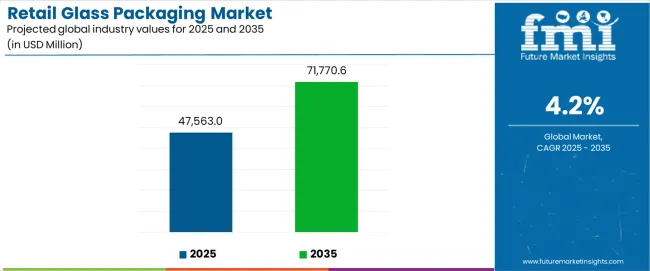

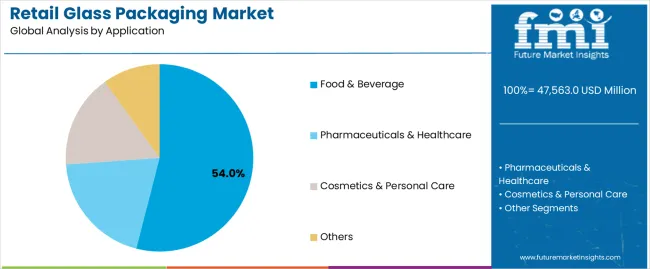

The retail glass packaging market is projected to grow from USD 47,563.0 million in 2025 to USD 71,770.6 million by 2035, registering a CAGR of 4.2%. Demand remains closely linked to premiumization in the food and beverage industry, where glass packaging functions as a critical component for product preservation, brand differentiation, and consumer appeal. The food and beverage segment continues to represent the largest application at 54.0%, supported by the growth of craft beverages, premium spirits, and a consumer preference for recyclable and inert packaging materials.

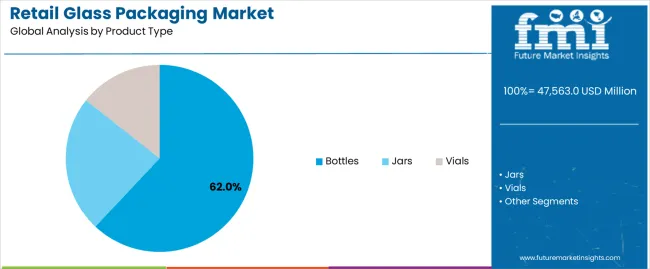

Bottles account for 62.0% of the market due to their superior barrier properties, compatibility with diverse closure systems, and established use across alcoholic and non-alcoholic beverages. The segment's dominance is further reinforced by the expansion of craft breweries and premium wineries that leverage distinctive bottle designs for brand storytelling. Advances in lightweighting technology and decorative techniques like embossing and frosting are enhancing aesthetic appeal while addressing cost and environmental concerns.

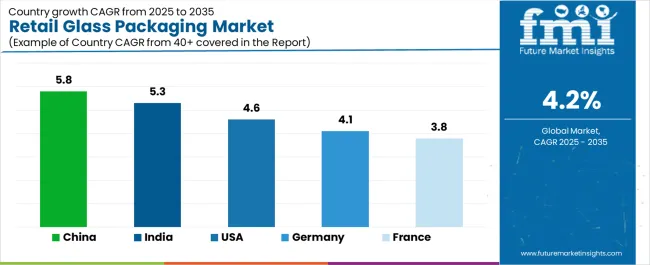

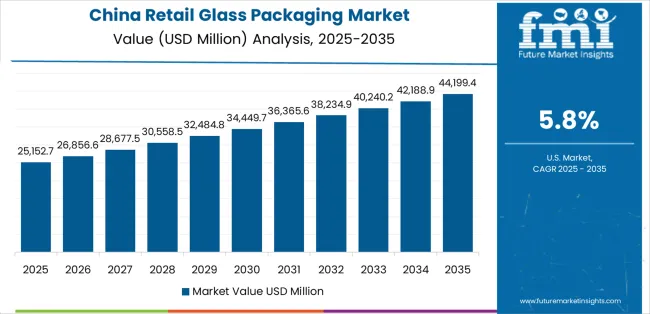

Regionally, Asia Pacific leads growth, with China (5.8% CAGR) and India (5.3% CAGR) driven by a burgeoning middle class and rapid beverage industry expansion, while more mature markets such as the United States (4.6% CAGR), Germany (4.1% CAGR), and France (3.8% CAGR) show steady demand fueled by premium product launches and strong heritage in wine and beer packaging.

The premiumization trend across food and beverage sectors significantly bolsters demand. Brands leverage glass packaging to convey quality, authenticity, and luxury, particularly in craft spirits, artisanal foods, and high-end cosmetics. The growing craft beverage industry, including craft beer, boutique wines, and premium spirits, has become a substantial demand driver. Consumers increasingly associate glass packaging with product integrity and are willing to pay premium prices for products presented in glass containers.

Innovation in lightweight glass technology presents significant opportunities, with manufacturers developing thinner yet durable glass that reduces weight without compromising strength. Smart packaging integration, incorporating QR codes and NFC technology into glass containers, opens new avenues for consumer engagement and product authentication. The expansion of e-commerce necessitates more robust packaging solutions, potentially favoring glass for premium products despite shipping considerations.

Growing markets in Asia-Pacific and Latin America, driven by rising disposable incomes and changing consumer preferences, offer substantial growth potential. Circular economy initiatives are reshaping the industry, with increased focus on closed-loop recycling systems and returnable bottle programs, while customization and aesthetic innovation continue to drive product differentiation through embossing, unique shapes, and colored glass gaining traction.

The retail glass packaging market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its premium adoption phase, expanding from USD 47,563 million to USD 58,247 million with steady annual increments averaging 4.1% growth. This period showcases the transition from standard glass containers to advanced systems with enhanced barrier capabilities and integrated brand differentiation becoming mainstream features.

The 2025 to 2030 phase adds USD 10,684 million to market value, representing 44% of total decade expansion. Market maturation factors include standardization of glass packaging protocols, declining production costs for specialty containers, and increasing brand awareness of glass packaging benefits reaching 75-80% effectiveness in retail applications. Competitive landscape evolution during this period features established manufacturers like Owens-Illinois Inc. and Ardagh Group S.A. expanding their retail packaging portfolios while new entrants focus on specialized container designs and enhanced aesthetic presentation.

From 2030 to 2035, market dynamics shift toward advanced customization and multi-format deployment, with growth accelerating from USD 58,247 million to USD 71,892 million, adding USD 13,645 million or 56% of total expansion.

This phase transition logic centers on universal glass packaging systems, integration with e-commerce platforms, and deployment across diverse retail scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic container quality to comprehensive brand experience systems and integration with supply chain optimization platforms.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 47,563 million |

| Market Forecast (2035) | USD 71,892 million |

| Growth Rate | 4.20% CAGR |

| Leading Technology | Bottles |

| Primary Application | Food & Beverage Segment |

Market expansion rests on three fundamental shifts driving adoption across beverage and food sectors.

1. Premium product positioning creates compelling competitive advantages through retail glass packaging systems that provide immediate quality perception with superior product visibility, enabling brands to enhance product value while maintaining consumer trust and justifying premium pricing.

2. Craft beverage expansion accelerates as small producers and artisanal brands worldwide seek authentic packaging materials that deliver heritage aesthetics directly to consumers, enabling premium brand experiences that align with traditional manufacturing values and consumer preference requirements.

3. Consumer perception focus drives adoption from beverage and food brands requiring superior preservation solutions that maximize product integrity while maintaining flavor protection during storage and distribution operations.

Growth faces headwinds from weight and transportation challenges that vary across distribution networks regarding logistics costs and handling requirements, potentially limiting deployment flexibility in long-distance supply chains. Production capacity considerations also persist regarding furnace investments and manufacturing scale that may increase operational complexity in markets with fluctuating demand patterns.

The retail glass packaging market represents a compelling intersection of premium packaging innovation, product preservation, and consumer perception management. With robust growth projected from USD 47,563 million in 2025 to USD 71,892 million by 2035 at a 4.20% CAGR, this market is driven by increasing premium product positioning requirements, craft beverage expansion, and consumer preference for recyclable packaging materials.

The market's expansion reflects a fundamental shift in how beverage brands and food manufacturers approach packaging infrastructure. Strong growth opportunities exist across diverse applications, from alcoholic beverage operations requiring sophisticated bottle designs to pharmaceutical facilities demanding maximum product protection and tamper-evidence features. Geographic expansion is particularly pronounced in Asia-Pacific markets, led by China (5.8% CAGR) and India (5.3% CAGR), while established markets in North America and Europe drive innovation and premium segment development.

The dominance of bottle systems and food & beverage applications underscores the importance of proven container technology and barrier excellence in driving adoption. Production cost considerations and weight challenges remain key barriers, creating opportunities for companies that can deliver premium quality while maintaining operational efficiency.

Primary Classification: The market segments by product type into bottles, jars, and vials categories, representing the evolution from basic glass containers to advanced specialized formats for comprehensive retail packaging operations.

Secondary Breakdown: Application segmentation divides the market into food & beverage, pharmaceuticals & healthcare, cosmetics & personal care, and others sectors, reflecting distinct requirements for preservation standards, barrier integration, and product protection.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with developed markets leading consumption while emerging economies show accelerating growth patterns driven by beverage industry expansion programs.

The segmentation structure reveals technology progression from standard bottle formats toward integrated multi-function containers with enhanced closure systems and decoration capabilities, while application diversity spans from beverage operations to pharmaceutical facilities requiring precise protection and regulatory compliance solutions.

Bottles segment is estimated to account for 62% of the retail glass packaging market share in 2025. The segment's leading position stems from its fundamental role as a critical component in beverage packaging applications and its extensive use across multiple drink categories. Bottles' dominance is attributed to their superior barrier properties, including oxygen protection, flavor preservation, and moisture resistance capabilities that make them indispensable for alcoholic beverages and premium soft drink operations.

Market Position: Bottle systems command the leading position in the retail glass packaging market through advanced container features, including comprehensive closure compatibility, aesthetic presentation options, and reliable shelf stability that enable brands to deploy sophisticated packaging solutions across diverse retail environments.

Value Drivers: The segment benefits from brand preference for proven premium containers that provide exceptional product visibility without requiring alternative material investments. Reliable filling processes enable deployment in wine packaging, beer bottling, and spirits applications where quality perception and product protection represent critical brand requirements.

Competitive Advantages: Bottle systems differentiate through excellent transparency, proven barrier performance, and compatibility with automated filling equipment that enhance product appeal while maintaining cost-effective operational profiles suitable for diverse beverage applications.

Key market characteristics:

Food & beverage segment is projected to hold 54% of the retail glass packaging market share in 2025. The segment's market leadership is driven by the extensive use of glass containers in alcoholic beverage packaging, soft drink applications, food preservation, and specialty product storage, where packaging serves as both a protective barrier and quality indicator. The beverage industry's consistent investment in premium packaging materials supports the segment's dominant position.

Market Context: Food & beverage applications dominate the market due to widespread adoption of glass packaging materials and increasing focus on product integrity management, flavor preservation, and premium brand positioning applications that enhance consumer perception while maintaining product quality.

Appeal Factors: Beverage brands prioritize packaging transparency, barrier properties, and integration with product preservation strategies that enable coordinated deployment across multiple distribution channels. The segment benefits from substantial production volumes and frequent product launches that emphasize premium presentation for retail and hospitality operations.

Growth Drivers: Craft beverage expansion programs incorporate glass bottles as standard packaging for artisanal products and premium collections. At the same time, retail industry initiatives are increasing demand for authentic containers that comply with food safety standards and enhance consumer confidence.

Market Challenges: Weight considerations and transportation costs may limit deployment flexibility in remote distribution scenarios or lightweight application requirements.

Application dynamics include:

Growth Accelerators: Craft beverage expansion drives primary adoption as retail glass packaging systems provide exceptional authenticity capabilities that enable product differentiation without alternative material costs, supporting brand heritage and consumer loyalty that require traditional packaging experiences.

Premium product positioning accelerates market expansion as specialty food and beverage brands seek quality packaging solutions that communicate superior product standards while enhancing consumer perception through transparent material presentation. Consumer preference increases worldwide, creating sustained demand for recyclable packaging systems that complement premium products and provide competitive advantages in quality-conscious retail environments.

Growth Inhibitors: Weight and logistics challenges vary across distribution networks regarding transportation investments and handling requirements, which may limit market penetration and operational efficiency in long-distance scenarios with moderate freight optimization.

Production capacity constraints persist regarding furnace operations and manufacturing scale that may increase lead times in custom applications with demanding production standards. Market competition from alternative packaging formats creates material substitution concerns between different container technologies and existing beverage filling infrastructure.

Market Evolution Patterns: Adoption accelerates in wine and spirits sectors where glass presentation justifies material costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by beverage industry growth and premium product expansion.

Technology development focuses on lightweight container engineering, improved decoration capabilities, and integration with automated filling platforms that optimize production efficiency and brand differentiation. The market could face disruption if alternative barrier materials or packaging innovations significantly challenge glass advantages in beverage applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.8% |

| India | 5.3% |

| USA | 4.6% |

| Germany | 4.1% |

| France | 3.8% |

The retail glass packaging market demonstrates varied regional dynamics with Growth Leaders including China (5.8% CAGR) and India (5.3% CAGR) driving expansion through beverage industry growth and consumer market development. Steady Performers encompass the US. (4.6% CAGR), Germany (4.1% CAGR), and France (3.8% CAGR), benefiting from established beverage sectors and premium packaging adoption.

Regional synthesis reveals Asia-Pacific markets leading growth through beverage industry expansion and consumer market development, while European countries maintain steady expansion supported by wine heritage and beer tradition requirements. North American markets show strong growth driven by craft beverage applications and premium product launches.

China establishes regional leadership through explosive beverage consumption expansion and comprehensive manufacturing capacity development, integrating advanced retail glass packaging systems as standard components in alcoholic beverage and premium soft drink applications. The country's 5.8% CAGR through 2035 reflects government initiatives promoting domestic consumption and beverage quality standards that mandate the use of premium packaging systems in commercial beverage operations.

Growth concentrates in major production centers, including Shandong, Hebei, and Guangdong provinces, where glass manufacturing facilities showcase integrated bottle production systems that appeal to domestic brands seeking quality containers and international standard compliance.

Chinese manufacturers are developing innovative glass packaging solutions that combine cost-effective production with quality specifications, including lightweight bottle technologies and advanced decoration capabilities.

Strategic Market Indicators:

The Indian market emphasizes alcoholic beverage applications, including rapid beer industry development and comprehensive spirits sector growth that increasingly incorporates glass bottles for premium product presentation and consumer appeal applications. The country is projected to show a 5.3% CAGR through 2035, driven by massive middle-class expansion under economic development programs and commercial demand for quality, authentic packaging systems. Indian beverage facilities prioritize material reliability with glass bottles delivering product protection through proven barrier capabilities and traditional format compatibility.

Technology deployment channels include major beverage manufacturers, regional glass producers, and brand procurement programs that support localized production for retail applications.

Performance Metrics:

The USA market emphasizes advanced glass packaging features, including innovative bottle designs and integration with comprehensive craft beverage platforms that manage product differentiation, brand storytelling, and consumer engagement applications through unified container systems.

The country is projected to show a 4.6% CAGR through 2035, driven by craft beverage expansion under artisanal production programs and commercial demand for distinctive, authentic packaging systems. American beverage brands prioritize product authenticity with glass bottles delivering exceptional transparency through proven material quality and heritage format associations.

Technology deployment channels include major glass manufacturers, specialized container suppliers, and brand procurement programs that support custom development for premium beverage operations.

Performance Metrics:

In Bavaria, North Rhine-Westphalia, and Baden-Württemberg, German breweries and beverage producers are implementing advanced glass bottle systems to enhance product protection capabilities and support heritage positioning that aligns with traditional brewing requirements and quality protocols. The German market demonstrates sustained growth with a 4.1% CAGR through 2035, driven by beer industry modernization programs and premium packaging investments that emphasize proven container systems for pilsner and specialty beer applications.

German beverage facilities are prioritizing glass bottle systems that provide exceptional barrier properties while maintaining compliance with purity standards and minimizing product quality inconsistencies, particularly important in heritage brewing and premium beverage operations.

Market expansion benefits from beverage excellence programs that mandate quality packaging in product specifications, creating sustained demand across Germany's beer and soft drink sectors, where container integrity and material purity represent critical requirements.

Strategic Market Indicators:

France's sophisticated wine market demonstrates meticulous bottle deployment, growing at 3.8% CAGR, with documented operational excellence in wine packaging and spirits applications through integration with existing bottling systems and appellation infrastructure. The country leverages wine-making expertise in quality standards and regional authenticity to maintain market leadership.

Wine regions, including Bordeaux, Burgundy, and Champagne, showcase premium installations where glass bottle systems integrate with comprehensive estate platforms and inventory management systems to optimize product presentation and brand heritage.

French wine producers prioritize bottle tradition and regional authenticity in packaging material development, creating demand for classic glass bottle systems with advanced features, including premium closures and integration with wine aging protocols. The market benefits from established wine infrastructure and willingness to invest in quality packaging technologies that provide superior product protection and appellation compliance.

Market Intelligence Brief:

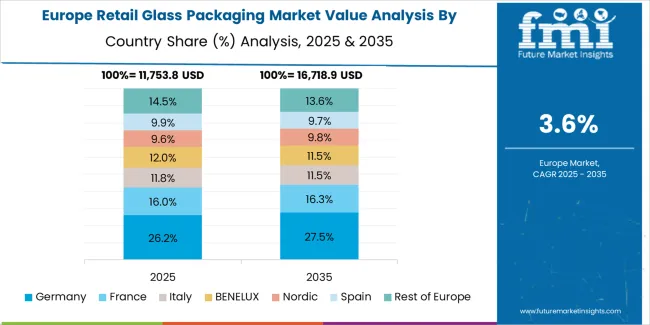

The retail glass packaging market in Europe is projected to grow from USD 14,687 million in 2025 to USD 21,543 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, declining slightly to 28.1% by 2035, supported by its beer industry heritage and major beverage production centers, including Bavaria and North Rhine-Westphalia.

France follows with a 24.6% share in 2025, projected to reach 24.8% by 2035, driven by comprehensive wine production and spirits packaging initiatives. Italy holds a 19.7% share in 2025, expected to maintain 19.9% by 2035 through established wine regions and beverage manufacturing sectors.

The United Kingdom commands a 14.2% share, while Spain accounts for 9.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.3% to 3.7% by 2035, attributed to increasing beverage adoption in Nordic countries and emerging Eastern European glass manufacturing facilities implementing modern production programs.

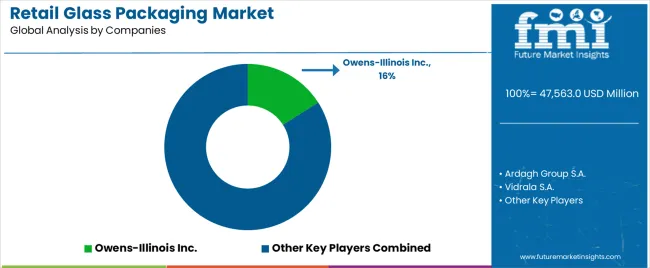

The retail glass packaging market features 10–15 players with moderate concentration, where the top three companies collectively hold around 48–55% of global market share, supported by large-scale furnace capacity, strong relationships with beverage, cosmetics, and food brands, and long-established distribution networks. The leading company, Owens-Illinois Inc., commands 16% of the market share, driven by its extensive global footprint, advanced glass-forming technologies, and strong sustainability programs aligned with growing consumer demand for recyclable packaging. Competition centers on glass quality, lightweighting, design customization, and supply reliability rather than price alone.

Market leaders such as Owens-Illinois Inc., Ardagh Group S.A., and Verallia maintain their dominance by offering high-performance glass packaging solutions tailored to premium beverages, sauces, condiments, and beauty products. These companies differentiate through innovative bottle designs, recycled glass integration, and strong regional manufacturing networks that support just-in-time delivery for brand owners.

Challenger companies including Vidrala S.A., Gerresheimer AG, and Vetropack Holding Ltd focus on specialized segments such as pharmaceuticals, cosmetics, and regional food and beverage brands. They emphasize product quality, flexibility in batch sizes, and strong customer partnerships.

Additional competition arises from Nihon Yamamura Glass Co., Ltd., Bormioli Rocco S.p.A., Consol Glass (Pty) Ltd, and Piramal Glass Limited, which strengthen their positions through regional production strength, cost-effective solutions, and strong design capabilities for local and multinational brands.

| Item | Value |

|---|---|

| Quantitative Units | USD 47,563 million |

| Product Type | Bottles, Jars, Vials |

| Application | Food & Beverage, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Germany, France, China, India, and 25+ additional countries |

| Key Companies Profiled | Owens-Illinois Inc., Ardagh Group S.A., Verallia, Vidrala S.A., Gerresheimer AG, Vetropack Holding Ltd, Nihon Yamamura Glass Co., Ltd., Bormioli Rocco S.p.A., Consol Glass (Pty) Ltd, and Piramal Glass Limited |

| Additional Attributes | Dollar sales by product type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with glass manufacturers and specialty suppliers, brand preferences for container design and barrier excellence, integration with beverage filling lines and retail systems, innovations in lightweight technology and decoration capabilities, and development of premium container solutions with enhanced preservation and presentation features |

The global retail glass packaging market is estimated to be valued at USD 47,563.0 million in 2025.

The market size for the retail glass packaging market is projected to reach USD 71,770.6 million by 2035.

The retail glass packaging market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in retail glass packaging market are bottles, jars and vials.

In terms of application, food & beverage segment to command 54.0% share in the retail glass packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Glass Packaging Companies

GCC Retail Glass Packaging Market Insights – Growth & Forecast 2023-2033

Market Share Breakdown of GCC Retail Glass Packaging Manufacturers

Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA