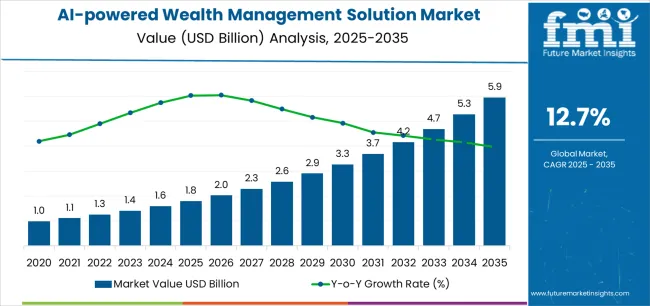

The AI-powered wealth management solution market is forecast to grow significantly from USD 1 billion in 2025 to USD 5.8 billion by 2035, recording an absolute increase of USD 4.8 billion during the forecast period. The AI-powered wealth management solution market is expected to rise at a compound annual growth rate (CAGR) of 12.7%, indicating a robust expansion over the next decade. The AI-powered wealth management solution market will grow as demand for AI-driven tools that offer personalized wealth management, risk analysis, and portfolio optimization increases. The rising interest in automated wealth management platforms that offer cost-effective solutions is expected to further fuel the expansion of the AI-powered wealth management solution market. By leveraging AI and machine learning, wealth managers can automate routine tasks, enabling them to focus on higher-value, strategic activities and improving operational efficiency.

The AI-powered wealth management solution market is expected to expand steadily as AI tools become increasingly integrated into wealth management services. AI-powered solutions are enhancing portfolio optimization, fraud detection, and client profiling, offering wealth managers improved capabilities for both efficiency and personalized service. As AI technologies continue to evolve, wealth management firms will increasingly rely on these tools to deliver tailored advice, improve customer experiences, and streamline operations. The growing availability of AI-driven analytics platforms will make these solutions more accessible, allowing smaller firms to leverage AI and compete alongside larger institutions.

Between 2025 and 2030, the market is projected to grow from USD 1 billion to USD 2.8 billion, marking a value increase of USD 1.8 billion. This period accounts for nearly half of the market’s forecasted growth. The initial phase of growth will be characterized by the widespread deployment of AI technologies for portfolio optimization, fraud detection, and client profiling. As AI-powered solutions become more sophisticated, wealth management firms will increasingly turn to these tools to provide personalized investment advice, enhance customer experiences, and improve operational efficiency. The growing availability of AI-driven analytics platforms will lower the barrier to entry for smaller wealth management firms.

From 2030 to 2035, the market will experience an accelerated growth phase, expanding from USD 2.8 billion to USD 5.8 billion. This period accounts for 53.3% of the overall market growth, with a notable increase in the adoption of AI-powered wealth management solutions by both institutional investors and retail clients. The continued development of AI algorithms will allow for more precise risk analysis, greater predictive capabilities, and more tailored investment strategies. The increasing demand for automated wealth management solutions, which offer lower fees and greater accessibility to a wider range of clients, will drive market expansion. These solutions will become essential tools for wealth managers seeking to remain competitive in an increasingly technology-driven financial services environment.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast Value (2035) | USD 5.8 billion |

| Forecast CAGR (2025–2035) | 12.7% |

The AI-powered wealth management solution market is expanding due to the increasing integration of artificial intelligence in financial advisory and investment management processes. Financial institutions and wealth managers are adopting AI-driven tools to improve portfolio management accuracy, automate data analysis, and deliver personalized investment recommendations. The ability of AI systems to process large volumes of financial data in real time enhances risk assessment, portfolio optimization, and client engagement, leading to improved decision-making and operational efficiency.

The growing demand for automation in the financial sector and the rising focus on delivering data-driven insights are accelerating AI adoption. As investors increasingly seek customized and efficient solutions, AI technologies are being deployed to analyze behavioral data, identify investment opportunities, and forecast market trends. Advancements in natural language processing and predictive analytics enable firms to enhance client advisory services and optimize resource utilization. Regulatory frameworks supporting digital transformation in wealth management are further contributing to market expansion. The combination of enhanced decision accuracy, cost reduction, and improved client experience positions AI-powered wealth management solutions as a critical component of modern financial services.

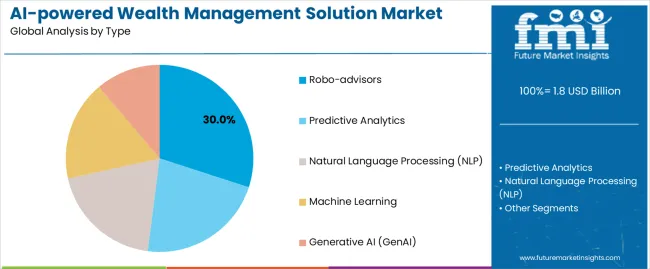

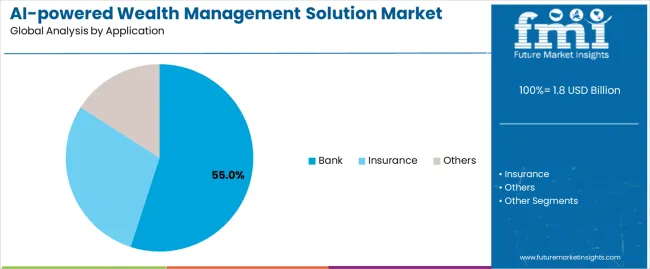

The market is segmented by classification, application, and region. Key classifications include Robo-advisors, Predictive Analytics, Natural Language Processing (NLP), Machine Learning, and Generative AI (GenAI). Applications include Banking, Insurance, and Others. The market spans North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, with varying adoption rates and growth driven by technological advances across regions.

The robo-advisors segment plays a critical role in the AI-powered Wealth Management Solution Market, accounting for 30.0% of the market share. Robo-advisors use AI algorithms and data analytics to offer automated, personalized investment advice, catering primarily to retail investors. These platforms analyze individual investor profiles, including risk tolerance, financial goals, and investment preferences, to design customized portfolio recommendations. The growing demand for cost-effective, efficient, and accessible financial advisory services has contributed significantly to the rise of robo-advisors, particularly among younger generations who prefer automated solutions.

Robo-advisors are particularly attractive due to their lower management fees compared to traditional wealth management services, offering a more affordable entry point for those seeking investment advice. The automation of tasks such as portfolio rebalancing, tax optimization, and risk assessment makes robo-advisors a scalable solution for mass-market adoption. Over time, these platforms have become increasingly sophisticated, integrating machine learning and predictive analytics to improve portfolio performance and asset allocation strategies. As technology continues to evolve, robo-advisors are expected to incorporate more advanced AI capabilities, further enhancing their personalized offerings. This growing accessibility and sophistication is expected to drive continued expansion in the robo-advisor segment, especially in the context of the rising demand for digital wealth management.

The bank segment is the largest contributor to the AI-powered Wealth Management Solution Market, accounting for 55.0% of the market share. Banks have long been at the forefront of adopting AI technologies to enhance their wealth management services. By integrating AI-powered solutions like predictive analytics, robo-advisors, and natural language processing (NLP), banks are significantly improving the efficiency, personalization, and accuracy of their financial advisory services. AI-driven solutions enable banks to offer customized, data-driven financial advice to a broad range of clients, from retail investors to high-net-worth individuals.

One of the primary benefits of AI adoption in banks is its ability to analyze vast amounts of financial data to identify trends, assess risks, and optimize asset allocation. This helps wealth managers make more informed, data-backed decisions for their clients. Banks are using AI to enhance customer engagement through personalized advice and automated services like portfolio rebalancing and tax optimization. The widespread use of digital banking and online platforms is accelerating AI adoption, allowing banks to serve a more diverse and global customer base. As the demand for digital wealth management solutions continues to grow, banks will increasingly rely on AI to maintain a competitive edge and improve service delivery. This trend is expected to drive further growth in the banking segment, positioning it as a dominant player in the AI-powered wealth management solutions market.

The market is expanding due to increasing demand for personalized investment services, automation, and improved client engagement. Key drivers include AI’s ability to optimize portfolios and enhance customer experience. Challenges such as data privacy, implementation costs, and regulatory uncertainty persist. Key trends involve the integration of advanced AI tools and the rise of digital platforms.

What are the Key Drivers of AI-powered Wealth Management Solutions?

The growth of AI in wealth management is primarily driven by the rising demand for personalized, data-driven investment advice. Financial institutions are increasingly adopting AI to enhance portfolio optimization, improve risk assessments, and offer tailored financial solutions to individual clients. As consumer expectations for more personalized services rise, wealth managers are integrating AI technologies that analyze real-time market data, optimize asset allocation, and automate the advisory process. This shift toward AI enables firms to provide scalable, efficient solutions while reducing the costs associated with traditional advisory services. Regulatory pressures and the demand for cost-effective, scalable solutions are pushing financial institutions to invest in AI technology to streamline operations, improve compliance, and better serve their clients. As these drivers intensify, the adoption of AI-powered wealth management solutions is expected to increase, further accelerating growth.

How are AI Technologies Transforming Wealth Management Solutions?

AI technologies are transforming wealth management by automating investment processes, improving portfolio management, and providing real-time, data-driven insights. Machine learning algorithms, predictive analytics, and natural language processing are enabling wealth managers to create highly personalized investment strategies for their clients. AI tools analyze large datasets to identify investment opportunities, assess risks, and optimize asset allocation, providing wealth managers with more accurate and timely decision-making capabilities. The use of AI in robo-advisory services is revolutionizing the wealth management landscape by offering low-cost, automated financial advice to a broader audience. As these technologies continue to evolve, they are reshaping wealth management into a more efficient, accessible, and scalable service model.

What are the Key Challenges in AI-powered Wealth Management Solutions?

Despite its growth, the adoption of AI in wealth management faces several challenges. Data privacy and security concerns are major barriers, as AI platforms require access to sensitive financial and personal information, creating risks of data breaches. There is a lack of standardization in AI models and concerns about algorithmic bias, which can undermine trust in AI-powered solutions. Regulatory uncertainties surrounding AI applications in finance also pose significant hurdles, as firms need to ensure compliance with data protection laws across jurisdictions. High implementation costs, including infrastructure upgrades and integration with legacy systems, also hinder adoption, particularly for smaller financial institutions. These challenges must be addressed to ensure the continued growth and acceptance of AI in wealth management.

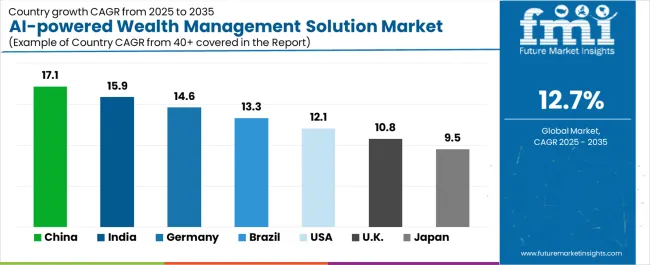

| Country | CAGR (%) |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| Brazil | 13.3% |

| USA | 12.1% |

| UK | 10.8% |

| Japan | 9.5% |

The AI-powered wealth management solution sector is expanding globally, with significant growth in key regions. China leads at 17.1% CAGR, driven by technological advancements and the rising demand for automated financial services. India follows at 15.9% CAGR, bolstered by its growing fintech ecosystem and digital adoption. Germany sees strong growth at 14.6% CAGR, supported by its advanced financial infrastructure. Other regions, including Brazil, the USA, the UK, and Japan, are also experiencing notable growth, reflecting the increasing demand for AI-driven wealth management solutions. These regions are adopting AI technologies to enhance financial decision-making, improve customer experience, and streamline wealth management processes.

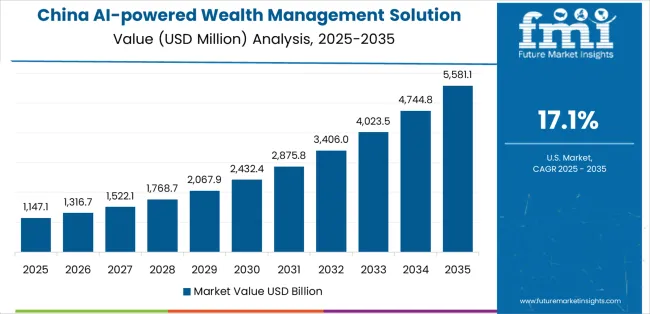

China is leading the AI-powered wealth management solutions sector with a 17.1% CAGR, primarily due to the rapid growth of its fintech and digital investment ecosystems. The country’s large population of tech-savvy consumers and the government’s favorable stance toward digital finance are key factors driving adoption. Chinese financial institutions are increasingly integrating AI technologies into their wealth management services, enabling them to offer personalized investment strategies at scale. With advancements in AI and machine learning, China’s wealth management sector is shifting toward automation and data-driven decision-making, providing consumers with customized financial solutions.

The growing adoption of mobile banking and digital finance platforms in China also plays a crucial role in expanding AI-driven wealth management services. China’s significant investments in AI research and development further support the country’s leadership in this space. As AI technology continues to evolve and become more accessible, China is poised to maintain its dominance in the sector, especially as demand for more efficient, cost-effective wealth management grows.

India is experiencing rapid growth in the AI-powered wealth management solutions sector, with a 15.9% CAGR. This growth is largely driven by the country’s expanding fintech ecosystem, increasing digital literacy, and a growing middle class that is becoming more aware of investment opportunities. The Indian market for AI-powered wealth management is further supported by government initiatives to promote digital financial services and the rapid adoption of mobile technology, which provides convenient access to financial advisory services. India’s strong technology workforce is also playing a key role in developing AI tools and platforms that can offer personalized financial solutions to a broad consumer base.

As AI continues to improve its capabilities in portfolio management, risk assessment, and personalized investment advice, the adoption of these technologies is expected to accelerate across Indian banks and wealth management firms. As more Indian investors seek efficient, low-cost alternatives to traditional wealth management services, AI-powered robo-advisory services are becoming increasingly popular. As the country’s regulatory environment continues to support innovation in digital finance, India is positioned for continued expansion in AI-driven wealth management solutions.

Germany is seeing steady growth in the AI-powered wealth management solutions sector, with a 14.6% CAGR. This growth is driven by the country’s advanced financial infrastructure, strong regulatory environment, and increasing demand for automated, data-driven financial solutions. German financial institutions are leveraging AI technologies, including machine learning and predictive analytics, to enhance portfolio management, improve client engagement, and optimize investment strategies. The rise of digital platforms and robo-advisors is also contributing to the expansion of AI-driven wealth management services, particularly among retail investors.

Germany’s mature banking sector, coupled with its focus on innovation in financial technologies, makes it an attractive market for AI adoption. Furthermore, the increasing focus on ESG (Environmental, Social, and Governance) investing is pushing wealth managers to adopt AI tools that can analyze and optimize portfolios based on metrics. As AI technology continues to evolve, Germany’s wealth management firms are increasingly using AI for client onboarding, asset allocation, and risk management, driving efficiency and enhancing customer experience. With a highly skilled workforce and strong investment in AI research, Germany is well-positioned to continue its growth in AI-powered wealth management.

Brazil is experiencing significant growth in the AI-powered wealth management solutions sector, with a 13.3% CAGR. The country’s rapid digital transformation, increasing internet penetration, and the rise of fintech startups have played a critical role in this growth. As Brazilian consumers become more interested in digital financial services, AI-powered wealth management solutions are gaining traction, particularly in the retail sector. The increasing adoption of mobile banking, online trading platforms, and robo-advisors in Brazil is fueling the demand for automated investment services.

Furthermore, as the Brazilian middle class continues to expand, more individuals are seeking efficient and cost-effective wealth management solutions. Local financial institutions are adopting AI tools to provide personalized financial advice, optimize asset allocation, and manage risk. Despite the challenges posed by regulatory uncertainties and data privacy concerns, the Brazilian government’s efforts to support fintech innovation have paved the way for AI-driven solutions to thrive in the wealth management sector. As AI technologies become more accessible and cost-effective, Brazil’s wealth management industry is likely to experience continued growth, catering to a growing demand for automated, personalized financial advisory services.

The USA is experiencing strong growth in the AI-powered wealth management solutions sector, with a 12.1% CAGR. The country’s established financial infrastructure, large consumer base, and high levels of technological adoption are key factors driving this growth. Wealth management firms in the USA are increasingly relying on AI to enhance portfolio management, risk assessment, and client engagement. The widespread use of robo-advisors and digital investment platforms is making AI-powered wealth management services more accessible to a broader range of investors, from retail to high-net-worth individuals. As AI tools evolve, USA firms are utilizing machine learning algorithms to personalize investment advice and optimize asset allocation.

The USA financial sector’s focus on digital transformation and regulatory frameworks that support innovation are helping accelerate the adoption of AI in wealth management. AI’s ability to process large volumes of data and provide real-time insights is particularly valuable in a complex financial landscape, enabling wealth managers to make informed decisions quickly. As consumer demand for more efficient, low-cost, and personalized financial services continues to rise, the USA is expected to maintain its leadership in AI-powered wealth management solutions.

The UK is experiencing steady growth in the AI-powered wealth management solutions sector, with a 10.8% CAGR. The country’s strong financial services industry, highly developed fintech ecosystem, and regulatory support for innovation are key factors driving this growth. UK financial institutions are increasingly adopting AI-driven technologies to enhance their wealth management services. AI tools, such as robo-advisors and predictive analytics, are enabling wealth managers to offer personalized financial advice, optimize investment strategies, and enhance customer engagement.

The rise of digital wealth management platforms and the growing demand for automated investment solutions are further fueling AI adoption. As consumer expectations for personalized, data-driven financial services increase, AI is becoming essential for delivering efficient and scalable wealth management solutions. The UK’s focus on responsible investing is also driving the need for AI tools that can analyze and optimize portfolios based on ESG criteria. As AI technology continues to evolve, the UK is positioned to maintain its growth in AI-powered wealth management, especially as digital transformation reshapes the wealth management landscape.

Japan is witnessing moderate growth in the AI-powered wealth management solutions sector, with a 9.5% CAGR. The country’s technological expertise, high financial literacy, and increasing demand for automated financial services are contributing to this growth. Japan’s financial institutions are adopting AI technologies, including machine learning and predictive analytics, to optimize portfolio management, automate financial planning, and provide personalized investment advice. The growing popularity of robo-advisors and digital platforms is making wealth management services more accessible to a broader audience, including retail investors. Japan’s emphasis on efficiency and technological innovation is driving the demand for AI-powered solutions that can improve client service and reduce costs.

The Japanese market is increasingly focused on socially responsible investing, prompting the need for AI tools that can analyze and optimize portfolios based on ESG criteria. As Japan continues to embrace digital transformation in the financial sector, AI-powered wealth management solutions are expected to play a larger role in shaping the future of the country’s wealth management industry. Despite the moderate growth rate, Japan’s commitment to technological innovation and regulatory support for AI adoption make it an important market in the global wealth management sector.

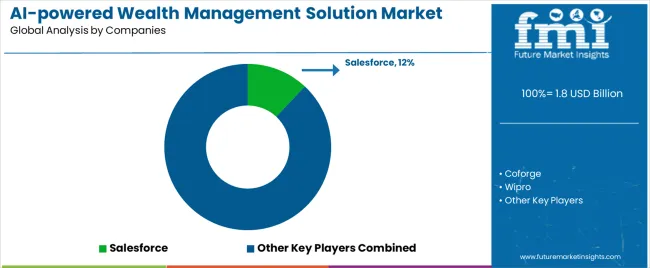

The AI-powered wealth management solutions sector is highly competitive, featuring both established technology leaders and emerging challengers. Salesforce leads with an estimated 12% market share, providing advanced AI-driven customer relationship management (CRM) tools for wealth management firms. Its platform helps firms optimize portfolios, enhance client engagement, and leverage predictive analytics to offer tailored investment advice. Other major players, such as Wipro and Coforge, are also significant contributors, offering dedicated AI solutions like WealthAI, which is designed to streamline asset management and improve client outcomes through machine learning and advanced analytics.

Emerging companies such as Ping An Group, JIFFY.ai, sapper.ai, Itransition, OpenXcell, SmartOSC, Axyon AI, Pivolt, Biz4Group, Soluzione, Aisot Technologies, Vise AI, Unique AI, TIFIN, and Range expand the competitive landscape by focusing on niche applications like robo-advisory, algorithmic portfolio management, and real-time market insights. These firms frequently offer specialized AI-powered solutions aimed at enhancing customer experience and automating financial processes. For instance, robo-advisory services powered by AI and machine learning are gaining traction, as they help firms provide cost-effective and efficient financial advisory services to a broader range of clients.

As the sector matures, platforms that combine a variety of AI functionalities msuch as predictive analytics, natural language processing (NLP), and machine learning are gaining a competitive edge. These technologies enable firms to offer personalized investment advice, optimize portfolio management, and improve client servicing throughout the entire lifecycle. Companies that integrate strong compliance frameworks and adapt quickly to regulatory standards will also have an advantage in serving institutional clients. The competitive dynamics of the sector continue to be shaped by technological advancements, market specialization, and scalability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Robo-advisors, Predictive Analytics, Natural Language Processing (NLP), Machine Learning, Generative AI (GenAI) |

| Application | Bank, Insurance, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Salesforce, Coforge, Wipro, Ping An Group, JIFFY.ai, sapper.ai, Itransition, Openxcell, SmartOSC, Axyon AI, Pivolt, Biz4Group, Soluzione, Aisot Technologies, Vise AI, Unique AI, TIFIN, Range |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, AI-powered wealth management solutions development trends, integration with financial services platforms. |

The global ai-powered wealth management solution market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the ai-powered wealth management solution market is projected to reach USD 5.9 billion by 2035.

The ai-powered wealth management solution market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in ai-powered wealth management solution market are robo-advisors, predictive analytics, natural language processing (nlp), machine learning and generative AI (genai).

In terms of application, bank segment to command 55.0% share in the ai-powered wealth management solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Wealth Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

5PL Solutions Market

High-Resolution Anoscopy Market Size and Share Forecast Outlook 2025 to 2035

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

G-3 PLC Solution Market – Smart Grids & Connectivity

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Geospatial Solution Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

E-Learning Solution Market by Solution, Deployment, & Region Forecast till 2035

eDiscovery solution Market

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA