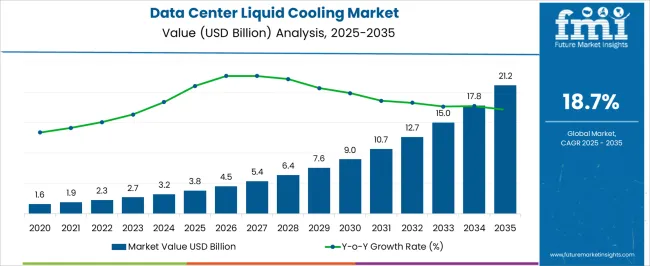

The Data Center Liquid Cooling Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 21.2 billion by 2035, registering a compound annual growth rate (CAGR) of 18.7% over the forecast period.

| Metric | Value |

|---|---|

| Data Center Liquid Cooling Market Estimated Value in (2025 E) | USD 3.8 billion |

| Data Center Liquid Cooling Market Forecast Value in (2035 F) | USD 21.2 billion |

| Forecast CAGR (2025 to 2035) | 18.7% |

The data center liquid cooling market is expanding rapidly as organizations face increasing demand for high performance computing, AI workloads, and data intensive applications. Rising heat densities in modern servers and the limitations of traditional air cooling methods are pushing operators toward liquid based solutions that provide superior thermal efficiency.

This shift is reinforced by the need to reduce operational costs, achieve energy efficiency targets, and meet sustainability goals set by enterprises and governments. Liquid cooling technologies are also enabling greater server density within existing infrastructure, which supports scalability without significant real estate expansion.

Innovations in immersion cooling, direct to chip solutions, and hybrid systems are driving adoption across hyperscale and colocation environments. With cloud adoption and digital transformation accelerating worldwide, the outlook for this market remains strong as liquid cooling establishes itself as a critical enabler of performance, sustainability, and cost optimization.

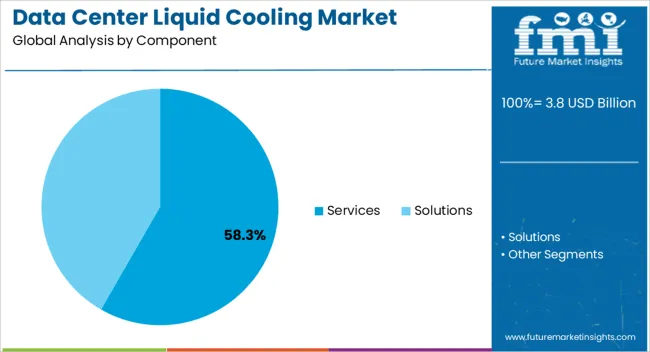

The services segment is projected to account for 58.30% of total revenue by 2025 within the component category, making it the dominant segment. This growth is being supported by rising demand for installation, maintenance, and optimization services that ensure the smooth deployment of liquid cooling solutions.

Service providers are delivering tailored solutions for integration with existing data center infrastructure, enabling operators to manage complex cooling systems efficiently. Additionally, the need for ongoing monitoring and performance tuning to achieve optimal efficiency has reinforced reliance on professional services.

As operators prioritize operational resilience and minimal downtime, the demand for specialized services has strengthened, leading to the leadership position of this segment.

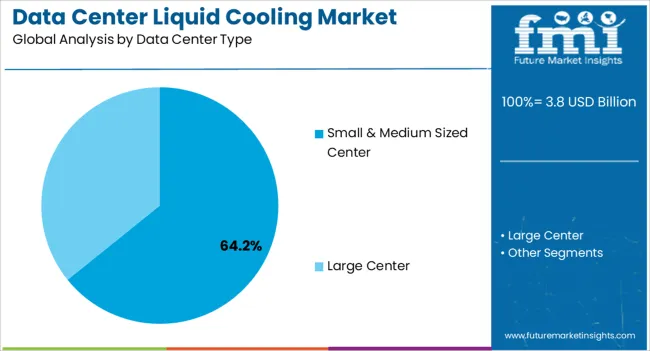

The small and medium sized data center type segment is expected to contribute 64.20% of total market revenue by 2025, positioning it as the largest segment. Growth is driven by the increasing deployment of edge computing facilities and regional data centers that support low latency applications and localized digital services.

Operators of these centers are adopting liquid cooling to overcome space constraints while maintaining efficiency and performance. The scalability and adaptability of liquid cooling solutions allow smaller facilities to achieve enterprise level performance standards.

With the rising adoption of AI, IoT, and real time analytics, small and medium sized centers are prioritizing liquid cooling as a cost effective and future ready solution.

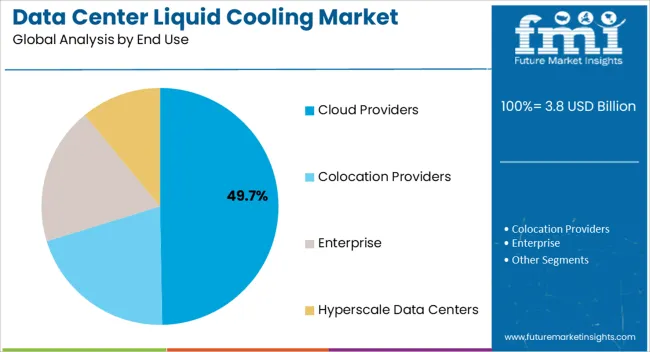

The cloud providers segment is projected to hold 49.70% of total revenue by 2025 within the end use category, establishing itself as the leading segment. This dominance is being fueled by the exponential growth in demand for cloud services and hyperscale infrastructure.

Cloud operators require highly efficient and sustainable cooling systems to manage massive compute loads and deliver uninterrupted services. Liquid cooling has been embraced as a solution that reduces energy usage, improves performance per rack, and aligns with carbon reduction goals set by global cloud leaders.

The increasing scale of AI and machine learning workloads has further accelerated adoption, as liquid cooling supports higher densities with greater reliability. As cloud providers continue to expand infrastructure globally, their investments in liquid cooling are expected to reinforce the leadership of this segment.

The global data center liquid cooling industry size expanded at a CAGR of 17.5% from 2020 to 2025. In 2020, the global market size stood at USD 1,180.7 million. In the following years, the market witnessed significant growth, accounting for USD 2,254.3 million in 2025.

Higher processing density could potentially be achieved in data centers within the same physical footprint through liquid cooling. Liquid cooling technologies enable the installation of more equipment in a smaller area by effectively eliminating heat. This is especially important in settings where space is expensive or scarce since it enables data centers to increase their processing power without changing their physical infrastructure.

Data centers are under pressure to lower their carbon footprint and energy use as environmental sustainability is becoming more and more of a concern. Compared to conventional air cooling, liquid cooling is a more ecologically friendly option since it increases energy efficiency and lessens the need for power-hungry cooling equipment. Data centers may aid in the development of a greener, more sustainable IT infrastructure by implementing liquid cooling technology.

High-performance, great-frequency, and intensive workload conditions, multi-core computing, such as artificial intelligence, machine learning, and end-to-end data center solutions, are in high demand in data centers. Data center owners may address a wide range of needs across the company, with the newest developments in indirect or direct-on-chip liquid cooling and system integrator services.

The increasing adoption of cold plates, direct liquid cooling (DLC), indirect liquid cooling, and rack liquid cooling by various end users. Such as cloud providers, colocation providers, hyperscale data centers, and others, are expected to drive demand for data center liquid cooling technology.

Data centers are experiencing unprecedented computation and core count-hungry applications in today's era. As traditional air cooling hits its limits, data center operators and owners must rethink rising density and the challenges they entail.

More than simply, mainframes and supercomputers benefit from liquid cooling in data centers.

Water and other liquids are far more efficient at carrying heat than air, and they can also remove some problems that come with air cooling systems. Especially as computer density rises and data centers grow, boosting the demand in the market. Liquid cooling technology has a far higher heat capacity than air; water is 4,000 times more efficient than air. This method provides improved energy efficiency across the data center when compared to air-cooled sites, with rack density estimates north of 50 kW.

The market is segmented into data center type, component, end-use, and region.

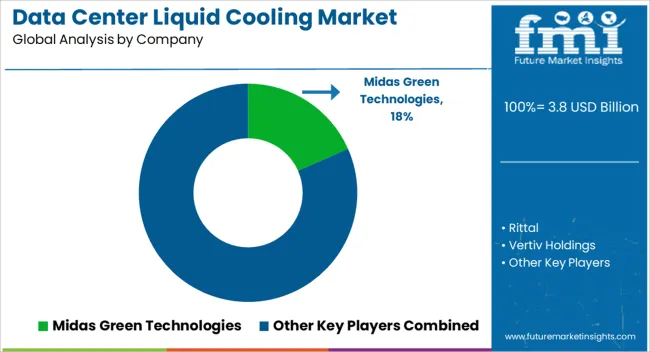

Enterprises favor liquid cooling systems for end users, which can be ascribed to customers' growing IT demands. By lowering downtime and enhancing disaster recovery capabilities, data center services assist save costs and preserving server availability. Due to these advantages, businesses are increasingly using data center liquid cooling in their data centers. As a result, the data center cooling market is anticipated to reach USD 3.8 billion by 2025.

By component, the FMI study finds that the solution component has a high revenue potential through 2035.

The adoption of the solution system is expected to be a CAGR of 18.6% during the forecast period. In 2025, the solution segment by component captured 55.4% shares in the global market. Key suppliers offer a variety of liquid cooling options, while niche and developing vendors offer niche and emerging liquid cooling solutions. Due to their usefulness in high-density cooling, data center liquid cooling technologies are garnering a lot of interest from large end-users.

Based on data centers, large data centers are predicted to grow at a rapid rate, with a CAGR of 17.7% through 2025. In 2025, the large data center type segment captured 61.2% shares in the global market. Large data centers are distinguished by their extensive use of processing power to meet the data center needs of large corporations. These data centers are distinguished by stringent operational cost limits and a stronger demand for energy efficiency. Currently, these data centers are seeing a lot of rack- and row-based cooling solutions, but immersion cooling technologies are expected to see a lot more acceptance. Because of the higher cooling requirements of high-density server racks.

North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America are the five key geographic regions that make up the global market.

Increasing technology adoption among North American organizations for reducing data center energy consumption, as well as the presence of data center liquid cooling vendors, are predicted to account for a huge market size of USD 3.8 billion over the projection period. In 2025, North America captured 34.3% shares in the global market, while the United States garnered 24.3% of global market shares. Individuals and businesses using the Internet in the United States of America are rapidly increasing. The country is a huge market for data center operations, and it is expected to continue to grow due to increased data consumption by end users.

The growing popularity of the Internet of Things (IoT) is a prominent driver for the hyper-scale data center market in the United States. Resulting in the construction of new facilities capable of handling exabytes of data generated by both commercial and consumer users.

Several sectors are experiencing a digital transformation, with enterprises migrating from traditional physical documents to digital services during the pandemic. According to the United Kingdom data center liquid cooling market, is expected to have a CAGR of 18.2% through 2035. In 2025, the United Kingdom captured 16.5% shares in the global market. Increased use of online payments in the BFSI industry has sparked demand for data centers with sophisticated cooling capabilities for servers to provide continuous and reliable services.

Companies provide effective thermal management systems to keep data centers running smoothly and with minimal downtime. Some benefits that are encouraging cloud service providers to use data center liquid cooling technologies include network reliability, security and compliance, hybrid cloud, and scalability.

The market leaders are concentrating their efforts on growing their consumer base to include international countries. To improve their market share and profitability, these companies are relying on strategic cooperation projects.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Component, Data Center Type, End Use, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global data center liquid cooling market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the data center liquid cooling market is projected to reach USD 21.2 billion by 2035.

The data center liquid cooling market is expected to grow at a 18.7% CAGR between 2025 and 2035.

The key product types in data center liquid cooling market are services and solutions.

In terms of data center type, small & medium sized center segment to command 64.2% share in the data center liquid cooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI Datacenter Liquid Cooling Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA