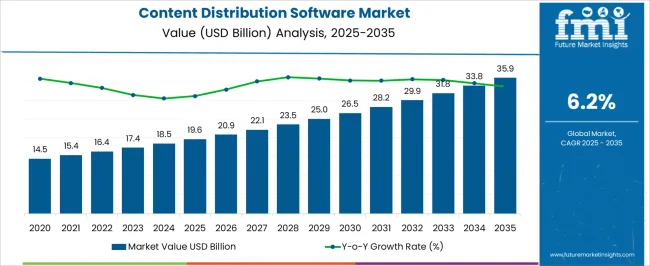

The Content Distribution Software Market is estimated to be valued at USD 19.6 billion in 2025 and is projected to reach USD 35.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Content Distribution Software Market Estimated Value in (2025 E) | USD 19.6 billion |

| Content Distribution Software Market Forecast Value in (2035 F) | USD 35.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The content distribution software market is expanding rapidly, fueled by the exponential rise in digital content consumption and the shift toward globalized business operations. Industry announcements and corporate reports have emphasized the growing need for efficient software platforms that enable seamless distribution of multimedia, data, and enterprise applications across geographies. Advancements in cloud infrastructure, edge computing, and AI-driven optimization have significantly improved content delivery speed, scalability, and personalization. Organizations are increasingly adopting content distribution solutions to support remote workforces, digital marketing campaigns, and real-time user engagement.

Regulatory standards related to data privacy and security have further accelerated the adoption of advanced distribution platforms with built-in compliance frameworks. Strategic partnerships between technology providers and enterprises are also broadening market penetration by integrating content distribution with analytics and workflow automation.

Looking ahead, the market is expected to sustain its growth through continuous innovation in content delivery networks, the adoption of hybrid distribution models, and the rising demand for scalable platforms across diverse industry verticals.

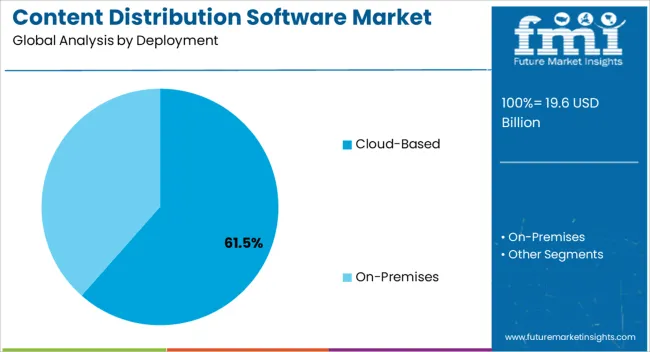

The Cloud-Based segment is projected to contribute 61.5% of the content distribution software market revenue in 2025, establishing itself as the dominant deployment model. Growth in this segment has been driven by enterprises prioritizing scalability, cost efficiency, and flexibility in managing distributed content. Cloud-based solutions have enabled organizations to reduce infrastructure expenses while ensuring high availability and rapid deployment across global regions.

Technology providers have enhanced platform capabilities with automated updates, AI-driven load balancing, and content security features, making cloud-based systems highly reliable. The increasing shift to digital-first operations and the widespread adoption of hybrid work models have reinforced reliance on cloud deployment to facilitate real-time collaboration and remote content delivery.

Additionally, the ability of cloud-based platforms to seamlessly integrate with enterprise applications and analytics tools has strengthened their adoption. As businesses continue to scale their digital operations, the Cloud-Based segment is expected to retain its leadership due to its adaptability and operational efficiency.

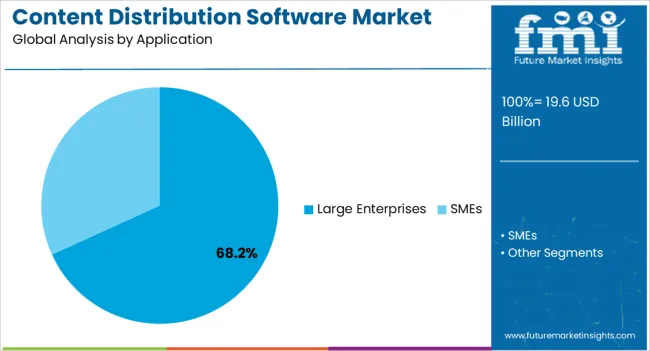

The Large Enterprises segment is projected to hold 68.2% of the content distribution software market revenue in 2025, maintaining its position as the leading application category. This dominance has been shaped by the high volume of content that large organizations must manage, distribute, and secure across multiple departments, regions, and customer touchpoints. Enterprises have invested heavily in content distribution platforms to streamline workflows, ensure consistent brand messaging, and enhance user engagement on a global scale.

Corporate disclosures and industry insights have highlighted increasing adoption of software that supports multi-channel delivery, content analytics, and compliance management. Large enterprises have also been early adopters of advanced features such as AI-driven personalization, automated localization, and integration with customer experience platforms.

Furthermore, the need to support complex partner ecosystems, extensive client bases, and high data traffic volumes has driven reliance on robust content distribution solutions. With continued digital transformation initiatives and growing emphasis on customer-centric operations, the Large Enterprises segment is expected to sustain its leadership in the market.

As per the Content Distribution Software Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2025, the market value of the Content Distribution Software Market increased at around 4.4% CAGR. With an absolute dollar opportunity of USD 35.9 billion, the market is projected to reach a valuation of USD 47.4 billion by 2035.

The global Content Distribution Software market is expected to expand due to rising data demands globally. Content Distribution Software allows for the structured storage of visuals, new records, video content, and other digital streaming content. Furthermore, vast applications of these systems and tools enable an organization to easily generate, evaluate, modify and publicly release electronic text.

Moreover, Content Distribution Software is progressively being used to maintain websites with countless reviewers and segments, like journals and official websites. Commuting, accommodation, commercial, schooling, administration and business, amusement, medical services, sports arenas, and other industries use Content Distribution Software.

Graphics, HD video, and animation technology advancements that result in morphed content are expected to drive the demand. Additionally, increasing the application of BYOD, mobile phones, tablet devices, mobile smartphone applications, and cloud services is expected to boost demand. The wider availability of omnichannel and unified platform solutions is expected to drive market growth by limiting complications and late delivery of solutions to end users.

The rise of cloud computing and big data analytics is the key driving force of the assertive Content Distribution Software market. Furthermore, one of the key factors contributing to the growth of the persuasive Content Distribution Software market is the growing demand for cost-effective and flexible solutions for better content distribution.

The Content Distribution System (CDS) is a software application that provides cooperative and managerial tools for easily managing web content. The web Content Distribution system's key features include easy content distribution, the ability to have number of users, simplified website maintenance, and simple modifications to the website interface. More network security and data backups are required for the system.

The fastest growing contributing sectors to the Content Distribution Software market are administration, biological sciences, medical services, e-commerce, consumables, and security. Moreover, the Content Distribution Software market is expected to be driven by rapidly growing data requirements and a surge in cloud platforms.

By offering improved interactive tools and effective analytics, Content Distribution Software ensures the effective management of content for various enterprises globally. This result in more cost-effective and performance-enhancing solutions, better IT infrastructure management, and increased decision-making efficiency. Furthermore, cost reductions in web server, electronics, internet access, and networking devices are expected to drive Content Distribution Software market growth.

The growing challenges in collecting data, combined with end-user ignorance, might very well present a challenge to industry growth. Furthermore, the growing sophistication of this software, as well as end-user perceptions, may thwart market growth. But nevertheless, future trends such as increased marketing digitization, customer engagement, smart device utilization, usage of online monitoring systems, an uptick in the number of social intranets, and increased e-commerce structures are anticipated to drive the market.

The media and entertainment industry has seen widespread implementation of Content Distribution Software. To meet changing customer expectations, media and entertainment companies are increasingly incorporating effective advertising techniques to provide enhanced customer experiences and personalized content. Artificial Intelligence (AI), analytics, and Machine Learning (ML) are advanced technologies that help marketers optimize their distributing operations and implement data-driven marketing strategies. The analytics-based insights assist firms in establishing successful marketing content for their customers. Content marketing software assists marketers in reducing the intricacies associated with making, releasing, and improving content. It also considerably reduces the time required for content creation and publication.

Government and public utilities, credit, finance and insurance, universal health care as well as biomedical, IT and communications systems, schooling, security, publication and broadcaster, among others are all part of the vertical segment. Due to the growing IT industry base and the growing need for document management in the sector, the IT and telecommunications segment will hold the largest market share in the future. The field of biomedical science segment is reported to witness the highest CAGR in the coming years, attributed to rapid technological advancements in this sector.

In 2025, North America held the largest share in the global Content Distribution Software market. The North American market will be driven by a substantial number of treatment possibilities, high awareness of Content Distribution Software, and the growing availability of innovative internet technologies to facilitate the work process over the projected timeframe.

Furthermore, significant investments in the creation of advanced devices and software will boost this segment growth. The United States' well-established IT industry contributes significantly to the country's large share of the region. Furthermore, the region's market is expected to be propelled in the future by a large consumer base that prefers technologically sophisticated customer interface software.

The Asia Pacific Content Distribution Software market is projected to expand at the fastest rate in the future, owing to increased investments and focus on medical data management, increased awareness of Content Distribution Software, rising R&D expenditure, and surge in prevalence of micro and small-scale enterprises in the region. The Asia Pacific market is also being influenced by the increasing adoption of technologically sophisticated systems, urban sprawl, and elevated cyber terrorism.

By the end of 2035, the United States is expected to account for the largest market share of USD 14.5 billion. It previously expanded at a significant CAGR of 11.8% from 2020 to 2025 and is expected to grow at a CAGR of 10.9% over the forecasted period. The increase in the number of industry participants, along with technological developments, are significant factors stimulating the development of the United Sates market.

Cloud-Based Content Distribution Software commanded the largest revenue and thrived at a CAGR of nearly 11.9% in 2025. The market through cloud-deployed content distribution software is forecasted to expand at a CAGR of 11% during the forecast period. The massive growth attributes anticipated to fuel the growth of the cloud segment in the persuasive Content Distribution Software market are cost reduction and sophistication.

Content distribution software revenues through large enterprises commanded the largest revenue and is forecasted to grow at a CAGR of 10.8% during the forecast period. The addition and implementation of new technologies in various industry verticals can be attributed to the growth of the large enterprise segment, which is a key growth factor for the global Content Distribution Software market. Due to the exponentially growing penetration of large enterprises in emerging economies, as well as rising awareness about the well-organized work process and Content Distribution Software, the large enterprise segment is expected to propel over the projected years.

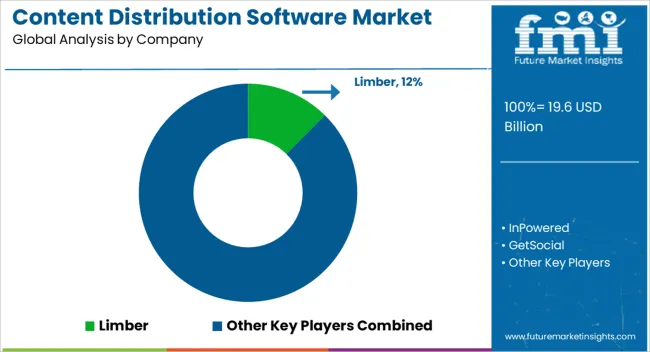

Some of the key players operating in the content distribution software market include Limber, InPowered, GetSocial, Revcontent, Brax, RelayTo, lippingBook, PaperFlite, ContentStudio, UpContent, CoSchedule Marketing Calendar, RebelMouse, Outbrain Amplify, and Structured Web.

Similarly, recent developments related to companies in Content Distribution Software services have been tracked by the team at Future Market Insights, which are available in the full report.

The global content distribution software market is estimated to be valued at USD 19.6 billion in 2025.

The market size for the content distribution software market is projected to reach USD 35.9 billion by 2035.

The content distribution software market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in content distribution software market are cloud-based and on-premises.

In terms of application, large enterprises segment to command 68.2% share in the content distribution software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

Content Creation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Curation Software Market Size and Share Forecast Outlook 2025 to 2035

GCC Software Distribution Market Analysis - Size, Share & Trends 2025 to 2035

USA Software Distribution Market Report – Growth, Demand & Forecast 2025-2035

Content Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Japan Software Distribution Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Software Distribution Market Insights – Size, Trends & Forecast 2025-2035

Content Analytics, Discovery, and Cognitive Software Market Analysis by Product Type, End User, and Region through 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA