The retail vending machine market is undergoing a dynamic shift, with leading Brands like Fuji Electric, Azkoyen Group, and Crane Merchandising Systems setting the pace. They lead the industry by offering the most advanced, energy-saving units, and highly individual solutions integrating urban consumers’ needs. fTheir paramount interest is the incorporation of IoT, AI, and cashless payment technologies that have piloted the market’s rise.

This sector’s expansion, projected to reach USD 45,592 million by 2035 with a CAGR of 9.8%, is driven by Brands’ ability to address key consumer needs-convenience, speed, and variety. Urbanization and increased disposable incomes have amplified the demand for unattended retail solutions, and top players are racing to expand their footprints in key regions.

| Metric | Value |

|---|---|

| Market Size, 2035 | USD 45,592 million |

| CAGR (2025 to 2035) | 9.8% |

The competitive advantage goes to companies that give priority to innovation, green practices, and flexibility. As they are changing the perception of the retail chain, the trailblazers in the industry are sure to capture a notable percentage of the phenomenal expansion.

Retail vending machine passed at a great speed, using smart technology to fulfill instant access and personalized shopping expectations of the consumers. Retailers employ vending machines as a tool for cheap self-extending distributions, sending the market growth. Increasing tendency towards cashless and contactless payments is also among the driving forces of adoption.

Global Brand Share & Industry Share (%):

| Category | Industry Share (%) |

|---|---|

| Top 3 (Fuji Electric, Azkoyen Group, Crane Merchandising Systems) | 30% |

| Rest of Top 5 (Sanden, Selecta Group) | 20% |

| Next 5 of Top 10 (Royal Brands, Jofemar, Westomatic, others) | 15% |

Type of Player & Industry Share (%):

| Type of Player | Industry Share (%) |

|---|---|

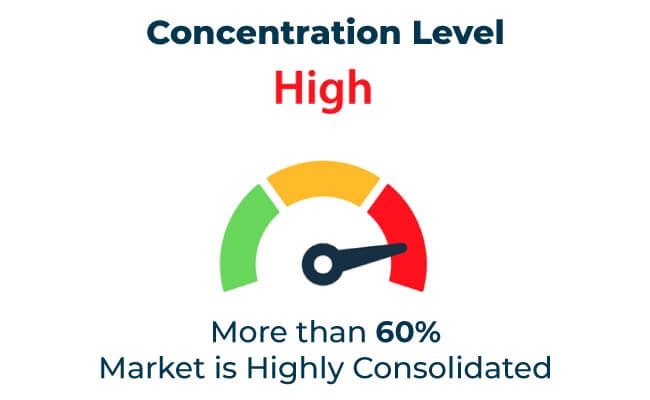

| Top 10 | 65% |

| Top 20 | 25% |

| Rest | 10% |

Year-over-Year Leaders:

Smart Payment Solutions:

IoT and Cloud Connectivity:

AI-Powered Personalization:

Energy Efficiency Innovations:

Eco-Friendly Designs:

Waste Reduction Initiatives:

Sustainable Partnerships:

On-the-Go Lifestyles:

Health-Conscious Choices:

Premium and Niche Offerings:

The retail vending machine market will grow through technological innovation, sustainable manufacturing, and regional expansion. Companies investing in AI integration, renewable energy solutions, and strategic partnerships will dominate the market. Emerging trends such as robotic dispensing and voice-activated machines will further revolutionize this sector.

Revenue and Share by Brand

Market leaders such as Fuji Electric and Azkoyen Group leverage strong distribution networks, scalable production, and cutting-edge technologies to maintain competitive advantages.

Figures/Visuals

| Brand | Fuji Electric |

|---|---|

| Market Contribution (%) | 12% |

| Key Initiatives | Introduced energy-efficient, solar-powered machines |

| Brand | Azkoyen Group |

|---|---|

| Market Contribution (%) | 10% |

| Key Initiatives | Expanded modular solutions for diverse product categories |

| Brand | Crane Merchandising Systems |

|---|---|

| Market Contribution (%) | 8% |

| Key Initiatives | Focused on IoT-enabled systems for real-time management |

Scope of Market Definition

The retail vending machine market includes automated dispensing systems for food, beverages, electronics, and other consumer products. This analysis excludes ATMs, ticketing machines, and other non-retail vending equipment.

Key Terms and Terminology

The primary research involved a combination of primary interviews, secondary data analysis, and industry-specific modelling. The data was cross-validated with market experts and industry stakeholders to validate the accuracy and relevance of the data.

The global retail vending machine market will grow at a CAGR of 9.8% between 2025 and 2035.

The global retail vending machine market will reach USD 45,592 million by 2035.

The top 10 players account for over 49% of the global market.

Key manufacturers include Fuji Electric, Azkoyen Group, Crane Merchandising Systems, Sanden, and Selecta Group among others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Automation Market Size and Share Forecast Outlook 2025 to 2035

Retail Clinics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Displays Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Retail Sourcing And Procurement Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Retail Analytics Market Analysis by Solution, Function, Enterprise Size, Deployment Model, Field Crowdsourcing, and Region Through 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Retail Signage Market

Retail Digital Signage Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA