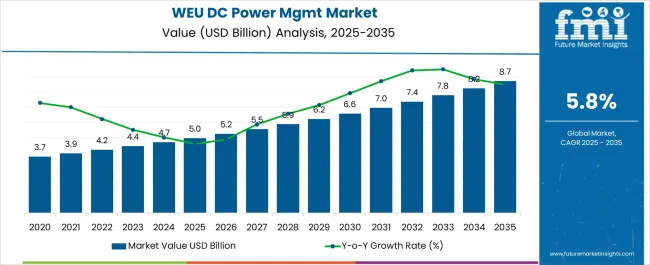

The Data Center Power Management Industry Analysis in Western Europe is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Data Center Power Management Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 5.0 billion |

| Data Center Power Management Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The data center power management industry in Western Europe is experiencing robust growth. Rising digital transformation, cloud adoption, and regulatory requirements for energy efficiency are driving the demand for advanced power management solutions. Current market conditions reflect significant investment in hyperscale and colocation facilities, with operators prioritizing sustainability and operational resilience.

Stricter energy regulations and carbon reduction commitments are influencing design choices and accelerating adoption of efficient hardware and software systems. Future growth will be shaped by the increasing need for power continuity, integration of renewable energy sources, and innovations in monitoring and control technologies.

The rationale for expansion is supported by the growing importance of reliable power infrastructure in ensuring uptime, the push for green data centers across the region, and the ability of advanced power management systems to reduce costs while enhancing scalability These factors collectively position the market for sustained growth and deeper penetration across both enterprise and service-provider segments.

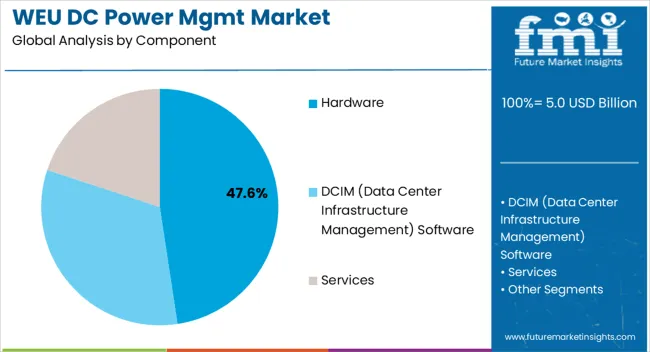

The hardware segment, representing 47.60% of the component category, is leading the market due to its essential role in maintaining power reliability and efficiency across large-scale data centers. High demand for UPS systems, switchgear, PDUs, and generators has reinforced the segment’s dominance. Hardware adoption has been supported by continuous infrastructure upgrades and the need to handle rising workloads and higher rack densities.

Innovations in modular and scalable power hardware are improving deployment flexibility and lifecycle management. Regulatory compliance and efficiency targets are also pushing investment toward advanced systems with lower energy losses and higher reliability.

As sustainability becomes a regional priority, hardware integrated with monitoring capabilities is enabling better energy optimization These advancements are expected to maintain the hardware segment’s market share while supporting modernization across hyperscale and colocation facilities.

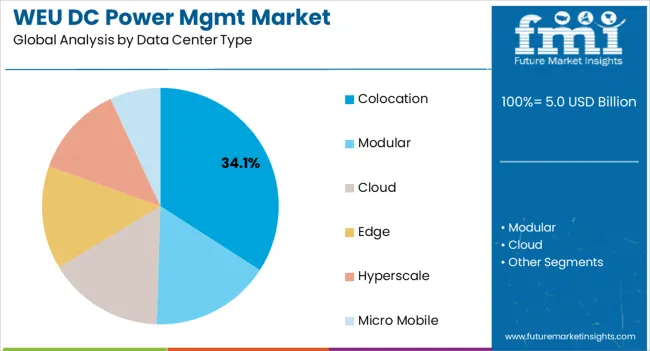

The colocation segment, accounting for 34.10% of the data center type category, has been leading due to strong enterprise outsourcing trends and cost-efficiency benefits. Businesses are increasingly relying on colocation providers to secure scalable, resilient infrastructure without the capital burden of building their own facilities.

Growth in cloud adoption, regulatory compliance needs, and rising data volumes has reinforced reliance on colocation operators. Providers have been enhancing their offerings with advanced power management solutions that ensure uptime, reduce operational risk, and improve energy efficiency.

The segment’s competitiveness has been further supported by strategic investments in renewable integration, modular expansion, and AI-enabled power monitoring With enterprises demanding flexible and sustainable options, colocation data centers are expected to continue holding significant share in the Western European market.

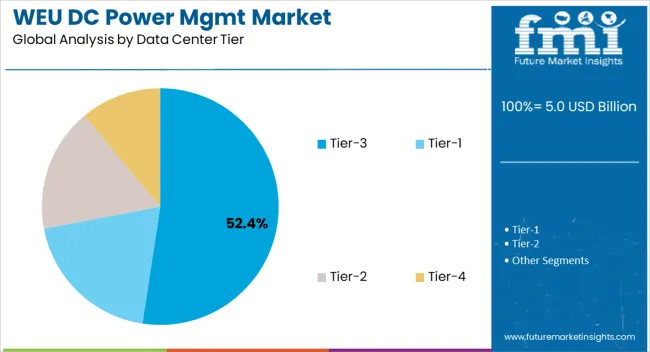

The Tier-3 category, holding 52.40% of the data center tier segment, has maintained leadership due to its balance between cost efficiency and high availability. Tier-3 facilities are designed with redundancy in critical systems, ensuring 99.982% uptime, which meets the reliability requirements of most enterprises while avoiding the higher costs associated with Tier-4 infrastructure.

Adoption has been driven by enterprises and service providers that prioritize resilience without excessive capital expenditure. Regulatory pressure for business continuity and sustainability has further encouraged investments in Tier-3 facilities equipped with advanced power management systems.

The ability of Tier-3 centers to integrate renewable energy sources, support modular scaling, and align with carbon neutrality goals has reinforced their market appeal As digital services expand and demand for dependable mid-range infrastructure grows, Tier-3 data centers are expected to retain their dominant position across the Western European market.

| Countries | Value CAGR from 2025 to 2035 |

|---|---|

| United Kingdom | 9.0% |

| Germany | 7.8% |

The United Kingdom has witnessed a substantial reduction in energy consumption over the past two decades, projected to witness at a CAGR of 9.0% through 2035. The achievement can be attributed to a concerted effort toward energy efficiency, driven by a growing awareness of the environmental and economic benefits of energy conservation. Both public and private sectors in the United Kingdom have embraced initiatives focused on energy savings, significantly contributing to a decrease in overall energy use.

As data centers play a crucial role in the energy landscape, they have also been influenced by the energy efficiency drive of the country. The United Kingdom data center industry has recognized the importance of optimizing power consumption while maintaining uninterrupted service delivery. The acknowledgment has increased demand for data center power management solutions to ensure efficient energy usage and minimize waste.

Germany is a critical player in the European data center landscape and, like its counterparts, places a strong emphasis on energy efficiency and sustainability. The industry in Germany is estimated to register a CAGR of 7.8% through 2035. The country has been actively promoting the responsible and efficient use of power in various sectors, and data centers are no exception.

The German data center industry recognizes the importance of reducing energy consumption, not only to minimize operational costs but also to meet strict environmental regulations and to contribute to the country overall energy-saving goals. This has increased demand for advanced data center power management solutions to monitor and optimize energy usage, resulting in more sustainable and cost-effective operations.

The table below highlights how the modular data centers and tier-4 data centers are projected to lead the solution-segment and platform-type segments in 2025.

| Category | Industrial Share in 2025 |

|---|---|

| Modular Data Centers | 25.7% |

| Tier-4 Data Centers | 35.9% |

The data center landscape has witnessed a surge in the popularity of modular data centers, reflecting a growing preference for a more flexible and cost-effective approach to data infrastructure. The modular data center segment is set to account for a substantial 25.7% industrial share in 2025, and this trend shows no sign of slowing down.

One of the key driving factors behind the rise of modular data centers is their inherent cost-effectiveness. These modular solutions offer a more budget-friendly alternative to traditional data centers, making them an attractive choice for organizations aiming to optimize their IT infrastructure without breaking the bank. The reduced upfront costs and lower energy requirements of modular data centers have garnered significant attention from industries looking to maximize efficiency.

The tier-4 segment has consistently asserted its dominance in the industry and is poised to maintain this lead during the forecast period. In 2025, the tier-4 data centers segment is projected to hold 35.9% industrial share, reflecting the growing demand for their unique capabilities.

One of the primary drivers behind the popularity of tier-4 data centers is their exceptional fault-tolerant functionality. The critical attribute sets them apart by enabling the site infrastructure to withstand unexpected failures, ensuring uninterrupted operations even in the face of unforeseen challenges. The fault-tolerant design of tier-4 data centers is a testament to their unwavering commitment to maintaining the critical load, making them a trusted choice for businesses that cannot afford downtime.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 5.0 billion |

| Projected Industry Size by 2035 | USD 8.7 billion |

| Anticipated CAGR between 2025 to 2035 | 5.8% CAGR |

| Demand Forecast for the Data Center Power Management in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing the Data Center Power Management in Western Europe, Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Countries Analyzed | United Kingdom, Germany, France, The Netherlands, Italy, Spain, Rest of Western Europe |

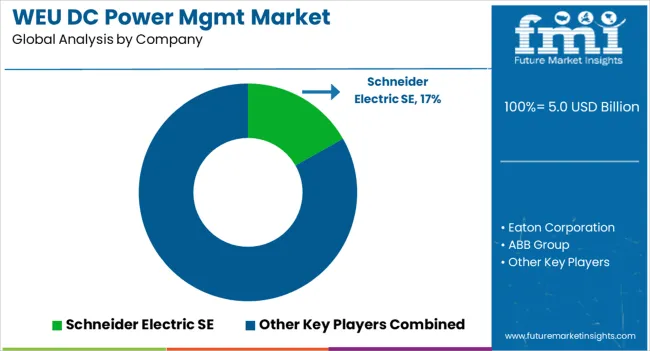

| Key Companies Profiled | Schneider Electric SE; Eaton Corporation; ABB Group; Vertiv Group Corp; Raritan Inc. (Legrand); Siemens AG; Riello Elettronica Group; Server Technology (Legrand); Piller Power Systems; Cyber Power Systems Inc. |

The global data center power management industry analysis in Western Europe is estimated to be valued at USD 5.0 billion in 2025.

The market size for the data center power management industry analysis in Western Europe is projected to reach USD 8.7 billion by 2035.

The data center power management industry analysis in Western Europe is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in data center power management industry analysis in Western Europe are hardware, dcim (data center infrastructure management) software and services.

In terms of data center type, colocation segment to command 34.1% share in the data center power management industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Data as a Service (DaaS) Market Analysis by Pricing Model, Deployment Type, End User, and Region Through 2035

Data Governance – AI-Driven Compliance & Security

Cloud-Based Data Orchestration – AI for Smarter Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA