The retail glass packaging industry analysis in Europe and the Middle East and Africa or consumer glass packaging industry is valued at USD 2.1 billion in 2025. As per FMI analysis, the industry will grow at a CAGR of 6.2% and reach USD 3.83 billion by 2035.

The consumer glass packaging industry in Europe and Middle East & Africa (EMEA) was buoyed in 2024 through investment initiatives targeted towards premium food and beverage segments and through an array of new product launches. A significant shift occurred in consumer buying patterns, with demand for food and beverage items packaged in glass, especially the luxury-oriented and organic, rising.

In Europe, retailers had started rationalizing SKUs under inflationary pressure but the premium segments held strong, particularly for personal care and spirits packaging. In contrast, in the Middle East and Africa, urban retail growth and an increased health consciousness sparked a revival in the use of glass for non-alcoholic beverages and skincare products.

Regulatory measures intensified across EU nations, where a few states enacted or are gearing up to legislate restrictions on single-use plastics and foster recyclable packaging alternatives.

By 2025, the consumer glass packaging sector in the EMEA was forecast to be USD 2,150 million in size according to FMI research. With sustainability imperatives being on the rise, increased per capita income in the Gulf Cooperation Council (GCC) countries, and growing consumer demand towards recyclable non-reactive types of packaging the industry is expected to exhibit a 6.2% CAGR by 2035 according to FMI.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.1 billion |

| Industry Value (2035F) | USD 3.83 billion |

| CAGR (2025 to 2035) | 6.2% |

The EMEA consumer glass packaging industry is posting steady growth led by the requirement for green and high-end packaging. In Europe, the surge in demand by governments and growing consumer preference for recyclable resources are leading the adoption of environmentally sustainable packaging concepts in food and beverages as well as personal care categories.

Firms concentrating on eco-friendly packaging solutions are expected to gain larger market shares, putting at risk those dependent on plastics and facing declining brand images among environmentally aware customers.

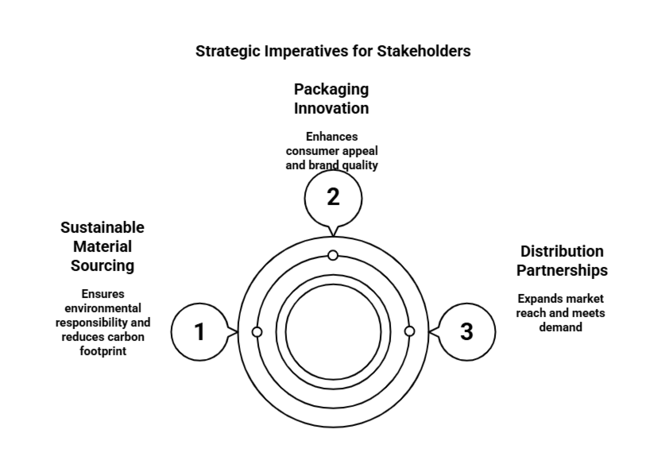

Place a Premium on Sustainable Material Sourcing

Managers need to invest in the acquisition of long-term supply deals for light glass and recyclable glass to meet sustainability demands and reduce carbon footprint requirements throughout the region.

Coordinate Packaging Innovation with Premiumization Trends

Create premium and health-aware consumer-desirable packaging formats through the use of bespoke designs, UV protection elements, and minimalist branding conveying quality and eco-accountability.

Increase Strategic Distribution and Co-Manufacturing partnerships.

Join up with local co-packers and retail distributors, especially in high-growth GCC and African urban industries, to grow faster and address increasing demand across personal care and food categories.

| Risk | Assessment (Probability - Impact) |

|---|---|

| Supply chain disruptions for recycled glass inputs | Medium - High |

| Regulatory shifts favoring alternative sustainable materials (e.g., bioplastics) | Low - Medium |

| Energy cost volatility affecting glass production economics | High - High |

| Priority | Immediate Action |

|---|---|

| Evaluate lightweight glass technology. | Run a feasibility study on integrating light weighting techniques in packaging lines. |

| Monitor regional policy changes. | Establish a regulatory task force to track and respond to EU and GCC packaging mandates. |

| Strengthen brand-retailer alignment | Launch co-branded pilot programs with top regional FMCG and personal care brands. |

To stay ahead, companies must prioritize a transformation to high-margin, sustainable packaging approaches by accelerating investment in supply chains for recycled glass packaging and lightweight manufacturing technology. Current data suggests a growing shift toward sustainable and premium packaging in EMEA, influenced by regulatory policies and evolving consumer preferences.

While competitors redefine branding and compliance, vanguard businesses that secure material supply chains under lock and key and construct solid regional distribution alliances, above all else, in sub-Saharan and GCC urban growth locations, will create lasting advantage. That requires realignment of channel strategy, product development timelines, and capital spending in the first 12 months.

| Region | Impact of Policies and Government Regulations |

|---|---|

| Europe | The EU Circular Economy Action Plan advocates for fully recyclable glass and limits single-use plastics to inspire businesses to develop sustainable packaging solutions. The fundamental structure of the EU Packaging and Packaging Waste Directive (94/62/EC) indicates that for packaging waste to be recyclable, producers need to fulfill recycling and recovery targets. It is essential for products to be labeled in accordance with the CE marking standards, signifying that those products comply with European health, safety, and environmental regulations. The EU member-both states include Extended Producer Responsibility (EPR) schemes, under which producers are responsible for the whole lifecycle of packaging and include recycling as well. The European Green Deal for includes the promotion of carbon-neutral production within the sector of Packaging. In contrast, food-grade glass packaging has to adhere to stringent food safety standards to be used safely in the food and beverage industries. |

| Middle East | Saudi Vision 2030 has established sustainability objectives, promoting green packaging solutions, and the government-sponsored National Industrial Development and Logistics Program is stimulating sustainable packaging technologies. GCC environmental regulations require packaging solutions to be efficient in waste reduction and emphasize recycling efforts. The UAE and Qatar have imposed more stringent import policies on packaging materials, especially plastics. Prior to industry entry, the Saudi Standards, Metrology, and Quality Organization (SASO) must certify packaging products. Governments in the region are beginning to introduce carbon emission standards on industrial processes, including packaging. |

| Africa | National packaging waste regulations are being implemented in South Africa, Kenya, and Nigeria, which make responsible packaging and recycling mandatory. To meet national recycling targets, businesses must use recyclable glass packaging. The African Union's Environment Agenda is compelling firms to adopt a circular economy by ensuring that firms utilize recyclable and environmentally friendly materials to meet regional sustainability targets. Within South Africa, the South African Bureau of Standards (SABS) regulates the certification of the quality of packages, particularly of food-grade glass. African countries, including Nigeria and South Africa, are increasingly regulating importation/exportation requirements on packaging material to guarantee that the products adhere to sustainability criteria. |

The industry is categorized across multiple parameters. In terms of packaging formats, the market includes bottles, jars, vials, ampoules, syringes, cartridges, and others. Based on glass grade, it is segmented into type I, type II, type III, and type IV. When assessed by capacity, the classification spans up to 50 ml, 51 to 250 ml, 251 to 750 ml, and above 750 ml. By end use, the market serves applications in food, beverages, personal care and cosmetics, pharmaceuticals, and other industrial sectors.

During 2025 to 2035, bottles will remain the most profitable category in the Europe, Middle East, and Africa Retail Glass Packaging Industry. The Bottles segment is expected to expand at a CAGR of 6.2% between 2025 and 2035, outpacing the industry growth rate.

Bottles are expected to dominate food and beverage packaging due to their recyclability, product protection qualities, and adaptability across multiple product lines. Demand for sustainable, recyclable packaging will propel the development of glass bottles, particularly in premium and alcoholic drinks. Lightweight glass bottles and sophisticated designs addressing sustainability issues will also stimulate growth.

During 2025 to 2035, Type III glass will be the most profitable grade in the Europe, Middle East, and Africa Retail Glass Packaging Industry. The Type III segment will witness growth at a CAGR of 5.9% between 2025 and 2035, consistent with the industry's growth rate as a whole.

Pharmaceuticals and food packaging prefer Type III glass due to its affordability and extensive use, making it the most versatile and sought-after grade. It's a compromise on cost and convenience that the increasing demand for economic, high-quality packaging in mass production has called for.

Between 2025 and 2035, 51 to 250 ml capacity will be the most profitable segment in the Europe, Middle East, and Africa Retail Glass Packaging Industry. The 51- to 250-mL segment is expected to register a CAGR of 5.7% between 2025 and 2035, marginally higher than the overall industry growth rate.

This capacity is particularly popular due to its extensive application in both the food and beverage sector, especially in packaged juices, sauces, and condiments, as well as personal care products. Smaller, easier-to-handle pack sizes are gaining widespread acceptance owing to consumers' increasing demand for convenience and portion control.

During 2025 to 2035, the pharmaceuticals segment is forecasted to be the most profitable end-use category in the Europe and the Middle East and Africa Retail Glass Packaging Industry. The pharmaceuticals segment is expected to expand at a CAGR of 6.5% between 2025 and 2035, outpacing the industry growth rate of 5.6%.

Glass remains widely used in the pharmaceutical industry for its inert properties, which help preserve the integrity of sensitive products such as injectables and vaccines. The ongoing growth of the pharmaceutical industry, coupled with regulatory impetus to adopt safer, more environmentally friendly packaging, will heavily propel the demand for glass in this category.

The retail glass packaging industry of Germany is anticipated to increase at a CAGR of 6.1% from 2025 to 2035. As Germany is among the leading manufacturing hubs of Europe, sustainability and environment-friendly packaging products take high importance, driven mostly by stringent EU legislation.

The glass packaging industry will grow due to increased awareness toward recycling and carbon footprint reduction. The German industry is also being fueled by the growing trend towards premium packaging in the food and beverage industry, particularly with beverages like beer and spirits, which are usually packaged in glass bottles.

France's retail glass packaging industry is expected to register a CAGR of 5.8% from 2025 to 2035. France's emphasis on sustainability, bolstered by EU guidelines and government regulations, significantly influences the growth of the consumer glass packaging industry.

France will be experiencing strong demand for glass packaging in the food and beverage segment, where glass jars and bottles remain the preferred choice for preserving product shelf life and quality. Increasing regulatory influence, calling for recycling material and waste reduction, also promotes demand for eco-friendly glass packaging solutions in France.

In Italy, retail glass packaging is expected to register a growth of 5.4% CAGR between 2025 and 2035. Italy, home to a large number of iconic food and beverage companies, has a robust need for glass packaging, primarily in the wine, olive oil, and food preservation industries.

As sustainability practices and eco-friendly consumption drive the demand for sustainable and recyclable packaging materials, we expect the industry to continue growing. EU regulatory policies such as the Waste Framework Directive have also spurred the Italian industry towards more environmentally friendly packaging solutions.

In the United Kingdom, the retail glass packaging industry is expected to grow at a CAGR of 5.2% between 2025 and 2035. The UK industry is witnessing a shift towards sustainable packaging, with increasing numbers of retailers and consumers demanding recyclable and sustainable options.

With initiatives such as the Extended Producer Responsibility (EPR) scheme, UK manufacturers are being forced to reduce packaging waste and increase recycling rates. The food and drink sector remains one of the biggest drivers of glass packaging demand, especially for premium products such as craft beer and premium wines, which are normally bottled in glass.

In Saudi Arabia, the industry for retail glass packaging is forecast to expand at a CAGR of 6.5% during 2025 to 2035. As part of the Vision 2030 program, Saudi Arabia is focusing on economic diversification and sustainable industrial development, including sustainable packaging solutions.

Packaging glass is increasing in the food and beverage industry, particularly in the premium segments of packaged food and premium drinks. Government incentives and policies are also compelling manufacturers to adopt more sustainable methods of operation, which is expected to enhance consumer glass packaging growth further.

In the UAE, the retail glass packaging industry is expected to expand at a CAGR of 6.0% from 2025 to 2035. The UAE is increasingly going green, with regulations encouraging the use of packaging made from recyclable materials. Glass packaging, being recyclable and aesthetic, is taking over as a preferred option in the premium consumer goods category.

The Emirates Recycling Program, as well as other reduction and recycling initiatives launched by the UAE government, will substantially drive up demand for glass packaging, particularly in the beverage and food industries.

The Qatar retail glass packaging industry is expected to increase at a CAGR of 5.7% from 2025 to 2035. The food and beverage sector in Qatar is experiencing bright growth prospects, primarily fueled by rising demand for premium and sustainable packaging from consumers.

Massive impetus toward sustainability aims at reducing environmental impact framed under Qatar's National Vision 2030. Glass packaging-with its recyclability and preservation-would benefit immensely from this trend especially in premium congested sectors such as bottled beverages and premium foodstuffs.

In short, the South African retail glass packaging industry is expected to expand at a CAGR of 5.3% from 2025 to 2035. South Africa, boasting the largest glass packaging industry in Africa, is driven by demand in the food and beverage sector, including alcoholic beverages like wine and spirits.

Local manufacturers are responding to regional and international demand for recyclable and sustainable packaging. With increasing government focus on recycling and enforcing extended producer responsibility (EPR) legislation, South African glass packaging will see continued growth, with particular emphasis placed on environmentally friendly packaging solutions.

Retail glass packaging in Nigeria is also expected to rise by a growth rate of 5.0% between the period 2025 to 2035. The fact that the food and beverage sector continues to grow increasingly leads to the situation where the largest economy in Africa, Nigeria, has an increasing demand for packaging materials, especially glass.

The consumers' awareness of sustainability grows, embracing glass packaging as being very recyclable in nature. More emphasis is now being placed by the Nigerian government on waste handling and recycling endeavors, which will help boost the demand for recyclable glass based packaging. However, the infrastructural limitations and economic volatility will temper growth prospects.

Retail glass packaging in Kenya is expected to register a CAGR of 5.2% between 2025 and 2035. Kenya's increasing middle class and growing retail sector are fueling the need for quality packaging solutions, particularly in the beverage and food sectors.

Glass packaging is increasingly perceived as a premium option, and heightened environmental awareness is encouraging businesses and consumers to adopt reusable glass containers. Regulatory intervention in terms of enacting laws for a better disposal system and fostering recycling will add more to the prospects of the packaging industry based on glass in Kenya.

Well-known players in retail glass packaging across Europe, the Middle East, and Africa will keep extending the operational footprint strategically to seize the growing demand for sustainable as well as premium packaging. For instance, leading manufacturers such as Ardagh Glass Packaging, Verallia, and Gerresheimer are incorporating lightweight glass technology advancements, practices of circular economy, and regional scale production features to gain a competitive edge.

These companies have innovated with a sustainability prism. They have localized super-low emission furnaces, recyclable design standards, and returnable packaging schemes focused on the most massive consumers of beverages and cosmetics. For example, Verallia has strengthened the closed-loop recycling programs across Europe, while Gerresheimer extends operations for pharmaceutical level glass in the Middle East to meet specific regulatory and client needs.

Regional suppliers and niche manufacturers upgrade their local distribution capacity and tailor their packaging formats to different shelf life and branding requirements. Their market influence, however, continues to contract due to the scale disadvantages relative to the rest of the market and lower R&D intensity. As carbon reduction regulations become tighter, especially under the European Green Deal and GCC sustainability targets, the top-tier manufacturers are aligning with ESG mandates to future-proof supply chains.

By 2035, light-weighted glass solutions and integrating recycled materials into a system of strategic partnerships throughout the supply chain will determine whether a business succeeds or fails in the industry. The major light will Continued to focus on balancing environmental performance with aesthetic and functional packaging, ensuring long-term relevance in the evolving retail landscape.

In 2025, a group of multinationals driving Europe's and MEA's retail glass packaging landscape from regional manufacturing hubs taking sustainable initiatives toward product specialization has captured much of the market. Ardagh Group S.A., the largest player globally, commands a 28% market share, thanks to strong production capacity in Europe, with equal demand for glass bottles from beverage brands. Verallia ranks next with a 23% share, you benefit from its acquisition strategy and circular economy initiatives across both regions.

Gerresheimer AG maintains an 18% share, strongly associated with the premium market it serves for pharmaceutical and cosmetic glass packaging. Owens-Illinois, Inc. (O-I Glass), is responsible for 12% of the market share due to its cost-efficient operations and increasing penetration into MEA's food and beverage segment. Other players such as Vidrala SA and Vetropack Group compete within niche categories and regional clusters but hold smaller individual shares.

| Company | Estimated Market Share (2025) |

| Ardagh Group S.A. | 28% |

| Verallia | 23% |

| Gerresheimer AG | 18% |

| Owens-Illinois, Inc. | 12% |

| Vidrala SA | 7% |

The industry is segmented into bottles, jars, vials, ampoules, syringes, cartridges and others.

The industry is segmented into type i, type ii, type iii and type iv.

The industry is segmented into up to 50 ml, 51 to 250 ml, 251 to 750 ml, and above 750 ml.

The industry is segmented into food, beverages, personal care & cosmetics, pharmaceuticals, and other industrial.

The industry is studied across Europe, the Middle East and Africa.

Rising consumer preference for sustainable and premium packaging is driving demand across the industry.

Industry growth is projected to remain stable, supported by rising demand for eco-friendly materials and visually appealing, premium packaging formats.

Key players in the industry include Owens-Illinois, Ardagh Group, Gerresheimer AG, Nampak Ltd., and Schott AG.

Bottles will continue to lead the industry due to strong demand in beverages and personal care sectors.

Trends will focus on lightweight recyclable glass and rising adoption of premium packaging formats across the industry.

Table 01: Market Value (US$ Million) Analysis, by Grade, 2017H to 2032F

Table 02: Market Volume (‘000 '000 Tonnes) Analysis, by Grade, 2017H to 2032F

Table 03: Market Value (US$ Million) Analysis, by Capacity, 2017H to 2032F

Table 04: Market Volume (‘000 '000 Tonnes) Analysis, by Capacity, 2017H to 2032F

Table 05: Market Value (US$ Million) Analysis, by Packaging Formats, 2017H to 2032F

Table 06: Market Volume (‘000 '000 Tonnes) Analysis, by Packaging Formats, 2017H to 2032F

Table 07: Market Value (US$ Million) Analysis, by End Use, 2017H to 2032F

Table 08: Market Volume (‘000 '000 Tonnes) Analysis, by End Use, 2017H to 2032F

Table 09: Market Value (US$ Million) Analysis, by Country, 2017H to 2032F

Table 10: Market Volume (‘000 '000 Tonnes) Analysis, by Country, 2017H to 2032F

Table 11: Middle East & Africa Retail Glass Packaging Market Value (US$ Million) Analysis, by Grade, 2017H to 2032F

Table 12: Middle East & Africa Retail Glass Packaging Market Volume (‘000 '000 Tonnes) Analysis, by Grade, 2017H to 2032F

Table 13: Middle East & Africa Retail Glass Packaging Market Value (US$ Million) Analysis, by Capacity, 2017H to 2032F

Table 14: Middle East & Africa Retail Glass Packaging Market Volume (‘000 '000 Tonnes) Analysis, by Capacity, 2017H to 2032F

Table 15: Middle East & Africa Retail Glass Packaging Market Value (US$ Million) Analysis, by Packaging Formats, 2017H to 2032F

Table 16: Middle East & Africa Retail Glass Packaging Market Volume (‘000 '000 Tonnes) Analysis, by Packaging Formats, 2017H to 2032F

Table 17: Middle East & Africa Retail Glass Packaging Market Value (US$ Million) Analysis, by End Use, 2017H to 2032F

Table 18: Middle East & Africa Retail Glass Packaging Market Volume (‘000 '000 Tonnes) Analysis, by End Use, 2017H to 2032F

Table 19: Middle East & Africa Retail Glass Packaging Market Value (US$ Million) Analysis, by Country, 2017H to 2032F

Table 20: Middle East & Africa Retail Glass Packaging Market Volume (‘000 '000 Tonnes) Analysis, by Country, 2017H to 2032F

Figure 01: Market Share Analysis by Grade 2022(E)

Figure 02: Market Value Share Analysis by Capacity, 2022(E)

Figure 03: Market Attractiveness Analysis by Packaging Formats, 2022E to 2032F

Figure 04: Market Incremental Opportunity Analysis (US$ Million), by End Use, 2022E to 2032F

Figure 05: Market Share Analysis by Country, 2022E to 2032F

Figure 06: Middle East & Africa Retail Glass Packaging Market Share Analysis by Grade 2022(E)

Figure 07: Middle East & Africa Retail Glass Packaging Market Value Share Analysis by Capacity, 2022(E)

Figure 08: Middle East & Africa Retail Glass Packaging Market Attractiveness Analysis by Packaging Formats, 2022E to 2032F

Figure 09: Middle East & Africa Retail Glass Packaging Market Incremental Opportunity Analysis (US$ Million), by End Use, 2022E to 2032F

Figure 10: Middle East & Africa Retail Glass Packaging Market Share Analysis by Country, 2022E to 2032F

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Paper Bag Market Size, Share & Forecast 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Signage Market

Retail Digital Signage Market

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA