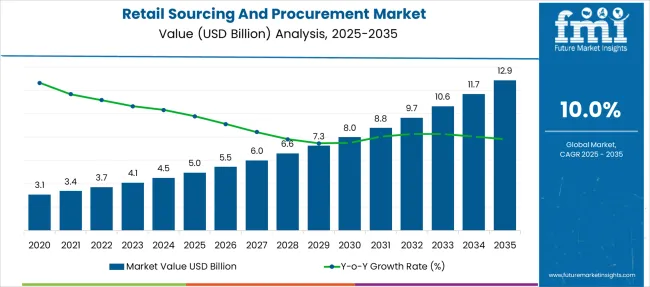

The Retail Sourcing And Procurement Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 12.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. Historical data indicates steady expansion from USD 3.1 billion in 2020 to USD 4.5 billion in 2024, before accelerating sharply post-2025. Between 2025 and 2030, the market advances from USD 5.0 billion to 8.0 billion, contributing USD 3.0 billion, supported by increasing reliance on AI-based procurement platforms and blockchain integration for supplier transparency. From 2030 to 2035, growth intensifies with a jump from USD 8.0 billion to 12.9 billion, accounting for 60% of total incremental gains, driven by predictive analytics and automation in sourcing workflows.

The year-on-year growth rate, as per the image, declines gradually from above 10% in early years to around 7-8% by 2029, stabilizing thereafter as digital procurement adoption matures. Key demand drivers include cost optimization, risk reduction in supply chains, and compliance-focused frameworks, making sourcing solutions critical for competitive retail operations. Players investing in end-to-end cloud-based procurement systems, advanced negotiation tools, and supplier performance analytics are positioned to capture substantial value as global retail networks expand their digital sourcing ecosystems.

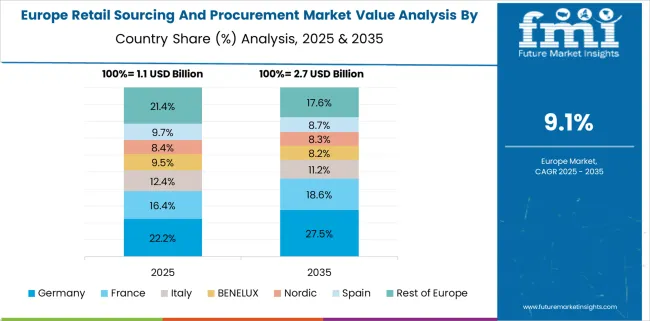

The retail sourcing and procurement market exhibits a notable regional growth imbalance driven by disparities in digital maturity, infrastructure readiness, and regulatory environments. North America is expected to dominate early adoption due to well-established retail ecosystems and heavy investment in AI-driven procurement platforms, accounting for a significant share of market revenue through 2030. Europe follows closely, propelled by strict compliance mandates and sustainability-linked sourcing strategies, favoring integrated procurement systems. In contrast, Asia-Pacific is projected to deliver the fastest growth rate, particularly post-2030, as emerging economies like India and Southeast Asian nations scale e-commerce and omnichannel retail operations, demanding agile procurement networks.

Latin America and the Middle East & Africa present a slower initial adoption curve due to limited digital penetration and higher dependency on traditional procurement processes. However, these regions are likely to experience rapid catch-up growth after 2032, supported by retail modernization and government-driven digital trade policies. The imbalance highlights a two-speed market, mature regions driving early revenue streams, while developing areas generate a substantial share of incremental growth later in the forecast horizon. Vendors with region-specific strategies, localized compliance frameworks, and scalable cloud platforms will benefit from bridging this adoption gap and capturing diverse growth opportunities globally.

| Metric | Value |

|---|---|

| Retail Sourcing And Procurement Market Estimated Value in (2025E) | USD 5.0 billion |

| Retail Sourcing And Procurement Market Forecast Value in (2035F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The retail sourcing and procurement market is witnessing accelerated growth, driven by heightened supply chain complexities, demand volatility, and the retail sector’s shift toward agile, data-driven decision-making. The push for cost optimization, better supplier collaboration, and faster time-to-market is encouraging the adoption of digital sourcing platforms.

Ongoing disruptions across global logistics and heightened scrutiny over ESG compliance are reinforcing the need for more transparent and automated procurement ecosystems. Retailers are leveraging procurement tools for strategic sourcing, contract management, and real-time supplier analytics to mitigate risk and ensure inventory continuity.

Advancements in AI, robotic process automation (RPA), and integration with ERP and POS systems are further modernizing procurement processes. Future growth is expected to be supported by increased investment in cloud-native platforms, sustainability-linked supplier scorecards, and multi-enterprise collaboration networks.

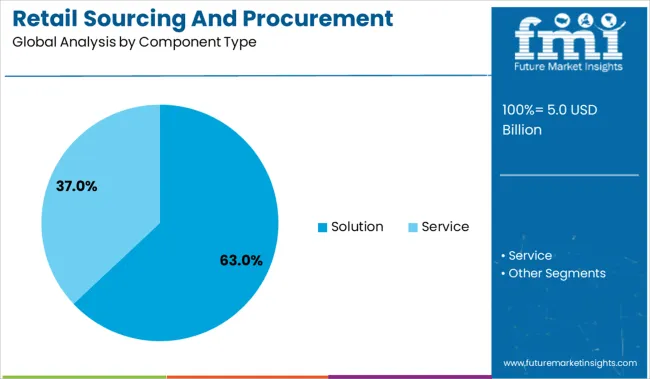

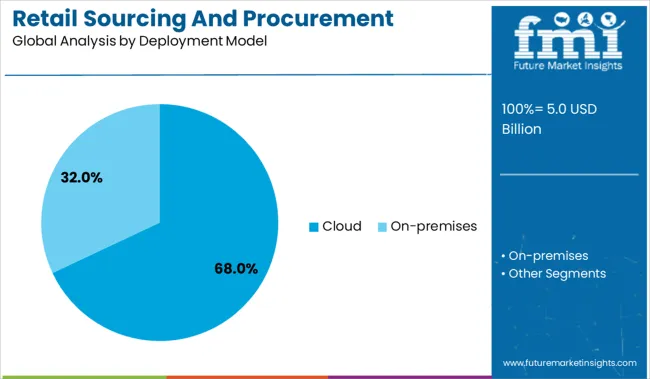

The retail sourcing and procurement market is segmented by component type, deployment model, and region. By component type, it includes solutions such as strategic sourcing, supplier management, contract management, spend analysis, and others, along with services covering implementation, consulting, and support and maintenance. In terms of deployment model, the segmentation comprises cloud-based and on-premises solutions, catering to different organizational infrastructure needs. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The solution segment is projected to account for 63.0% of the total revenue share in 2025, making it the leading component in the retail sourcing and procurement market. This dominance is being attributed to the rapid digitalization of procurement functions, where software solutions offer end-to-end visibility, analytics, and automation.

Solutions provide retailers with modular capabilities including spend analysis, e-sourcing, contract lifecycle management, and supplier performance evaluation. The demand for real-time procurement intelligence and predictive analytics has driven significant investments in advanced platforms that can integrate with legacy retail systems.

Moreover, retailers are increasingly prioritizing solutions that support compliance tracking and supplier risk scoring, particularly in global sourcing environments. The growing need to streamline procurement workflows and reduce manual intervention continues to reinforce preference for solution-based offerings over standalone services.

Cloud-based deployment is expected to dominate the market with a 68.0% revenue share in 2025. This growth is being driven by retailers’ focus on scalability, lower infrastructure costs, and the ability to access procurement tools across distributed teams. Cloud platforms offer faster implementation cycles and regular software updates, aligning with the dynamic requirements of the retail sector.

With the rise of hybrid and remote work models, cloud deployment ensures uninterrupted access to procurement dashboards, supplier networks, and contract repositories. Enhanced data security frameworks, API integrations, and multi-tenant architecture have further increased trust in cloud-based models.

Retailers are also benefiting from AI and ML capabilities embedded in cloud-native procurement suites, enabling them to automate sourcing strategies, detect fraud, and optimize supplier selection with minimal IT dependency. The flexibility and cost-efficiency offered by cloud platforms continue to make them the deployment model of choice for sourcing and procurement modernization.

Retail sourcing and procurement platforms are being enhanced through digital transformation, real-time supplier management, and AI-driven spend analytics. Integration of e-invoicing, vendor scorecards, and contract management tools has elevated transparency and cost control. Adoption is strongest in fast-moving consumer goods, apparel, and grocery sectors, where agility and supplier compliance are critical. Cloud-based systems with mobile access, automated purchase orders, and supplier collaboration portals are enabling retailers to streamline on boarding, reduce maverick spend, and improve inventory turnover across multi-channel networks.

Retailers are adopting sourcing and procurement systems to gain centralized oversight of supplier performance, contract terms, and spend patterns. AI-powered analytics are being used to identify cost-saving opportunities, demand forecasts, and compliance risks. Automation of PO creation, invoice reconciliation, and payment workflows is reducing manual errors and accelerating cycle times. Vendor portals are enabling real-time collaboration on lead times, quality issues, and delivery updates, improving responsiveness. The need for multi-tier supplier traceability, especially for ethical sourcing and regulatory compliance, has reinforced investment. Platforms offering integration with ERP, inventory management, and supplier financing modules are being favored for their end-to-end process alignment. These capabilities have positioned procurement software as a strategic enabler of margin improvement and operational agility.

Complexity arises when retailers attempt to integrate data from disparate supplier systems, catalogs, and compliance databases. Inconsistent master data and non-standardized item definitions reduce the accuracy of spend analysis and impede automation. Smaller suppliers often lack digital readiness, leading to ill-timed invoices, manual confirmations, and delayed onboarding. Customization requirements to align procurement systems with existing ERP landscapes increase implementation costs and timelines. Data security concerns over sensitive pricing and contract information have hindered adoption in collaborative supplier networks. Regulatory requirements around country-of-origin documentation and supplier certifications further complicate data gathering. As retailers seek tight integration of sourcing and inventory signals, variability in supplier responsiveness and digital maturity remains a major constraint.

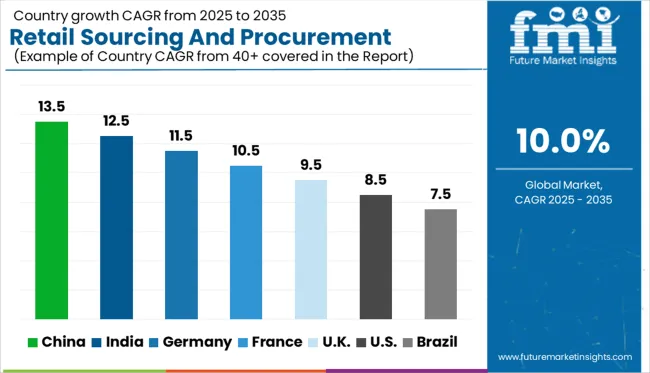

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global retail sourcing and procurement market is projected to grow at a 12% CAGR from 2025 to 2035, supported by AI-driven vendor selection, digital contract management, and compliance-led sourcing strategies. China leads with 13.5%, fueled by e-commerce expansion and blockchain adoption for traceability in export-driven retail chains. India follows at 12.5%, driven by organized retail procurement and integration of automated purchase order systems across FMCG and grocery segments. Germany grows at 11.5%, emphasizing category-specific sourcing and EU-compliant procurement standards. France records 10.5%, focusing on luxury retail and omnichannel procurement platforms. The United Kingdom, at 9.5%, invests in cloud-native sourcing tools aligned with post-Brexit trade frameworks. The report includes an analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 13.5% CAGR, driven by the rapid digitization of procurement processes and strong adoption of AI-powered supplier evaluation tools. Large retail chains are implementing predictive sourcing models to manage high-volume e-commerce and omnichannel purchases. Blockchain-based traceability systems are deployed to ensure food safety and cross-border compliance. Strategic alliances between retail enterprises and technology providers are creating integrated procurement ecosystems with real-time vendor risk monitoring. SaaS platforms dominate, offering centralized contract lifecycle management and interoperability for export-oriented supply chains. Government-led digital trade initiatives further accelerate platform integration and data standardization.

India is expected to expand at a 12.5% CAGR, supported by organized retail growth and widespread adoption of cloud-based procurement platforms. Large retail players are using integrated sourcing solutions for multi-location vendor onboarding and automated purchase order cycles. Mobile-first procurement applications are gaining popularity among small and mid-tier retailers, enabling real-time bidding and dynamic pricing capabilities. The launch of ONDC (Open Network for Digital Commerce) is driving interoperability and standardization across FMCG and grocery supply chains. Retailers are investing heavily in analytics-driven demand forecasting to minimize stockouts, improve inventory planning, and optimize procurement cycles for faster fulfillment.

Germany is expected to record an 11.5% CAGR, anchored in strict EU sourcing regulations and advanced procurement automation. Retailers are integrating AI-powered compliance modules for supplier audits and sustainability certifications under EU green directives. Omnichannel retail expansion has increased adoption of category-specific sourcing tools for apparel, food, and consumer electronics. Procurement software providers are embedding predictive analytics to manage inventory volatility in seasonal and promotional cycles. Large retail enterprises are consolidating vendor contracts through centralized procurement hubs that align with ISO and GDPR data security frameworks. Germany emphasizes high-quality supplier verification and transparent sourcing processes for risk mitigation in retail procurement.

France is projected to grow at a 10.5% CAGR, driven by procurement digitization in luxury retail, food distribution, and pharmacy chains. Retailers are adopting SaaS-based platforms for multi-tier supplier collaboration and category-specific sourcing workflows. Blockchain is being piloted to authenticate origin claims in wine and premium goods procurement. Retail groups are embedding dynamic bidding engines into procurement systems for cost efficiency in promotional planning. Integration of e-signature and digital documentation is accelerating procurement cycle times for large distributors. French retailers prioritize supplier diversity and traceability while maintaining compliance with EU consumer safety directives, which influences software feature requirements for sourcing automation.

The United Kingdom is forecast to grow at a 9.5% CAGR, supported by the shift toward omnichannel retail and post-Brexit trade complexities. Retailers are investing in procurement platforms integrated with customs compliance modules to manage cross-border sourcing challenges. Cloud-native solutions are gaining traction among large retailers for centralized vendor negotiations and contract lifecycle automation. Advanced analytics and AI-driven negotiation tools are being deployed to optimize sourcing costs in high-margin categories such as electronics and apparel. Supplier risk assessment platforms integrated with ESG scoring are influencing vendor selection strategies. UK retail procurement reflects a focus on operational resilience and compliance optimization across multiple trade routes.

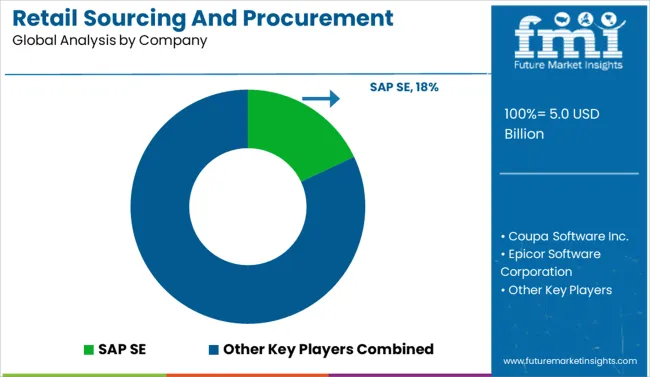

The retail sourcing and procurement market is dominated by SAP SE, which holds the leading position due to its deep integration with SAP ERP and Ariba networks, enabling end-to-end procurement and supplier collaboration. Oracle and Coupa Software follow closely, leveraging cloud-native platforms and AI-driven analytics to enhance spend visibility and supplier engagement. Coupa, now under Thoma Bravo ownership, emphasizes predictive intelligence and machine-learning insights to deliver real-time decision-making capabilities.

Other major players such as GEP Smart, IBM, Infor, Ivalua, Jaggaer, Epicor, and Zycus are strengthening their market presence by offering modular procurement solutions that include strategic sourcing, category management, contract lifecycle management, and procure-to-pay automation. These platforms are increasingly incorporating advanced features like supplier risk assessment, ESG compliance tracking, and predictive analytics to align with enterprise sustainability and governance requirements. Competition in the market is largely defined by cloud scalability, API interoperability, AI-based decision intelligence, and integration with ERP and TMS systems. Vendors are prioritizing innovation in blockchain-enabled traceability, real-time analytics, and AI-powered sourcing optimization, which are becoming critical differentiators in large-scale retail procurement ecosystems.

In May 2025, at its annual Inspire conference, Coupa acquired Croatia-based Cirtuo, an AI-powered category management platform, bolstering its total spend management suite with advanced strategic sourcing tools.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Component Type | Solution, Strategic sourcing, Supplier management, Contract management, Spend analysis, Others, Service, Implementation, Consulting, and Support and maintenance |

| Deployment Model | Cloud and On-premises |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SAP SE, Coupa Software Inc., Epicor Software Corporation, GEP Smart, IBM Corporation, Infor Inc., Ivalua Inc., Jaggaer (formerly SciQuest), Oracle Corporation, and Zycus Inc. |

| Additional Attributes | Dollar sales in the retail sourcing and procurement market are segmented by solution type including strategic sourcing, supplier management, contract management, procure-to-pay, and spend analysis, with strategic sourcing leading in adoption. Demand is rising for AI-driven analytics, blockchain-based contract management, and cloud-enabled procurement platforms. Key sectors such as apparel, electronics, and grocery retail are driving uptake. Major players including SAP, Oracle, Coupa, and GEP are enhancing their offerings with automation capabilities, sustainability-focused features, and advanced supplier collaboration tools. North America and Europe continue to lead adoption, fueled by digital transformation initiatives and stringent regulatory compliance requirements. |

The global retail sourcing and procurement market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the retail sourcing and procurement market is projected to reach USD 12.9 billion by 2035.

The retail sourcing and procurement market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in retail sourcing and procurement market are solution, strategic sourcing, supplier management, contract management, spend analysis, others, service, implementation, consulting and support and maintenance.

In terms of deployment model, cloud segment to command 68.0% share in the retail sourcing and procurement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Examining Market Share Trends in the Retail Paper Bag Industry

Market Share Distribution Among Retail Glass Packaging Companies

Market Share Distribution Among Retail Vending Machine Suppliers

India Retail Mineral Turpentine Oil Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA