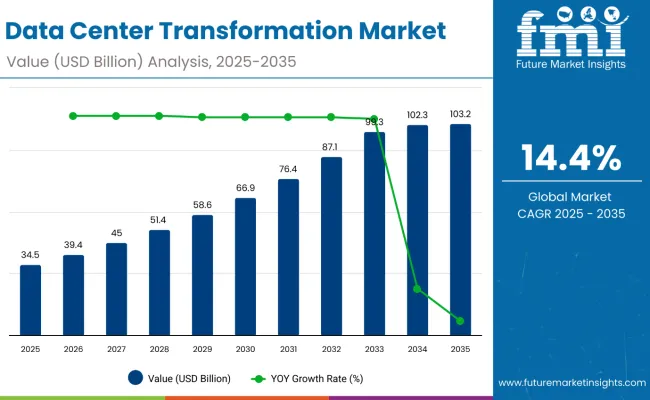

The global data center transformation market is projected to grow USD 34.56 billion in 2025 to USD 103.26 billion by 2035. This represents a robust compound annual growth rate (CAGR) of 14.4%. Accelerated adoption of cloud computing and digital transformation initiatives across industries such as BFSI (banking, financial services, and insurance), healthcare, and IT is driving this rapid expansion.

| Attributes | Description |

|---|---|

| Estimated Size, 2025 | USD 34.56 billion |

| Projected Size, 2035 | USD 103.26 billion |

| Value-based CAGR (2025 to 2035) | 14.4% |

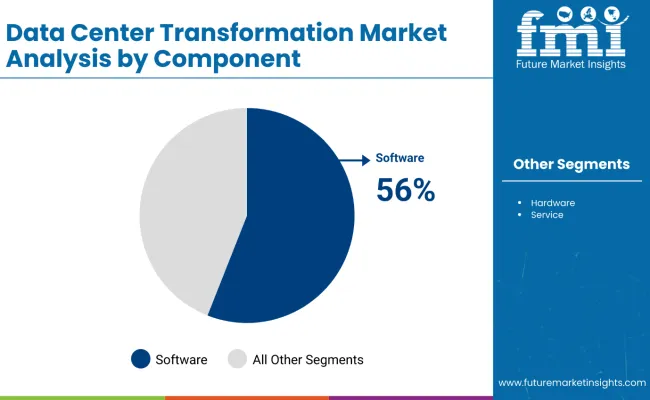

Operational efficiency and sustainability remain top priorities for enterprises, fueling strong demand for Data Center Infrastructure Management (DCIM) software. DCIM platforms enable centralized monitoring and control of data center assets, power usage, cooling systems, and space optimization. This software segment is expected to grow at a CAGR of 15.8% between 2025 and 2035, driven by the need to reduce operational costs, improve uptime, and comply with environmental regulations.

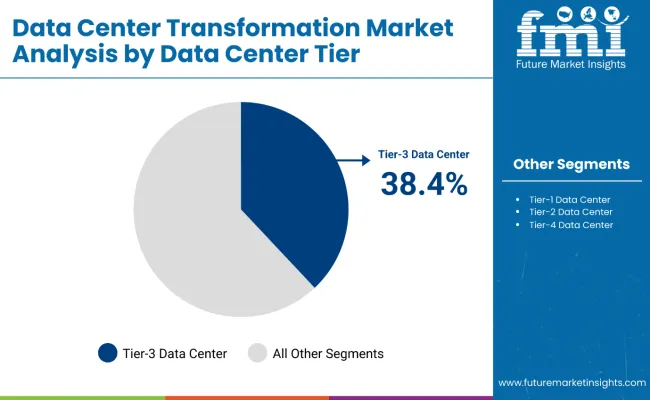

Government-led programs also play a pivotal role. The USA Federal Data Center Consolidation Initiative (FDCCI) has been instrumental in accelerating the shift toward Tier 3 data centers. These centers, known for their N+1 redundancy and high availability, accounted for 38.4% of the market share in 2024 and are poised to maintain dominance. Tier 3 facilities offer enhanced resilience, energy efficiency, and scalability, aligning with enterprise demands for robust digital infrastructure.

In March 2025, Gartner recognized data center modernization as a crucial pillar in enterprise digital strategies. The increasing shift toward hybrid and multi-cloud environments is driving investments in next-generation data centers that combine advanced hardware, software-defined infrastructure, and AI-powered management tools. “Data center transformation is essential for achieving digital agility while meeting stringent sustainability goals,” said Anjali Rao, Chief Technology Officer at Equinix. She highlighted that Tier 3 data centers effectively balance reliability and energy efficiency to support evolving business needs.

With continuous advancements in DCIM solutions and growing cloud consumption, the Data Center Transformation market outlook remains highly positive. Regulatory pressures, sustainability mandates, and the pursuit of operational excellence will continue to propel market growth through 2035.

As data centers evolve to support cloud computing, edge infrastructure, and AI workloads, governments are enforcing stricter regulations to ensure data security, energy efficiency, sustainability, and operational resilience. These regulations guide the design, operation, and modernization of data centers in both public and private sectors.

Data Protection and Privacy Laws:

Data centers must comply with regulations such as the General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA) in the U.S., and other national data protection laws. These frameworks require secure storage, processing, and transfer of personal data, along with strict access controls and data sovereignty compliance during transformation initiatives.

Energy Efficiency and Sustainability Standards:

Governments mandate the use of energy-efficient infrastructure and green technologies through frameworks like the EU Energy Efficiency Directive, U.S. Department of Energy (DOE) efficiency guidelines, and LEED certification. During transformation, data centers must adopt efficient cooling, power usage effectiveness (PUE) metrics, and renewable energy sources to meet climate goals and reduce environmental impact.

Cybersecurity and Critical Infrastructure Protection:

Regulations such as the NIST Cybersecurity Framework (U.S.), ENISA guidelines (EU), and Critical Infrastructure Protection (CIP) standards require data centers to implement robust cybersecurity protocols during modernization. This includes network segmentation, encryption, intrusion detection, and compliance with national critical infrastructure designations where applicable.

Health, Safety, and Operational Compliance:

Data centers must adhere to building codes, fire safety standards, and occupational safety regulations such as OSHA (Occupational Safety and Health Administration) in the U.S. and equivalent bodies in other countries. Transformation projects involving facility upgrades or new builds must follow structural, electrical, and environmental compliance to ensure safety and uptime.

The below table presents the expected CAGR for the global Data Center Transformation market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Data Center Transformation industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 13.0%, followed by a slightly higher growth rate of 15.0% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 13.0% |

| H2 (2024 to 2034) | 15.0% |

| H1 (2025 to 2035) | 13.6% |

| H2 (2025 to 2035) | 15.2% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 13.6% in the first half and remain higher at 15.2% in the second half. In the first half H1 the market witnessed an increase of 60 BPS while in the second half H2, the market witnessed an increase of 20 BPS.

DCIM software is projected to grow at a CAGR of 15.8% between 2025 and 2035. This segment is critical for optimizing data center operations, asset utilization, and energy efficiency. Increasingly complex infrastructures and sustainability mandates DCIM adoption. The software provides real-time monitoring and analytics, enabling predictive maintenance and capacity planning. BFSI, healthcare, and IT sectors are leading adopters, driven by the need for operational transparency and risk management.

TechCrunch reported in 2024 that DCIM software investments surged due to growing cloud workloads and regulatory compliance requirements. This trend is expected to intensify as organizations modernize their data centers. Anjali Rao of Equinix stated, “DCIM tools empower organizations to transform data centers into agile, efficient environments aligned with sustainability targets.”

Tier 3 data centers held a 38.4% market share in 2025, expected to remain dominant through 2035. These centers offer high availability, fault tolerance, and scalability, essential for enterprise and government applications.

The USA government’s FDCCI initiative has accelerated consolidation towards Tier 3 facilities, focusing on resilience and efficiency. Tier 3 data centers combine uptime reliability with cost-effective operations. Bloomberg noted in 2025 that Tier 3 adoption surged as organizations sought robust infrastructure to support cloud migration and digital transformation. This segment balances performance and sustainability requirements. Anjali Rao highlighted, “Tier 3 data centers are the backbone of resilient, sustainable IT infrastructure, critical for future-proofing enterprises.”

Rising demand for scalable and energy-efficient data center infrastructure

The increasing volume of data being processed and stored across various industries has resulted in growing demand for scalable and energy efficient data center infrastructure. With increasing workloads and demand for performance, enterprises are modernizing their data centers to optimally use and reduce operational cost.

Traditional Data Centers require huge amounts of power, leading to soaring energy bills and carbon footprints. To mitigate this, organizations are pursuing modular and liquid-cooled solutions to maximize scale and minimize power usage. Governments around the globe are implementing energy efficiency standards for data centers and rewarding the use of green infrastructure.

In 2024, the USA Department of Energy announced USD 500 million in grants for companies making energy-efficient cooling and power distribution a reality in data centers. In a similar vein, the European Commission also aims for data centers to be climate-neutral by 2030, meaning that operators would need to implement renewable energy systems. These challenges - combined with climbing power costs - drive businesses toward high-efficiency cooling systems, often integrated with renewable energy, and AI-based power optimization.

Growing need for AI-driven automation and predictive analytics in data centers

From AI-powered predictive analytics to smarter infrastructure management, artificial intelligence is changing the data center landscape for the better. As data centers asset become increasingly complex, AI-powered tools are being used to monitor, optimize, and predict system performance.

These solutions minimize downtime, improve workload distribution, and optimize cooling and energy consumption. Apart from efficient usage, AI-driven management aids in capacity planning, anticipating the infrastructure needs for the future based on usage trends.

They are also aware of the stake AI occupies on their social contracts as part of their governments’ investments and interest in AI; for the operation of a data center, where the data remains stable, AI can play a role as a cybersecurity safeguard and in improving energy efficiency (Yao et al. China’s Ministry of Industry and Information Technology allocated USD 1.2 billion toward AI-driven infrastructure projects, including automation of data centers, in 2023.

The Indian government eventually introduced AI to a data center on a public cloud, with an exciting initiative to improve computational efficiency and reduce power waste in data centers. Data Center Infrastructure Management (DCIM) software is also starting to build in predictive analytics, predicting real-time failures and automatically resolving issues, which will help cut down maintenance costs.

Increasing preference for hyperscale and modular data centers

Rising cloud usage, IoT expansion, and increased demand for real-time processing have led to a trend towards hyperscale and modular data centers. Hyperscale data centers run by AWS, Microsoft, Google, and other cloud giants grow in size to power high-performance workloads, artificial intelligence, and big data analytics.

Compared to conventional data centers, these facilities provide better scalability, efficiency, and cost-efficiency. Modular data centers, however, offer a modular, scalable solution that enables organizations to quickly and cost-effectively deploy infrastructure.

Hyperscale OTT cloud vendors are driving their expansion to enable low-latency service availability via government incentives, infrastructure projects, and investment. Earlier in 2024, Singapore also revealed USD 750 million worth of new data center projects, with stringent sustainability requirements.

A new initiative to reward modular data center projects for edge computing applications in relation to smart cities and 5G networks has also been launched by the European Union. There are more than 800 data centers in the hyperscale market, which is forecasted to grow to over 1,200 by the year 2026.

High initial investment in next-gen servers, cooling systems, and network infrastructure

For updating data center hardware components, such as the latest generation of servers, improved cooling systems, and other speedy networking technology all need massive amounts of capital for modernization.

As data grow, and the compute required to extract value from this data increases, organizations must deploy high-performance servers with greater processing power, storage capacity, and energy efficiency. Nonetheless, the significant per-server cost of such high-end units makes mass upgrades prohibitively costly and presents a difficulty for enterprise budgets.

Cooling systems represent another significant cost associated with data center transformation. The traditional cooling means tend to be inefficient and expensive, which increases energy consumption and operational costs.

In addition to the initial investment for the solutions, costs arise due to their installation complexities and maintenance requirements (liquid cooling and immersion cooling technologies). Moreover, modern data centers require organizations to seek investment in redundant power supplies, and energy-efficient cooling solutions to enhance both ensuring high availability high reliability.

Vendor Tier 1 vendors are leading global companies with high technological capabilities and comprehensive service coverage. All these giants in any given industry leverage large R&D investments and wide-scale deployments to innovate and standardize for larger enterprises.

Tier 2 vendors, characterized by strong regional presence and specialized solutions designed for particular industry transitions. They are crucial in bridging the global gap with regional requirements due to their specialized services and ability to provide localized support for transforming businesses according to global standards.

Tier 3 vendors: often smaller, niche and/or local service providers. However, their smaller size means less complicated operations, and they are crucial in meeting the needs of a growing market and providing niche solutions. Overall, this combination of different tiers creates a balanced ecosystem around a rich set of customer needs, leading drove innovation and agility across the landscape of data center transformation.

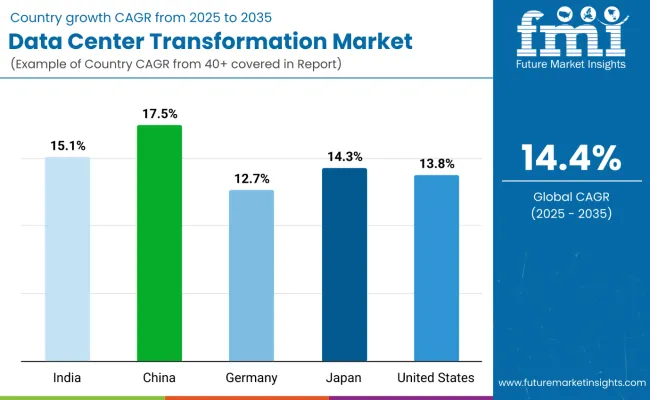

The section highlights the CAGRs of countries experiencing growth in the Data Center Transformation market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.1% |

| China | 17.5% |

| Germany | 12.7% |

| Japan | 14.3% |

| United States | 13.8% |

Both the government initiatives and a booming digital economy are making India as the Promising Market for data center transformation. The Digital India initiative of the Indian government and policies such as the Data Center Policy 2020 have attracted investments into new generation data centers.

Cloud adoption has increased by 30% and AI workloads are becoming commonplace, leading enterprises to high-performance (HP) infrastructure to scale their businesses. Moreover, the push by India for data localization laws has increased the demand within India for data centers, causing enterprises to upgrade and expand their IT infrastructure.

In 2023, an investment of USD 1 billion was revealed from the Indian government in data centre parks to promote digital transformation and enhanced cloud infrastructure. This has prompted global players to set up hyperscale and edge data centers to address the country’s rising demand for low-latency, high-performance computing.

In addition, several state-level policies in Maharashtra, Tamil Nadu and Telangana offer tax incentives for emerging data center projects. India is anticipated to see substantial growth at a CAGR 15.1% from 2025 to 2035 in the Data Center Transformation market.

The USA leads the data center evolution with enterprises quickly moving to software-defined and AI-based associate management systems. The demand for automation, real-time monitoring, and predictive analytics is propelling the adoption of Software-Defined Data Centers (SDDCs).

These AI-powered solutions would help manage workload/working power distribution and security automation thereby delivering higher operational efficiency and minimizing downtime. To scale operations seamlessly, most of the major cloud providers and enterprises are relying on hyperconverged infrastructure (HCI).

Data center modernization has been a flat out supported theory by the USA government with energy effectiveness controls and cybersecurity strategies. The USA Department of Energy earmarked USD 500 million in 2023 for next-generation cooling technology research to help curb information center energy use. USA Data Center Transformation market is anticipated to grow at a CAGR 13.8% during this period.

The digital transformation is rapidly in China fueled through government-driven initiatives and cloud integration projects in China. The government’s 14th Five-Year Plan (2021 to 2025) focuses on the growth of intelligent data centers, supporting the nation’s transition toward an AI-powered, “cloud first” infrastructure.

However, with new data localization laws and increased regulatory oversight, enterprises are investing in next-generation data centers to address stringent cybersecurity needs while enabling high-performance computing.

China’s Ministry of Industry and Information Technology (MIIT) allocated USD 2 billion to the development of green data centers in 2024, and targets a 20% reduction in power consumption by large data centers by 2026.

Furthermore, significant investments in hyprescale data centers have been driven by the New Infrastructure Plan, particularly in Guangdong, Jiangsu and Zhejiang provinces. ISP) services and the aggressive push for 5G, AI and blockchain pen why cloud adoption is accelerating and businesses must modernize their network, storage and compute infrastructure. China is anticipated to see substantial growth in the Data Center Transformation market significantly holds dominant share of 54.2% in 2025.

The Data Center Transformation market has been seeing substantial growth globally as it has progressed significantly in the last two decades. Innovative technologies like AI-powered automation, cloud integration and software-defined data centers can allow companies to achieve higher levels of performance and reliability. It’s a competitive environment, with companies racing to provide tailored solutions for a wide range of industries including cloud computing, telecom and healthcare.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 34.56 billion |

| Projected Market Size (2035) | USD 103.26 billion |

| CAGR (2025 to 2035) | 14.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Components Analyzed (Segment 1) | Hardware, Software, Services |

| Data Center Types Analyzed (Segment 2) | Enterprise Data Centers, Edge Data Centers, Colocation Data Centers, Hyperscale Data Centers, Cloud Data Centers, Managed Data Centers |

| Data Center Tiers Analyzed (Segment 3) | Tier-1, Tier-2, Tier-3, Tier-4 |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

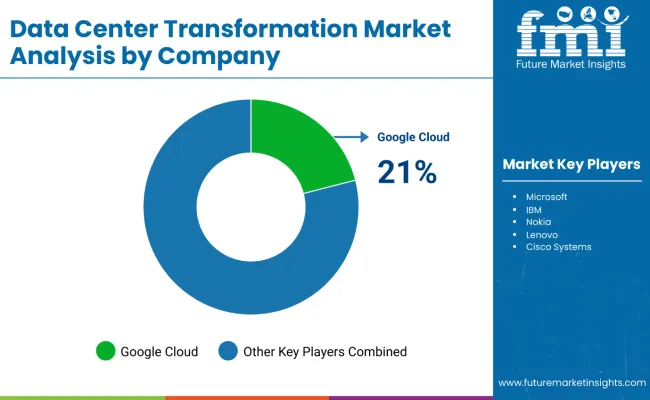

| Key Players influencing the Data Center Transformation Market | Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, Nokia, Lenovo, Huawei Technologies, Cisco Systems, Dell Technologies, Schneider Electric |

| Additional Attributes | Dollar sales by component (hardware, software, services), Market dominance by Tier 3 and Tier 4 data centers, Trends in hyperscale and edge deployment, Role of DCIM in operational efficiency, Industry-specific data center modernization in BFSI, healthcare, and telecom |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of component, the segment is divided into hardware, software and services.

In terms of data center type, the segment is segregated into Enterprise Data Centers, Edge Data Centers, Colocation Data Centers, Hyper scale Data Centers, Cloud Data Centers and Managed Data Centers.

In terms of data center tier, the segment is segregated into Tier-1 Data Center, Tier-2 Data Center, Tier-3 Data Center and Tier-4 Data Center.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Data Center Transformation industry is projected to witness CAGR of 14.4% between 2025 and 2035.

The Global Data Center Transformation industry stood at USD 34.56 billion in 2025.

The Global Data Center Transformation industry is anticipated to reach USD 103.26 billion by 2035 end.

East Asia is set to record the highest CAGR of 16.9% in the assessment period.

The key players operating in the Global Data Center Transformation Industry Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, Nokia, Lenovo, Huawei Technologies, Cisco Systems, Dell Technologies, Schneider Electric.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Service Types, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Tier Type, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End-Use , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 17: Global Market Attractiveness by Service Types, 2023 to 2033

Figure 18: Global Market Attractiveness by Tier Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End-Use , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 37: North America Market Attractiveness by Service Types, 2023 to 2033

Figure 38: North America Market Attractiveness by Tier Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End-Use , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Service Types, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Tier Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-Use , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 77: Europe Market Attractiveness by Service Types, 2023 to 2033

Figure 78: Europe Market Attractiveness by Tier Type, 2023 to 2033

Figure 79: Europe Market Attractiveness by End-Use , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Service Types, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Tier Type, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End-Use , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Service Types, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Tier Type, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End-Use , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Service Types, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Tier Type, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End-Use , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Service Types, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Tier Type, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End-Use , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Service Types, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Service Types, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Service Types, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Tier Type, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Tier Type, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Tier Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End-Use , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End-Use , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End-Use , 2023 to 2033

Figure 157: MEA Market Attractiveness by Service Types, 2023 to 2033

Figure 158: MEA Market Attractiveness by Tier Type, 2023 to 2033

Figure 159: MEA Market Attractiveness by End-Use , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA