The Data Center Infrastructure Management Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.5 billion |

| Industry Value (2035F) | USD 7.5 billion |

| CAGR (2025 to 2035) | 11.8% |

The data center infrastructure management (DCIM) market is experiencing steady growth, driven by escalating demand for operational efficiency, energy optimization, and enhanced asset visibility within increasingly complex data center environments. Rapid growth in data generation, the rise of cloud computing, edge data centers, and enterprise digital transformation initiatives have intensified the need for integrated management platforms capable of monitoring, controlling, and optimizing both IT and facility infrastructures.

The market is further supported by increased regulatory focus on energy efficiency and sustainability within data center operations, prompting operators to adopt advanced DCIM solutions for improved energy monitoring and predictive maintenance. Looking ahead, the market outlook remains positive, with expansion expected across both hyperscale and colocation facilities.

Investments in artificial intelligence, machine learning-enabled monitoring tools, and real-time analytics are anticipated to redefine operational workflows and risk management strategies. The ability of DCIM systems to deliver centralized oversight, proactive issue resolution, and integration with hybrid cloud platforms will likely solidify their value proposition in future-ready data center ecosystems.

The market is segmented by Component, Application, Deployment Model, Data Center Type, and Vertical and region. By Component, the market is divided into Solution and Services. In terms of Application, the market is classified into Asset Management, Capacity Planning, Power Monitoring, Environmental Monitoring, and BI and Analytics. Based on Deployment Model, the market is segmented into On-premises and Cloud. By Data Center Type, the market is divided into Enterprise Data Center, Managed Data Center, Colocation Data Center, and Cloud and Edge Data Center. By Vertical, the market is segmented into BFSI, Government and Public Sector, IT and ITeS, Manufacturing, Healthcare and Life Sciences, Telecommunications, and Others (Retail, Education, Media, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Component, Application, Deployment Model, Data Center Type, and Vertical and region. By Component, the market is divided into Solution and Services. In terms of Application, the market is classified into Asset Management, Capacity Planning, Power Monitoring, Environmental Monitoring, and BI and Analytics. Based on Deployment Model, the market is segmented into On-premises and Cloud. By Data Center Type, the market is divided into Enterprise Data Center, Managed Data Center, Colocation Data Center, and Cloud and Edge Data Center. By Vertical, the market is segmented into BFSI, Government and Public Sector, IT and ITeS, Manufacturing, Healthcare and Life Sciences, Telecommunications, and Others (Retail, Education, Media, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

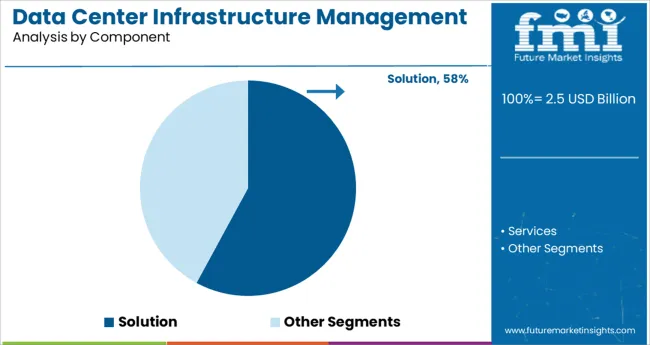

The solution segment held a commanding 57.9% share of the data center infrastructure management market, underpinned by its essential role in providing centralized, scalable, and customizable infrastructure management capabilities. Enterprises and colocation providers continue to favor comprehensive DCIM solutions as they offer integrated modules for monitoring power, cooling, asset tracking, and environmental parameters within increasingly distributed and mission-critical data center environments.

The segment’s dominance is further sustained by the heightened focus on operational visibility, capacity planning, and risk mitigation, especially as data center architectures grow more complex with the rise of edge computing and hybrid cloud deployments. Leading solution providers have expanded their offerings with AI-driven predictive analytics, automated asset discovery, and real-time visualization features, enabling operators to optimize resource utilization and reduce downtime risks.

The growing demand for modular, cloud-compatible, and vendor-agnostic management platforms is expected to fuel sustained adoption within this segment over the forecast period, ensuring its continued market leadership.

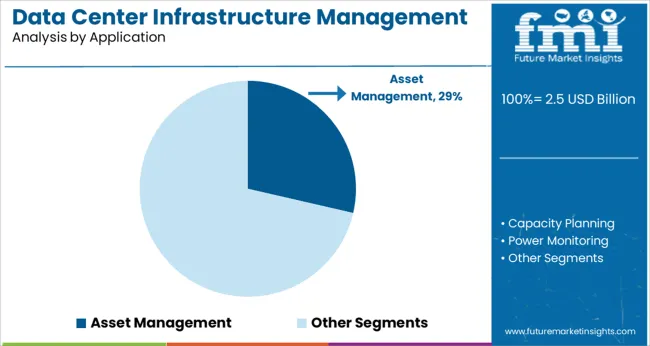

Within the application category, the asset management segment led with a 28.6% market share, supported by the critical importance of real-time tracking, auditing, and lifecycle management of physical and virtual assets within modern data centers. As infrastructure complexity increases and organizations adopt multi-cloud and edge strategies, efficient asset management solutions have become indispensable for maintaining operational control and cost transparency.

This segment has witnessed growing demand from operators seeking to enhance asset inventory accuracy, reduce equipment redundancy, and optimize resource deployment while ensuring compliance with internal and regulatory standards. Advanced asset management applications now integrate RFID, IoT sensors, and AI-powered analytics to provide real-time visibility into asset location, status, and performance.

Additionally, the ability to support predictive maintenance, capacity forecasting, and dynamic workload management further strengthens the value proposition of this application area. The anticipated integration of automated workflows and advanced reporting capabilities is expected to reinforce the segment’s market dominance in the coming years.

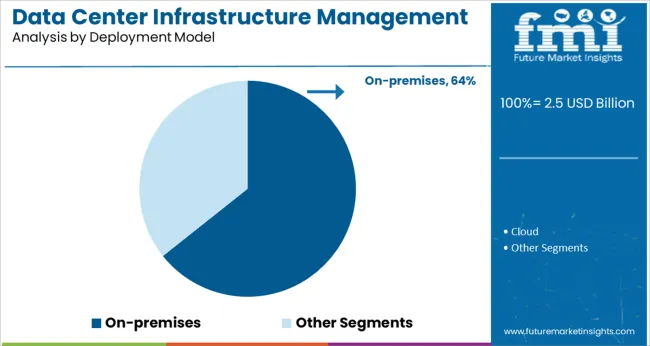

The on-premises segment commanded a 64.3% share within the deployment model category, maintaining its position as the preferred infrastructure management approach for enterprises and service providers prioritizing control, security, and data sovereignty. This segment’s sustained leadership is largely attributed to mission-critical industries such as finance, healthcare, government, and telecom, where regulatory compliance and latency-sensitive workloads necessitate dedicated, in-house infrastructure oversight.

Despite the growing popularity of cloud-based solutions, on-premises DCIM systems continue to dominate due to their ability to offer direct integration with legacy systems, high customizability, and minimal dependence on third-party networks. Organizations operating hyperscale and large colocation facilities further favor on-premises deployments for managing complex, multi-layered environments with stringent uptime requirements.

The market is witnessing continued innovation in this segment, with solution providers enhancing system scalability, remote access capabilities, and real-time environmental monitoring features. As hybrid IT environments evolve, on-premises DCIM solutions are expected to retain a significant market share by addressing operational risks and ensuring data governance for critical workloads.

This below table presents the expected CAGR for the Global data center infrastructure management market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 9.4%, followed by a slightly higher growth rate of 10.0% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 9.4% (2025 to 2035) |

| H2 | 10.0% (2025 to 2035) |

| H1 | 12.1% (2025 to 2035) |

| H2 | 11.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 12.1% in the first half from 2025 to 2035 and remain relatively moderate at 11.7% in the second half 2025 to 2035. In the first half (H1) 2025 the market witnessed a decrease of 60 BPS while in the second half (H2) 2025 the market witnessed an increase of 40 BPS.

Rapid Growth in Data Generation from IoT and Digital Services Necessitates Efficient Management for Data Center Infrastructure

IoT gadgets constantly acquire and transmit evidences, even as virtual offerings which include social media, e-trade, and cloud applications generate sizable quantities of statistics day by day. This inflow of information demand for statistics facilities to address massive and ever-growing volumes of facts. Efficient control of this statistics is vital to ensure that it's far stored securely, processed successfully, and reachable when wanted.

DCIM solutions provide the necessary tools to manipulate this statistics inflow, imparting visibility and control over data center operations to save blocks, optimize performance, and make certain records integrity.

Moreover, the diverse nature of statistics generated by way of IoT and digital services gives unique demanding situations. IoT gadgets, as an instance, regularly produce real-time data that desires immediately processing, while digital offerings generate huge documents requiring giant storage potential. DCIM solutions assist information facilities to evolve to these numerous needs with the aid of offering dynamic aid allocation, secure data control practices, and better scalability.

Increasing Demand for Real-time Monitoring and Analytics to Optimize Data Center Operations

Real-time tracking enables data internal operators to track the reputation of vital infrastructure components, consisting of energy, cooling, and network systems, in real-time. This visibility is critical for detecting variances, preventing ability and ensuring the fresh operation of records facilities. Real-time analytics further enhance this functionality by analyzing the enlarged data to provide actionable insights, assisting operators to make informed selections quick and optimize useful resource utilization.

Additionally, real-time monitoring and analytics are vital for maintaining high service levels and assembly stringent SLAs (Service Level Agreements). By constantly monitoring the fitness and performance of the infrastructure, data centers can proactively deal with troubles before they amplify into main troubles, thereby minimizing downtime and improving reliability.

Leveraging AI for Predictive Analytics and Automation is Driving Advancements in Data Center Infrastructure Management

AI-driven predictive analytics permit information internal operators to predict capacity difficulties before they occur, bearing in mind proactive upkeep and minimizing downtime. By reading large quantities of early and real-time records, AI can pick out patterns and traits that human operators might pass over, supplying early warnings of device failures, power variances, or cooling inefficiencies. This predictive capability guarantees that data centers can maintain most reliable overall performance and reliability, reducing the chance of sudden outages and improving normal performance.

In addition to predictive analytics, AI-driven automation is transforming how information centers are managed. Automation tools powered with the aid of AI can carry out ordinary obligations, such as useful resource provisioning, configuration control, and incident reaction, with minimal social intervention.

High Implementation Costs and Complexity is Significant Limitations

Establishing a robust DCIM system demand for significant in advance investment in each hardware and software. Data centers need to spend money on advanced monitoring gear, sensors, and software program systems which could manage the complicated necessities of present day infrastructure control.

These costs can be prohibitive, mainly for smaller groups or people with restrained budgets. Beyond the initial buy, there are ongoing prices related to software program licensing, renovation, and upgrades that could add to the economic problem. This financial constraint can deter many corporations from adopting comprehensive DCIM solutions, aside their capability advantages.

Additionally, the implementation procedure itself may be useful resource-extensive and time-ingesting. Integrating DCIM solutions into present data center environments frequently demand for extensive customization to make sure compatibility with legacy structures and workflows.

The data center infrastructure management industry recorded a CAGR of 9.7% during the historical period between 2020 and 2025. The growth of data center infrastructure management industry was positive as it reached a value of USD 1,755.2 million in 2025 from USD 1,242.0 million in 2020.

During this era, businesses more and more prioritized the optimization in their data center operations, aiming to enhance efficiency, minimize prices, and ensure seamless overall performance. The adoption of DCIM solutions surged as groups sought complete tools to reveal, control, and optimize their complex data center infrastructures. Factors along with the growing volume of records generated, the shift in the direction of cloud computing, and the developing importance of records protection and compliance in addition driven the demand for superior DCIM technology.

Looking in advance from 2025 to 2035, the call for forecast for DCIM is predicted to preserve its upward trajectory, though with a few super shifts and trends. The speedy expansion of digital ecosystems, pushed by way of rising technologies like artificial intelligence (AI), Internet of Things (IoT), side computing, and 5G networks, will power the need for greater and adaptable DCIM solutions.

Data facilities will look an increasing number of complicated challenges, which include handling hybrid and multi-cloud environments, optimizing power intake, ensuring regulatory compliance, and enhancing cybersecurity measures.

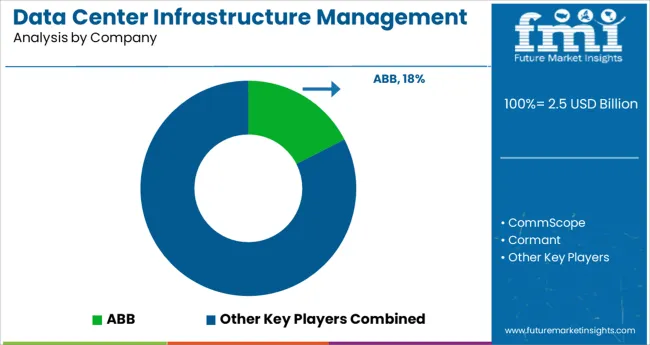

Tier 1 carriers within the DCIM are normally huge, set up businesses with an enormous global presence and a wide range of comprehensive DCIM solutions.

These companies often have robust design popularity, vast consumer bases, and a history of successful deployments in large-scale data center locations. Vendors in DCIM market include, Schneider Electric, IBM Corporation, Cisco Systems, Hewlett Packard Enterprise (HPE) and Vertiv Group Corporation.

Tier 2 vendors inside the DCIM are generally mid-sized agencies or divisions of larger corporations that offer specialized DCIM solutions concentrated on specific enterprise segments or technological niches.

While they not have the equal international attain as Tier 1 vendors, Tier 2 providers regularly excel in providing tailored solutions and personalized customer support. Vendors in DCIM include, Nlyte Software, Panduit Corporation, Sunbird Software and Device42.

Tier 3 providers inside the DCIM are usually smaller agencies or startups that focus on niche areas or offer progressive solutions with specific functions. These vendors additionally have a more confined geographic presence but exceedingly competitive in particular segments. Tier 3 providers frequently differentiate themselves via specialization, agility, and a focus on emerging technologies.

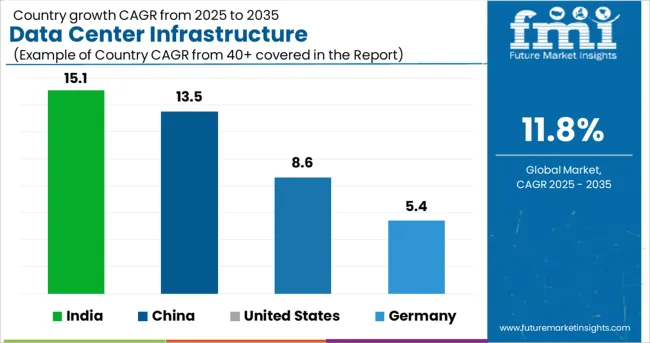

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 15.1% |

| China | 13.5% |

| United States | 8.6% |

| Germany | 5.4% |

This below section covers the industry analysis for the data center infrastructure management market for different countries. This country-specific insights highlight the dynamics and growth opportunities within the data center infrastructure management market. The United States' continued dominance reflects its mature landscape and ongoing advancements in data center technologies.

India's rising prominence highlights the evolving landscape in South Asia and Pacific, driven by digital initiatives and increasing demand for efficient data center management solutions. The United States is anticipated to remain at the forefront in North America, with a value share of 68.4% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 8.6% by 2035.

The United States Data Center Infrastructure Management Market is growing. This is due to Advanced Technological Infrastructure and Substantial Investments in Data Center Modernization. A Strong Presence of Key Industry Players Contributes to the Industry as well

USA data center infrastructure management market is poised to exhibit a CAGR of 8.6% between 2025 and 2035. The country boasts advanced technological infrastructure that includes robust networking capabilities and modern data center technologies. This supports sophisticated DCIM solutions deployment and enable efficient data center resource management, monitoring, and optimization.

Several investments in data center modernization also drive growth. Companies in various industries upgrade facilities for scalability and reliability. They also seek energy efficiency, boosting advanced DCIM solutions adoption.

Germany holds around 20.8% share by 2035 in Western Europe data center infrastructure management industry amounting to a valuation of USD 7.5 million by 2035.

Germany claims an advanced technological infrastructure, including high-speed connectivity, data center facilities, and cloud computing capabilities. These technological assets enable the deployment of sophisticated DCIM solutions that provide real-time monitoring, automation, and optimization of data center operations.

Germany maintains demanding regulatory standards, particularly regarding data protection, security, and environmental sustainability. Compliance with these standards drives the adoption of robust DCIM solutions that ensure regulatory adherence and risk mitigation.

China has skilled a first frequency virtual transformation over the past few many years, with big investments in era infrastructure, such as excessive-pace networks, cloud computing offerings, and information data centers. This technological proficiency has enabled Chinese organizations to embrace superior DCIM solutions for optimizing their data in middle operations.

With a growing emphasis on performance, scalability, and reliability, Chinese businesses are increasingly turning to DCIM equipment to manipulate their complicated IT environments successfully. China is expected to continue its dominance and it currently holds around 62.9% share of the East Asia data center infrastructure management industry.

This section contains information about the leading segments in the industry. By solution, software segment is estimated to grow at a CAGR of 12.9% throughout 2035. Additionally, by industry, IT and telecommunications segment is projected to expand at 12.7% till 2035.

| Solution | Hardware |

|---|---|

| Value Share (2035) | 42.9% |

The hardware segment dominates the market in terms of revenue and will account for almost 42.9% of the market share in 2035. The essential role plays in managing and optimizing data center operations. Hardware components such as sensors, servers, networking equipment, and storage devices are essential for collecting data, monitoring performance, and ensuring efficient resource utilization within data centers.

As data centers continue to evolve with technological advancements like IoT and edge computing, hardware remains a fundamental stake in supporting their functionalities and driving growth in the DCIM market.

| Industry | IT & Telecommunications Venues |

|---|---|

| Value Share (2035) | 22.8% |

The IT and telecommunications venues segment is forecast to account for a revenue of over USD 23,577.87 million in the data center infrastructure management market by 2035 end.

Data center infrastructure management plays an essential role in delivering notifications, alerts, and updates to users regarding system status, software updates, security alerts, and service interruptions. These messages are helpful in keeping users informed about critical IT proceedings in real-time, certifying smooth operations and prompt perseverance of any issues.

Key players operating in the data center infrastructure management market are investing in advanced technologies and also entering into partnerships. Key data center infrastructure management providers have also been acquiring smaller players to grow their presence to further penetrate the market across multiple regions.

Recent Industry Developments in Data Center Infrastructure Management Market

The industry is divided into cloud-based and on-premises messaging platform.

The sector is segregated into large enterprises and small and medium enterprises.

The industry is classified by BFSI, retail, healthcare, travel and hospitality, IT and telecommunications and others.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The global data center infrastructure management market is estimated to be valued at USD 2.5 billion in 2025.

It is projected to reach USD 7.5 billion by 2035.

The market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types are solution and services.

asset management segment is expected to dominate with a 28.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Data Pipeline Observability Solutions Market Size and Share Forecast Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA