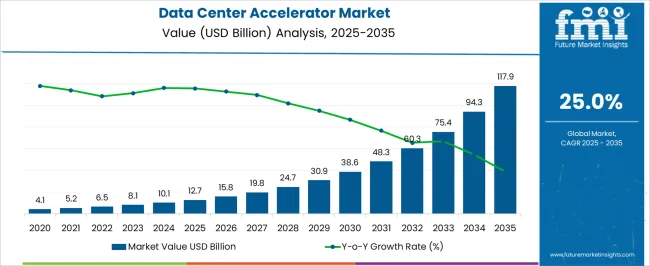

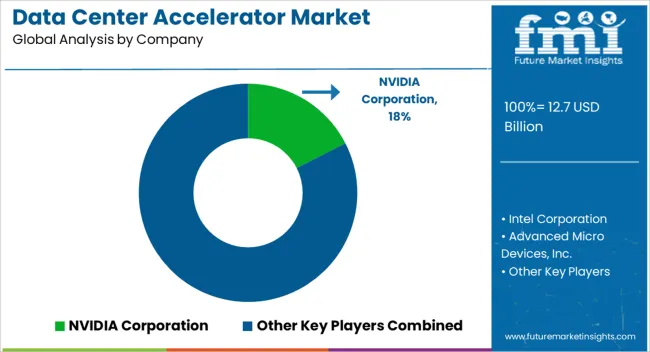

The data center accelerator market is estimated to be valued at USD 12.7 billion in 2025 and is projected to reach USD 117.9 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period. The initial market phase from 2025 to 2027, with values growing from USD 12.7 billion to USD 19.8 billion, corresponds to the early adoption stage characterized by pilot deployments in hyperscale data centers and early enterprise AI applications.

During this period, adoption is constrained by capital intensity, integration complexity, and limited awareness of accelerator benefits, with uptake concentrated among technology-forward organizations seeking performance gains in AI training, high-performance computing, and data analytics. The growth from USD 19.8 billion in 2027 to USD 48.3 billion in 2031 signals the transition into the early majority stage, where broader deployment occurs as cost efficiencies improve, standardization increases, and software-hardware integration becomes more seamless.

Market penetration expands to mid-sized enterprises, cloud providers, and specialized computational sectors, supported by strategic vendor partnerships and scalable accelerator architectures. From 2031 to 2035, the market enters the late majority and approaches maturity, with projected values reaching USD 117.9 billion. During this stage, adoption is mainstream, driven by widespread recognition of performance gains, declining unit costs, and regulatory incentives for energy-efficient computing. The market’s maturity curve reflects a steep initial growth slope, accelerating through early and late majority phases, and gradually stabilizing as the market approaches saturation within the broader data center ecosystem.

| Metric | Value |

|---|---|

| Data Center Accelerator Market Estimated Value in (2025 E) | USD 12.7 billion |

| Data Center Accelerator Market Forecast Value in (2035 F) | USD 117.9 billion |

| Forecast CAGR (2025 to 2035) | 25.0% |

The data center accelerator market represents a specialized segment within the global data center and high-performance computing industry, emphasizing computational speed, energy efficiency, and workload optimization. Within the broader data center hardware sector, it accounts for about 6.5%, driven by demand from cloud computing, artificial intelligence, and machine learning applications. In the server and storage solutions segment, its share is approximately 5.9%, reflecting the adoption of GPUs, FPGAs, and ASICs to accelerate data processing.

Across the high-performance computing and enterprise IT market, it holds around 5.2%, supporting analytics, simulation, and virtualization workloads. Within the artificial intelligence and machine learning infrastructure category, it represents 4.8%, highlighting integration with deep learning, natural language processing, and real-time inference tasks. In the overall data center efficiency and optimization solutions sector, the market contributes about 4.1%, emphasizing reduction in latency, energy consumption, and operational costs.

Recent developments in the market have focused on specialized hardware, software integration, and workload-specific optimization. Innovations include GPU clusters, FPGA accelerators, and AI-specific ASICs to enhance performance for deep learning and data analytics. Key players are collaborating with cloud service providers, hyperscale data centers, and AI software companies to develop optimized accelerator architectures and deployment frameworks.

Adoption of heterogeneous computing environments, hardware-software co-design, and real-time monitoring solutions is gaining traction to improve throughput and energy efficiency. The integration with containerized workloads and orchestration platforms is being deployed to enhance flexibility and scalability.

The data center accelerator market is witnessing significant growth, driven by the rapid expansion of cloud infrastructure, artificial intelligence workloads, and high-performance computing demands across industries. Organizations are increasingly deploying specialized accelerators to improve computational speed and efficiency, particularly as data volumes surge from applications such as deep learning, real-time analytics, and large-scale simulations. Rising energy consumption and the need for efficient processing solutions are pushing data centers to adopt purpose-built hardware accelerators capable of offloading complex tasks from general-purpose CPUs.

Innovation in heterogeneous computing architectures, including the integration of CPUs, GPUs, and custom ASICs, is enabling higher throughput and optimized workload management. The growing reliance on generative AI models, edge inference, and real-time decision-making is expected to further fuel market demand.

With hyperscalers, enterprises, and government institutions investing heavily in scalable AI infrastructure, data center accelerators are emerging as a critical enabler of next-generation computing. The market outlook remains strong as cloud services, AI-driven applications, and automation continue to reshape digital infrastructure globally.

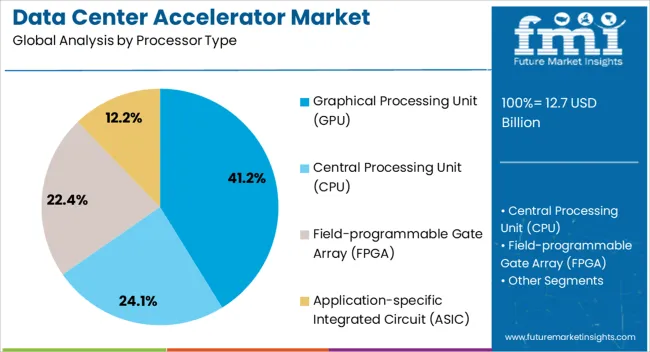

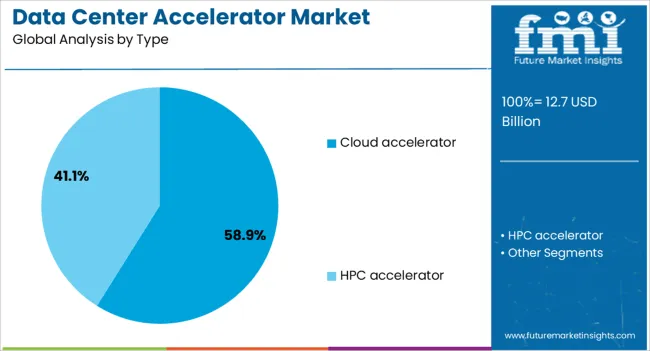

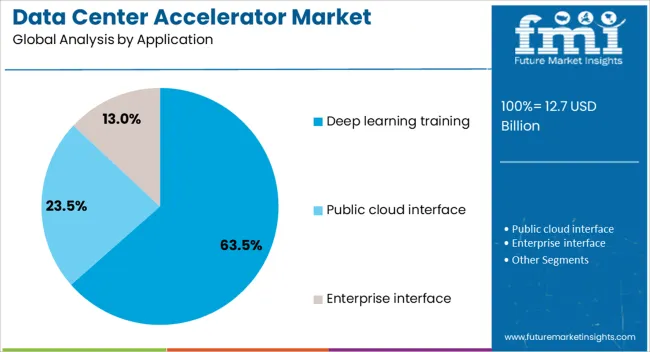

The data center accelerator market is segmented by processor type, type, application, end use, and geographic regions. By processor type, data center accelerator market is divided into Graphical Processing Unit (GPU), Central Processing Unit (CPU), Field-programmable Gate Array (FPGA), and Application-specific Integrated Circuit (ASIC). In terms of type, data center accelerator market is classified into Cloud accelerator and HPC accelerator.

Based on application, data center accelerator market is segmented into Deep learning training, Public cloud interface, and Enterprise interface. By end use, data center accelerator market is segmented into IT & telecom, Healthcare, BFSI, Government, Energy, Manufacturing, and Others. Regionally, the data center accelerator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The graphical processing unit segment is expected to account for 41.2% of the data center accelerator market revenue share in 2025, making it the leading processor type. This position is being driven by the GPU's unmatched ability to handle parallel processing at scale, making it the preferred hardware for AI, machine learning, and deep learning workloads. Its capability to execute thousands of simultaneous threads allows for faster model training and more efficient resource utilization compared to traditional CPUs.

With increasing demand for high-performance computing in cloud environments, GPUs are being widely adopted by hyperscalers and AI infrastructure providers. Continued advancements in memory bandwidth, core density, and power efficiency are enhancing GPU performance, making them suitable for both training and inference tasks in data-intensive environments.

Their compatibility with popular AI development frameworks and widespread industry support further strengthens their role as the dominant accelerator type. As enterprise and research institutions invest in next-generation computing platforms, GPUs are expected to retain a leading role in the processing backbone of modern data centers.

The cloud accelerator type segment is projected to hold 58.9% of the data center accelerator market revenue share in 2025, establishing it as the leading type category. This leadership is being driven by the growing shift of enterprise computing workloads to public and hybrid cloud environments, where the scalability and cost-efficiency of cloud-native accelerator solutions provide significant advantages. Cloud service providers are increasingly offering AI-as-a-service platforms that integrate accelerators to support model training, data processing, and inference workloads.

These platforms are enabling organizations to access high-performance computing resources on-demand without investing in on-premise infrastructure. The growing need for low-latency, energy-efficient, and elastic compute environments is reinforcing the adoption of cloud accelerators.

Moreover, innovations in virtualization and workload orchestration are allowing multiple tenants to securely utilize shared accelerator resources, further improving cost optimization. As digital transformation accelerates across industries, the role of cloud accelerators in supporting compute-intensive workloads will continue to expand, ensuring the segment's sustained dominance in the data center landscape.

The deep learning training segment is anticipated to represent 63.5% of the data center accelerator market revenue share in 2025, making it the leading application area. This dominance is being driven by the exponential increase in demand for training large-scale neural networks that power AI applications across sectors such as healthcare, autonomous systems, natural language processing, and computer vision. The training process requires massive parallel processing capabilities, which are effectively provided by hardware accelerators, particularly GPUs and custom ASICs.

These accelerators enable faster convergence of models, reducing training time from weeks to days or even hours. The growing complexity and size of AI models, including transformer-based architectures and generative AI systems, are further increasing computational requirements, thereby fueling the demand for dedicated acceleration hardware.

Investments by cloud providers and research institutions in large AI clusters and model training infrastructure are supporting segment growth. As deep learning continues to evolve and scale, the reliance on specialized accelerators for training workloads will remain a key factor propelling this segment's leadership in the market.

Accelerators such as GPUs, FPGAs, and AI-specific ASICs are deployed to enhance processing speed, reduce latency, and improve energy efficiency in data centers. The adoption of cloud computing, edge computing, and hyperscale data centers has intensified the need for accelerators capable of handling massive workloads.

Organizations across finance, healthcare, research, and e-commerce rely on accelerators to optimize data throughput and computational efficiency. Technological innovations, including hardware-software co-design, improved interconnects, and cooling solutions, have enhanced performance.

The adoption of data center accelerators is strongly driven by AI workloads and high-performance computing requirements. GPUs and FPGAs are extensively deployed for training and inference in neural networks, natural language processing, and predictive analytics. Accelerators reduce computation time and enable parallel processing, addressing the growing demand for real-time insights. Cloud providers integrate accelerators into their offerings to provide scalable solutions for enterprise and research applications.

Enhanced performance per watt and support for diverse workloads make accelerators attractive for reducing operational costs. Organizations are leveraging accelerators to process large datasets efficiently, improve application responsiveness, and enable advanced analytics, thereby driving demand for accelerator-equipped data center infrastructure.

Expansion of edge and cloud computing infrastructures has created new avenues for data center accelerators. Edge data centers require compact, energy-efficient accelerators to handle processing closer to data sources, reducing latency and bandwidth usage. Cloud service providers integrate accelerators in hyperscale facilities to support AI, virtualization, and high-performance workloads. Optimized interconnects, network acceleration, and memory enhancements improve system throughput. The combination of edge and cloud deployments allows organizations to scale computing capabilities without compromising performance. As enterprises increasingly adopt hybrid and multi-cloud strategies, accelerators play a pivotal role in enhancing computational efficiency and enabling complex applications such as autonomous systems, real-time analytics, and immersive media, driving market expansion globally.

Energy efficiency and thermal management are critical factors in data center accelerator adoption. High-density accelerator deployments generate substantial heat, necessitating advanced cooling solutions such as liquid immersion, direct-to-chip, and optimized airflow designs. Power-efficient architectures, dynamic voltage scaling, and workload optimization improve energy utilization. Reducing power consumption per operation is crucial to minimize operating costs and environmental impact. Innovations in cooling and energy management enable data centers to host more accelerators in a limited footprint without compromising performance. Energy-efficient designs also support regulatory compliance and sustainability initiatives, making accelerator-equipped infrastructures more attractive for enterprises, hyperscalers, and government organizations that prioritize operational efficiency alongside high computational capabilities.

Despite performance advantages, the deployment of data center accelerators faces challenges related to integration complexity and high costs. Hardware-software co-optimization is required to ensure compatibility with existing infrastructure and workloads. Initial procurement costs for accelerators, along with specialized cooling and power infrastructure, can significantly increase capital expenditure. System architecture adjustments, firmware updates, and maintenance requirements add operational complexity. Organizations are investing in modular, scalable solutions and accelerator-as-a-service offerings to reduce upfront costs and simplify integration. Training personnel and optimizing workload management are also critical to maximize utilization and return on investment. Overcoming these barriers is essential to enable broader adoption across enterprise, research, and hyperscale data centers.

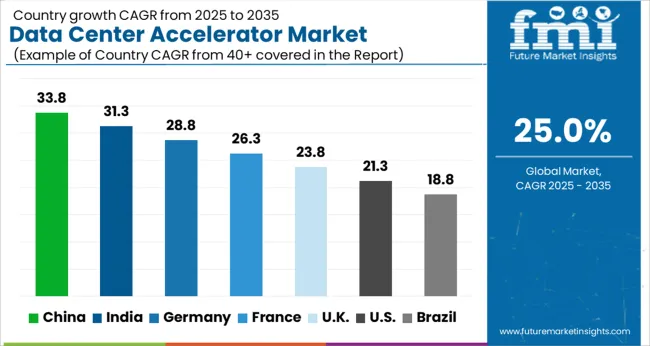

| Country | CAGR |

|---|---|

| China | 33.8% |

| India | 31.3% |

| Germany | 28.8% |

| France | 26.3% |

| UK | 23.8% |

| USA | 21.3% |

| Brazil | 18.8% |

The market is anticipated to expand at a CAGR of 25.0% from 2025 to 2035. Germany reached 28.8%, supported by advanced computing infrastructure and enterprise adoption. China led with 33.8%, driven by large-scale data center deployments and government initiatives for high-performance computing. India recorded 31.3%, reflecting growing cloud services demand and digital transformation projects. The United Kingdom reached 23.8%, supported by data center modernization and AI integration. The United States recorded 21.3%, reflecting steady adoption of accelerators in cloud and enterprise environments. These countries are actively scaling, engineering, and innovating in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 33.8%, driven by rising adoption of AI, machine learning, and high performance computing in data centers. Demand is reinforced by expansion of hyperscale and enterprise data centers, and government support for advanced computing infrastructure. Domestic manufacturers focus on high efficiency GPUs, FPGA accelerators, and AI processors optimized for cloud computing and big data workloads. Integration with energy efficient cooling and modular architectures enhances performance while reducing operational costs.

India is expected to grow at a CAGR of 31.3%, supported by increasing cloud adoption, enterprise digitalization, and AI driven analytics. Adoption is reinforced by growing demand for high throughput computing, server virtualization, and big data processing. Manufacturers focus on GPUs, FPGA cards, and AI optimized accelerators for enterprise and telecom data centers. Expansion of hyperscale and co-location facilities accelerates adoption of high performance accelerators.

Germany is forecast to grow at a CAGR of 28.8%, driven by adoption in enterprise IT, cloud service providers, and industrial AI applications. Adoption is reinforced by the need for energy efficient, high throughput accelerators to support big data, analytics, and AI workloads. Manufacturers focus on integrating FPGA and GPU solutions with existing server architectures for optimized performance and scalability. Government support for digital infrastructure and smart manufacturing strengthens market growth.

The United Kingdom is projected to grow at a CAGR of 23.8%, supported by demand from AI based analytics, cloud computing, and financial technology sectors. Adoption is reinforced by enterprise investments in high performance computing infrastructure and AI optimized accelerators. Manufacturers focus on energy efficient and high throughput solutions that reduce operational costs while supporting AI and big data workloads. Data center operators increasingly adopt modular architectures and accelerator enabled servers.

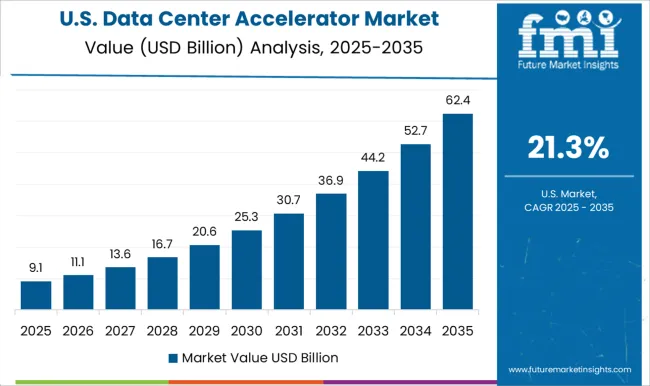

The United States is projected to grow at a CAGR of 21.3%, driven by hyperscale data centers, cloud computing, AI, and machine learning workloads. Adoption is reinforced by demand for high performance, low latency accelerators to improve computational efficiency and energy usage. Manufacturers focus on GPUs, AI processors, and FPGA solutions with integration for server and network optimization. Expansion of cloud infrastructure and AI services continues to drive adoption.

The market is characterized by intense competition among global technology leaders, focusing on high-performance computing, artificial intelligence (AI), machine learning (ML), and cloud infrastructure optimization. NVIDIA Corporation holds a dominant position with its GPU accelerators tailored for AI workloads, deep learning, and data analytics, offering end-to-end solutions for enterprise and hyperscale data centers. Intel Corporation and Advanced Micro Devices (AMD) provide CPU and FPGA-based accelerators that emphasize compatibility, scalability, and integration with existing server architectures, enabling enterprises to deploy heterogeneous computing solutions efficiently.

IBM Corporation and Dell Inc. leverage hardware-software integration to offer turnkey accelerator solutions that combine AI inference engines, optimized storage, and compute resources, targeting enterprise adoption. Micron Technology, Inc. and Marvell Technology Inc. focus on memory-intensive accelerators and interconnect solutions to enhance throughput and reduce latency in large-scale data centers. Other significant players, such as Qualcomm Incorporated, Lenovo Ltd., Lattice Semiconductor, NEC Corporation, Synopsys Inc., and Microchip Technology Inc., contribute through specialized accelerators for edge computing, network optimization, FPGA-based customizable processing, and simulation tools, enabling data centers to manage growing workloads efficiently. Competition in this market is driven by innovation in AI acceleration, low-power high-throughput designs, software-hardware co-optimization, and ecosystem partnerships. Firms focus on expanding product portfolios, strategic collaborations, and performance benchmarking to gain a competitive edge, making the market highly dynamic and technology-intensive, with rapid adoption cycles dictated by evolving enterprise and cloud computing demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.7 Billion |

| Processor Type | Graphical Processing Unit (GPU), Central Processing Unit (CPU), Field-programmable Gate Array (FPGA), and Application-specific Integrated Circuit (ASIC) |

| Type | Cloud accelerator and HPC accelerator |

| Application | Deep learning training, Public cloud interface, and Enterprise interface |

| End Use | IT & telecom, Healthcare, BFSI, Government, Energy, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., IBM Corporation, Dell Inc., Micron Technology, Inc., Qualcomm Incorporated, Marvell Technology Inc., Lenovo Ltd., Lattice Semiconductor, NEC Corporation, Synopsys Inc., and Microchip Technology Inc. |

| Additional Attributes | Dollar sales by accelerator type and application, demand dynamics across hyperscale, enterprise, and cloud data centers, regional trends in AI and high-performance computing adoption, innovation in processing speed, energy efficiency, and integration, environmental impact of energy consumption and electronic waste, and emerging use cases in AI training, scientific simulations, and real-time analytics. |

The global data center accelerator market is estimated to be valued at USD 12.7 billion in 2025.

The market size for the data center accelerator market is projected to reach USD 117.9 billion by 2035.

The data center accelerator market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in data center accelerator market are graphical processing unit (gpu), central processing unit (cpu), field-programmable gate array (fpga) and application-specific integrated circuit (asic).

In terms of type, cloud accelerator segment to command 58.9% share in the data center accelerator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA