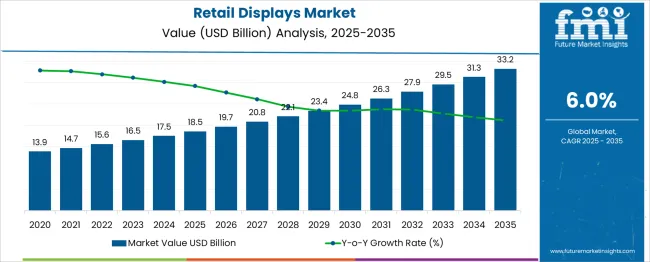

The Retail Displays Market is estimated to be valued at USD 18.5 billion in 2025 and is projected to reach USD 33.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The retail displays market is projected to create an absolute gain of USD 14.7 billion and achieving a growth multiplier of 1.8x over the decade. Supported by a CAGR of 6%, this growth is driven by the increasing demand for visually appealing in-store displays, technological integration, and personalized shopping experiences.

During the first five years (2025–2030), the market is expected to expand from USD 18.5 billion to USD 24.8 billion, adding USD 6.3 billion, which accounts for 42.8% of the total incremental growth, with a 5-year multiplier of 1.34x. The second phase (2030–2035) contributes USD 8.4 billion, representing 57.2% of incremental growth, reflecting the shift toward digital signage, interactive displays, and data-driven customer experiences in retail environments.

Annual increments will increase from USD 1.2 billion in the early years to USD 1.7 billion toward 2035, driven by the rising adoption of omnichannel retail strategies and smart displays in global markets. Companies focusing on LED technology, touch-based interfaces, and immersive experiences will capture the largest share of this USD 14.7 billion opportunity, particularly as the retail sector continues to embrace digital transformation.

| Metric | Value |

|---|---|

| Retail Displays Market Estimated Value in (2025 E) | USD 18.5 billion |

| Retail Displays Market Forecast Value in (2035 F) | USD 33.2 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The retail displays market is undergoing a digital transformation, driven by evolving consumer engagement trends, enhanced in-store brand experiences, and technological convergence. Retailers are increasingly integrating display systems to influence purchasing behavior and reduce reliance on human interaction at physical locations.

Innovations in content management systems, energy-efficient panels, and interactive interfaces have accelerated digital display adoption across diverse retail formats. The rising preference for omnichannel strategies and data-driven merchandising is supporting the deployment of advanced display technologies that provide both promotional impact and real-time analytics.

Regulatory support for sustainable and recyclable materials, combined with demand for high-impact visual communication, is further propelling market growth. Looking forward, increased investments in retail automation, AI-powered content personalization, and connected display ecosystems are expected to create new avenues for value creation and customer retention in brick-and-mortar environments.

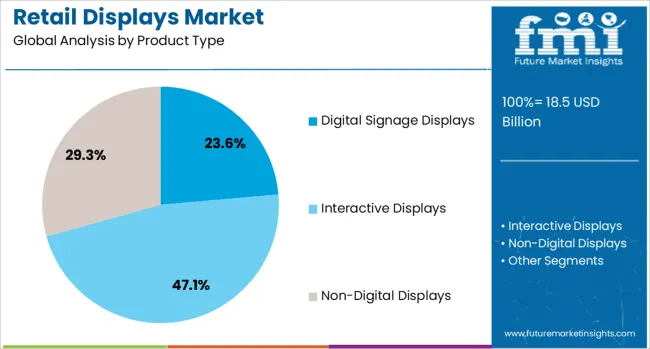

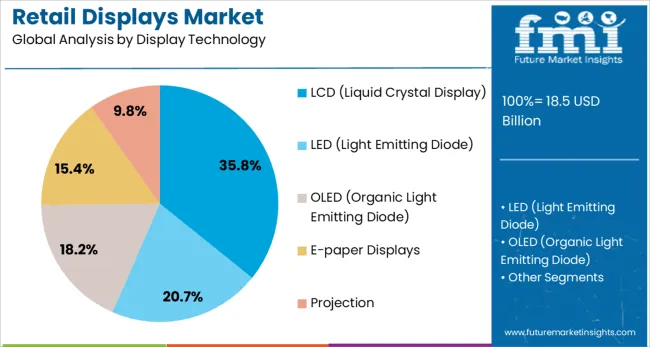

The retail displays market is segmented by product type, display technology, application, end-use industry, and geographic regions. By product type, the retail displays market is divided into Digital Signage Displays, Interactive Displays, and Non-Digital Displays. In terms of display technology, the retail displays market is classified into LCD (Liquid Crystal Display), LED (Light Emitting Diode), OLED (Organic Light Emitting Diode), and E-paper Displays.

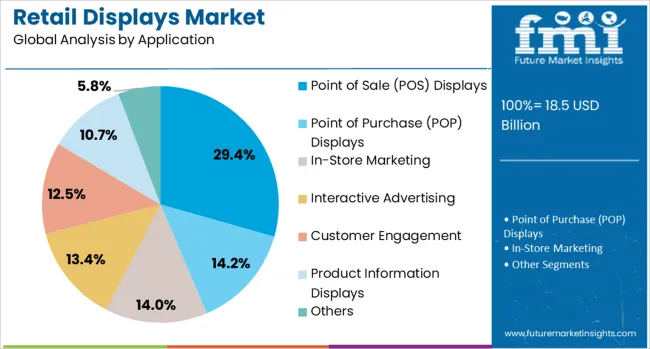

Based on the application of the retail displays market, it is segmented into Point of Sale (POS) Displays, Point of Purchase (POP) Displays, In-Store Marketing, Interactive Advertising, Customer Engagement, Product Information Displays, and others.

By end-use industry, the retail displays market is segmented into Retail Stores, Hospitality, Healthcare, Transportation, and others. Regionally, the retail displays industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Digital signage displays are anticipated to lead the product type category with a projected market share of 23.60% in 2025. This leadership has been shaped by the growing demand for dynamic content delivery and real-time promotional capabilities within retail spaces. These displays provide flexibility in updating messaging, enabling retailers to adapt marketing strategies instantly based on footfall, product inventory, or seasonal demand.

Their ability to integrate with customer analytics tools and POS systems has further enhanced their appeal as part of retail digitization strategies. With the increasing focus on contactless engagement and operational efficiency, digital signage is being deployed across formats ranging from departmental stores to pop-ups and convenience outlets.

Cost reductions in display hardware and improvements in display resolution and power consumption have also supported wider adoption. As physical stores compete with e-commerce on experience, digital signage displays are playing a central role in creating immersive, brand-led customer journeys.

LCD technology is projected to dominate the display technology segment with a 35.80% revenue share in 2025. This segment’s dominance stems from its affordability, reliability, and high-definition visual performance, making it suitable for a broad range of retail applications.

LCD displays offer clarity and brightness necessary for well-lit retail environments and have benefited from a mature supply chain that ensures consistent product quality and cost efficiency. Their widespread compatibility with digital signage platforms and content delivery networks has also made them the default choice for scalable deployments.

Furthermore, continued innovation in thin-bezel design, energy efficiency, and touch-enabled features has strengthened their relevance across both small-format stores and multi-screen retail walls. The longevity and low maintenance needs of LCD panels support operational stability, a critical factor for high-traffic retail locations aiming to minimize downtime and cost of ownership.

Point of Sale (POS) displays are expected to account for 29.40% of the total application-based revenue share in 2025, establishing them as the leading application segment. This dominance is attributed to their strategic placement at high-traffic checkout zones, where they effectively capture last-minute purchase intent and enhance product visibility.

Retailers are increasingly using POS displays not just for impulse buys but also for promoting loyalty programs, seasonal deals, and targeted messaging based on customer demographics. The convergence of physical and digital marketing has made POS displays an essential touchpoint, especially when integrated with QR codes, sensors, or real-time inventory triggers.

The rise in smaller-format urban stores and experiential retail concepts has also favored modular, space-efficient POS display formats. As brick-and-mortar players seek to optimize every square foot of retail space, POS displays are expected to remain a critical tool for revenue maximization and shopper engagement.

The retail displays market is expanding due to the increasing demand for enhanced customer experiences and adoption of advanced technologies. Growth is driven by the need for innovative visual merchandising solutions and the integration of digital signage. Opportunities lie in the development of interactive displays and in-store media networks. Emerging trends include the use of augmented reality and artificial intelligence in display technologies. However, challenges such as high implementation costs and the complexity of integrating new technologies into existing retail environments pose significant restraints.

The primary growth driver is the rising consumer demand for engaging and immersive shopping experiences. Retailers increasingly focused on creating visually appealing and interactive displays to attract and retain customers. The integration of digital signage and interactive kiosks became more common, offering dynamic content and personalized interactions. This shift towards experience-driven retail environments highlights the importance of innovative display solutions in enhancing customer engagement and driving sales.

Significant opportunities exist in developing interactive displays and expanding in-store media networks. Retailers have invested in touch-screen displays and digital signage to provide real-time product information and promotions. The growth of in-store media networks, where retailers can monetize physical spaces through advertising, opened new revenue streams. These developments suggest that retailers can leverage advanced display technologies to enhance customer engagement and generate additional income.

Emerging trends in the market include incorporating augmented reality (AR) and artificial intelligence (AI) into retail display technologies. AR applications allow customers to visualize products in real-time, enhancing the shopping experience. AI-driven displays provide personalized content based on customer behavior and preferences. These innovations highlight a shift toward more personalized and interactive retail environments, where technology plays a pivotal role in shaping customer experiences.

Market restraints include high implementation costs and challenges in integrating new technologies into existing retail infrastructures. Advanced display solutions often require significant investment in hardware and software, which can pose barriers for smaller retailers. Furthermore, integrating new technologies with legacy systems can lead to operational complexities and higher maintenance costs. These factors highlight the need for cost-effective and scalable display solutions to facilitate broader adoption across the retail sector.

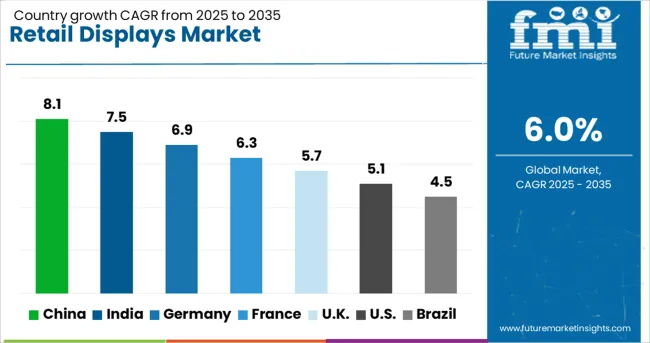

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

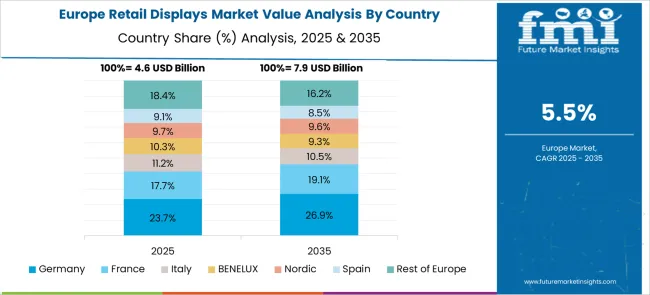

The global retail displays market is projected to grow at 6% CAGR from 2025 to 2035. China leads with 8.1% CAGR, supported by rapid urbanization, growing retail sectors, and increasing demand for innovative display solutions. India follows at 7.5%, driven by rising consumer spending and the growth of organized retail chains. Germany records 6.9% CAGR, with strong demand for high-quality, interactive, and sustainable retail displays. The United Kingdom grows at 5.7%, while the United States posts 5.1%, reflecting stable demand in mature markets with a focus on technology-driven and customer experience-oriented displays. Asia-Pacific leads growth due to retail sector expansion, while Europe and North America prioritize innovation and sustainability in retail display solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The retail displays market in China is forecasted to grow at 8.1% CAGR, driven by the booming retail industry and increasing demand for interactive and digital display solutions. With a rise in e-commerce and brick-and-mortar retail stores, businesses are adopting digital signage, LED displays, and augmented reality technologies to enhance customer experiences and promote products. China’s rapid urbanization and growth in high-end retail further accelerate the demand for innovative display solutions.

The retail displays market in India is projected to grow at 7.5% CAGR, fueled by the country’s expanding retail landscape, increasing consumer disposable incomes, and the adoption of technology-driven retail strategies. Retailers are shifting to digital signage and interactive displays to engage customers and enhance the shopping experience. The rapid growth of organized retail and shopping malls also drives the adoption of modern retail display solutions in India’s major urban centers.

The retail displays market in Germany is expected to grow at 6.9% CAGR, driven by strong demand for high-quality, interactive displays in both physical retail spaces and digital environments. Germany’s retail sector focuses on creating personalized shopping experiences with the use of smart displays and digital signage. The adoption of sustainable, eco-friendly materials in retail displays also aligns with the country’s commitment to environmental responsibility. The increasing use of interactive and augmented reality displays further drives market growth.

The retail displays market in the United Kingdom is projected to grow at 5.7% CAGR, supported by steady demand for innovative retail display solutions in both online and offline retail environments. With a growing focus on customer experience, retailers are increasingly adopting digital signage, LED displays, and smart interactive systems to enhance engagement. The UK’s shift toward omnichannel retailing and the increasing demand for personalized shopping experiences drive the adoption of advanced retail displays.

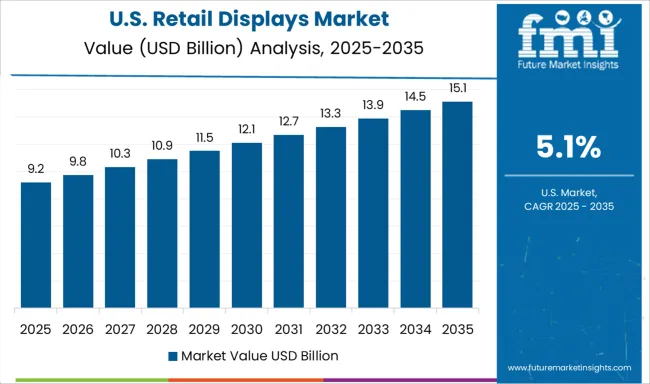

The retail displays market in the United States is projected to grow at 5.1% CAGR, reflecting steady demand in a mature retail industry. With the increasing focus on enhancing in-store customer experiences, demand for interactive displays, digital signage, and LED systems rises. The trend toward data-driven retail solutions, where displays are used for real-time promotions and targeted advertising, strengthens market growth. Additionally, as more retailers integrate e-commerce with physical stores, the demand for omnichannel retail solutions continues to rise.

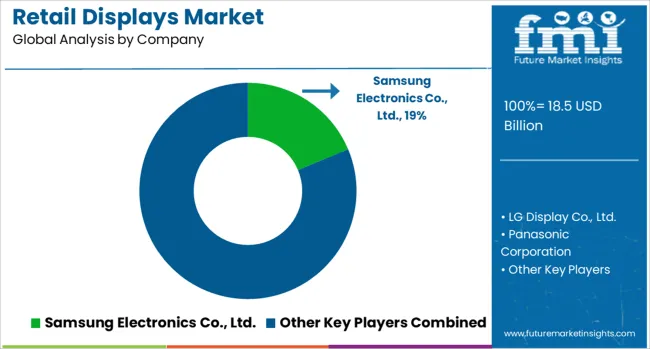

The retail displays market is dominated by Samsung Electronics Co., Ltd., which secures its leadership through innovative, high-resolution digital signage solutions and large-format displays designed to enhance customer engagement and drive in-store marketing. Samsung’s dominance is supported by its global reach, cutting-edge technology, and strong brand presence in retail and advertising sectors.

Key players such as LG Display Co., Ltd., Panasonic Corporation, Sharp Corporation, and Sony Corporation hold significant market shares by offering interactive displays, OLED solutions, and advanced LED technologies that deliver vibrant, energy-efficient visuals for retail environments. These companies emphasize seamless integration with retail systems and the ability to create immersive shopping experiences through high-quality video walls and signage solutions.

Emerging players including NEC Display Solutions Ltd., Planar Systems, Inc., and others are expanding their market presence by providing cost-effective, customizable display solutions for smaller retail setups and targeted applications such as in-store promotions and digital kiosks. Their strategies focus on improving user interaction, enhancing screen durability, and offering scalable systems for diverse retail environments.

Market growth is driven by the increasing demand for digital signage in retail marketing, the rise of smart retail experiences, and the integration of AI-powered content management systems. Continuous innovations in touch technology, LED screen resolution, and interactive features are expected to shape the competitive dynamics within the global retail displays market.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.5 Billion |

| Product Type | Digital Signage Displays, Interactive Displays, and Non-Digital Displays |

| Display Technology | LCD (Liquid Crystal Display), LED (Light Emitting Diode), OLED (Organic Light Emitting Diode), E-paper Displays, and Projection |

| Application | Point of Sale (POS) Displays, Point of Purchase (POP) Displays, In-Store Marketing, Interactive Advertising, Customer Engagement, Product Information Displays, and Others |

| End-Use Industry | Retail Stores, Hospitality, Healthcare, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co., Ltd., LG Display Co., Ltd., Panasonic Corporation, Sharp Corporation, Sony Corporation, NEC Display Solutions Ltd., and Planar Systems, Inc. |

| Additional Attributes | Dollar sales by display type and material, demand dynamics across retail sectors like fashion and electronics, regional trends in retail display adoption, innovation in interactive and digital displays, environmental impact of materials used, and emerging use cases in experiential marketing and point-of-purchase displays. |

The global retail displays market is estimated to be valued at USD 18.5 billion in 2025.

The market size for the retail displays market is projected to reach USD 33.2 billion by 2035.

The retail displays market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in retail displays market are digital signage displays, _video walls, _kiosks, _led displays, _lcd displays, _oled displays, interactive displays, _touchscreen displays, _interactive kiosks, non-digital displays, _poster displays, _banner displays and _shelf displays.

In terms of display technology, lcd (liquid crystal display) segment to command 35.8% share in the retail displays market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA