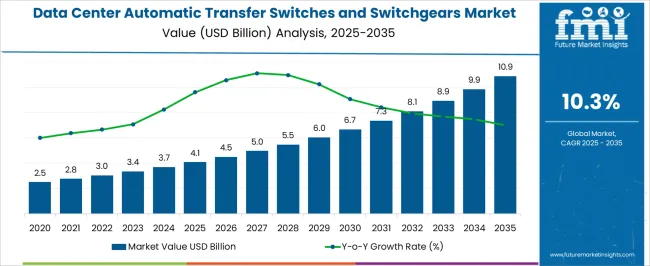

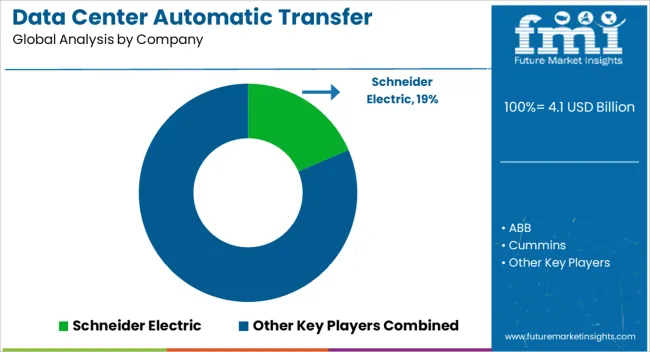

The Data Center Automatic Transfer Switches and Switchgears Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period. This growth is driven by the rapid expansion of hyperscale data centers, rising global internet traffic, and the need for resilient backup power infrastructure. Automatic transfer switches play a critical role in ensuring an uninterrupted power supply by seamlessly shifting between primary and backup sources, while switchgears safeguard critical IT assets from power surges and distribution failures. Cloud adoption, edge computing, and AI-driven workloads are intensifying energy demands, prompting operators to invest in advanced electrical distribution systems with higher reliability and scalability. Compliance with global energy efficiency standards and heightened sensitivity toward downtime risks are further reinforcing demand. Vendors are differentiating through smart monitoring, modular architectures, and integration with digital twins to optimize energy management and operational efficiency.

| Metric | Value |

|---|---|

| Data Center Automatic Transfer Switches and Switchgears Market Estimated Value in (2025 E) | USD 4.1 billion |

| Data Center Automatic Transfer Switches and Switchgears Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The data center automatic transfer switches and switchgears market is expanding rapidly, driven by the global surge in data consumption, increased hyperscale deployments, and the critical demand for uninterrupted power systems. As digital infrastructure grows across sectors such as finance, healthcare, and cloud computing, reliable electrical transition systems are essential to prevent downtime.

Regulatory emphasis on energy efficiency and operational safety is also encouraging the modernization of electrical infrastructure in both new and retrofitted data centers. The growing integration of intelligent switchgear with real-time monitoring and automation capabilities is reshaping operational efficiency while reducing maintenance overhead.

With rapid advancements in edge computing and hybrid cloud models, the need for robust power control and transfer systems is expected to remain strong across all scales of data centers.

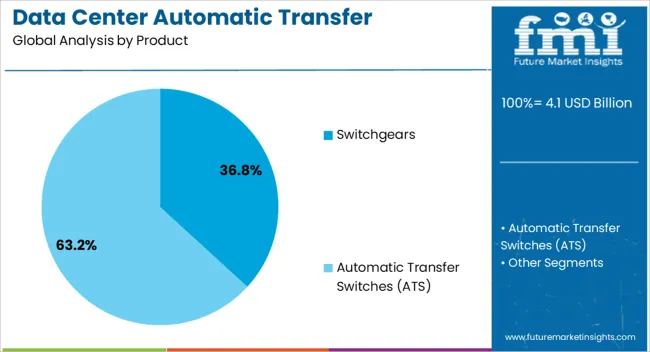

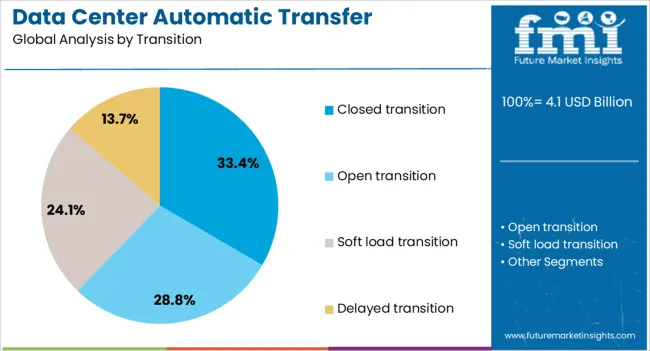

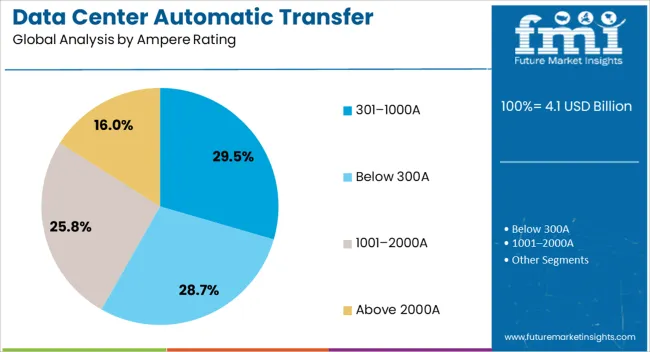

The data center automatic transfer switches and switchgears market is segmented by product, transition, ampere rating, end use, and geographic regions. By product, data center automatic transfer switches and switchgears market is divided into Switchgears and Automatic Transfer Switches (ATS). In terms of transition, data center automatic transfer switches and switchgears market is classified into Closed transition, Open transition, Soft load transition, and Delayed transition. Based on ampere rating, data center automatic transfer switches and switchgears market is segmented into 301–1000A, Below 300A, 1001–2000A, and Above 2000A. By end use, data center automatic transfer switches and switchgears market is segmented into Cloud service providers, Enterprises, Telecommunications, and Government. Regionally, the data center automatic transfer switches and switchgears industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Switchgears are expected to account for 36.80% of the market share by 2025, establishing them as the dominant product type in the market. Their increasing preference stems from their critical role in ensuring safety, isolation, and protection of electrical equipment within data center environments.

Switchgears offer enhanced fault management, modular scalability, and reliable load-handling capacity, aligning with the needs of high-density computing environments. The rising demand for compact, intelligent switchgear with integrated diagnostics and IoT compatibility is further accelerating segment growth.

Additionally, investments in medium- and low-voltage switchgear systems are being supported by infrastructure upgrades across both hyperscale and edge data centers.

The closed transition segment is projected to hold 33.40% of the market share in 2025, leading the market by transition type. This dominance is largely driven by its capability to transfer power between sources without momentary interruption, which is vital for mission-critical applications like data centers.

Closed transition systems offer operational reliability, minimal voltage fluctuation, and reduced risk of data loss or system failure. Their increased adoption is also supported by growing compliance requirements around uptime guarantees and energy quality.

Data centers prioritizing zero-downtime environments are increasingly favoring closed transition ATS systems, especially where tier certification or SLA-driven service delivery is involved.

The 301–1000A range is expected to contribute 29.50% of the total market share by 2025, making it the most prominent ampere rating segment. This range aligns well with medium-capacity data centers, co-location facilities, and edge installations that require scalable power transfer solutions.

Its leadership is supported by a balance of cost-efficiency, compact footprint, and sufficient load handling for a wide array of IT and support infrastructure.

With the proliferation of modular data centers and growing demand in developing regions, systems in the 301–1000A bracket offer the versatility and performance needed to support localized expansion without compromising on power reliability or safety.

The data center automatic transfer switches and switchgears market is expanding rapidly as operators prioritize reliability, scalability, and energy efficiency to support digital infrastructure growth. Automatic transfer switches ensure uninterrupted power by enabling seamless transitions between grid and backup sources, while switchgears protect critical assets against faults and surges. Rising cloud adoption, hyperscale data center construction, and 5G-driven workloads accelerate investments in these systems. Vendors are embedding smart monitoring, predictive maintenance, and modular configurations to meet evolving operational and compliance needs.

Data centers cannot afford downtime, making reliable backup systems a core driver of demand. Automatic transfer switches reduce transition time during power disruptions, ensuring continuity for AI-driven, cloud-based, and mission-critical workloads. Switchgears add fault protection, maintaining equipment safety and minimizing costly outages. With operators expanding global data centers to meet digital traffic growth, advanced power continuity solutions are now considered essential infrastructure.

Growth in hyperscale and colocation data centers pushes demand for high-capacity, scalable switchgear and transfer switch systems. Rising power densities and energy efficiency targets require equipment with advanced monitoring, modular layouts, and integration with digital energy management platforms. Operators prioritize technologies that optimize load distribution, improve reliability, and support green compliance standards, reinforcing adoption of intelligent systems.

Despite strong growth prospects, high capital costs for advanced switchgear and transfer switch solutions act as a restraint, particularly for smaller data center operators. Compliance with global energy standards and safety regulations requires frequent upgrades and testing, adding operational complexity. Supply chain bottlenecks for high-grade electrical components also pose risks, slowing deployments. Vendors that balance affordability with compliance and energy performance gain competitive advantage.

Intelligent switchgears with IoT connectivity, predictive diagnostics, and digital twin integration are becoming mainstream. Real-time monitoring enables operators to detect faults early, optimize energy distribution, and reduce maintenance costs. Cloud-based dashboards, cybersecurity-ready PLCs, and AI-driven analytics enhance reliability while supporting compliance with evolving standards. This trend is reshaping procurement strategies, with demand shifting toward smart, modular, and service-backed offerings that future-proof data center operations.

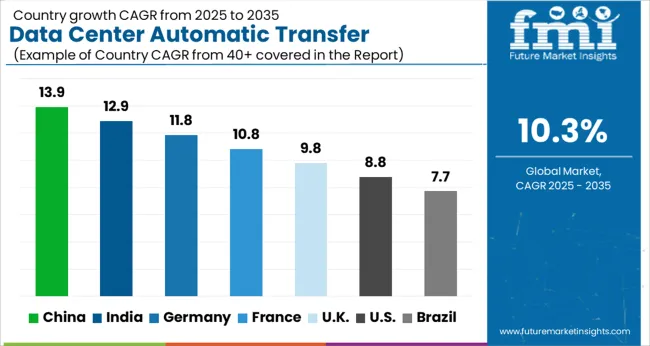

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

| USA | 8.8% |

| Brazil | 7.7% |

The data center automatic transfer switches and switchgears market is projected to grow at a CAGR of 10.3% through 2035, supported by the rapid expansion of hyperscale facilities, cloud service demand, and the need for resilient backup power systems. Among leading nations, China leads with 13.9% growth, reflecting aggressive data center infrastructure development and strong government backing for digital transformation. India follows at 12.9%, driven by expanding cloud adoption, data localization policies, and increasing demand from enterprise and colocation operators. In Europe, Germany reports 11.8% growth, influenced by high energy standards and automation in advanced data centers, while France grows at 10.8%, supported by regional data hub development. The United Kingdom, at 9.8%, reflects steady investments in modular and edge facilities. In the Americas, the United States grows at 8.8%, leveraging large-scale hyperscale expansions and renewable integration, while Brazil posts 7.7%, propelled by rising connectivity and investments in colocation services. The report analyzes more than 40 countries; seven key markets are highlighted below.

The market in China is forecast to expand at a 13.9% CAGR, supported by large-scale data center construction in Tier-1 and Tier-2 cities, hyperscale operator investments, and government-backed smart city initiatives. Emphasis on uninterrupted power systems has increased procurement of advanced transfer switches with monitoring features.

Expansion of hyperscale and colocation facilities boosts equipment demand

Integration of AI-driven monitoring enhances switchgear reliability

Strong domestic manufacturing base ensures rapid supply scaling

India is expected to grow at a 12.9% CAGR, driven by rising demand from cloud providers, government digital programs, and enterprise data adoption. Local energy challenges increase reliance on backup systems, positioning advanced switchgears as critical.

Data localization policies accelerate domestic infrastructure growth

Demand for modular transfer switches grows in colocation projects

Expansion of training centers supports technical workforce readiness

Germany records an 11.8% CAGR, shaped by strict power quality regulations and increasing automation. High preference for modular, intelligent switchgear systems with energy-efficient designs ensures compliance and operational stability.

Stringent energy standards drive advanced system procurement

Modular switchgears favored for scalable data center deployments

Smart monitoring integrated with digital twin platforms is prioritized

France is projected to grow at a 10.8% CAGR, supported by its role as a European data hub. Rising investments in regional colocation centers and renewable energy integration strengthen demand for resilient electrical systems.

Renewable-powered data hubs encourage advanced switch adoption

Increased hyperscale expansion raises switchgear installation rates

Growing adoption of cloud services expands electrical capacity needs

The United Kingdom is set to expand at a 9.8% CAGR, supported by edge data centers and modular deployments. Increasing demand from financial services and healthcare IT boosts installations of high-reliability switchgear.

Edge facility growth enhances demand for compact systems

Finance and healthcare IT sectors drive resilience requirements

Vendors differentiate with cybersecurity-ready monitoring solutions

The competitive landscape of the data center automatic transfer switches and switchgears market is defined by a mix of global electrical giants and specialized regional players competing on technology, reliability, and service integration. Leading companies such as Schneider Electric, ABB, Eaton, Siemens, Mitsubishi Electric, and Legrand dominate through extensive product portfolios, global distribution networks, and established partnerships with hyperscale operators and colocation providers. Their strength lies in delivering high-capacity, modular, and intelligent systems that support large-scale deployments with advanced monitoring and compliance features. Mid-sized manufacturers focus on cost-effective solutions for regional data centers, often emphasizing compact designs and quick installation models.

Innovation is increasingly centered on IoT-enabled monitoring, predictive maintenance, and digital twin integration, which allow operators to optimize energy management and minimize downtime. Service capabilities, including training, after-sales support, and remote diagnostics, have become key differentiators as operators demand lifecycle reliability. Vendors are also competing by aligning with green data center goals, offering energy-efficient switchgears and sustainable materials to meet regulatory and corporate ESG targets. Strategic partnerships with cloud service providers, IT integrators, and local utilities are common, enabling market players to expand adoption and consolidate positions in an intensifying competitive environment.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Product | Switchgears and Automatic Transfer Switches (ATS) |

| Transition | Closed transition, Open transition, Soft load transition, and Delayed transition |

| Ampere Rating | 301–1000A, Below 300A, 1001–2000A, and Above 2000A |

| End Use | Cloud service providers, Enterprises, Telecommunications, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Cummins, Eaton, Fuji Electric, Legrand, Mitsubishi Electric, Siemens, Toshiba, and Vertiv |

| Additional Attributes | Dollar sales by type including manual, automatic, and hybrid transfer switches, and low, medium, and high-voltage switchgears, application across colocation, enterprise, and hyperscale data centers, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising data traffic, demand for reliable power backup, and increasing adoption of automated power management solutions. |

The global data center automatic transfer switches and switchgears market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the data center automatic transfer switches and switchgears market is projected to reach USD 10.9 billion by 2035.

The data center automatic transfer switches and switchgears market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in data center automatic transfer switches and switchgears market are switchgears, low voltage switchgear, medium voltage switchgear, high voltage switchgear, automatic transfer switches (ats), static transfer switches, power transfer switches and hybrid transfer switches.

In terms of transition, closed transition segment to command 33.4% share in the data center automatic transfer switches and switchgears market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Data Pipeline Observability Solutions Market Size and Share Forecast Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA