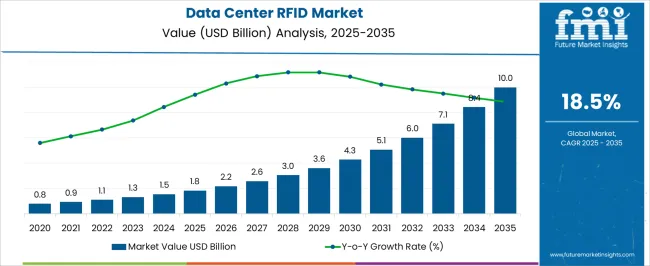

The data center RFID market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 18.5% over the forecast period. Rapid adoption of automation and advanced asset management solutions within data centers is driving demand for RFID systems, enabling precise tracking of IT assets, servers, and storage devices. Increasing data center deployments globally and the need for enhanced operational efficiency, security, and inventory management are key growth drivers. Integration of RFID with IoT and cloud-based monitoring platforms is further accelerating adoption. Vendors focusing on scalable, real-time tracking solutions and specialized RFID tags for high-density server environments are expected to gain a competitive edge in this expanding market.

| Metric | Value |

|---|---|

| Data Center RFID Market Estimated Value in (2025 E) | USD 1.8 billion |

| Data Center RFID Market Forecast Value in (2035 F) | USD 10.0 billion |

| Forecast CAGR (2025 to 2035) | 18.5% |

The data center RFID market is expanding steadily as organizations intensify their focus on asset visibility, automation, and operational efficiency within data-intensive environments. Rising demand for secure, real-time tracking of IT assets has underscored the relevance of RFID technology in minimizing downtime, enhancing audit accuracy, and optimizing inventory management.

Growth is further propelled by increasing complexity in data center infrastructure and the need for scalable solutions capable of managing large volumes of hardware with minimal manual intervention. RFID-enabled systems are being adopted to support regulatory compliance, improve asset lifecycle management, and reduce human error.

The market outlook remains strong as hyperscale and colocation data centers integrate RFID to drive smarter facility operations and reduce total cost of ownership. Future adoption will be supported by advancements in UHF RFID, AI-enabled analytics, and seamless integration with existing data center infrastructure management systems

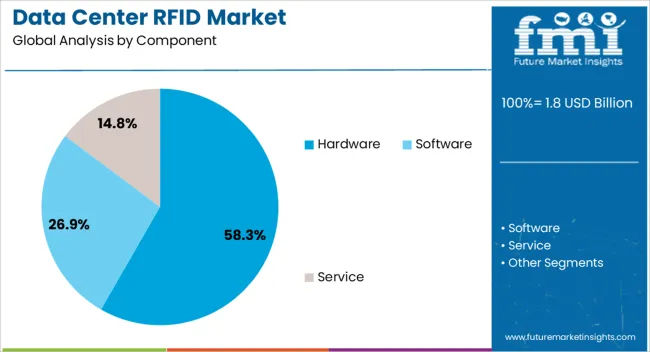

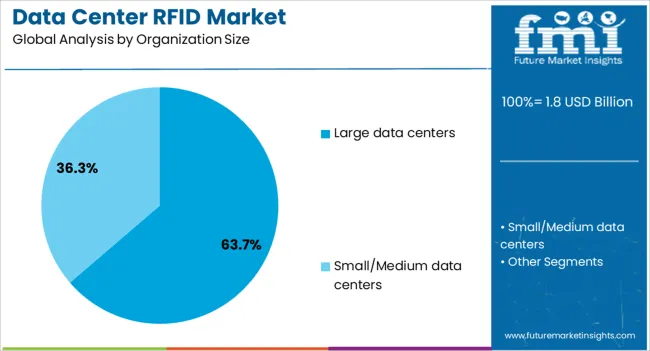

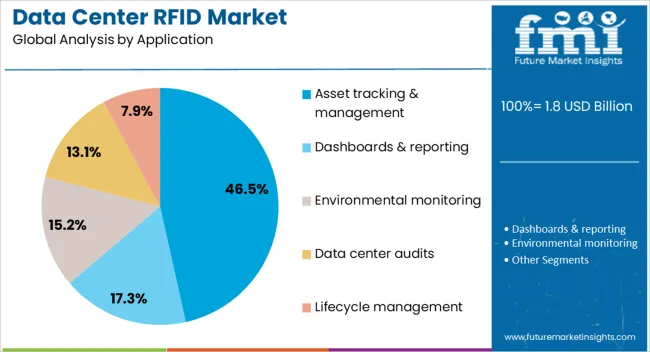

The data center rfid market is segmented by component, organization size, application, and geographic regions. By component, data center rfid market is divided into Hardware, Software, and Service. In terms of organization size, data center rfid market is classified into Large data centers and Small/Medium data centers. Based on application, data center rfid market is segmented into Asset tracking & management, Dashboards & reporting, Environmental monitoring, Data center audits, and Lifecycle management. Regionally, the data center rfid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment dominates the component category with a commanding 58.3% market share, driven by the essential role of RFID tags, readers, antennas, and sensors in enabling real-time asset tracking and monitoring. Hardware components form the foundational layer of RFID systems, ensuring accurate data capture, consistent signal strength, and compatibility with data center architecture.

Growth in this segment is supported by the increasing deployment of fixed and handheld RFID readers tailored to server racks, network devices, and storage units. Manufacturers are focusing on miniaturized and thermally durable hardware to address data center-specific challenges, such as limited space and high ambient temperatures.

As demand for automated infrastructure monitoring grows, investment in hardware continues to rise, driven by its direct impact on efficiency, security, and compliance. The segment is expected to maintain its lead as data centers expand and require robust physical-layer tracking systems

Large data centers hold a dominant 63.7% share in the organization size category, reflecting their complex operational requirements and high-value infrastructure, which make them ideal candidates for RFID integration. These facilities often house thousands of IT assets, making manual tracking inefficient and error-prone.

RFID solutions offer a scalable and accurate approach to asset management, supporting enhanced visibility, faster audits, and improved security. Adoption among hyperscale operators, cloud service providers, and enterprise data centers is rising as they seek to reduce operational risk and improve compliance with internal and external regulations.

Additionally, RFID technology plays a vital role in supporting predictive maintenance and reducing unplanned outages. With increasing investment in digital infrastructure and global expansion of data center footprints, large data centers are expected to continue driving substantial demand for RFID solutions

The asset tracking and management segment leads the application category with a 46.5% share, underlining its importance in enhancing data center visibility, security, and operational control. RFID-enabled asset management allows for real-time location tracking, audit automation, and reduced loss or misplacement of high-value equipment.

This segment has gained traction as data centers face mounting pressure to ensure equipment uptime, regulatory compliance, and cost-effective resource utilization. Automated tracking reduces human dependency while enabling accurate and timely decision-making related to asset relocation, decommissioning, or maintenance.

The increasing complexity of hybrid and multi-cloud environments further underscores the need for sophisticated asset management systems powered by RFID. As data centers prioritize digital maturity and operational transparency, the asset tracking and management segment is poised to sustain robust growth

RFID solutions provide real-time visibility into equipment, enabling data center operators to optimize resource allocation, reduce downtime, and improve overall operational efficiency. The market is driven by the rapid expansion of data centers, the need for more robust security, and the rising demand for automation. However, challenges such as the high initial investment costs for RFID systems, integration complexity, and data privacy concerns may hinder adoption. Opportunities lie in the increasing demand for IoT-based solutions, advancements in RFID technology, and the growing need for data center optimization and security.

The demand for RFID technology in data centers is largely driven by the need for automation and operational efficiency. As the volume of data processed by data centers continues to grow, operators are seeking advanced solutions to monitor and manage assets more effectively. RFID technology allows for real-time tracking of servers, network equipment, and other critical assets, enabling faster identification, maintenance, and replacement. By reducing the need for manual checks and improving inventory accuracy, RFID enhances operational efficiency and minimizes human error. Furthermore, RFID systems help reduce downtime, making them essential for large-scale, high-performance data centers that require continuous uptime. This shift toward automation is a key driver of market growth.

Implementing RFID solutions requires significant upfront costs for hardware, software, and training. The integration of RFID systems with existing IT infrastructure can be technically challenging, particularly in legacy systems that were not designed to support RFID technology. Moreover, RFID data collection raises concerns about data privacy and cybersecurity, especially in highly regulated industries such as finance and healthcare. Regulatory frameworks that govern data protection and privacy must be carefully adhered to when deploying RFID solutions. These challenges create barriers to entry for smaller data centers but offer opportunities for vendors to provide tailored solutions and robust security features.

The integration of Internet of Things (IoT) technology with RFID systems offers significant growth opportunities in the data center RFID market. IoT-enabled RFID systems provide enhanced capabilities, such as remote monitoring and automated data collection, which improve asset tracking and real-time management. The ability to track assets in real-time and receive automated alerts when maintenance or replacement is required allows data centers to optimize their operations and reduce downtime. advancements in RFID technology, such as higher read rates, longer ranges, and improved accuracy, are making RFID systems more cost-effective and practical for larger data center environments. As demand for more efficient and scalable solutions rises, IoT-driven RFID applications are expected to drive market expansion.

RFID systems allow data center operators to secure sensitive equipment by providing automated access control and tracking unauthorized movement. These systems are also crucial for compliance with industry standards, such as ISO/IEC 27001 and SOC 2, which require robust asset management practices and data protection measures. Real-time monitoring is becoming a key trend, as it allows operators to gain instant insights into asset conditions, location, and usage, improving decision-making and response times. RFID-enabled monitoring of physical and environmental conditions also helps optimize energy efficiency and prevent equipment failure. These trends are driving the demand for advanced RFID solutions in data center management.

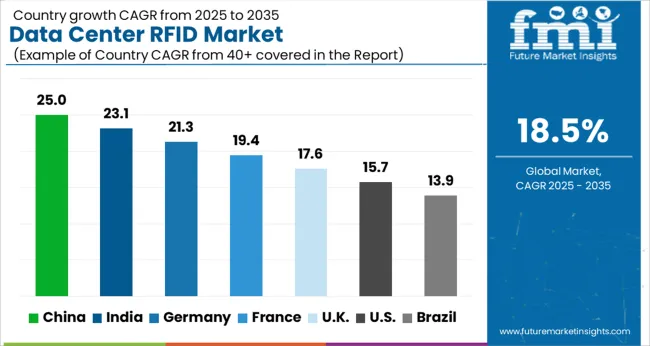

| Country | CAGR |

|---|---|

| China | 25.0% |

| India | 23.1% |

| Germany | 21.3% |

| France | 19.4% |

| UK | 17.6% |

| USA | 15.7% |

| Brazil | 13.9% |

The global data center RFID market is growing at an 18.5% CAGR from 2025 to 2035, with China leading at a 25.0% growth rate, followed by India at 23.1% and France at 19.4%. The UK and USA exhibit more moderate growth rates of 17.6% and 15.7%, respectively. The market is driven by the growing demand for efficient asset tracking, automation, and digital transformation in data centers. RFID technology is crucial for enhancing operational efficiency, reducing errors, and improving asset security as data volumes continue to rise across various regions. The analysis includes over 40+ countries, with the leading markets detailed below.

The data center RFID market in China is expected to grow at a CAGR of 25.0% from 2025 to 2035. The country’s rapid digitalization, growth in cloud computing, and increasing demand for data storage are major drivers for this market. As data centers in China continue to expand in response to growing demands for digital services, the need for efficient and automated inventory management solutions becomes more crucial. RFID technology is playing a significant role in improving data center operations by providing accurate asset tracking, reducing human error, and enhancing operational efficiency. The government’s focus on advancing smart cities and industries is further propelling the adoption of RFID technology in various sectors, including data centers. With the rise of 5G, AI, and IoT technologies, the data volume processed by data centers is expected to increase, further driving the demand for RFID systems to manage and track large amounts of hardware efficiently.

The data center RFID market in India is set to grow at a CAGR of 23.1% from 2025 to 2035. The country’s growing IT infrastructure and data center industry, driven by the rapid rise of e-commerce, digital services, and cloud computing, is fueling this demand. RFID technology helps enhance operational efficiency, asset tracking, and inventory management in data centers, which is becoming increasingly important as the country expands its digital footprint. India’s government push toward digital transformation, coupled with the rise of technologies like artificial intelligence (AI) and machine learning (ML), has heightened the need for effective data center management systems. As India’s data centers continue to scale, the demand for RFID systems to ensure smooth operations and the security of hardware assets is increasing.

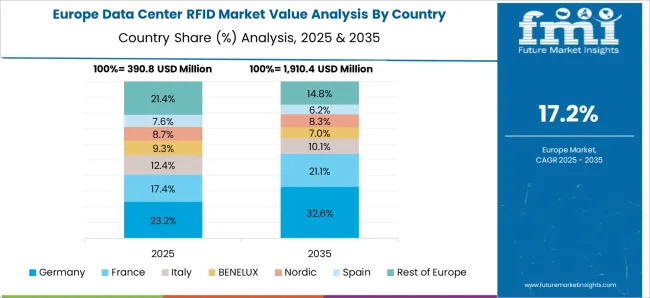

The data center RFID market in France is projected to grow at a CAGR of 19.4% from 2025 to 2035. The country’s increasing investments in digital infrastructure, along with its significant presence in the European data center market, are key drivers of this growth. RFID technology offers enhanced asset tracking, security, and management capabilities that are becoming crucial as the volume of data processed by data centers rises. France’s strong focus on technological innovation and data center modernization has created a conducive environment for the adoption of advanced solutions like RFID. France’s role in the EU’s push for data sovereignty and digital innovation is expected to further drive the use of RFID for efficient data management.

The UK’s data center RFID market is expected to grow at a CAGR of 17.6% from 2025 to 2035. The country’s rapidly growing digital economy and increasing number of data centers are driving the adoption of RFID technology. With rising data traffic, the need for efficient asset tracking and management in data centers has become paramount. RFID technology allows data centers in the UK to streamline their operations, ensuring that hardware and other critical assets are tracked accurately and securely. The UK.’s emphasis on reducing operational costs and improving energy efficiency in data centers is fueling the demand for more automated solutions like RFID.

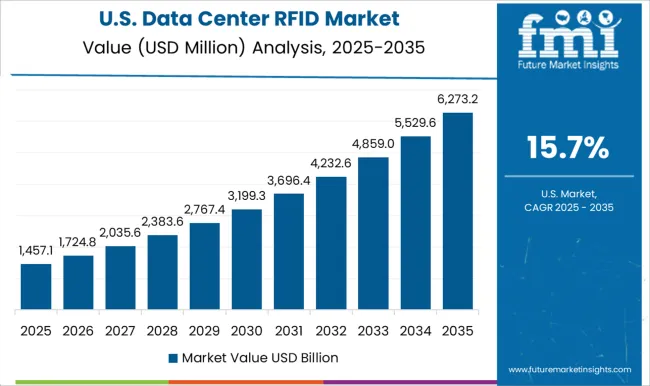

The USA data center RFID market is projected to grow at a CAGR of 15.7% from 2025 to 2035. The USA has the largest data center market in the world, and the demand for RFID technology is being driven by the increasing complexity of managing data center assets as they scale. With the rise of digital transformation, cloud computing, and AI technologies, USA data centers are handling more data than ever before, creating a need for efficient asset management solutions. RFID technology is increasingly being implemented in data centers to automate processes, reduce human error, and improve tracking and security. The market is also being fueled by the growing focus on operational efficiency and the optimization of data center operations.

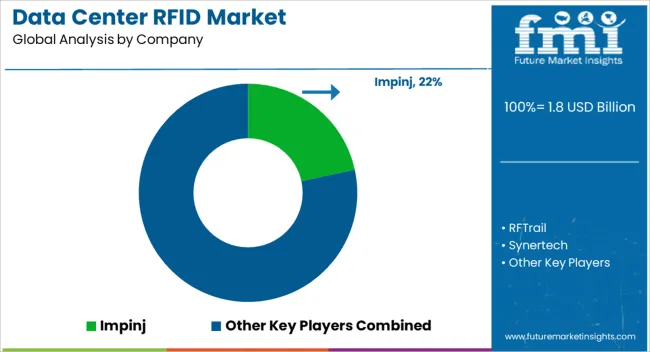

The data center RFID market is highly competitive, with key players focusing on improving asset tracking, security, and operational efficiency through RFID technology. Impinj leads with its comprehensive RFID solutions, providing high-performance tags and readers that enhance asset management and inventory control within data centers. Their strategy emphasizes scalability and integration, enabling seamless operation across large-scale data center environments. RFTrail competes by offering tailored RFID solutions with a focus on real-time tracking and monitoring, which are crucial for maintaining efficient workflows in data centers. Their products are built for accuracy and reliability, addressing the need for streamlined operations in IT environments. Synertech offers innovative RFID products, emphasizing cost-effective and reliable solutions for smaller and mid-sized data centers. Their focus on value and adaptability makes them an attractive option for companies seeking to implement RFID systems on a budget. Zebra Technologies stands out with a broad portfolio of RFID readers, printers, and software solutions, offering integrated systems for asset tracking, inventory management, and equipment monitoring. Zebra’s products are known for their ease of use, integration capabilities, and durability, designed to cater to data centers of all sizes. Alien Technology and ThingMagic are recognized for their expertise in providing high-frequency RFID solutions, with advanced readers and tags designed to deliver precise data collection. These companies target industries looking to automate their asset management and improve operational visibility. CAEN RFID and Convergence Systems Limited (CSL) offer specialized RFID solutions that focus on providing high-throughput capabilities and robust security for data centers. Both companies focus on providing RFID systems with low latency and superior reliability. GAO RFID Inc. offers a wide range of cost-effective RFID hardware solutions, providing flexible and scalable systems ideal for tracking equipment and assets within data centers. Product brochures from these companies emphasize features like high-speed data processing, seamless integration with existing IT infrastructure, and the ability to track assets in real time. They focus on scalability, low operational costs, and enhanced security features, making it easier for data centers to manage critical assets while improving operational efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Component | Hardware, Software, and Service |

| Organization Size | Large data centers and Small/Medium data centers |

| Application | Asset tracking & management, Dashboards & reporting, Environmental monitoring, Data center audits, and Lifecycle management |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Impinj, RFTrail, Synertech, Zebra Technologies, Alien Technology, ThingMagic, CAEN RFID, Convergence Systems Limited (CSL), and GAO RFID Inc |

| Additional Attributes | Dollar sales by product type (tags, readers, antennas), application (asset tracking, inventory management, security, equipment monitoring), and system type (active, passive, semi-passive). Demand dynamics are driven by the increasing need for real-time data, enhanced operational efficiency, and automation within data centers. Regional trends show growing adoption in North America and Europe, where data centers are evolving toward more advanced, tech-driven, and automated operations. Rising investments in cloud computing and data storage also drive the market forward. |

The global data center RFID market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the data center RFID market is projected to reach USD 10.0 billion by 2035.

The data center RFID market is expected to grow at a 18.5% CAGR between 2025 and 2035.

The key product types in data center RFID market are hardware, RFID tags, RFID readers, RFID antennas, other hardware components, software and service.

In terms of organization size, large data centers segment is expected to command 63.7% share in the data center RFID market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA