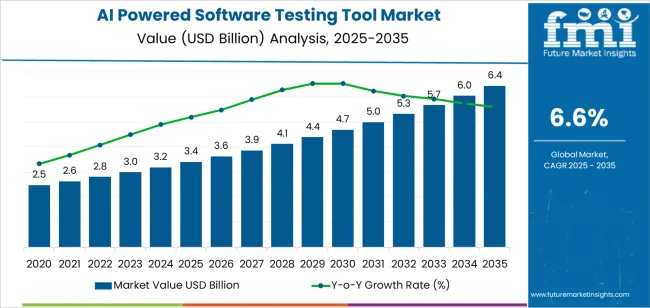

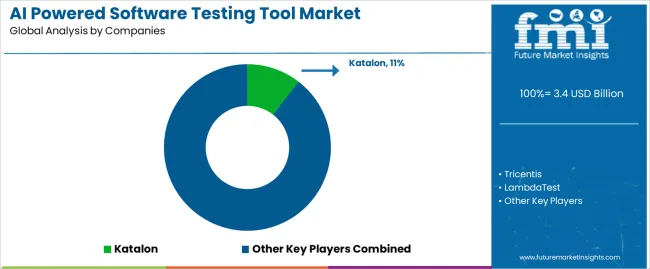

The global AI powered software testing tool market is valued at USD 3.4 billion in 2025. It is slated to reach USD 6.4 billion by 2035, recording an absolute increase of USD 3.0 billion over the forecast period. This translates into a total growth of 89.5%, with the market forecast to expand at a compound annual growth rate of 6.6% between 2025 and 2035. The market size is expected to grow by nearly 1.9 times during the same period, supported by increasing demand for automated testing solutions, growing adoption of AI and machine learning technologies in software development, and rising focus on continuous integration and continuous deployment practices across diverse enterprise applications and digital transformation initiatives.

Between 2025 and 2030, the market is projected to expand from USD 3.4 billion to USD 4.6 billion, resulting in a value increase of USD 1.3 billion, which represents 42.1% of the total forecast growth for the decade. This phase of development will be shaped by increasing software development velocity and agile methodology adoption, rising complexity of web and mobile applications requiring comprehensive test coverage, and growing demand for intelligent test automation that reduces manual testing effort and accelerates release cycles. Software development organizations and quality assurance teams are expanding their AI powered testing capabilities to address the growing need for efficient testing solutions that ensure application quality while supporting rapid deployment schedules.

From 2030 to 2035, the market is forecast to grow from USD 4.6 billion to USD 6.4 billion, adding another USD 1.8 billion, which constitutes 57.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of autonomous testing capabilities and self-healing test scripts, the development of predictive analytics for defect identification and test optimization, and the growth of specialized applications for microservices architecture testing and cloud-native application validation. The growing adoption of DevOps practices and shift-left testing methodologies will drive demand for AI powered testing tools with enhanced intelligence and comprehensive automation features.

Between 2020 and 2025, the market experienced steady growth, driven by increasing recognition of test automation benefits and growing awareness of AI capabilities to improve test coverage, reduce testing time, and enhance defect detection accuracy. The market developed as software development teams and quality assurance professionals recognized the advantages of AI powered testing technology to optimize test case generation, improve test maintenance, and support continuous testing objectives while addressing resource constraints. Technological advancement in natural language processing and computer vision began focusing the importance of maintaining test reliability and intelligent test execution in complex application environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.4 billion |

| Forecast Value in (2035F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Market expansion is being supported by the increasing global demand for accelerated software delivery cycles driven by digital transformation initiatives and competitive market pressures, alongside the corresponding need for intelligent testing automation that can improve test coverage, reduce manual effort, and maintain quality assurance effectiveness across various web applications, mobile apps, and enterprise software systems. Modern software development organizations and quality assurance teams are increasingly focused on implementing AI powered testing solutions that can generate test cases automatically, adapt to application changes, and provide consistent testing performance in dynamic development environments.

The growing focus on continuous testing and DevOps integration is driving demand for AI powered tools that can support automated test execution, enable intelligent defect prediction, and ensure comprehensive quality validation throughout software development lifecycles. Development teams' preference for testing platforms that combine automation capabilities with intelligent analysis and self-maintenance features is creating opportunities for advanced AI powered implementations. The rising influence of cloud computing adoption and microservices architecture is also contributing to increased utilization of AI powered testing tools that can provide scalable testing capabilities without compromising test reliability or development velocity.

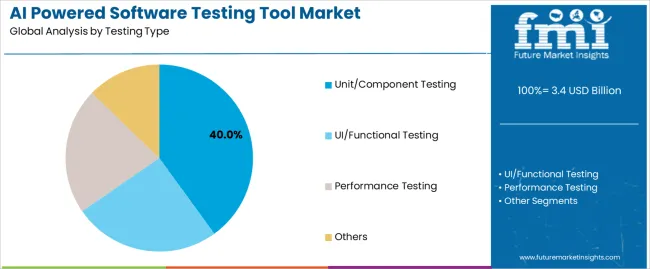

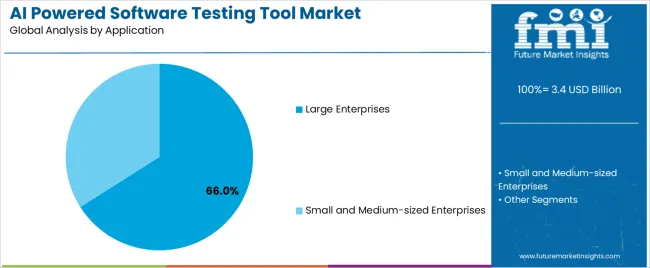

The market is segmented by testing type, application, and region. By testing type, the market is divided into unit/component testing, UI/functional testing, performance testing, and others. Based on application, the market is categorized into large enterprises and small and medium-sized enterprises. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The unit/component testing segment is projected to maintain its leading position in the market with 40.0% market share in 2025, reaffirming its role as the preferred testing category for early-stage defect detection and code quality validation. Software developers and quality assurance engineers utilize AI powered unit testing tools for their ability to automatically generate test cases, identify code coverage gaps, and proven effectiveness in detecting bugs during development phases while supporting test-driven development practices. Unit testing technology's proven reliability and integration with continuous integration pipelines directly address the development requirements for rapid feedback and code quality assurance across diverse programming languages and development frameworks.

This testing segment forms the foundation of modern software quality practices, as it represents the testing type with the greatest frequency of execution and established impact on defect prevention throughout the software development lifecycle. Technology company investments in automated testing infrastructure continue to strengthen adoption among development teams and quality assurance organizations. With agile methodologies focusing early testing and continuous validation, unit/component testing aligns with both quality objectives and development efficiency requirements, making it the central component of comprehensive software testing strategies.

The large enterprises application segment is projected to represent the 66.0% market share of AI powered software testing tool demand in 2025, highlighting its role as the primary driver for advanced testing tool adoption across complex application portfolios, enterprise resource planning systems, and mission-critical software platforms. Large enterprises utilize AI powered testing tools due to their extensive software portfolios, complex testing requirements, and ability to justify investment in advanced automation technologies while supporting digital transformation initiatives and quality improvement programs. Positioned as essential technology investments for enterprise IT departments, AI powered testing tools offer both operational efficiency and quality assurance benefits.

The segment is supported by continuous expansion in enterprise software complexity and the growing availability of integrated testing platforms that enable comprehensive test automation with improved defect detection rates and reduced testing cycle times. Large enterprises are investing in comprehensive testing transformation programs to support increasingly demanding application release schedules and quality expectations from business stakeholders. As software complexity increases and release frequencies accelerate, the large enterprises application will continue to dominate the market while supporting advanced testing capabilities and quality engineering maturity.

The AI powered software testing tool market is advancing due to increasing pressure for faster software delivery driven by competitive dynamics and growing adoption of DevOps practices that require intelligent automation technologies providing enhanced testing efficiency and defect detection capabilities across diverse application types and deployment platforms. The market faces challenges, including implementation complexity and learning curve requirements, concerns about test script maintenance and false positive rates, and integration constraints related to legacy systems and existing testing frameworks. Innovation in machine learning algorithms and natural language processing continues to influence product development and market expansion patterns.

The growing adoption of DevOps methodologies is driving demand for AI powered testing tools that address continuous integration requirements including automated test execution, rapid feedback delivery, and seamless integration with development pipelines for accelerated release cycles. Software development organizations require intelligent testing platforms that deliver consistent performance across frequent code changes while maintaining comprehensive test coverage and minimizing manual intervention. Development teams are increasingly recognizing the strategic advantages of AI powered testing integration for quality assurance automation and release velocity optimization, creating opportunities for advanced testing solutions specifically designed for continuous delivery environments.

Modern testing tool vendors are incorporating self-healing technologies to enhance test maintenance efficiency, reduce test script fragility, and support comprehensive automation objectives through intelligent element identification and automatic test repair mechanisms. Leading companies are developing AI algorithms for dynamic locator strategies, implementing predictive maintenance for test scripts, and advancing visual validation technologies that adapt to user interface changes without manual intervention. These technologies improve test reliability while enabling operational sustainability, including reduced maintenance overhead, improved test stability across application updates, and enhanced return on test automation investment. Advanced self-healing integration also allows quality assurance teams to support comprehensive testing coverage and automation scalability beyond traditional script maintenance limitations.

The expansion of AI and machine learning capabilities is driving adoption of intelligent test generation tools with automatic test case creation and optimization algorithms that maximize defect detection while minimizing test execution time. These advanced systems require testing platforms with sophisticated analysis engines and learning capabilities that identify critical test scenarios, predict high-risk application areas, and optimize test suite composition, creating specialized market segments with enhanced value propositions. Vendors are investing in AI research and algorithm development to serve emerging autonomous testing applications while supporting innovation in predictive quality analytics and intelligent test orchestration.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| Brazil | 6.9% |

| United States | 6.3% |

| United Kingdom | 5.6% |

| Japan | 5.0% |

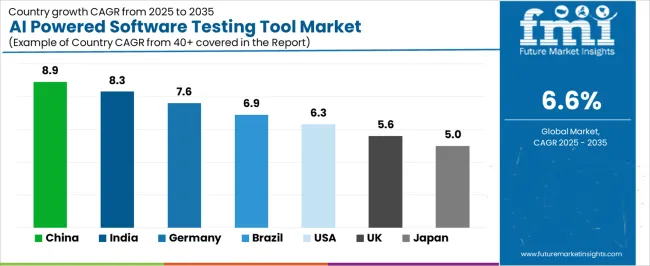

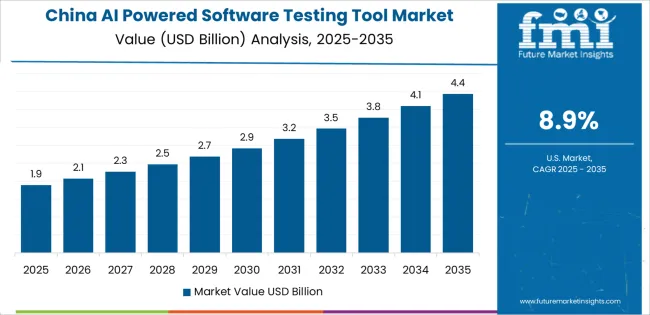

The market is experiencing solid growth globally, with China leading at an 8.9% CAGR through 2035, driven by massive software development industry expansion, growing technology company presence, and increasing adoption of automated testing practices. India follows at 8.3%, supported by expanding IT services sector, growing software development outsourcing, and increasing quality assurance automation adoption. Germany shows growth at 7.6%, focusing engineering software quality, automotive software testing, and industrial application validation.

Brazil demonstrates 6.9% growth, supported by expanding technology sector, increasing digital transformation initiatives, and growing software development capabilities. The United States records 6.3%, focusing on enterprise software quality, technology innovation leadership, and mature DevOps adoption. The United Kingdom exhibits 5.6% growth, focusing financial services software testing and technology sector development. Japan shows 5.0% growth, focusing quality-focused software development and precision testing standards.

The report covers an in-depth analysis of 40 countries, top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 8.9% through 2035, driven by expanding software development industry and rapidly growing technology sector supported by government digital economy initiatives and software innovation programs. The country's massive technology company presence and increasing investment in software quality practices are creating substantial demand for intelligent testing automation. Major software companies and international testing tool providers are establishing comprehensive sales and technical support capabilities to serve both domestic technology enterprises and emerging software startups.

India is expanding at a CAGR of 8.3%, supported by expanding IT services industry, growing software development outsourcing, and increasing adoption of test automation practices driven by global delivery model evolution and quality improvement initiatives. The country's substantial software engineering workforce and established technology services infrastructure are driving demand for advanced testing tools throughout diverse software development organizations. Leading testing tool vendors and local distributors are establishing comprehensive partner networks and training programs to address growing market demand.

Germany is expanding at a CAGR of 7.6%, supported by the country's focus on software quality, automotive software development requirements, and engineering precision standards for safety-critical applications. Germany's industrial software sophistication and quality culture are driving demand for advanced testing technologies throughout automotive, industrial automation, and enterprise software sectors. Leading technology companies and automotive suppliers are investing in comprehensive testing infrastructure and quality assurance capabilities.

Brazil is growing at a CAGR of 6.9%, driven by expanding technology sector, growing digital transformation initiatives, and increasing software development capabilities across financial services, retail, and technology companies. Brazil's developing software industry and technology adoption are supporting investment in quality assurance capabilities. Software companies and enterprise IT departments are establishing automated testing practices for application development.

The United States is expanding at a CAGR of 6.3%, supported by mature software industry, extensive enterprise application portfolios, and established quality assurance practices driving continuous improvement in testing automation and DevOps integration. The nation's technology innovation leadership and software development maturity are driving demand for advanced testing platforms. Enterprise technology departments and software vendors are investing in next-generation testing capabilities and quality engineering transformation.

The United Kingdom is expanding at a CAGR of 5.6%, supported by financial services software development, growing technology sector, and ongoing digital innovation initiatives across fintech companies and enterprise organizations. The country's financial technology strength and software development capabilities are driving demand for quality assurance automation. Technology companies and financial institutions are implementing advanced testing practices for regulatory compliance and customer experience optimization.

Japan is expanding at a CAGR of 5.0%, supported by the country's focus on software quality, established testing practices, and manufacturing industry software requirements ensuring high reliability standards. Japan's quality culture and technological sophistication are driving demand for advanced testing solutions. Leading technology companies and manufacturing enterprises are investing in automated testing capabilities for industrial software and consumer electronics applications.

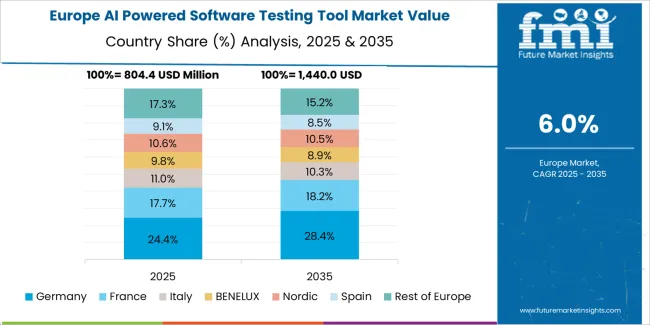

The AI powered software testing tool market in Europe is projected to grow from USD 1,274.0 million in 2025 to USD 2,104.6 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain leadership with a 27.3% market share in 2025, moderating to 27.0% by 2035, supported by automotive software testing requirements, industrial application quality standards, and engineering excellence in software development.

France follows with 18.9% in 2025, projected at 19.2% by 2035, driven by enterprise software development, digital transformation initiatives, and technology sector growth. The United Kingdom holds 16.8% in 2025, declining to 16.4% by 2035 due to competitive dynamics and market maturation. Italy commands 12.4% in 2025, rising to 12.6% by 2035, while Spain accounts for 9.7% in 2025, reaching 10.0% by 2035 aided by technology sector development and software outsourcing growth.

The Netherlands maintains 7.2% in 2025, up to 7.4% by 2035 due to technology hub presence and software development concentration. The Rest of Europe region, including Nordic countries, Central and Eastern Europe, and other markets, is anticipated to hold 7.7% in 2025 and 7.4% by 2035, reflecting gradual adoption in emerging technology markets and software development center expansion.

The market is characterized by competition among established testing platform providers, specialized automation vendors, and emerging AI-focused testing startups. Companies are investing in machine learning algorithm development, natural language processing integration, cloud platform capabilities, and application-specific testing features to deliver intelligent, scalable, and user-friendly testing solutions. Innovation in self-healing test automation, autonomous testing capabilities, and predictive quality analytics is central to strengthening market position and competitive advantage.

Katalon leads the market with comprehensive testing platform solutions with a focus on ease of use, integrated testing capabilities, and AI powered test generation across web, mobile, and API testing applications. Tricentis provides innovative continuous testing platforms with focus on autonomous testing and risk-based test optimization for enterprise applications. LambdaTest offers cloud-based testing infrastructure with focus on cross-browser testing and parallel test execution capabilities. BrowserStack delivers comprehensive testing platforms with focus on real device testing and seamless developer tool integration. SmartBear provides established testing solutions with focus on API testing, performance testing, and quality intelligence. OpenText offers enterprise testing platforms with comprehensive application lifecycle management integration.

Parasoft specializes in automated software testing with focus on embedded systems and compliance-driven testing requirements. Keysight provides testing solutions with focus on software validation and measurement capabilities. Worksoft delivers test automation platforms for enterprise applications and business process testing. Progress offers application development and testing tools with integrated quality assurance capabilities. ACCELQ focuses on autonomous testing platforms with codeless test automation. Kobiton specializes in mobile testing with AI powered scriptless automation. Qt Group provides software development and testing tools for embedded and desktop applications. Copado delivers DevOps testing platforms for Salesforce and cloud applications.

UiPath offers test automation as part of comprehensive robotic process automation platforms. Perforce provides software development tools including test management and automation capabilities. Applitools specializes in visual testing with AI powered visual validation. Zeenyx Software focuses on codeless test automation for enterprise applications. Opkey delivers continuous testing platforms for packaged enterprise applications. Functionize provides autonomous testing powered by machine learning and natural language processing. LEAPWORK offers visual automation platforms for test creation without coding. Testsigma delivers cloud-based test automation with natural language test creation. Endtest Technologies provides codeless automation for web and mobile testing. Sauce Labs offers continuous testing cloud with comprehensive browser and device coverage. QMetry delivers test management and automation platforms for agile teams. Avo Automation specializes in intelligent test automation with self-healing capabilities.

AI powered software testing tools represent a software quality assurance technology segment within enterprise software development and digital application delivery, projected to grow from USD 3.4 billion in 2025 to USD 6.4 billion by 2035 at a 6.6% CAGR. These intelligent automation platforms serve as essential technologies in software development organizations, quality assurance teams, and DevOps environments where test efficiency, defect detection accuracy, and continuous testing capabilities are required. Market expansion is driven by accelerating software release cycles, growing application complexity, advancing AI and machine learning technologies, and rising focus on quality engineering practices across diverse enterprise and commercial software development initiatives.

How Technology Regulators Could Strengthen Standards and Quality Assurance?

How Industry Associations Could Advance Testing Practices and Knowledge Sharing?

How Testing Tool Vendors Could Drive Innovation and Market Leadership?

How Software Development Organizations Could Optimize Testing Effectiveness?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.4 billion |

| Testing Type | Unit/Component Testing, UI/Functional Testing, Performance Testing, Others |

| Application | Large Enterprises, Small and Medium-sized Enterprises |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Katalon, Tricentis, LambdaTest, BrowserStack, SmartBear, OpenText |

| Additional Attributes | Dollar sales by testing type and application category, regional demand trends, competitive landscape, technological advancements in AI algorithms, automation capabilities, self-healing mechanisms, and continuous testing integration |

The global ai powered software testing tool market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the ai powered software testing tool market is projected to reach USD 6.4 billion by 2035.

The ai powered software testing tool market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in ai powered software testing tool market are unit/component testing, ui/functional testing, performance testing and others.

In terms of application, large enterprises segment to command 66.0% share in the ai powered software testing tool market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

AI in Oil and Gas Market Forecast and Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

AI Trading Platform Market Forecast Outlook 2025 to 2035

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

AI in Packaging Market Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA