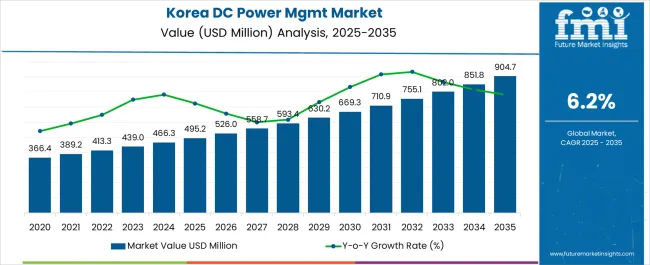

The Data Center Power Management Industry Analysis in Korea is estimated to be valued at USD 495.2 million in 2025 and is projected to reach USD 904.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Data Center Power Management Industry Analysis in Korea Estimated Value in (2025 E) | USD 495.2 million |

| Data Center Power Management Industry Analysis in Korea Forecast Value in (2035 F) | USD 904.7 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The data center power management industry in Korea is experiencing steady expansion driven by the rapid adoption of digital services, cloud computing, and big data analytics. Rising electricity demand, coupled with increasing concerns over energy efficiency and sustainability, is shaping the market trajectory.

Operators are investing in advanced power management solutions to optimize energy consumption, reduce operational costs, and ensure regulatory compliance. Current dynamics highlight a surge in demand for scalable infrastructure and reliable backup systems, as downtime risks have become critical considerations for enterprises and service providers.

The future outlook is characterized by continuous investments in green technologies, integration of AI and IoT for predictive maintenance, and growing deployment of renewable energy sources in data center facilities Growth rationale is supported by the need to balance energy efficiency with high availability, technological innovation in power systems, and the expansion of large-scale colocation and hyperscale facilities, all of which are expected to sustain momentum and drive long-term market development in Korea.

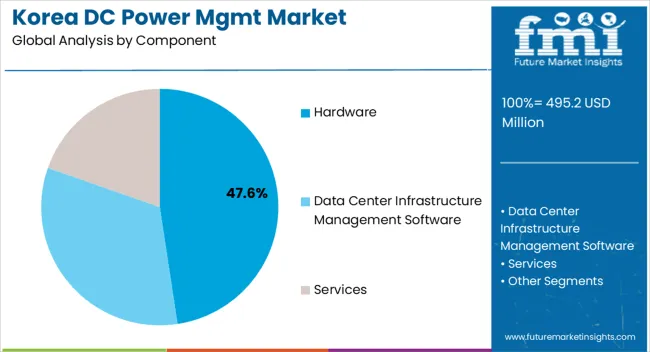

The hardware segment, accounting for 47.60% of the component category, has remained dominant due to its critical role in ensuring uninterrupted energy distribution and operational stability within data centers. Its leadership is supported by demand for advanced uninterruptible power supply systems, power distribution units, and generators that enable high-performance computing environments to function without disruption.

The segment’s strength is reinforced by the rapid expansion of data-intensive applications requiring reliable and scalable infrastructure. Continuous improvements in hardware design, including energy-efficient systems and modular configurations, have elevated adoption.

Compliance with safety and efficiency standards has bolstered trust among operators, while investments in innovative hardware technologies are positioning the segment as an indispensable foundation for effective power management across diverse data center facilities in Korea.

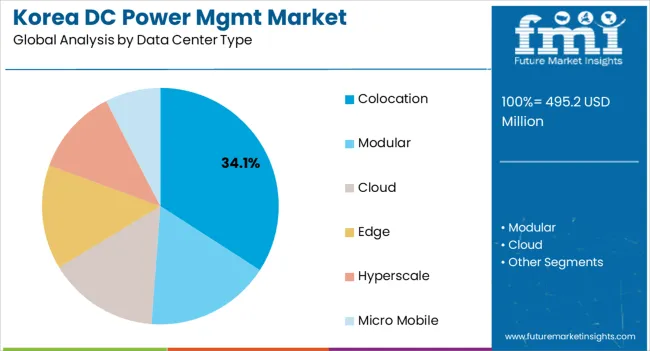

The colocation segment, holding 34.10% of the data center type category, has established itself as the leading model due to increasing demand from enterprises seeking cost-efficient, scalable, and secure facilities. Market strength is driven by the preference of businesses to outsource infrastructure management while maintaining access to advanced technologies and reliable connectivity.

Growth has been reinforced by rising digital transformation initiatives among small and medium enterprises, as well as the expansion of international cloud service providers entering the Korean market. Power management within colocation centers has been enhanced by adopting intelligent monitoring systems and energy optimization strategies.

The segment’s share is expected to remain robust as enterprises prioritize flexibility, regulatory compliance, and cost optimization in their data center strategies.

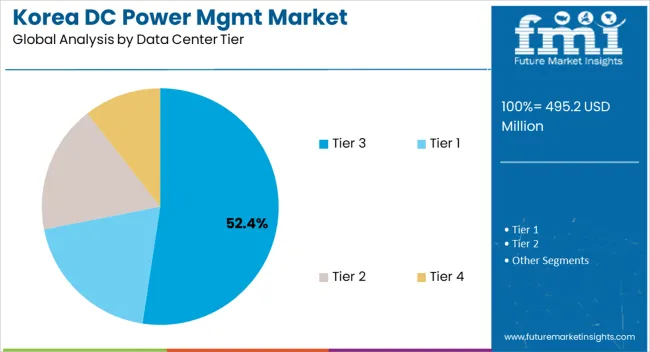

The tier 3 segment, representing 52.40% of the data center tier category, has emerged as the leading standard owing to its balance between high reliability and cost efficiency. Its dominance has been supported by the ability to provide concurrent maintainability, ensuring that facilities can undergo maintenance without downtime.

This tier level has become the preferred choice for enterprises requiring strong operational resilience without the cost intensity of higher-tier facilities. Market adoption has been strengthened by the rapid growth of e-commerce, financial services, and cloud-driven applications in Korea, all of which rely on consistent availability.

Investment in tier 3 facilities has been increasing as operators pursue scalable designs, energy-efficient technologies, and compliance with international standards, ensuring the segment’s continued leadership in the country’s evolving data center power management industry.

Modular data centers allow organizations to quickly scale their IT infrastructure to meet changing demands. Businesses in Korea, especially those experiencing rapid growth or seasonal variations in data processing needs, can benefit from this scalability.

| Data Center Power Management in Korea based on Data Center Type | Modular Data Centers |

|---|---|

| Share in % in 2025 | 25.1% |

In terms of data center type, the modular segment is expected to account for an industry share of 25.1% in 2025. Modular data centers often offer cost savings through economies of scale, efficient resource usage, and reduced construction and operational costs. Given the competitiveness of the business landscape in Korea, cost efficiency is a significant driver.

Modular data centers can be deployed more quickly than traditional data centers, which is crucial in an environment where time to industry is a key factor. Businesses in Korea can rapidly respond to industry demands by using modular solutions.

Tier 4 data centers are designed to ensure near 100% uptime and are suitable for organizations with mission-critical applications. Businesses in Korea that require uninterrupted operations, such as financial institutions, healthcare providers, and government agencies, are drawn to Tier 4 data centers.

Based on data center tier, the Tier 4 segment is expected to account for an industry share of 34.6% in 2025. Certain industries in Korea, such as finance and healthcare, are subject to strict regulatory requirements regarding data security and availability. Tier 4 data centers are often better equipped to meet these compliance standards, driving their adoption.

The heightened level of reliability and redundancy in Tier 4 data centers ensures data security and robust disaster recovery capabilities. Organizations in Korea prioritize data security and the ability to recover quickly from any service interruptions.

| Data Center Power Management in Korea based on Data Center Tier | Tier 4 |

|---|---|

| Share in % in 2025 | 34.6% |

South Gyeongsang is renowned for its industrial and economic development, housing a concentration of manufacturing and technology companies. With a growing demand for efficient power management solutions, these industries heavily rely on data centers for their operations.

The region boasts various manufacturing facilities, and many of these industries necessitate data centers for production, quality control, and supply chain management. Power management solutions play a vital role in ensuring the smooth operation of these data centers.

North Jeolla is known for its agricultural and food processing industries. The sectors increasingly rely on data centers for supply chain management, quality control, and data analysis. Efficient power management is vital for supporting these operations.

North Jeolla hosts educational and research institutions that require data centers for research, data storage, and collaborative projects. These organizations contribute to the demand for advanced power management solutions.

The data centers in the region may support data-intensive applications related to meteorological data, environmental monitoring, and tourism analytics. Power management is essential for these data centers to maintain reliable operations.

Organizations in Jeju are aiming to pursue digital transformation initiatives to modernize their operations. Data centers play a crucial role in these efforts and require effective power management to ensure reliability and performance.

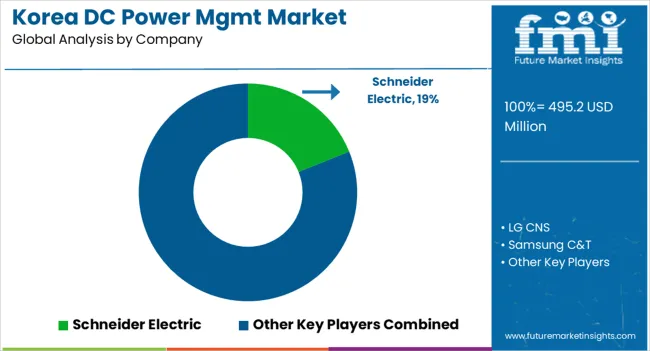

The competitive landscape of the data center power management industry in Korea is marked by innovation and a pursuit of sustainable solutions. Power management has become a critical aspect of maintaining operational efficiency and reducing environmental impact as the demand for data center services continues to surge in the digital age.

Several key players and emerging companies are actively contributing to this dynamic landscape, shaping the trajectory of the industry in Korea.

Recent Developments Observed in Data Center Power Management in Korea

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 495.2 million |

| Projected Industry Size by 2035 | USD 904.7 million |

| Anticipated CAGR from 2025 to 2035 | 6.2% CAGR |

| Historical Analysis of Demand for Data Center Power Management in Korea | 2020 to 2025 |

| Demand Forecast for Data Center Power Management in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing the adoption of Data Center Power Management in Korea, Insights on Global Players and their Industry Strategy in Korea, Ecosystem Analysis of Providers in Korea |

| Key Provinces Analyzed while Studying Opportunities in Data Center Power Management in Korea | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

| Key Companies Profiled | LG CNS; Samsung C&T; KT Corporation; SK Telecom; Korea Electric Power Corporation; NHN Corporation; Naver Corporation; Kakao Corporation; Celltrion Corporation; Schneider Electric; Eaton Corporation; Emerson Electric |

The global data center power management industry analysis in Korea is estimated to be valued at USD 495.2 million in 2025.

The market size for the data center power management industry analysis in Korea is projected to reach USD 904.7 million by 2035.

The data center power management industry analysis in Korea is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in data center power management industry analysis in Korea are hardware, data center infrastructure management software and services.

In terms of data center type, colocation segment to command 34.1% share in the data center power management industry analysis in Korea in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Market Insights – Demand & Growth 2024-2034

Data Center Power Management Market Growth – Demand, Trends & Forecast 2025–2035

Data Center Power Market Size and Share Forecast Outlook 2025 to 2035

Data Center Industry Analysis in Egypt Size and Share Forecast Outlook 2025 to 2035

Data Center Power Solutions Market

Data Center LV/MV Power Distribution Market Size and Share Forecast Outlook 2025 to 2035

Data Center Infrastructure Management Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Fleet Management Market Growth – Trends & Forecast 2023-2033

Edutainment Center Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

On-Site Solar Power Market Growth – Trends & Forecast 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA