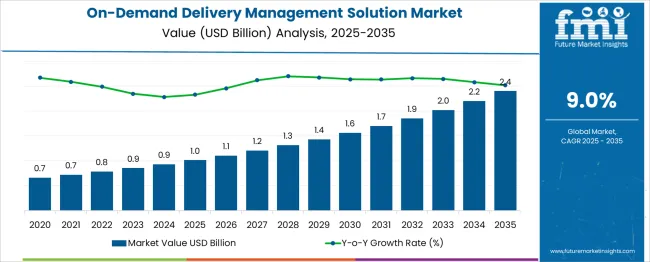

The On-Demand Delivery Management Solution Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

This growth trajectory reflects the increasing reliance on digital logistics platforms that offer real-time tracking, route optimization, and seamless delivery coordination across last-mile operations. Between 2025 and 2030, the market is expected to grow from USD 1.0 billion to USD 1.6 billion, achieving a five-year absolute growth of USD 0.6 billion. Year-on-year (YoY) increases average around 10%, with gains of approximately USD 0.1 to 0.2 billion annually.

The rise in e-commerce, food delivery, and courier services continues to be the primary demand driver, as enterprises invest in smart tools to enhance customer experience and operational efficiency. The demand for scalable cloud-based platforms and AI-powered analytics is rising, enabling businesses to optimize delivery routes, predict delays, and manage driver performance in real time. North America and Asia-Pacific are leading regional contributors, while B2B and hyperlocal delivery ecosystems are emerging as high-growth verticals. The market’s focus remains on cost efficiency, transparency, and speed-to-customer, making delivery software adoption a strategic imperative across industries.

| Metric | Value |

|---|---|

| On-Demand Delivery Management Solution Market Estimated Value in (2025 E) | USD 1.0 billion |

| On-Demand Delivery Management Solution Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The On‑Demand Delivery Management Solution market is anchored by retail and e-commerce delivery, which represents approximately 44% of total application share. This sector requires real-time order processing, route optimization, and customer tracking solutions to handle high volumes of last-mile deliveries in online shopping and Q-commerce platforms.

The food and beverage delivery segment follows closely, accounting for about 40% of usage, encompassing restaurants, meal kit services, grocery delivery, and cloud kitchen operations that rely heavily on efficient dispatch software. Together, these two sectors drive the majority of demand in delivery management. The pharmaceutical and healthcare logistics market contributes around 8–10%, where precise temperature control, traceability, and tamper-proof labels are critical for medicine and medical supply distribution.

The general logistics and transportation services, including courier and parcel providers handling business-to-business (B2B) and business-to-consumer (B2C) shipments outside retail, hold roughly 6–8%. Other industries such as consumer services (e.g. flower delivery, laundry, retail returns) make up the remaining 2–3% of demand. By industry size, B2C consumers account for over 63% of demand versus B2B applications, reflecting greater reliance on delivery in home-use scenarios. Growth is fueled by rising expectations for fast, trackable delivery in urban areas and the proliferation of on‑demand platforms.

The on-demand delivery management solution market is expanding rapidly, fueled by increasing demand for real-time order tracking, route optimization, and end-to-end visibility in last-mile delivery operations. The rising penetration of mobile commerce and growing consumer expectations for fast and reliable delivery have pushed enterprises to adopt agile delivery orchestration platforms.

Advanced software capabilities, such as predictive ETAs, dynamic routing, driver behavior analytics, and automated dispatch, are transforming traditional logistics workflows into data-driven, customer-centric operations. Cloud-native architecture and API-driven integration have further enabled seamless alignment with ERP, POS, and CRM systems, providing real-time data synchronization and enhanced customer experience.

The proliferation of gig economy models, coupled with expanding urbanization and hyperlocal delivery networks, is also influencing the shift toward scalable software platforms. Looking ahead, the market is likely to witness greater demand from sectors such as retail, food delivery, healthcare, and logistics, with artificial intelligence, machine learning, and IoT continuing to elevate the value proposition of on-demand delivery ecosystems.

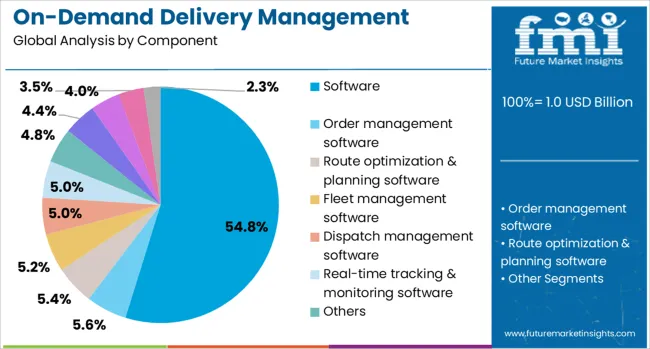

The on-demand delivery management solution market is segmented by component, deployment mode, enterprise size, end use, and geographic regions. The on-demand delivery management solution market is divided into the following components: Software, Order management software, Route optimization & planning software, Fleet management software, Dispatch management software, Real-time tracking & monitoring software, Others, Services, Implementation & integration, Training & support, and Consulting.

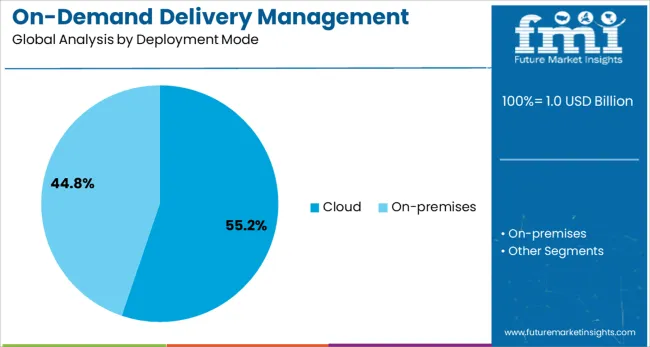

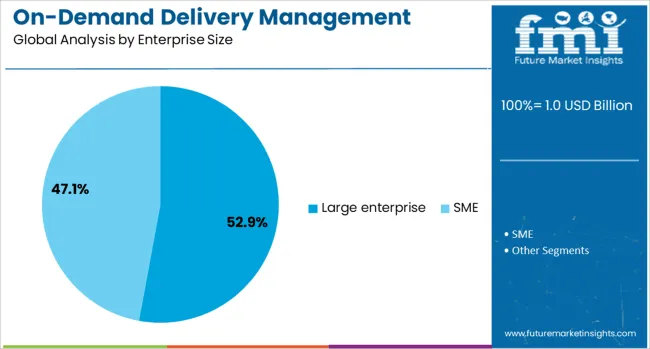

In terms of deployment mode, the on-demand delivery management solution market is classified into Cloud and On-premises. Based on the enterprise size, the on-demand delivery management solution market is segmented into Large enterprises and SME. By end use, the on-demand delivery management solution market is segmented into Retail and e-commerce, Food and beverage, Logistics & transportation, Healthcare & pharmaceuticals, and Others.

Regionally, the on-demand delivery management solution industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to account for 54.8% of the On-Demand Delivery Management Solution market revenue share in 2025, emerging as the leading component. This segment's growth has been driven by the increasing need for centralized control, real-time analytics, and automation across delivery workflows. Organizations have been adopting delivery software solutions to enhance route efficiency, reduce operational costs, and improve customer communication.

The ability of software platforms to integrate with third-party logistics systems and mobile apps has enabled seamless management of large-scale deliveries in both B2B and B2C models. Features such as real-time driver tracking, proof of delivery, automated scheduling, and exception handling have reinforced the reliance on software over manual or semi-digital processes.

The flexibility to deploy AI-powered decision engines and generate actionable insights has further strengthened this segment’s position. As enterprises prioritize digital transformation in last-mile operations, the software component is expected to continue leading the demand curve in the delivery management space.

The cloud deployment mode is expected to hold 55.2% of the market’s revenue share in 2025, establishing it as the dominant mode of delivery solution deployment. The preference for cloud-based platforms has been influenced by their scalability, ease of integration, and cost-effectiveness for businesses of all sizes. Cloud solutions have enabled real-time coordination between dispatch centers, delivery personnel, and customers through internet-connected interfaces without the need for heavy infrastructure investments.

Additionally, automatic software updates, minimal IT overhead, and robust data backup features have made cloud deployment the go-to choice for dynamic and fast-paced delivery environments. The growth in multi-region operations, remote workforce expansion, and integration of third-party logistics providers has further elevated the demand for flexible and cloud-native platforms.

Enhanced security protocols and compliance support for data-sensitive industries have also encouraged broader adoption. As global businesses continue to expand their delivery networks, cloud deployment is likely to remain at the forefront of delivery technology architecture.

Large enterprises are anticipated to capture 52.9% of the On-Demand Delivery Management Solution market revenue in 2025, reflecting their dominant role in driving advanced logistics automation. The segment's leadership is attributed to the extensive delivery volumes, multi-location operations, and complex supply chain requirements typical of large-scale enterprises. These organizations have been actively investing in end-to-end delivery software to optimize costs, reduce delivery times, and enhance service reliability.

The need for centralized command centers, business intelligence dashboards, and API-based integration with existing enterprise systems has driven demand for comprehensive delivery management platforms. Large enterprises have also been leveraging predictive analytics, real-time tracking, and automated scheduling to improve last-mile performance and customer satisfaction.

The ability to customize delivery operations based on regional logistics dynamics, compliance mandates, and customer SLAs has reinforced the value of software-defined delivery infrastructure. As global enterprises continue to scale their e-commerce and omnichannel operations, this segment is expected to retain its strategic advantage in the adoption of on-demand delivery solutions.

Growth opportunities arise from increasing adoption of cloud-based and software-driven delivery management systems. These technologies streamline operations and offer scalability to meet fluctuating demand.

Cloud-based delivery management solutions are becoming essential for companies seeking flexibility and scalability. By hosting delivery software on the cloud, businesses eliminate the need for complex on-premises infrastructure and enable seamless updates and maintenance. Cloud platforms allow real-time data sharing across multiple stakeholders, including dispatchers, drivers, and customers, improving collaboration and transparency. The flexibility to scale operations up or down during peak and off-peak periods helps companies manage costs effectively. Additionally, cloud solutions support remote access, enabling managers to monitor and control deliveries from anywhere. This widespread adoption is transforming how delivery fleets are managed and helps companies respond quickly to market changes.

Delivery management software integrates automation tools that optimize task assignments, track shipments, and manage inventory in real time. Automated workflows reduce manual errors and speed up processes such as order processing, route planning, and proof of delivery. Advanced analytics within the software offer insights into performance metrics, helping businesses identify bottlenecks and improve decision-making. The ability to customize software features according to business size and delivery complexity makes these solutions highly adaptable. As companies focus on improving operational efficiency and customer satisfaction, software-driven automation stands out as a key enabler in meeting the demands of fast-paced delivery environments.

Modern delivery platforms now feature dynamic route optimization and instantaneous dispatch adjustments to support precision delivery windows and reduce fuel usage. Algorithms analyze live traffic, delivery priorities, and vehicle capacity to reroute drivers in real time. This trend improves delivery success rates, especially in urban environments, by minimizing idle time and shortening transit durations. Customers receive electronic notifications, real‑time tracking, and estimated arrival times that enhance service transparency. As fleets grow, dispatching software adjusts assignments based on driver location and workload, improving efficiency. Adoption of AI‑backed scheduling engines is rising among logistics providers aiming to reduce labor costs and carbon footprint. Over time, this leads to lower per‑delivery costs and higher customer satisfaction through timely delivery and reduced delays.

Delivery platforms targeting grocery, meal kit, and retail e‑commerce offer significant opportunity for delivery management solution providers. These verticals demand precise temperature control, high order frequency, and narrow delivery windows. Grocers and meal kit services integrate solutions to manage perishable inventory, assign appropriate vehicle types, and synchronize dispatch with storage conditions. E-commerce platforms use these tools to manage same-day or next-hour delivery services, offering subscription or premium delivery tiers. Companies providing seamless order integration, delivery slot management, and exception handling software gain preference among operators seeking speed with reliability. This vertical growth enables deeper penetration of delivery tools across time‑sensitive use cases, yielding higher recurring revenue and platform retention among food and retail operators.

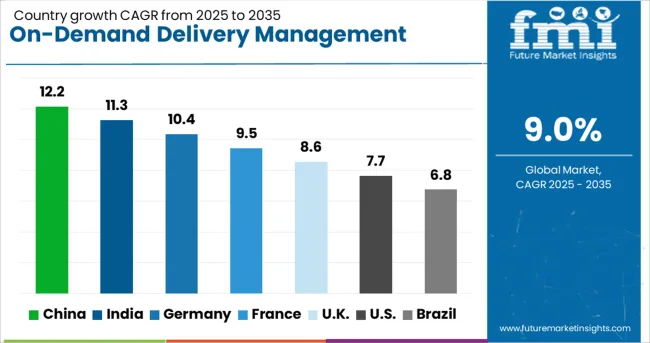

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

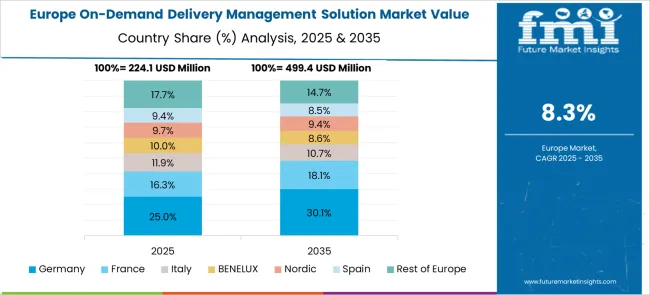

The global on-demand delivery management solution market is projected to grow at a CAGR of 9.0% through 2035, supported by expanding e-commerce and last-mile distribution networks. Among BRICS nations, China leads with 12.2% growth, driven by widespread adoption of digital platforms and urban logistics hubs. India follows at 11.3%, where rising online retail and service sectors have accelerated solution deployment. In the OECD region, Germany reports 10.4% growth, backed by investments in logistics infrastructure and regulatory frameworks for delivery efficiency.

France, growing at 9.5%, has seen steady integration of management platforms in retail and healthcare logistics. The United Kingdom, at 8.6%, reflects increasing demand from courier services and consumer delivery providers. Market growth has been shaped by compliance standards, data security regulations, and procurement strategies. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The on-demand delivery management solution market in China is growing at a CAGR of 12.2%, driven by expanding e-commerce and rapid urban logistics. Platforms offering real-time tracking, route optimization, and automated dispatch have been widely implemented to improve delivery efficiency. Investments in AI-powered analytics and mobile app integration have increased to support last-mile delivery operations. Partnerships between solution providers and logistics companies have enabled scaling of delivery fleets and enhanced customer communication. Cloud-based solutions have been adopted to provide scalable infrastructure for peak demand periods. Enhanced security protocols for data protection and payment processing have been incorporated. Distribution networks have been optimized for cold chain and fast-moving consumer goods sectors, ensuring timely delivery.

In India, market for on-demand delivery management solutions is growing at a CAGR of 11.3%, supported by rising online retail and food delivery services. Platforms with features like automated dispatch, real-time order tracking, and delivery agent management have been increasingly adopted. Integration with mobile payment systems and digital wallets has facilitated seamless transactions. Cloud infrastructure usage has expanded to handle fluctuating order volumes and geographic diversity. Partnerships between technology providers and logistics firms have enhanced last-mile delivery capabilities, particularly in tier-2 and tier-3 cities. Emphasis has been placed on optimizing delivery routes to reduce fuel consumption and improve service levels. Security features protecting customer data and delivery details have been strengthened.

In Germany, on-demand delivery management solution market is advancing at a CAGR of 10.4%, fueled by growth in e-commerce, retail, and food delivery sectors. Solutions offering dynamic routing, delivery slot management, and predictive analytics have been incorporated. Integration with warehouse management systems and ERP platforms has improved operational coordination. Cloud-based platforms have supported scalability during peak seasons and holiday periods. Security compliance with GDPR and data privacy regulations has been strictly maintained. Collaborations with last-mile carriers and local delivery providers have enhanced fulfillment speed. Mobile applications allowing customers real-time updates and flexible delivery options have increased user satisfaction. Investments in AI and machine learning have improved demand forecasting and fleet utilization.

On-demand delivery management solution market in France is growing at a CAGR of 9.5%, driven by expanding online retail and food delivery industries. Platforms with features like route optimization, driver tracking, and automated notifications have been widely adopted. Integration with payment gateways and customer service tools has enhanced transaction and support processes. Cloud infrastructure has been expanded to accommodate growing order volumes and geographic coverage. Collaborations between solution providers and logistics companies have optimized last-mile delivery efficiency. Security measures aligned with European data privacy standards have been implemented. Customer-facing mobile apps offering real-time updates and flexible delivery options have improved user experience.

The on-demand delivery management solution market in the United Kingdom is expanding at a CAGR of 8.6%, supported by increasing demand from e-commerce, grocery, and food delivery services. Features such as automated dispatch, real-time tracking, and dynamic route planning have been implemented to improve delivery speed and accuracy. Cloud-based platforms have been adopted to ensure scalability during peak demand periods. Security protocols complying with GDPR have been integrated. Partnerships between technology providers and logistics operators have enhanced last-mile delivery capabilities. Mobile apps providing delivery status updates and contactless delivery options have gained popularity. Investment in AI and predictive analytics has optimized fleet management and demand forecasting.

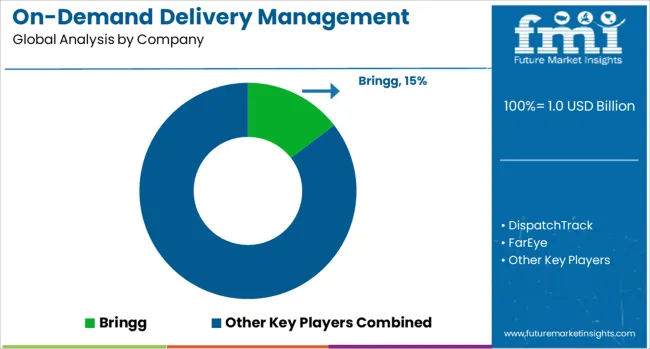

The on-demand delivery management solution market is rapidly evolving, driven by the surge in e-commerce, same-day delivery expectations, and the need for operational agility across industries. Leading players such as Bringg offer enterprise-grade platforms enabling real-time delivery tracking, automated route optimization, and seamless customer engagement—making it a preferred choice for large retailers and logistics firms.

FarEye leverages AI and predictive analytics to enhance delivery reliability, offering a comprehensive suite for shipment visibility, driver performance, and dynamic routing that reduces fuel costs and delivery time. Similarly, Locus supports multi-modal logistics optimization, integrating third-party fleets, warehouses, and hubs to streamline delivery networks in both urban and rural contexts.

DispatchTrack and FleetComplete focus on automated scheduling and fleet asset monitoring, serving industries from food and beverage to furniture delivery. Their platforms emphasize compliance tracking, driver routing, and ETA accuracy, providing value through detailed post-delivery analytics. LogiNext and WiseSystems use machine learning and geospatial algorithms to dynamically allocate resources and balance delivery loads, helping clients scale operations without compromising SLA performance. For SMEs, Dispatchit, Sorted, and Stuart offer lightweight, customizable platforms that cater to cost-sensitive and flexible fulfillment needs.

Their emphasis on last-mile connectivity, gig workforce integration, and real-time alerts allows smaller businesses to compete with larger players in dense urban markets. Collectively, these providers are reshaping how deliveries are planned and executed—prioritizing speed, visibility, and customer experience in a competitive logistics landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Component | Software, Order management software, Route optimization & planning software, Fleet management software, Dispatch management software, Real-time tracking & monitoring software, Others, Services, Implementation & integration, Training & support, and Consulting |

| Deployment Mode | Cloud and On-premises |

| Enterprise Size | Large enterprise and SME |

| End Use | Retail and e-commerce, Food and beverage, Logistics & transportation, Healthcare & pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bringg, DispatchTrack, FarEye, Locus, FleetComplete, Dispatchit, LogiNext, WiseSystems, Sorted, and Stuart |

| Additional Attributes | Dollar sales by on-demand delivery management solutions, including software and services, by end-use industries such as retail and e-commerce, food and beverage, logistics and transportation, and healthcare and pharmaceuticals, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by the rise of online shopping, consumer expectations for fast and reliable delivery, and advancements in artificial intelligence for route optimization; innovation in cloud-based platforms, real-time tracking, and predictive analytics; costs influenced by infrastructure investments and operational expenses; and emerging use cases in hyperlocal deliveries, electric vehicle integration, and sustainable packaging solutions. |

The global on-demand delivery management solution market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the on-demand delivery management solution market is projected to reach USD 2.4 billion by 2035.

The on-demand delivery management solution market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in on-demand delivery management solution market are software, order management software, route optimization & planning software, fleet management software, dispatch management software, real-time tracking & monitoring software, others, services, implementation & integration, training & support and consulting.

In terms of deployment mode, cloud segment to command 55.2% share in the on-demand delivery management solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Revenue Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Parking Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Management Solutions Market

Comprehensive Management Solution for Power Quality Market Size and Share Forecast Outlook 2025 to 2035

Correspondence Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Building Energy Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Bimodal Identity Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Drone Management Solutions Market Analysis 2025 to 2035 by Type, Technology, Application, and Region

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Multicarrier Parcel Management Solutions Software Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Asset And Liability Management Solutions Market

Quality and Compliance Management Solution Market Forecast and Outlook 2025 to 2035

Commodity Supply Chain Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Incident and Deviation Management Solution Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA