specialty retailers. By region, coverage includes Greater London, South East, North West, West Midlands, Scotland, and all other UK regions.

Chickpea-based snacks are projected to maintain the dominant position through 2035, supported by consumer familiarity, versatile flavor applications, and strong nutritional profile. While maintaining leadership, the category faces growing competition from pea-based alternatives.

Legume snacks in the UK are available across multiple format categories, each serving distinct consumption occasions and consumer preferences. Puffs and extruded products are expected to maintain format leadership through 2035, supported by familiar textures and broad appeal.

Legume snacks in the UK are distributed through multiple retail channels, with supermarkets and hypermarkets maintaining channel leadership while online platforms expand rapidly. Distribution strategies reflect both mainstream adoption and specialty positioning across different retail environments.

Regional demand for legume snacks varies significantly across the UK, with Greater London and South East regions leading both absolute sales and growth rates. Urban density, higher incomes, and diverse demographic profiles contribute to stronger adoption in these areas.

Greater London represents the largest regional segment, growing from USD 60.8 million (19% share) in 2025 to USD 128 million (20% share) by 2035, reflecting a CAGR of 7.72%. This growth is supported by high consumer openness to alternative snacking options, strong presence of health-conscious millennials, and extensive retail distribution across both premium and mainstream channels.

South East England follows with growth from USD 48 million (15% share) to USD 102.4 million (16% share) by 2035, achieving a CAGR of 7.83%. The region benefits from affluent suburban populations, growing health awareness, and increasing availability through major supermarket chains and specialty retailers.

North West England maintains USD 38.4 million in 2025, growing to USD 76.8 million by 2035 (12% share both years) with a CAGR of 7.18%. The region shows steady adoption driven by urban centres like Manchester and Liverpool, with particular strength in pea-based and familiar legume formats.

West Midlands holds consistent 10% share, growing from USD 32 million to USD 64 million with a 7.18% CAGR, supported by Birmingham's diverse population and growing health consciousness across the regional consumer base.

Scotland maintains 9% share throughout the forecast period, growing from USD 28.8 million to USD 57.6 million with a 7.18% CAGR, showing steady but measured adoption of legume snacking options across both urban and rural areas.

Regional concentration remains significant, with the top five regions (Greater London, South East, North West, West Midlands, Scotland) accounting for 65% of sales in 2025, growing to 67% by 2035. This concentration reflects urban density, higher disposable incomes, and greater consumer openness to alternative snacking options in these key regions.

The data indicates that while absolute growth occurs across all regions, the highest growth rates concentrate in Greater London and South East, reflecting their role as early adopters and trend-setters for alternative snacking categories.

Product format preferences show gradual evolution, with puffs and extruded products strengthening their leadership from 48% to 50% share, while traditional roasted formats maintain stable positioning. The slight shift toward extruded products reflects consumer preference for lighter textures and innovative flavor applications.

Consumer product preferences demonstrate increasing sophistication, with chickpea-based varieties maintaining leadership despite slight share decline from 42% to 38%, while pea-based options gain ground from 18% to 22%. This evolution reflects growing consumer familiarity with diverse legume sources and increasing comfort with pea-based ingredients across food categories.

Channel evolution reflects broader retail trends, with supermarkets maintaining dominance while adapting to changing consumer shopping patterns. The growth of online channels from 6% to 10% share indicates increasing consumer comfort with purchasing snack foods through e-commerce platforms, supported by subscription services and bulk purchasing options.

Discounter growth to 17% share reflects the democratization of healthier snacking options, making legume snacks accessible to broader income segments through value-positioned private label offerings.

Legume snack adoption concentrates among health-conscious consumers seeking alternatives to traditional salty snacks, fitness enthusiasts requiring convenient protein sources, and plant-forward families looking for nutritious snacking options for children and adults. Urban professionals drive significant consumption through convenience channel purchases, while families rely on supermarket multipacks for household consumption.

Regional taste preferences influence product success, with London consumers showing openness to exotic flavors and premium positioning, while northern regions favor familiar taste profiles and value-oriented options. This geographic variation supports the need for regional product mix optimization across retail channels.

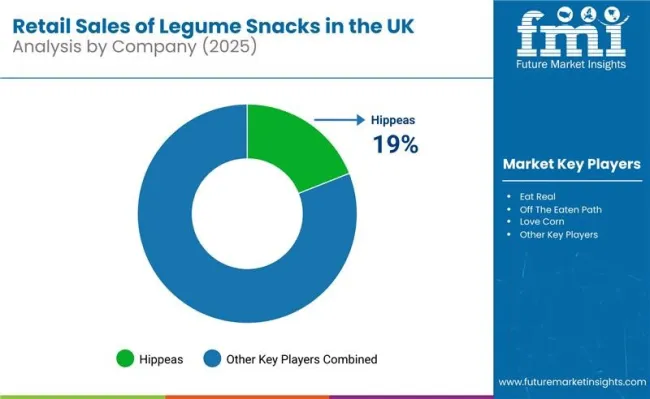

Competition in the legume snack space is shaped by three key strategic priorities: meeting regulatory requirements, expanding distribution, and ensuring secure ingredient sourcing. With growing pressure from health authorities and NGOs on salt and fat content, brands are prioritizing reformulation without compromising on flavor or crunch.

At the same time, legume snacks are now widely available in mainstream grocery chains, forecourt retailers, and quick-commerce platforms. Players with strong supply contracts for high-quality pulses, particularly from Canada and Eastern Europe, are better equipped to manage volatility in input costs. While own-brand labels continue to gain ground, branded products still hold consumer trust by offering clean labels, strong sustainability credentials, and distinctive taste profiles.

| Attribute | Details |

|---|---|

| Study Coverage | UK sales and consumption of legume snacks from 2025 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Units of Measurement | USD (sales), Percentage shares, CAGR |

| Geography Covered | All UK regions with detailed analysis of top 5 regions |

| Top Regions Analyzed | Greater London, South East, North West, West Midlands, Scotland |

| By Product Type | Chickpea-based, Lentil-based, Pea-based, Bean-based, Mixed blends |

| By Format | Puffs/extruded, Roasted crunchy, Chips/crisps, Bars & bites |

| By Distribution Channel | Supermarkets/hypermarkets, Discounters, Convenience, Online, Health/specialty |

| Metrics Provided | Sales (USD), Share by segment, CAGR (2025-2035), YoY growth |

| Competitive Landscape | Channel strategies, private label presence, regional positioning |

| Forecast Drivers | Health consciousness, protein trends, snacking evolution, retail expansion |

By 2035, total UK sales of legume snacks are projected to reach USD 640 million, up from USD 320 million in 2025, reflecting a CAGR of 7.2%.

Chickpea-based varieties hold the leading share, accounting for 42% of total sales by 2025, followed by lentil-based (26%) and pea-based (22%) options.

South East England leads in projected growth with a CAGR of 7.83%, followed by Greater London at 7.72%, both outpacing the national average.

Supermarkets and hypermarkets dominate with 55% share by 2035, while online channels show rapid expansion from 6% to 10% share over the forecast period.

Puffs and extruded products lead with 48% share by 2025, supported by familiar textures and broad consumer appeal, followed by roasted crunchy varieties at 23% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Retail Signage Market

Retail Digital Signage Market

India Retail Mineral Turpentine Oil Market Growth – Trends & Forecast 2024-2034

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Vending Machine Suppliers

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Europe Retail Paper Bag Market Trends – Growth & Forecast 2023-2033

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Retail Glass Packaging Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA