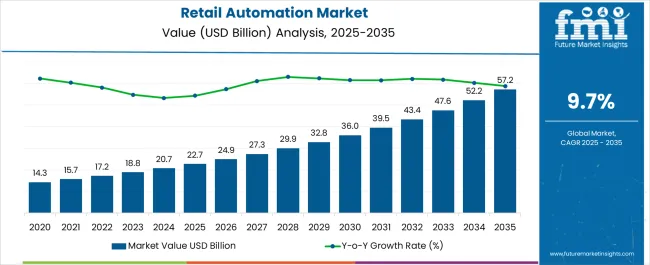

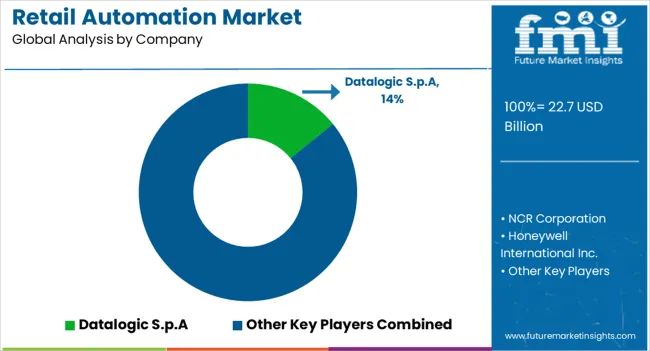

The Retail Automation Market is estimated to be valued at USD 22.7 billion in 2025 and is projected to reach USD 57.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Retail Automation Market Estimated Value in (2025E) | USD 22.7 billion |

| Retail Automation Market Forecast Value in (2035F) | USD 57.2 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The retail automation market is progressing at a strong pace, propelled by the transformation of retail operations toward efficiency, accuracy, and customer-centric engagement. Industry announcements and technology briefings have pointed to increased investments in automated systems, driven by the need to optimize checkout processes, reduce operational costs, and enhance inventory management.

Retail chains are actively adopting automation technologies such as point-of-sale terminals, self-checkout kiosks, and robotic systems to improve throughput and minimize human error. The rise of omnichannel retailing has further strengthened demand for automation, as seamless integration across digital and physical platforms requires real-time transaction and inventory synchronization.

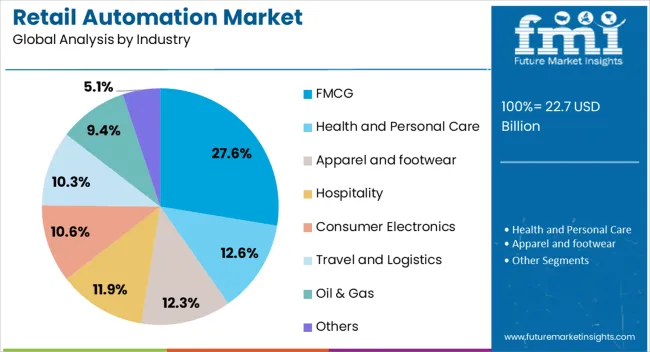

Additionally, organized retail expansion in developing economies has accelerated adoption, with store formats shifting toward standardized operations and technology-enabled customer experiences. Future growth is expected to be shaped by artificial intelligence integration, advanced payment technologies, and data-driven automation solutions that cater to the evolving needs of retailers across sectors. Segmental strength is being led by manned POS terminals, organized market formats, and the FMCG sector, reflecting both current reliance on proven technologies and the demand dynamics of high-volume consumer industries.

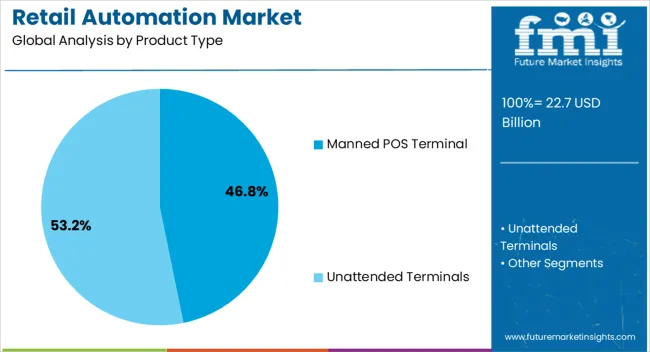

The manned POS terminal segment is projected to account for 46.8% of the retail automation market revenue in 2025, maintaining its leadership position among product categories. This dominance has been reinforced by the widespread reliance on staffed checkout systems in both large-format and mid-sized retail stores.

Retailers have favored manned POS terminals due to their reliability, ability to handle complex transactions, and integration with customer loyalty programs. Operational reports have indicated that POS terminals continue to provide stability and familiarity to both employees and customers, particularly in regions where the adoption of self-checkout systems is still in the early stages.

Moreover, advances in POS software and hardware have improved transaction speed, payment security, and compatibility with digital wallets and contactless payment solutions. The balance between human assistance and technology-driven efficiency has ensured sustained preference for manned POS systems, making them a critical component in the retail automation landscape.

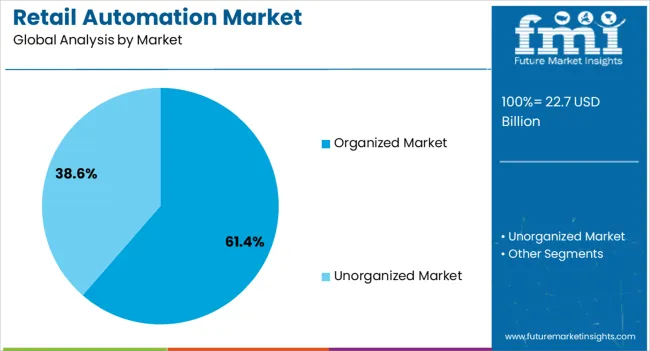

The organized market segment is projected to contribute 61.4% of the retail automation market revenue in 2025, underscoring its role as the primary driver of automation adoption. Growth in this segment has been fueled by the rapid expansion of retail chains, supermarkets, hypermarkets, and branded stores, which require standardized processes and reliable technology systems.

Industry reports and investor presentations have emphasized that organized retailers prioritize automation to streamline operations, maintain consistent service quality, and optimize supply chain integration. The structured nature of organized retail formats allows for efficient deployment of advanced solutions such as integrated POS systems, electronic shelf labeling, and automated inventory tracking.

Furthermore, consumer expectations for quick transactions and seamless shopping experiences have pushed organized retailers to invest heavily in automation. With the continuing shift from unorganized to organized retail in emerging markets, this segment is expected to sustain its market dominance.

The FMCG segment is projected to hold 27.6% of the retail automation market revenue in 2025, making it the leading industry segment. This growth has been driven by the fast-paced and high-volume nature of FMCG sales, which necessitates efficient transaction processing, real-time inventory monitoring, and rapid product replenishment.

Automation technologies have been instrumental in supporting FMCG retailers by minimizing stockouts, ensuring accurate demand forecasting, and accelerating checkout processes. Industry updates have highlighted significant investments by FMCG retailers in automation systems that improve operational efficiency while reducing overhead costs.

Additionally, the competitive nature of the FMCG sector has pushed companies to adopt solutions that enhance customer experience, such as automated loyalty program integration and faster payment options. With consumer demand for convenience and affordability remaining high, the FMCG segment is expected to continue driving strong adoption of retail automation solutions.

The lack of effective management in the retail industry significantly impacts the retail automation sector. It hampers departmental integration, leading to difficulties in managing procedures and aligning them with company goals.

Retailers face various obstacles, including improper storage design, a suboptimal product mix, inefficient warehouse space usage, evolving consumer needs, and a lack of control over channel partners.

Meeting demanding standards in e-commerce and retail logistics becomes challenging without proper management. Businesses with excellent logistics and strong management are expected to outshine competitors and dominate the market in the long run.

| Factor | Details |

|---|---|

| Cloud-based POS | Retailers typically utilize POS systems to conduct sales transactions. The bulk of businesses wants instant access to their sales data from any location, at any time, and on any device, which is why the retail automation industry is seeing an increase in the adoption of cloud-based POS systems. It simplifies the task for retailers and is anticipated to alter the future of the retail POS business. According to Forbes, the bulk of new stores choose cloud-based POS over traditional POS, and a sizable portion of established retailers are considering the transition. By 2024, a significant increase in cloud-based POS deployment is predicted for the market. The retail automation sector is anticipated to increase significantly throughout the forecast period. |

| AI Technology | The demand for retail automation is being further influenced by the increase in machine learning capabilities being incorporated into retail automation. RPA uses artificial intelligence (AI) to provide better business insights and data integrity. Additionally, the market benefits from rising urbanization, a shift in lifestyle, an increase in expenditures, and higher consumer spending. |

| Industry 4.0 | The emergence of Industry 4.0 offers lucrative chances to market participants in retail automation. The market also grows as demand for robotic process automation increases in the logistics sector. |

During the period of 2020 to 2025, the global retail automation market witnessed significant growth. Increasing adoption of automation technologies in the retail sector, driven by the need for operational efficiency and enhanced customer experience, contributed to this growth. The market value in 2020 was estimated to be around USD 22.7 billion and reached USD 16.22 billion by 2025.

Looking ahead, the forecast outlook for the period of 2025 to 2035 suggests continued growth and expansion in the global retail automation sector. Factors such as the rising demand for contactless and self-service technologies, advancements in artificial intelligence and robotics, and the increasing focus on omnichannel retailing are expected to drive market growth.

The market is projected to witness a CAGR of around 9.6% during the forecast period, reaching a value of US$ 57.2 billion by 2035. Retailers are expected to invest in automation solutions to streamline operations, reduce costs, and provide seamless customer experiences across various touch points.

Overall, the global retail automation sector has shown significant growth in recent years, and the forecast indicates continued expansion fueled by technological advancements and changing consumer preferences. Retailers are embracing automation to meet the demands of a rapidly evolving retail landscape and drive competitive advantage.

Hardware components have witnessed high demand in the retail automation sector, accounting for a significant market share of 44.2% in 2024. Within the hardware category, the point-of-sale (POS) systems have been dominant and are expected to continue their dominance in the projected period.

The demand for retail automation hardware is driven by several factors. Research and Development investments in advanced POS systems, such as those offering contactless payment options and RFID transponders, contribute to the growth.

Biometric-based POS systems provide personalized payment options, enhancing the overall customer experience. These technological advancements and customization capabilities are expected to fuel the growth of the hardware segment in the retail automation business.

Among various deployment options, the cloud segment is projected to witness the leading CAGR of 13.3% during the forecast period. This is attributed to the increasing demand for remote management capabilities, which is a key driver in the retail automation industry.

By automating retail outlets and leveraging cloud-based solutions, operators reduce maintenance costs associated with routine inspections. Real-time notifications sent and received through the cloud, enabling prompt response to issues.

Connected machines communicate with each other, facilitating automatic inventory replenishment when supplies run low. Additionally, cloud-based solutions enable dynamic route optimization and other logistical efficiencies, enhancing overall operational performance.

The adoption of cloud-based solutions in retail automation offers scalability, flexibility, and real-time data accessibility, which are critical in today's fast-paced retail environment. As a result, the cloud segment is expected to play a significant role in shaping the future of the market.

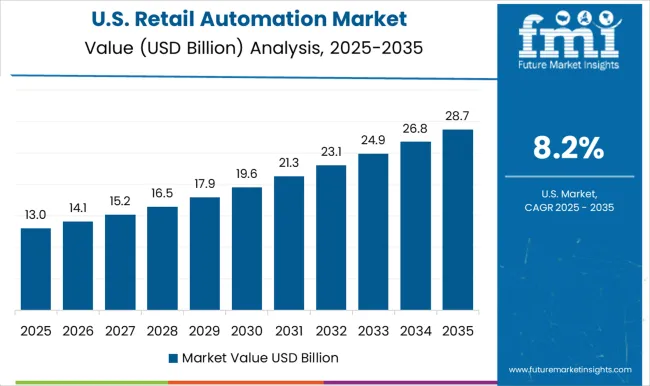

Through 2035, the market is anticipated to expand at a CAGR of over 9.9% in North America. The increased adoption of automation technology by key companies like Walmart and Amazon is anticipated to fuel the retail automation industry in the United States.

The United States is seen as a successful market for retail automation systems, which has led to a number of manufacturers moving there in an effort to attract a sizable customer base and thus obtain economies of scale.

From the loading dock to the checkout line, emerging technologies are offering a variety of ways to improve operational efficiency. Additionally, mobile checkout equipment has made it feasible to sell goods everywhere, including kiosks, pop-up shops, events, and other public spaces. As a result, the retail sector in India is about to change as new automation technologies are used.

The retail automation market in the United Kingdom is experiencing steady growth, driven by evolving consumer expectations, a focus on operational efficiency, the rise of e-commerce, and the adoption of contactless solutions.

Retailers in the United Kingdom are leveraging automation technologies to enhance efficiency, improve customer experiences, and stay competitive. With the emphasis on convenience and personalization of shopping experiences, technologies such as self-checkout systems and automated inventory management are being adopted.

The COVID-19 pandemic has further accelerated the adoption of contactless solutions. Overall, the United Kingdom retail automation business is poised for expansion as retailers embrace automation to meet evolving consumer demands and enhance operational effectiveness.

The demand for effective warehouse and inventory management systems has increased as a result of the expansion of multiple products. To address the lack of workers and rising demand, key firms in the e-commerce industry like Amazon and Walmart have started using robots. Startups still have a chance to enter the industry and make a contribution to it.

Companies that operate in the market use a variety of expansion tactics to establish themselves in attractive areas. These tactics include working with important actors, launching products, making acquisitions, forming partnerships, and improving regional and international distribution networks.

For instance:

The global retAIl automation market is estimated to be valued at USD 22.7 billion in 2025.

The market size for the retAIl automation market is projected to reach USD 57.2 billion by 2035.

The retAIl automation market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in retAIl automation market are manned POS terminal and unattended terminals.

In terms of market, organized market segment to command 61.4% share in the retAIl automation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America and Europe Retail Automation Market Analysis by Geography, Operator Type, Product, and Region through 2025 to 2035

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA