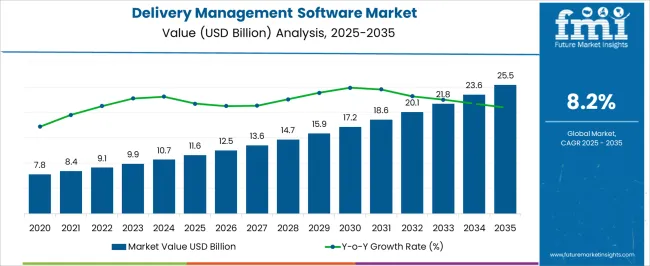

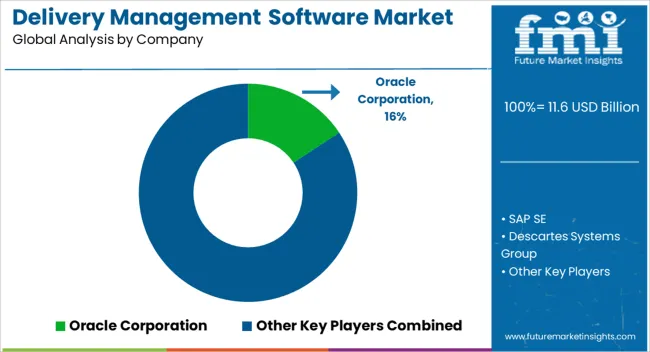

The Delivery Management Software Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 25.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Delivery Management Software Market Estimated Value in (2025 E) | USD 11.6 billion |

| Delivery Management Software Market Forecast Value in (2035 F) | USD 25.5 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The Delivery Management Software market is experiencing robust growth, driven by the ongoing expansion of e-commerce, on-demand services, and logistics optimization requirements. In the current market scenario, businesses are increasingly adopting intelligent platforms that enable real-time tracking, automated dispatch, route optimization, and data-driven decision-making. Growth is being supported by rising consumer expectations for faster and more reliable deliveries, coupled with the operational need to reduce costs and improve efficiency.

The future outlook of this market is expected to be shaped by the continued integration of artificial intelligence, machine learning, and predictive analytics into delivery management platforms. Investments in SaaS-based solutions and cloud infrastructure are further facilitating scalable adoption across small, medium, and large enterprises.

Increasing demand for contactless and last-mile delivery services, particularly in urban areas, is creating opportunities for software platforms that can provide seamless coordination among drivers, customers, and businesses The adoption of modular solutions that allow for customization according to industry-specific requirements is also driving market expansion, positioning the Delivery Management Software market for sustained growth in the coming decade.

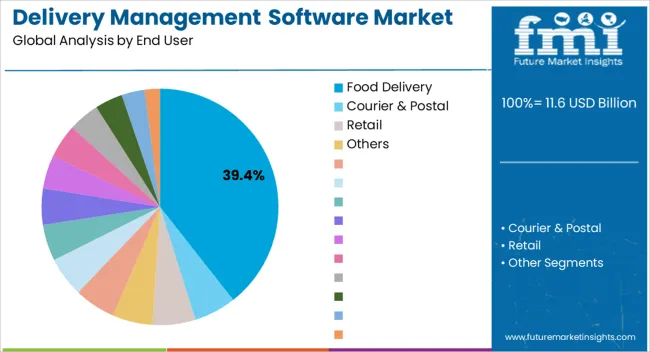

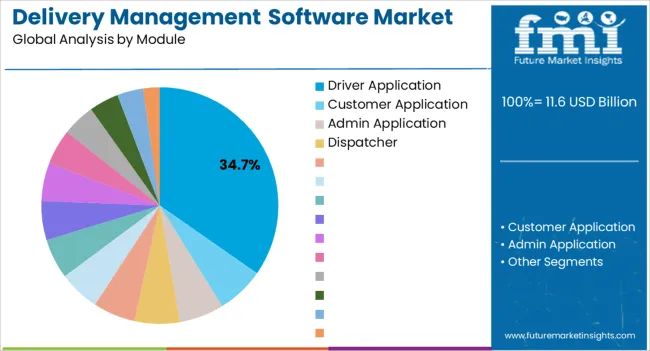

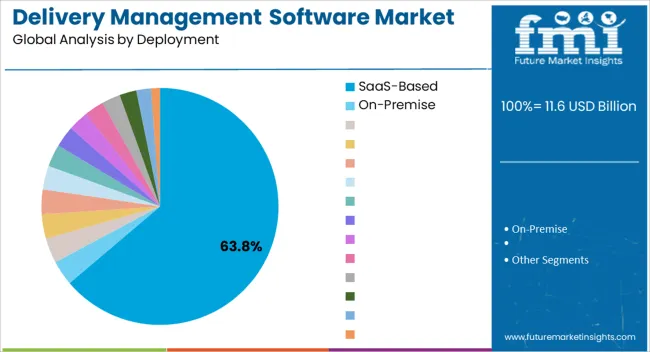

The delivery management software market is segmented by end user, module, deployment, and geographic regions. By end user, delivery management software market is divided into Food Delivery, Courier & Postal, Retail, and Others. In terms of module, delivery management software market is classified into Driver Application, Customer Application, Admin Application, and Dispatcher. Based on deployment, delivery management software market is segmented into SaaS-Based and On-Premise. Regionally, the delivery management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Food Delivery end-user segment is projected to hold 39.40% of the Delivery Management Software market revenue in 2025, making it the leading segment. This dominance is being attributed to the rapid expansion of online food ordering platforms, increasing consumer preference for convenient delivery services, and heightened competition among restaurants to provide faster and more reliable delivery experiences.

Growth in this segment has been supported by the need for real-time order tracking, seamless communication with delivery personnel, and optimization of delivery routes to meet strict time constraints. The rise in demand for cloud-based mobile platforms that can integrate with restaurant POS systems has further accelerated adoption.

The use of analytics to monitor performance metrics, reduce delays, and enhance customer satisfaction has reinforced the segment’s position as the largest contributor to market revenue With the continuous expansion of urban delivery networks and increasing consumer reliance on digital ordering, the Food Delivery segment is expected to maintain its leadership, driven by scalable, technology-enabled operational efficiencies.

The Driver Application module is anticipated to account for 34.70% of the overall Delivery Management Software market revenue in 2025, reflecting its leading role among functional modules. Its growth has been enabled by the increasing emphasis on real-time driver communication, route optimization, and automated task management. This module allows drivers to efficiently manage deliveries, report status updates, and navigate dynamic traffic conditions, resulting in reduced delivery times and enhanced operational efficiency.

Adoption has been accelerated by the need to streamline last-mile operations, particularly in high-density urban areas where timely delivery is critical. The integration of AI-based routing and predictive analytics within the Driver Application module has further improved performance metrics, while mobile accessibility ensures adaptability across varied geographic regions.

The ability to upgrade the application over software updates without changing the underlying platform has reinforced its adoption As delivery networks expand and customer expectations for timely service continue to rise, the Driver Application module is expected to retain its dominant market position and drive further innovation in delivery management solutions.

The SaaS-based deployment segment is projected to hold 63.80% of the Delivery Management Software market revenue in 2025, representing the leading deployment model. This predominance is being driven by the flexibility, scalability, and cost efficiency offered by cloud-based solutions, allowing businesses to quickly onboard, configure, and expand software without significant infrastructure investment. Growth has been reinforced by the ability to provide real-time updates, centralized management, and seamless integration with multiple endpoints, including drivers, customers, and warehouse systems.

The subscription-based pricing model reduces upfront costs and enables small and medium enterprises to access enterprise-level functionalities. Additionally, SaaS platforms facilitate rapid deployment of feature upgrades, analytics capabilities, and security enhancements, ensuring consistent performance and compliance.

The increasing reliance on remote and distributed delivery networks has further accelerated adoption As enterprises continue to prioritize operational agility, reduced IT overhead, and software flexibility, the SaaS-based deployment model is expected to maintain its leadership, driving market expansion across multiple delivery sectors.

Transforming business operations and the increasing preferences of customers for online shopping are driving the global delivery management software market. Delivery management software connects the driver and the back-end office through a single platform.

Delivery management software provides all the information required by a driver for the delivery of an item and gives a complete overview of the delivery status to the back-end office. Through delivery management software, companies get complete information about the delivery, improvements in driver efficiency, receive real-time updates and improved tracking of deliveries, among others.

Through handheld devices, delivery management software enables the assigning of daily tasks to drivers and provides updates on deliveries, among others. Delivery management software enhances the driver efficiency by providing complete details about the pending delivery and helps avoid late delivery. Delivery management software enables the capturing of the time, date and location of delivery along with reasons for failed delivery. Delivery management software provides real-time updates and data can be directly uploaded to the ERP system, thus providing timely and accurate information needed for reporting and monitoring.

Vendors offer delivery management software with a delivery driver application, admin panel, dispatcher panel, customer tracking application and others. The delivery driver application in delivery management software provides the real-time requests, delivery verification, driver tracking, route optimisation, driver dashboard and other features.

The admin panel in the delivery management software includes route optimisation, intelligent dispatch, customer communication, reporting & analytics, real-time tracking and others. The dispatcher panel in the delivery management software includes a dispatch dashboard that aids in the creation & assignment of a task, tracking of the driver, provides notification alerts, etc. The customer tracking application in the delivery management software provides options that include order tracking, real-time updates, service feedback, contact driver and others. Vendors integrate various modules into the delivery management software, i.e. requirement analytics, payment gateways, notification integration, security compliance checks, marketing services, booking integration, support & maintenance and others.

The global delivery management software market is expected to witness double-digit Y-o-Y growth during the forecast period with a CAGR of around 14%. Several developments in delivery management software with reference to technology, along with recent developments and innovations, are expected to drive the global delivery management software market during the forecast period.

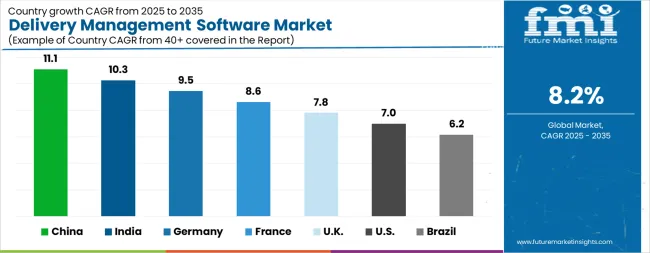

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.5% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The Delivery Management Software Market is expected to register a CAGR of 8.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.1%, followed by India at 10.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.2%, yet still underscores a broadly positive trajectory for the global Delivery Management Software Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.5%. The USA Delivery Management Software Market is estimated to be valued at USD 4.0 billion in 2025 and is anticipated to reach a valuation of USD 7.9 billion by 2035. Sales are projected to rise at a CAGR of 7.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 522.1 million and USD 354.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| End User | Food Delivery, Courier & Postal, Retail, and Others |

| Module | Driver Application, Customer Application, Admin Application, and Dispatcher |

| Deployment | SaaS-Based and On-Premise |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oracle Corporation, SAP SE, Descartes Systems Group, Manhattan Associates, Infor, BluJay Solutions, Project44, Bringg, FarEye, LogiNext Solutions, Onfleet, GetSwift, Shippo, FourKites, Wise Systems, DispatchTrack, and Zebra Technologies |

The global delivery management software market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the delivery management software market is projected to reach USD 25.5 billion by 2035.

The delivery management software market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in delivery management software market are food delivery, courier & postal, retail and others.

In terms of module, driver application segment to command 34.7% share in the delivery management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

The dental delivery system market is segmented by modality, and end user from 2025 to 2035

Oxygen Delivery Units Market

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network (CDN) Market Report - Growth, Demand & Forecast 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Insulin Delivery Pen Market Growth – Trends & Forecast 2024-2034

Content Delivery Network Security Market

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Last Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA