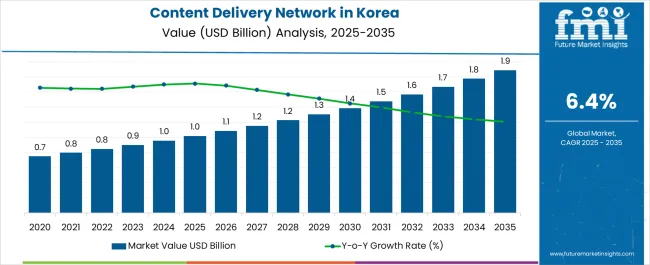

The Content Delivery Network Industry Analysis in Korea is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Content Delivery Network Industry Analysis in Korea Estimated Value in (2025 E) | USD 1.0 billion |

| Content Delivery Network Industry Analysis in Korea Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The content delivery network (CDN) industry in Korea is expanding rapidly. Growth is being driven by the surge in digital content consumption, strong internet penetration, and rising demand for seamless streaming experiences. The current scenario is shaped by heavy investments in network infrastructure, widespread adoption of cloud-based solutions, and increased reliance on real-time content distribution across platforms.

Service providers are focusing on low-latency delivery, improved caching, and security-enhanced solutions to meet the requirements of enterprises and consumers. The future outlook is underpinned by the continued rise of OTT platforms, gaming, and e-learning, which are expected to place greater emphasis on high-capacity CDN services.

Regulatory alignment with data localization and cybersecurity frameworks is also shaping the industry’s trajectory The growth rationale rests on the convergence of digital transformation initiatives, the proliferation of high-definition content formats, and the ability of CDN providers to deliver scalability and resilience, positioning the market for sustained adoption across multiple application domains.

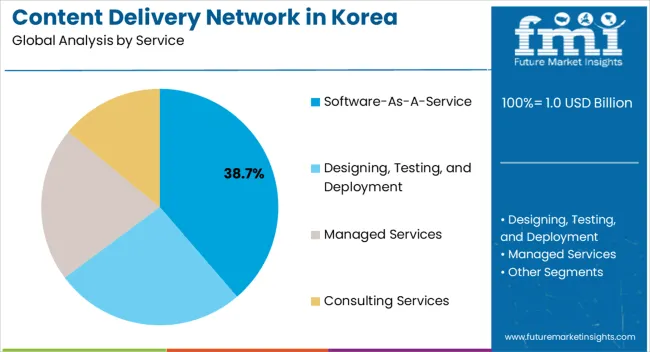

The software-as-a-service segment, accounting for 38.70% of the service category, has been leading the market due to its scalability, flexibility, and cost-efficient deployment model. Its prominence is being reinforced by demand from enterprises requiring rapid CDN integration without extensive capital investment.

Adoption is further driven by the ability to deliver enhanced traffic management, real-time analytics, and automated scaling capabilities. Korean enterprises have embraced SaaS-based CDN models to support the increasing complexity of multi-device content consumption.

The segment’s sustained performance is being supported by continuous improvements in software capabilities, integration with cloud platforms, and strong security protocols With ongoing emphasis on efficiency and adaptability, SaaS models are expected to maintain a competitive edge, enabling widespread adoption across businesses of varying sizes in Korea.

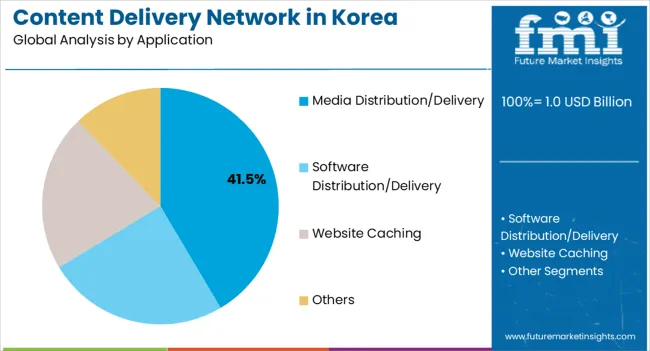

The media distribution and delivery segment, holding 41.50% of the application category, has established dominance due to the explosive demand for streaming services, live broadcasting, and interactive content platforms. Its market leadership is being sustained by consistent end-user consumption of video-on-demand, sports streaming, and real-time media events.

CDN providers are optimizing delivery networks to ensure high-definition and ultra-HD streaming experiences with minimal buffering and latency. The growing consumption of short-form video and social media content is further strengthening demand.

In Korea, a digitally active population and the popularity of OTT platforms are key drivers maintaining the segment’s share Future momentum will be reinforced by increased adoption of immersive content formats such as VR and AR, requiring advanced CDN solutions to support higher bandwidth and real-time delivery.

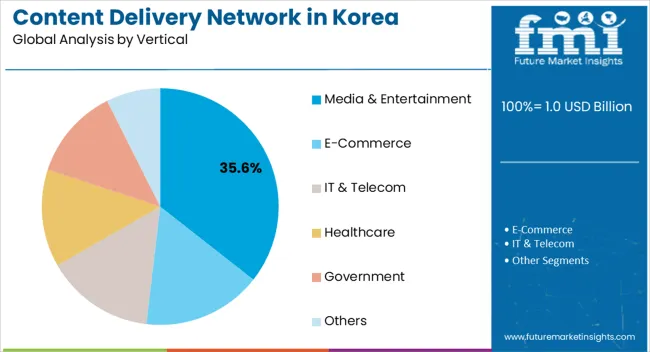

The media and entertainment vertical, representing 35.60% of the vertical category, is maintaining its leading position as digital content continues to dominate consumer engagement channels. The vertical’s growth is supported by investments from broadcasters, gaming companies, and OTT providers who rely on CDN solutions to ensure uninterrupted user experiences.

Korean media companies are leveraging CDN technologies to deliver localized and global content with consistency and compliance. Demand is being amplified by high internet penetration and a cultural preference for high-quality, fast-access media.

As the sector shifts towards personalized and interactive content, CDN solutions are being integrated with analytics and AI-driven platforms to optimize performance This evolution is expected to sustain the media and entertainment segment’s market share, ensuring continued leadership in the Korean CDN industry.

Rapid Growth in Online Content Consumption Drives the CDN Industry Growth in Korea

Korea is technologically one of the most advanced countries in the world. In the last few years, the demand for online content, including streaming services, gaming, and eCommerce, has grown substantially in Korea.

The young population in Korea relies heavily on digital platforms for entertainment, information, and shopping. This has increased the demand for efficient content delivery, driving the expansion of CDN services.

Apart from this, internet services have penetrated every nook and corner of the Korean region. The availability of high-speed internet in the hands of the general Korean population has also been one of the significant drivers for the expansion of this industry. The demand for CDN services is also soaring due to the rise of video streaming services in Korea.

On the basis of application, media distribution/delivery dominates the Korea content delivery network industry, with a whopping share of 24.40%. Not only this, CDN also provide scalability to handle sudden spikes in demand during media events, such as live streaming of sports events, concerts, or popular TV shows.

| Attributes | Details |

|---|---|

| Application | Media Distribution/Delivery |

| Value Share in 2025 | 24.40% |

For decades, the media distribution industry has been looking for an efficient way to distribute content in large quantities. CDN deploy servers in multiple locations worldwide, significantly reducing latency and improving load times.

This is crucial for media distribution, especially in streaming services, where delays can result in buffering and a poor user experience. Their demand in the media distribution and delivery industry is also rising because of their capability to provide effective analytics tools to monitor the performance of media distribution.

Based on the vertical, media and entertainment industries dominate the Korea CDN industry, holding a share of 15.50%. CDN are in high demand in Korea because they enhance user experience by preventing buffering, reducing load times, and ensuring smooth content delivery.

| Attributes | Details |

|---|---|

| Vertical | Media and Entertainment |

| Value Share in 2025 | 15.50% |

The demand for CDN in the Korean media and entertainment world is high, enabling companies to deliver content globally. Video streaming is a dominant form of media consumption, and CDN are instrumental in optimizing the delivery of video content.

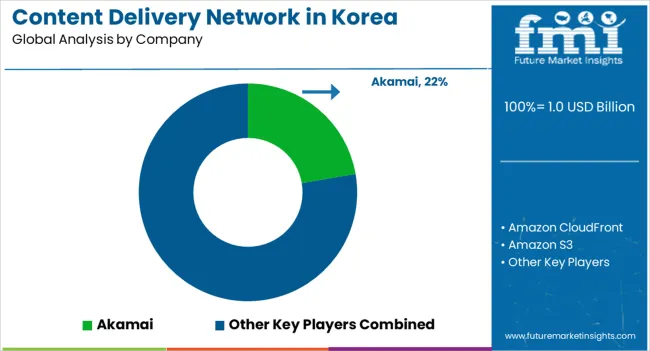

The competitive landscape of the content delivery network industry in Korea is filled with numerous players, such as Akamai, Amazon CloudFront, Alibaba Cloud CDN, etc. These companies provide content delivery services not only to local consumers but also to international consumers.

The sustenance of small and new enterprises in this cutthroat competition is very difficult. In this scenario, players have to keep up with new technological innovations and evolving consumer demands to stay relevant in the industry.

Recent Developments in the Content Delivery Network Industry in Korea:

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 1.0 billion |

| Projected Valuation (2035) | USD 1.9 billion |

| Anticipated CAGR (2025 to 2035) | 6.4% CAGR |

| Historical Analysis of the Content Delivery Network in Korea | 2020 to 2025 |

| Demand Forecast for the Content Delivery Network in Korea | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Companies Profiled | Akamai; Amazon CloudFront; Amazon S3; Alibaba Cloud CDN; Cloudflare; Fastly; Google Cloud CDN; Limelight Networks; Microsoft Azure CDN; Oracle Cloud Infrastructure CDN; StackPath; Verizon Cloud CDN |

The global content delivery network industry analysis in Korea is estimated to be valued at USD 1.0 billion in 2025.

The market size for the content delivery network industry analysis in Korea is projected to reach USD 1.9 billion by 2035.

The content delivery network industry analysis in Korea is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in content delivery network industry analysis in Korea are software-as-a-service, _bundled suites, _individual modules, designing, testing, and deployment, managed services and consulting services.

In terms of application, media distribution/delivery segment to command 41.5% share in the content delivery network industry analysis in Korea in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Content Creation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Disarm and Reconstruction Market Size and Share Forecast Outlook 2025 to 2035

Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Content Curation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Experience Platforms Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics, Discovery, and Cognitive Software Market Analysis by Product Type, End User, and Region through 2035

Content Service Platform Market Trends - Demand & Growth Forecast 2025 to 2035

Content as a Service (CaaS) Market

Content Automation AI Tools Market

Content Intelligence – AI-Powered Insights for Marketers

Content Protection and Watermarking Market

Content Delivery Network (CDN) Market Report - Growth, Demand & Forecast 2025 to 2035

Content Delivery Network Security Market

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

AI-Powered Content Creation – Automating Digital Media

OTT Content Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA