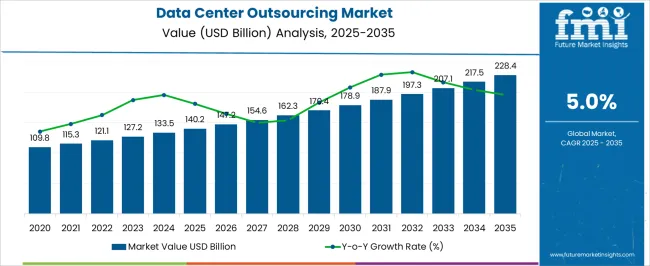

The data center outsourcing market is estimated to be valued at USD 140.2 billion in 2025 and is projected to reach USD 228.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The data center outsourcing market is expected to register notable expansion, moving from USD 140.2 billion in 2025 to USD 228.4 billion by 2035 at a steady CAGR of 5%. Over the 10-year span, the market is projected to add close to USD 88 billion in incremental opportunity, with values climbing consistently each year from USD 147.2 billion in 2026 to USD 217.5 billion by 2034. This predictable rise demonstrates a strong reliance of enterprises on managed hosting, colocation services, and third-party infrastructure support to optimize operations and reduce overheads. The decade-long comparison highlights how businesses are shifting from in-house operations toward outsourced services, driven by cost efficiency, performance reliability, and resource scalability.

The data center outsourcing market growth trajectory suggests that providers who can deliver flexible contracts, strong security frameworks, and region-specific compliance solutions will likely capture larger market shares. The CAGR of 5% represents a balanced and dependable expansion pace, which appeals to investors seeking long-term value accumulation without extreme volatility. Regional disparities in adoption are anticipated, but the overall growth indicates that both mature and emerging economies are aligning toward outsourced IT infrastructure. The 10-year growth comparison paints the industry as a resilient service sector that is steadily cementing its role in the digital economy, where outsourcing is seen less as an option and more as a strategic necessity for enterprises competing in data-intensive environments.

| Metric | Value |

|---|---|

| Data Center Outsourcing Market Estimated Value in (2025 E) | USD 140.2 billion |

| Data Center Outsourcing Market Forecast Value in (2035 F) | USD 228.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The data center outsourcing market has secured a sizeable position within the global IT ecosystem, representing nearly 15-17% of the IT services market, close to 11-13% of the cloud computing market, nearly 14-16% of the managed services market, around 9-11% of the colocation services market, and about 10-12% of the enterprise IT infrastructure market. When aggregated, these proportions indicate a combined share in the range of 59-69%, reflecting the strong dependence of enterprises on outsourcing models to streamline IT operations and reduce capital-intensive infrastructure costs.

The adoption of outsourcing in the data center space has been driven by enterprises seeking resilience, scalability, and specialized expertise, while offloading the operational burden of maintaining hardware, cooling, and energy management systems. This market has gained traction as CIOs and IT leaders have been compelled to pursue hybrid approaches that balance in-house capabilities with outsourced infrastructure to optimize costs and performance.

Vendors offering outsourcing solutions have been preferred for their ability to provide flexible service-level agreements, robust security measures, and compliance with regulatory standards, which have become decisive factors for enterprises with sensitive workloads. In opinion, the data center outsourcing market has evolved as a fundamental extension of managed IT frameworks, positioning itself as a long-term solution for organizations aiming to balance efficiency with operational reliability.

The data center outsourcing market is expanding rapidly as enterprises increasingly shift focus from in-house infrastructure management to third-party service providers for enhanced agility, cost efficiency, and scalability. Rising IT complexities, coupled with the need for uninterrupted uptime, energy optimization, and global data compliance, are driving organizations toward outsourced solutions.

This trend is particularly pronounced among large enterprises aiming to streamline operations and focus on core competencies while relying on external expertise for data center performance. The growing adoption of hybrid and multi-cloud environments is reinforcing the value proposition of outsourcing as companies seek seamless integration, disaster recovery, and real-time monitoring services.

Future growth will be fueled by increasing workloads, demand for edge computing support, and investment in green and modular data center technologies. As regulatory compliance, data sovereignty, and cybersecurity concerns intensify, managed outsourcing solutions are set to become even more indispensable for enterprise IT strategies

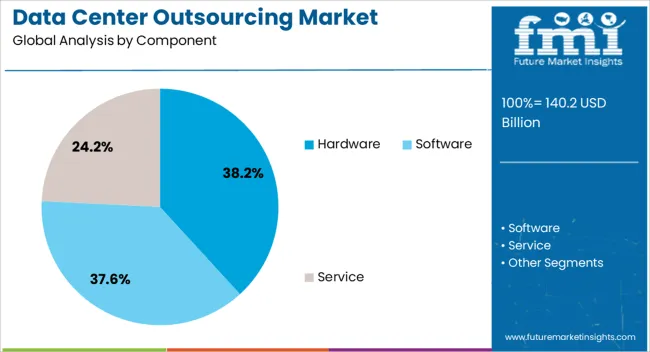

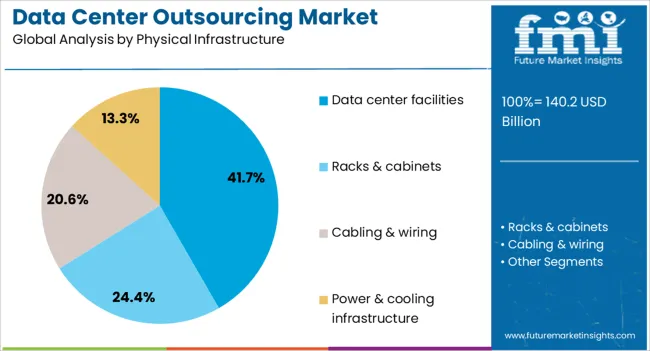

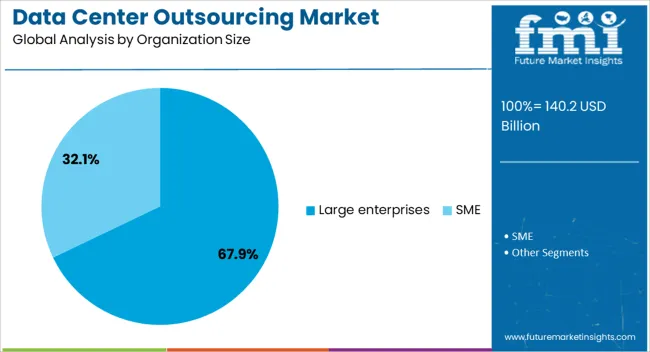

The data center outsourcing market is segmented by component, physical infrastructure, organization size, end user, and geographic regions. By component, data center outsourcing market is divided into hardware, software, and service. In terms of physical infrastructure, data center outsourcing market is classified into data center facilities, racks & cabinets, cabling & wiring, and power & cooling infrastructure. Based on organization size, data center outsourcing market is segmented into large enterprises and SME. By end user, data center outsourcing market is segmented into BFSI, colocation, energy, government, healthcare, manufacturing, IT & telecom, and others. Regionally, the data center outsourcing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment accounts for 38.2% of the component category, establishing itself as a key contributor within the data center outsourcing market due to the continued reliance on high-performance computing infrastructure. Outsourcing providers are investing heavily in next-generation hardware such as scalable servers, storage arrays, and networking equipment to meet growing enterprise demands.

This segment benefits from organizations offloading capital-intensive procurement and maintenance responsibilities to experienced vendors who can ensure optimal performance and regular upgrades. With data volumes escalating, the need for robust and energy-efficient hardware solutions has grown significantly, especially in colocation and managed service environments.

Furthermore, hardware outsourcing ensures continuity in service delivery, minimizes downtime, and aligns with business continuity planning. This segment is poised to grow steadily as clients prioritize performance, efficiency, and up-to-date infrastructure through outsourced data center arrangements

Data center facilities dominate the physical infrastructure category with a 41.7% market share, highlighting the strategic significance of location, scalability, and design in outsourcing decisions. These facilities encompass the essential components such as power systems, cooling units, racks, and physical security, forming the backbone of reliable data hosting.

Enterprises are increasingly opting for third-party facilities that offer advanced design standards, green certifications, and proximity to major connectivity hubs. The segment's growth is bolstered by rising energy costs, stringent environmental regulations, and the high capital expenditure involved in building and maintaining in-house data centers.

Providers are enhancing their offerings with modular architectures and smart monitoring tools that optimize power usage effectiveness (PUE) and operational efficiency. As enterprises seek to reduce infrastructure complexity and carbon footprints, demand for outsourced data center facilities is expected to remain robust and resilient

The large enterprises segment leads the organization size category with a commanding 67.9% share, driven by the scale and complexity of data management requirements across global operations. These enterprises often face challenges related to infrastructure scalability, real-time data processing, regulatory compliance, and round-the-clock uptime, making data center outsourcing a strategic priority.

By partnering with experienced service providers, large organizations can leverage economies of scale, enhance service quality, and reduce the burden of IT infrastructure ownership. This segment has shown a strong preference for hybrid outsourcing models that blend on-premise control with offsite hosting for mission-critical applications.

Furthermore, rising data privacy concerns and the need for secure, compliant infrastructure are reinforcing the shift toward trusted outsourcing partners. The segment is projected to maintain dominance as enterprises continue to pursue digital transformation, cloud integration, and IT modernization initiatives that require scalable and secure infrastructure solutions

The data center outsourcing market is being driven by enterprises shifting infrastructure burdens for efficiency and scalability. Opportunities are being created through hybrid systems, cloud adoption, and demand for advanced compliance-driven services. Trends such as automation, AI integration, and bundled service delivery are redefining outsourcing models. However, challenges related to regulatory compliance, data sovereignty, and operational risks continue to test market players. Overall, the market is expected to remain resilient as enterprises prioritize outsourcing to optimize performance, reduce costs, and address the growing complexity of managing IT infrastructure.

The data center outsourcing market is witnessing strong demand as enterprises across industries are shifting infrastructure responsibilities to specialized providers. The rising complexity of managing on-premise data centers, combined with the pressure to achieve cost efficiency, has fueled the outsourcing preference. Organizations are recognizing that outsourcing offers scalability, enhanced uptime, and expert management without heavy capital expenditure. Increasing data volumes from digital platforms, cloud applications, and connected devices are further reinforcing the demand for outsourced services. Enterprises in sectors like banking, telecom, and healthcare are leading adoption, as they require secure, compliant, and resilient infrastructure management. The demand is also being driven by the need for hybrid cloud models, disaster recovery services, and 24/7 monitoring, all of which are better supported through outsourcing agreements. As a result, the market is being shaped by a clear preference for managed and optimized infrastructure solutions.

Significant opportunities are being created in the data center outsourcing market as businesses embrace cloud adoption and hybrid operating models. The transition from traditional hardware-heavy systems to flexible and cloud-based infrastructures has created new prospects for outsourcing providers to deliver integrated solutions. Enterprises are actively seeking partnerships that allow them to optimize workloads between on-premises systems, private clouds, and public cloud platforms, driving demand for comprehensive outsourcing agreements. Emerging markets in Asia-Pacific, Latin America, and Eastern Europe offer untapped opportunities where enterprises are modernizing IT ecosystems but lack in-house expertise. Outsourcing providers are also benefiting from the growing requirement for advanced cybersecurity measures, data governance, and compliance, which smaller firms struggle to manage independently. These opportunities are supported by rising digital transformation initiatives, creating a favorable environment for providers offering specialized services like workload balancing, edge data management, and secure migration strategies.

The data center outsourcing market is experiencing prominent trends marked by automation, artificial intelligence, and integration of managed services. Providers are embedding automation tools to streamline server maintenance, resource allocation, and capacity planning, reducing downtime and operational inefficiencies. Artificial intelligence is being applied in predictive analytics to monitor energy consumption, detect anomalies, and optimize cooling systems, making outsourcing agreements more performance-oriented. Another notable trend is the bundling of outsourcing services with value-added offerings such as cloud management, disaster recovery, and cybersecurity, which strengthens client-provider relationships. Clients are increasingly seeking unified service frameworks that reduce the complexity of handling multiple vendors, paving the way for long-term partnerships. The growing popularity of “as-a-service” models is also influencing outsourcing patterns, as enterprises prefer flexible and subscription-based payment structures aligned with usage. Together, these trends are reshaping outsourcing practices, making providers indispensable partners in managing critical digital infrastructure.

The data center outsourcing market faces critical challenges arising from stringent regulatory frameworks, compliance requirements, and data sovereignty concerns. Enterprises operating in finance, government, and healthcare must adhere to strict data residency rules, which limit outsourcing flexibility across borders. Providers are required to meet varying compliance standards such as GDPR, HIPAA, and other country-specific regulations, making global service delivery highly complex. Concerns regarding data security and breaches further challenge outsourcing decisions, as organizations weigh risks of handing over sensitive workloads to external parties. High dependency on third-party vendors also creates operational risks in terms of downtime, service disruptions, and contract rigidity. Rising geopolitical tensions and restrictions on cross-border data flows complicate long-term agreements and global expansion strategies. While these challenges impose limitations, they are also compelling outsourcing providers to enhance transparency, strengthen security protocols, and tailor services to meet local compliance needs.

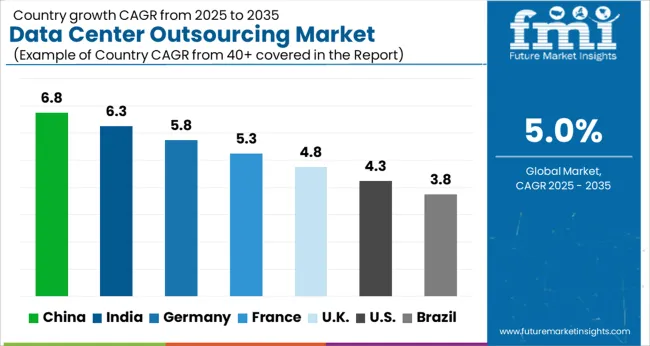

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global data center outsourcing market is projected to register a CAGR of 5% between 2025 and 2035. China leads among the key markets with 6.8% growth, followed by India at 6.3% and France at 5.3%. The United Kingdom is forecast to grow at 4.8%, while the United States trails at 4.3%. Growth is influenced by rising enterprise demand for cost-efficient IT infrastructure management, growing cloud adoption, and increasing need for reliable data processing capabilities. Developing economies such as China and India are advancing quickly with digital transformation investments, while developed markets like the USA, UK, and France are focusing on vendor consolidation and managed service adoption. This report covers insights across 40+ countries, with the leading markets summarized below.

The data center outsourcing market in China is expanding at a CAGR of 6.8%, reflecting its rapid pace of digital transformation. Increasing demand for cloud services, e-commerce, and enterprise digitalization is driving strong adoption of outsourcing solutions. Local companies and global providers are investing in advanced data center facilities to support hyperscale needs and government-mandated data localization policies. China’s emphasis on smart manufacturing, AI-driven applications, and financial services digitalization has further enhanced outsourcing demand. Service providers are offering cost-efficient models, disaster recovery solutions, and managed infrastructure tailored for domestic enterprises. While regulatory requirements create challenges for foreign players, the market is propelled by domestic demand, government support, and rapid growth in cloud-native enterprises.

The data center outsourcing market in India is growing at a CAGR of 6.3%, fueled by increasing enterprise digital transformation and rising reliance on IT-managed services. Large corporations and mid-sized firms are outsourcing infrastructure operations to reduce costs, improve scalability, and enhance security. The rapid expansion of fintech, telecom, and e-commerce industries has amplified the need for outsourced infrastructure and managed cloud services. Government initiatives supporting data localization and the growth of smart cities are also pushing enterprises toward outsourcing. Domestic and global vendors are building new hyperscale facilities and offering flexible service contracts to capture rising demand. The market outlook remains positive as enterprises continue to prioritize scalability, disaster recovery, and compliance with evolving data regulations.

The data center outsourcing market in France is expanding at a CAGR of 5.3%, supported by strong enterprise adoption of managed infrastructure services. French enterprises are outsourcing IT operations to enhance efficiency, manage costs, and comply with stringent EU data protection regulations. The adoption of hybrid and multi-cloud strategies is also increasing reliance on outsourcing providers who can deliver customized and compliant solutions. Data localization requirements under GDPR and government emphasis on digital sovereignty drive steady investments in local infrastructure. Key outsourcing providers are expanding their regional footprint to meet the growing demand from finance, healthcare, and retail sectors. The market outlook in France is shaped by regulatory compliance, demand for multi-cloud services, and continued enterprise cost optimization.

The data center outsourcing market in the United Kingdom is forecast to grow at a CAGR of 4.8%, driven by enterprise efforts to reduce IT costs and enhance scalability. The growing reliance on cloud computing, remote working infrastructure, and digital services has encouraged firms to outsource infrastructure management. UK-based enterprises prefer outsourcing models that combine efficiency with compliance to strict data protection laws. Market demand is further supported by financial institutions and public sector entities adopting hybrid and private cloud outsourcing strategies. While Brexit-related uncertainties initially slowed investments, outsourcing remains a key solution for businesses facing cost pressures and data compliance requirements. The market maintains moderate growth supported by cloud adoption, regulatory compliance, and demand for operational efficiency.

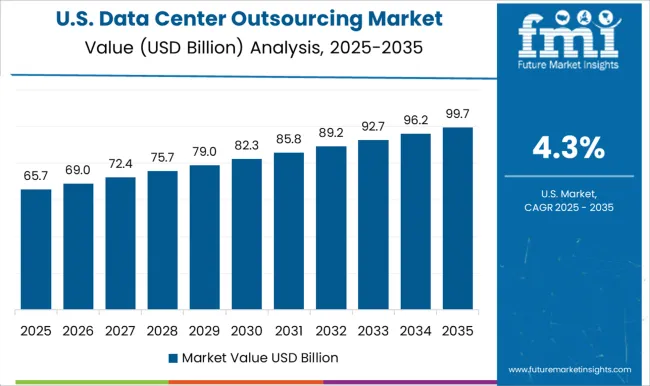

The data center outsourcing market in the United States is growing at a CAGR of 4.3%, reflecting stable but slower adoption compared to developing markets. USA enterprises already have mature digital infrastructures, and outsourcing is primarily focused on optimizing costs, enhancing disaster recovery, and ensuring regulatory compliance. Vendor consolidation is a notable trend, as large organizations prefer working with a smaller number of providers offering end-to-end managed services. The strong presence of hyperscale cloud providers also influences outsourcing patterns, with enterprises relying on integrated services combining cloud and colocation. While growth is modest, the USA market remains important due to its size, advanced enterprise adoption, and demand for managed infrastructure resilience.

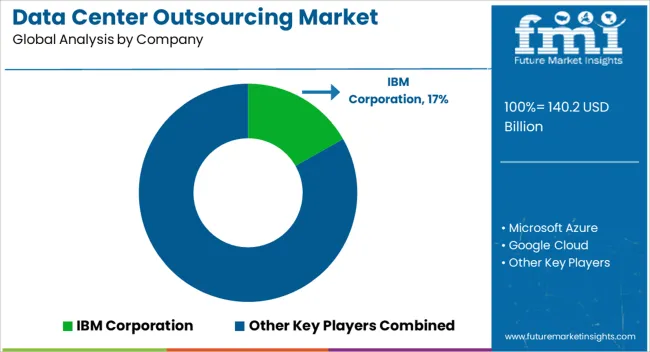

The data center outsourcing market has emerged as a critical enabler for organizations seeking to optimize IT operations, reduce capital expenditure, and enhance agility in managing digital workloads. Major players such as IBM Corporation, Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) are leading the way with cloud-based outsourcing solutions, offering clients flexibility, scalability, and strong service-level agreements. These companies dominate the market by providing infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and managed data center solutions that align with enterprise demands for efficiency and security. Complementing these leaders, firms like Cognizant and Tata Consultancy Services (TCS) specialize in hybrid outsourcing models, integrating traditional on-premises systems with modern cloud-based infrastructure.

Telecom-driven providers such as NTT Communications and Verizon Communications focus on secure connectivity, colocation, and network-integrated outsourcing solutions, serving multinational corporations with high availability and compliance-driven needs. The synergy between technology leaders, IT service companies, and telecom providers strengthens the ecosystem, enabling enterprises to outsource complex infrastructure management while focusing on core business operations. Growth in the data center outsourcing market is fueled by rising enterprise adoption of cloud migration strategies, the need for cost containment, and demand for advanced cybersecurity measures.

Organizations are increasingly outsourcing data centers to handle the surge in data generated by artificial intelligence, Internet of Things (IoT), and 5G-enabled devices. Companies such as IBM and Microsoft Azure are investing in AI-driven automation and predictive analytics to optimize workloads and reduce downtime. AWS and Google Cloud are extending their global footprint by expanding data center regions, ensuring low-latency services for international clients.

At the same time, providers like NTT Communications and TCS are enhancing service portfolios with consulting, multi-cloud management, and compliance-focused offerings to address industry-specific challenges. Strategic collaborations, cost-effective outsourcing packages, and robust cybersecurity frameworks are positioning these players at the forefront of market expansion. With enterprises demanding agility, scalability, and security, the data center outsourcing market is expected to remain an essential pillar of digital transformation strategies worldwide.

| Items | Values |

|---|---|

| Quantitative Units | USD 140.2 billion |

| Component | Hardware, Software, and Service |

| Physical Infrastructure | Data center facilities, Racks & cabinets, Cabling & wiring, and Power & cooling infrastructure |

| Organization Size | Large enterprises and SME |

| End User | BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, IT & Telecom, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM Corporation, Microsoft Azure, Google Cloud, Cognizant, Amazon Web Services (AWS), NTT Communications, Tata Consultancy Services (TCS), and Verizon Communications |

| Additional Attributes | Dollar sales by service type (infrastructure management, network management, storage, disaster recovery) and deployment model (cloud-based, on-premises, hybrid) are key metrics. Trends include rising demand for cost-efficient IT operations, growth in cloud adoption, and increasing preference for managed services. Regional adoption, regulatory compliance, and technological advancements are driving market growth. |

The global data center outsourcing market is estimated to be valued at USD 140.2 billion in 2025.

The market size for the data center outsourcing market is projected to reach USD 228.4 billion by 2035.

The data center outsourcing market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in data center outsourcing market are hardware, software and service.

In terms of physical infrastructure, data center facilities segment to command 41.7% share in the data center outsourcing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA