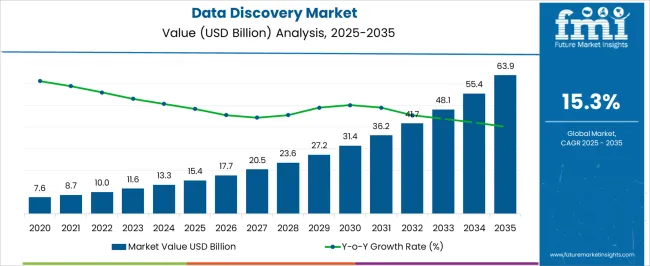

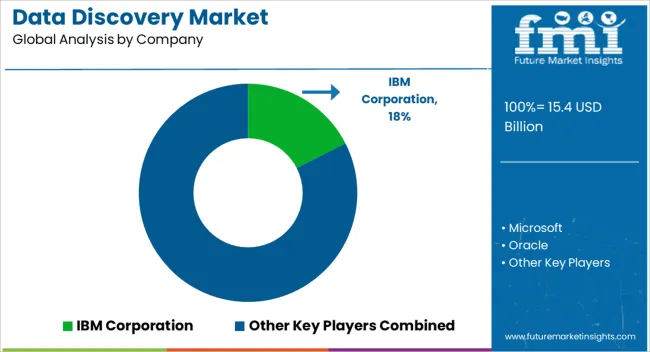

The Data Discovery Market is estimated to be valued at USD 15.4 billion in 2025 and is projected to reach USD 63.9 billion by 2035, registering a compound annual growth rate (CAGR) of 15.3% over the forecast period.

| Metric | Value |

|---|---|

| Data Discovery Market Estimated Value in (2025 E) | USD 15.4 billion |

| Data Discovery Market Forecast Value in (2035 F) | USD 63.9 billion |

| Forecast CAGR (2025 to 2035) | 15.3% |

The Data Discovery market is experiencing robust growth, driven by the increasing need for organizations to transform raw data into actionable insights to enhance decision-making and operational efficiency. Rising adoption of self-service analytics and business intelligence platforms is enabling users across various industries to explore, visualize, and analyze large datasets without relying on IT teams. Advanced analytics, machine learning, and AI integration are further strengthening capabilities, allowing for predictive and prescriptive insights.

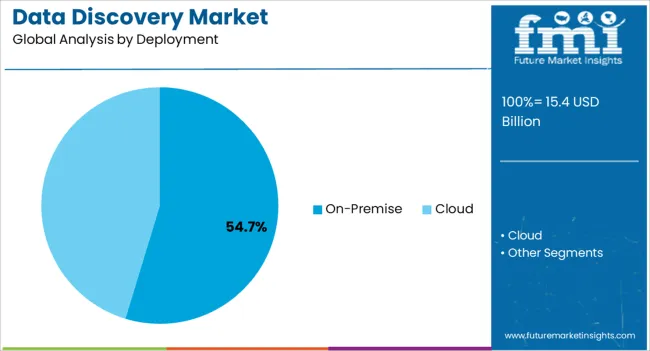

On-premise and cloud deployments are being leveraged to meet diverse organizational requirements, including security, compliance, and scalability. Increasing demand from BFSI, retail, healthcare, and other data-intensive sectors is supporting market expansion. Regulatory compliance and governance requirements are also encouraging adoption, as organizations seek to maintain accurate, auditable, and secure data analysis practices.

As enterprises increasingly embrace digital transformation initiatives, investments in data discovery tools are expected to grow Continuous innovation in interactive dashboards, intuitive visualization, and real-time analytics is shaping the market landscape and positioning it for sustained growth over the coming decade.

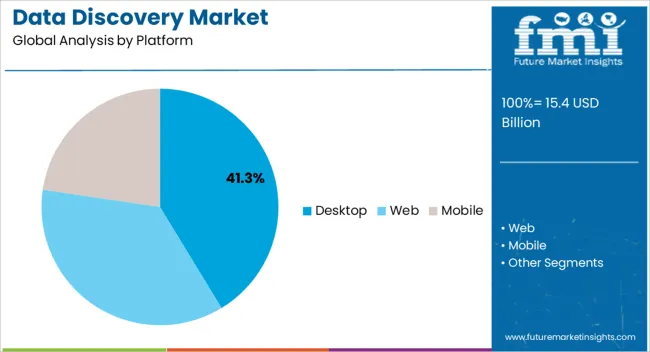

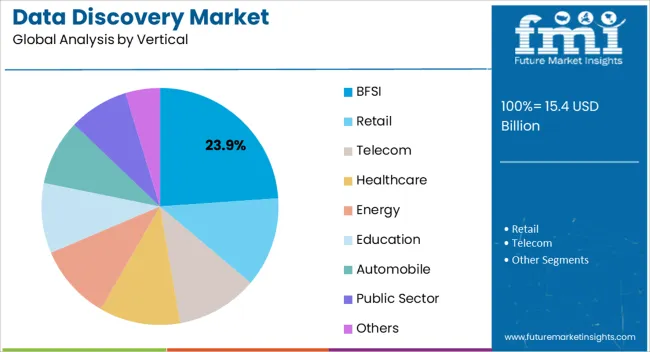

The data discovery market is segmented by platform, deployment, vertical, and geographic regions. By platform, data discovery market is divided into Desktop, Web, and Mobile. In terms of deployment, data discovery market is classified into On-Premise and Cloud. Based on vertical, data discovery market is segmented into BFSI, Retail, Telecom, Healthcare, Energy, Education, Automobile, Public Sector, and Others. Regionally, the data discovery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The desktop platform segment is projected to hold 41.3% of the Data Discovery market revenue in 2025, establishing it as the leading platform type. Growth in this segment is driven by its ease of use, comprehensive functionality, and ability to handle complex analytics on local systems. Desktop platforms provide robust capabilities for data integration, transformation, and visualization, which enhance operational efficiency for business analysts and decision-makers.

Organizations are leveraging these platforms to perform in-depth analytics, build predictive models, and generate insights without relying heavily on IT teams. The ability to work offline, maintain data security, and access high-performance computational resources further reinforces adoption.

Continuous enhancements in user-friendly interfaces, customizable dashboards, and advanced analytics functionalities are strengthening the segment The desktop platform’s reliability and flexibility in addressing diverse analytics requirements position it to maintain market leadership, supported by increasing enterprise demand for self-service and high-performance data discovery solutions across multiple industries.

The on-premise deployment segment is expected to account for 54.7% of the market revenue in 2025, making it the leading deployment category. Growth is being driven by organizations’ increasing focus on data security, regulatory compliance, and control over critical business information. On-premise deployment allows enterprises to manage sensitive data within their own IT infrastructure, reducing risk exposure and ensuring compliance with data governance regulations.

The ability to customize, scale, and integrate solutions with existing systems enhances operational efficiency. This deployment model is particularly preferred in sectors such as BFSI, healthcare, and government, where data confidentiality and auditability are paramount.

Enterprises are increasingly seeking high-performance analytics capabilities that can be tailored to organizational requirements, making on-premise solutions appealing As businesses continue to balance scalability, control, and compliance, on-premise deployment is expected to remain a primary driver of market growth, supported by robust infrastructure and evolving enterprise analytics needs.

The BFSI vertical is projected to hold 23.9% of the market revenue in 2025, establishing it as the leading end-use industry for data discovery solutions. Growth in this vertical is being driven by the sector’s increasing reliance on data analytics for risk assessment, fraud detection, customer behavior analysis, and regulatory compliance.

Financial institutions are leveraging advanced data discovery tools to process large volumes of structured and unstructured data, enabling faster decision-making and improved operational efficiency. AI-powered predictive analytics and real-time reporting are being integrated to support credit risk evaluation, investment decisions, and marketing strategies.

The increasing demand for accurate insights and compliance with stringent regulations, such as data privacy and anti-money laundering directives, is further accelerating adoption As banks, insurance companies, and financial service providers continue to prioritize data-driven strategies, the BFSI vertical is expected to maintain its leading position, supported by continuous innovation in analytics technologies, enhanced visualization capabilities, and integration with enterprise systems for seamless decision support.

During the last decade, Technologies have evolved rapidly and huge volume of data about the customers is collected daily which can be transformed to useful information by using correct set of data discovery tools. The data discovery tools are a subsidiary of the business intelligence tools, which can provide the users with the possibility of building queries and finding the answers to these spontaneous queries.

The data discovery tools need to handle the full range of use cases from data profiling to delivery of actionable insights efficiently and cost effectively. Data discovery tools are also used to gain predictive insights into the data rather than using just for explorative purposes.

As the data discovery market evolves to maturity the vendors had to provide tools which are more agile and faster cycle iterations to provide insights. It is no longer sufficient for the data discovery Vendors to provide quality services and producing quality tools but they also need to adapt the new economic needs for the organizations and the customer needs.

The also a need for the global data discovery market vendors to cater for the needs of small, niche business.

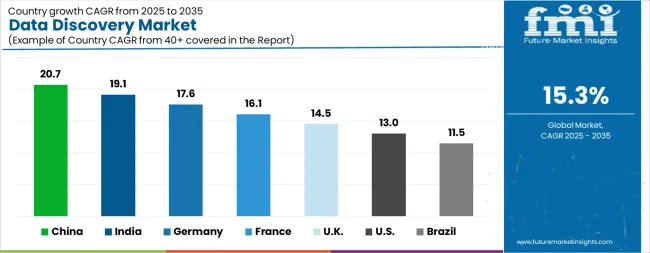

| Country | CAGR |

|---|---|

| China | 20.7% |

| India | 19.1% |

| Germany | 17.6% |

| France | 16.1% |

| UK. | 14.5% |

| USA | 13.0% |

| Brazil | 11.5% |

The Data Discovery Market is expected to register a CAGR of 15.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.7%, followed by India at 19.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.5%, yet still underscores a broadly positive trajectory for the global Data Discovery Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.6%. The USA Data Discovery Market is estimated to be valued at USD 5.4 billion in 2025 and is anticipated to reach a valuation of USD 18.5 billion by 2035. Sales are projected to rise at a CAGR of 13.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 715.1 million and USD 474.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.4 Billion |

| Platform | Desktop, Web, and Mobile |

| Deployment | On-Premise and Cloud |

| Vertical | BFSI, Retail, Telecom, Healthcare, Energy, Education, Automobile, Public Sector, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM Corporation, Microsoft, Oracle, Salesforce, Inc., SAS Institute Inc., Google, Amazon Web Services, Inc., Open Text, MicroStrategy, and Cloudera, Inc. |

The global data discovery market is estimated to be valued at USD 15.4 billion in 2025.

The market size for the data discovery market is projected to reach USD 63.9 billion by 2035.

The data discovery market is expected to grow at a 15.3% CAGR between 2025 and 2035.

The key product types in data discovery market are desktop, web and mobile.

In terms of deployment, on-premise segment to command 54.7% share in the data discovery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Data Pipeline Observability Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA