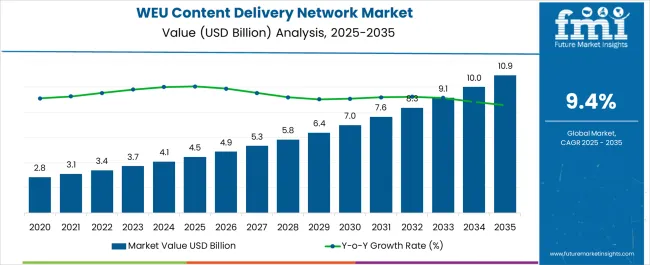

The Content Delivery Network Industry Analysis in Western Europe is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

| Metric | Value |

|---|---|

| Content Delivery Network Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 4.5 billion |

| Content Delivery Network Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The content delivery network industry in Western Europe is experiencing consistent growth. Increasing internet penetration, rising demand for high-quality streaming, and the surge in digital media consumption are driving expansion. Market dynamics are being shaped by adoption of cloud-based platforms, investments in edge infrastructure, and regulatory emphasis on data protection and network security.

Competitive intensity is pushing providers to enhance scalability and reduce latency, ensuring seamless digital experiences across multiple platforms. Future growth outlook is anchored in rising video-on-demand consumption, online gaming, and enterprise adoption of cloud-based applications. Expansion of 5G networks and continued growth of SaaS platforms are expected to further strengthen industry demand.

The rationale for sustained growth lies in the convergence of high data traffic volumes, the critical need for reliable delivery infrastructure, and the strategic role of CDNs in enabling digital transformation across enterprises As organizations scale digital operations and consumers demand faster, secure, and uninterrupted experiences, the Western European CDN industry is expected to deliver stable revenue expansion and higher adoption rates.

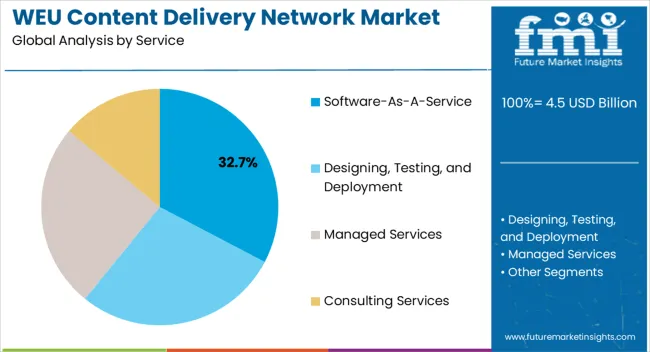

The software-as-a-service segment, representing 32.70% of the service category, has maintained leadership due to its ability to provide scalable, cost-efficient, and easily deployable solutions across enterprises. Its prominence has been reinforced by the growing shift toward subscription-based delivery models that ensure flexibility and reduced capital expenditure.

SaaS-enabled CDNs support enterprises in addressing bandwidth spikes, optimizing content delivery, and improving user engagement. The segment benefits from seamless integration with cloud ecosystems, driving adoption among both large enterprises and SMEs.

Enhanced security protocols, automated updates, and real-time analytics are further strengthening SaaS uptake within the region Sustained demand from industries with dynamic digital traffic requirements, combined with rising focus on remote accessibility and efficiency, is expected to sustain the segment’s share and support long-term market stability.

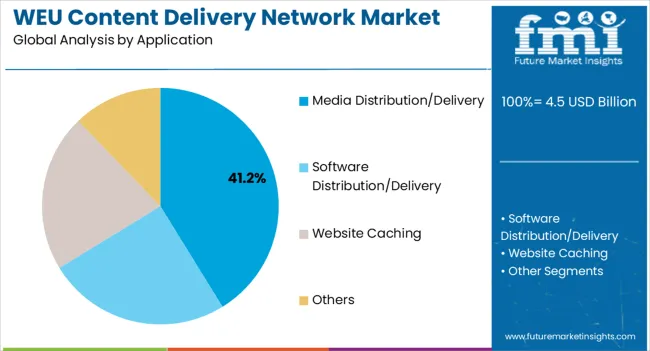

The media distribution and delivery segment, accounting for 41.20% of the application category, has been driving CDN adoption as demand for high-definition video streaming, live broadcasting, and online content surges. Market dominance is being reinforced by increasing consumer preference for on-demand media and the expansion of over-the-top platforms.

Reduced buffering times and improved latency management have positioned CDNs as critical infrastructure for media applications. Western Europe’s robust digital ecosystem and rising internet speeds are further strengthening segment growth.

Investments in edge computing and adaptive bitrate streaming technologies have improved user experiences, making CDNs indispensable for broadcasters and content providers With media consumption continuing to rise across mobile and connected devices, this segment is expected to sustain its leadership and remain a cornerstone of CDN deployment in the region.

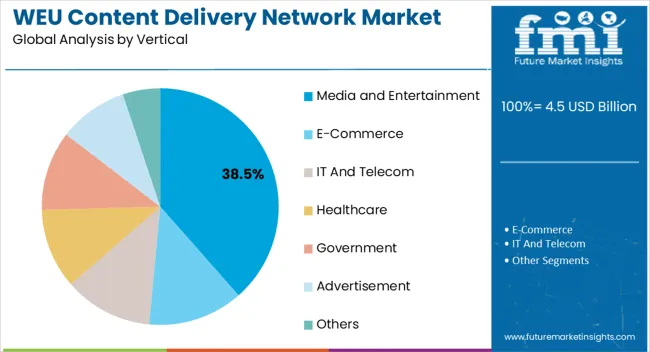

The media and entertainment vertical, holding 38.50% of the vertical category, has emerged as the largest contributor due to increasing digitalization of content and high consumer demand for immersive experiences. The vertical benefits from steady growth in online streaming, gaming, and digital events, all requiring robust CDN infrastructure for seamless delivery.

Market share is supported by strong adoption among broadcasters, studios, and online platforms leveraging CDN capabilities to enhance user satisfaction and minimize service disruptions. Integration of content analytics, monetization models, and personalized delivery solutions has further strengthened adoption within the sector.

With the ongoing expansion of 5G, rising investment in digital entertainment platforms, and consumer preference for multi-device accessibility, the media and entertainment vertical is expected to maintain its leading position and drive significant growth opportunities for the Western European CDN industry.

A thorough segmentation analysis of content delivery network (CDN) in Western Europe is included in this section. The service providers of content delivery network (CDN) in Western Europe are closely monitoring market trends and the expanding demand in the media distribution/delivery segment. The media and entertainment segment is likely to outshine other verticals.

With the media distribution/delivery segment expected to dominate sales, Western Europe's content delivery network (CDN) sector is projected to expand significantly. The increasing popularity of online media consumption, combined with the growing need for effective content streaming, are the primary catalysts.

| Segment | Media Distribution/Delivery |

|---|---|

| Industry Share in 2025 | 26.70% |

The media distribution/delivery application becomes significant as many rely on digital platforms for information and entertainment. A strong surge in demand for optimized media delivery solutions has defined the trajectory of the sales of content delivery network (CDN) in Western Europe, putting the media distribution/delivery segment at the pinnacle of market reshaping.

The media and entertainment vertical are set to lead sales in the content delivery network (CDN) industry in Western Europe. The industry's growing reliance on seamless content delivery for gaming platforms, streaming services, and online media consumption is the reason for the spike in demand.

| Segment | Media and Entertainment |

|---|---|

| Industry Share in 2025 | 15.60% |

The media and entertainment sector is at the forefront of content delivery network (CDN) adoption in Western Europe. This is because it prefers rich media content and real-time streaming, which guarantees dependable delivery to a large audience. The spread of digital platforms is another factor propelling the trend, robust CDN infrastructures keep up with the changing demands of consumers and content providers.

The table below depicts the expected demand for content delivery network in Western Europe, with an emphasis on the region's major economies, the United Kingdom, Germany, France, the Netherlands, and Italy. According to the comprehensive investigation, the Germany has lucrative potential with the presence of influential content delivery network (CDN) service providers in Western Europe.

| Country | CAGR from 2025 to 2035 |

|---|---|

| United Kingdom | 7.4% |

| Germany | 10.3% |

| France | 8.4% |

| Netherlands | 6.9% |

| Italy | 8.4% |

Given the profit margins in Western Europe businesses, the content delivery network is highly fragmented. To establish long-term, sustainable revenue strategies and expedite the development of new products, content delivery network service providers in Western Europe emphasize strategic alliances with end user companies and other players. Video-on-demand and video conferencing applications present significant opportunities that content delivery solution vendors are keeping an eye on.

Examining the Cutting-Edge Content Delivery Network Developments in Western Europe

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 4.5 billion |

| Projected Valuation (2035) | USD 10.9 billion |

| Anticipated CAGR (2025 to 2035) | 9.4% |

| Historical Analysis of Content Delivery Network (CDN) in Western Europe | 2020 to 2025 |

| Demand Forecast for Content Delivery Network (CDN) in Western Europe | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Countries Analyzed while Studying Opportunities for Content Delivery Network (CDN) in Western Europe | United Kingdom, Germany, France, Netherlands, Italy |

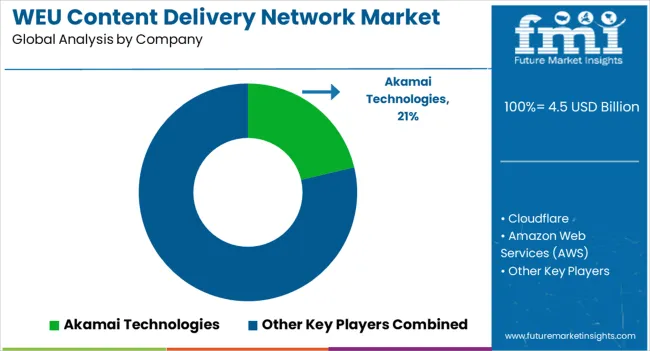

| Key Companies Profiled Content Delivery Network in Western Europe | Akamai Technologies; Cloudflare; Amazon Web Services (AWS); Limelight Networks; Fastly; CDNetworks; Level 3 Communications; Imperva (formerly Incapsula) |

By Country:

The global content delivery network industry analysis in Western Europe is estimated to be valued at USD 4.5 billion in 2025.

The market size for the content delivery network industry analysis in Western Europe is projected to reach USD 11.0 billion by 2035.

The content delivery network industry analysis in Western Europe is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in content delivery network industry analysis in Western Europe are software-as-a-service, _bundled suites, _individual modules, designing, testing, and deployment, managed services and consulting services.

In terms of application, media distribution/delivery segment to command 41.2% share in the content delivery network industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Content Creation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Disarm and Reconstruction Market Size and Share Forecast Outlook 2025 to 2035

Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Content Curation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Experience Platforms Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics, Discovery, and Cognitive Software Market Analysis by Product Type, End User, and Region through 2035

Content Service Platform Market Trends - Demand & Growth Forecast 2025 to 2035

Content as a Service (CaaS) Market

Content Automation AI Tools Market

Content Intelligence – AI-Powered Insights for Marketers

Content Protection and Watermarking Market

Content Delivery Network (CDN) Market Report - Growth, Demand & Forecast 2025 to 2035

Content Delivery Network Security Market

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

AI-Powered Content Creation – Automating Digital Media

OTT Content Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA