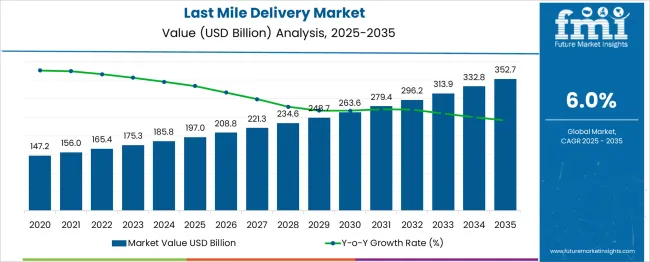

The Last Mile Delivery Market is estimated to be valued at USD 197.0 billion in 2025 and is projected to reach USD 352.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Last Mile Delivery Market Estimated Value in (2025 E) | USD 197.0 billion |

| Last Mile Delivery Market Forecast Value in (2035 F) | USD 352.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The last mile delivery market is experiencing rapid growth as e-commerce and online retail continue to expand globally. Consumer expectations for faster and more reliable delivery have pushed logistics providers to optimize the final stage of the delivery process. The market is influenced by urbanization trends, rising demand for doorstep delivery, and advancements in delivery technologies.

Increasing investments in fleet expansion and infrastructure have improved service coverage and efficiency. Additionally, environmental concerns are shaping vehicle choices and route planning.

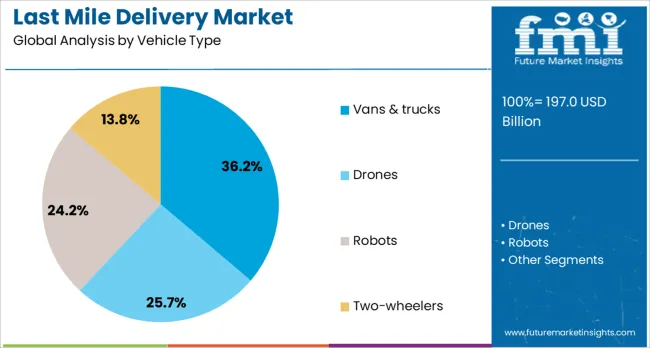

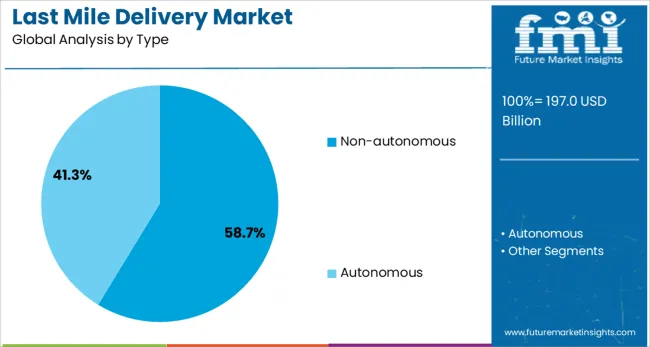

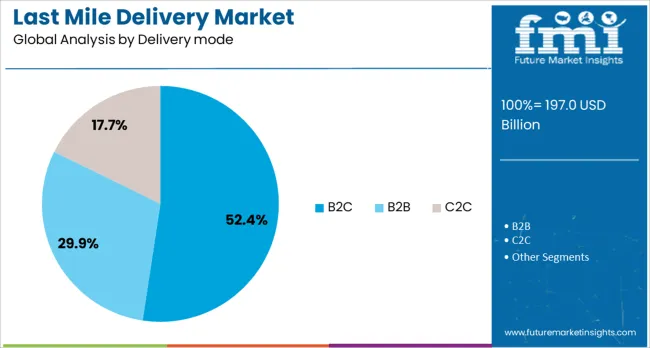

The market outlook remains positive as companies explore innovative delivery models and sustainable practices to meet growing customer demands. Segment growth is expected to be driven by Vans & Trucks as the preferred vehicle type, Non-autonomous delivery methods as the dominant type, and Business-to-Consumer (B2C) as the leading delivery mode.

The last mile delivery market is segmented by vehicle type, type, delivery mode, and application and geographic regions. By vehicle type of the last mile delivery market is divided into Vans & trucks, Drones, Robots, and Two-wheelers. In terms of type of the last mile delivery market is classified into Non-autonomous and Autonomous.

Based on delivery mode of the last mile delivery market is segmented into B2C, B2B, and C2C. By application of the last mile delivery market is segmented into E-commerce, Food and grocery, Parcel & courier services, Pharmaceutical, and Furniture & appliance. Regionally, the last mile delivery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Vans & Trucks segment is projected to hold 36.2% of the last mile delivery market revenue in 2025, establishing its position as the leading vehicle type. This segment has expanded due to the versatility of vans and trucks in handling diverse delivery volumes and parcel sizes. Their capacity to navigate urban and suburban areas efficiently makes them ideal for last mile logistics.

Fleet operators have favored these vehicles for their ability to balance cost and payload, supporting a wide range of delivery requirements. Additionally, the adaptability of vans and trucks for route optimization and multiple deliveries per trip has increased their utilization.

As delivery volumes continue to rise with e-commerce growth, vans and trucks are expected to remain the backbone of last mile vehicle fleets.

The Non-autonomous delivery segment is forecasted to account for 58.7% of the market revenue in 2025, retaining its dominance. This segment’s growth is supported by the current technological maturity and regulatory environment, which favor human-driven delivery operations. Non-autonomous vehicles offer operational flexibility, especially in complex urban environments where navigation and dynamic decision-making are critical.

Delivery companies have relied on experienced drivers to maintain service quality and customer satisfaction. While autonomous technologies are advancing, non-autonomous delivery remains the mainstay due to safety considerations and cost efficiency.

This segment will likely continue leading the market during the transition toward increased automation.

The Business-to-Consumer (B2C) delivery mode is expected to represent 52.4% of the last mile delivery market revenue in 2025, positioning it as the largest segment. The rise of e-commerce platforms and direct-to-consumer sales models has significantly increased B2C delivery volumes. Consumers are demanding fast, flexible, and reliable delivery options, prompting logistics providers to enhance their B2C capabilities.

Retailers are investing in last mile solutions that improve customer experience, including same-day and next-day delivery services. The growth of subscription-based services and online grocery shopping has also contributed to B2C dominance.

As consumer expectations continue to evolve, B2C delivery is set to remain the primary driver of last mile delivery market growth.

The last mile delivery market is being propelled by expanding consumer demand for fast and reliable parcel delivery. In 2024, e-commerce providers adopted fleet expansion strategies to support same-day and next-day services. In 2025, urban logistics firms implemented route optimization tools to reduce delivery times and operational costs. Simultaneously, opportunities are growing in electric vehicle and micro-fulfillment center integration. Providers offering tech-enabled delivery solutions with scalable fleet management capabilities are well positioned to lead in this competitive sector.

Rapid growth in online shopping has been recognized as the key driver of last mile delivery deployment. In 2024, fulfillment centers were observed expanding their delivery fleets to meet same-day and next-day delivery promises for consumers. In 2025, delivery services also began securing partnerships with cross-border retailers to handle increased parcel volumes during peak online sale periods. These trends indicate that consumer expectations, rather than retail platform growth alone, are shaping delivery infrastructure investments. Providers offering scalable fleet solutions and routing capabilities are therefore being positioned to support growing e-commerce fulfillment demands.

In 2024, delivery operators began pilot programs using electric vans and e-bikes for urban parcel drop-offs to lower emissions and reduce fuel expenditure. In 2025, dedicated electric depots and charging infrastructure were deployed by logistics firms to support full electric fleets in dense urban districts. These deployments show that electrification can elevate delivery services from standard transport providers into low-noise, emission-controlled partners. Suppliers offering integrated electric vehicle solutions, charging network support, and fleet telematics are thus being well positioned to capture demand from sustainable fleet–oriented delivery contracts.

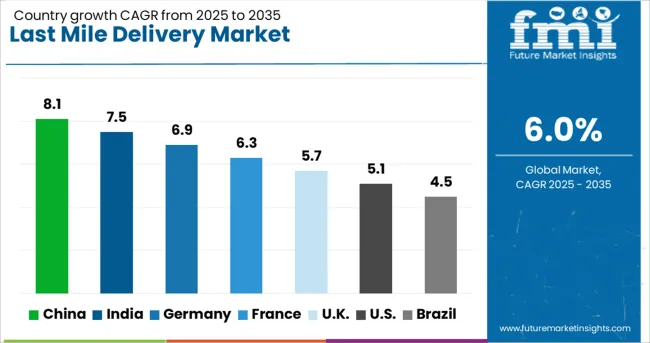

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global last mile delivery market is projected to grow at a CAGR of 6% between 2025 and 2035. China leads with 8.1%, followed by India at 7.5% and Germany at 6.9%. France records 6.3%, while the United Kingdom posts 5.7%. Growth is fueled by e-commerce expansion, demand for same-day delivery, and technological integration in logistics networks. China and India dominate through massive online retail ecosystems, while Germany focuses on automation and sustainability in delivery fleets. France and the UK prioritize electric delivery vehicles and route optimization solutions to meet emission targets and improve efficiency.

China is expected to grow at 8.1%, driven by its vast e-commerce ecosystem and high consumer expectations for ultra-fast deliveries. Logistics firms invest in autonomous delivery robots, drones, and electric vehicles for urban distribution. Integration of AI-driven route optimization platforms enhances delivery speed and cost-efficiency. Government support for smart logistics zones further accelerates last mile delivery adoption.

India is projected to grow at 7.5%, supported by booming online retail and hyperlocal delivery segments. E-commerce giants collaborate with third-party logistics players to expand reach in tier-2 and tier-3 cities. Battery-swapping EV models and two-wheeler fleets dominate cost-sensitive last mile networks. Digital platforms enhance visibility, enabling real-time tracking and dynamic route planning for improved consumer satisfaction.

Germany is forecast to grow at 6.9%, driven by demand for eco-friendly delivery solutions and precision logistics for e-commerce and B2B sectors. Electric vans and cargo bikes dominate green delivery initiatives in urban areas. German firms prioritize route optimization and predictive delivery technologies integrated with AI. Regulatory incentives for zero-emission logistics fleets support rapid infrastructure development for EV charging networks.

France is projected to grow at 6.3%, supported by growth in online grocery, fashion, and pharmacy deliveries. Adoption of zero-emission vehicles for city deliveries aligns with clean mobility mandates. Logistics companies deploy automated parcel lockers in high-density urban zones to optimize delivery schedules. Real-time tracking solutions integrated with consumer apps enhance transparency and improve delivery success rates.

The UK is forecast to grow at 5.7%, driven by e-commerce growth and demand for time-critical deliveries in healthcare and grocery sectors. Companies invest in delivery optimization platforms for multi-stop route planning. EV adoption gains momentum under government-backed clean transport programs. Subscription-based delivery models are rising, supported by increasing consumer preference for convenience-driven services.

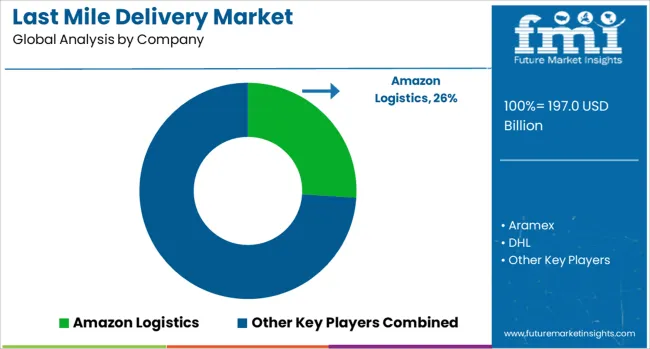

The last mile delivery market is moderately consolidated, led by Amazon Logistics with a 26.0% market share. The company holds a dominant position through its massive fulfillment network, advanced routing algorithms, and integration with its e-commerce platform. Dominant player status is held exclusively by Amazon Logistics.

Key players include Aramex, DHL, DoorDash, DPD, FedEx, GrubHub, Postmates, UPS, and USPS, each offering specialized delivery solutions such as same-day, food, and parcel services empowered by technology-driven tracking systems, dynamic pricing models, and local partnerships.

Emerging players are limited due to the high scale required to compete and strong customer expectations of delivery speed and visibility. Market demand is driven by rising e-commerce penetration, consumer demand for convenience, and the push for faster, reliable delivery in urban areas.

In May 2025, Amazon signed a multi‑year agreement with FedEx to handle residential delivery of select large and heavy packages, particularly where UPS has scaled back due to profitability concerns. This move strengthens Amazon’s delivery capabilities in bulk and rural segments, offers cost advantages, and diversifies its last‑mile delivery partners alongside UPS and USPS.

| Item | Value |

|---|---|

| Quantitative Units | USD 197.0 Billion |

| Vehicle Type | Vans & trucks, Drones, Robots, and Two-wheelers |

| Type | Non-autonomous and Autonomous |

| Delivery mode | B2C, B2B, and C2C |

| Application | E-commerce, Food and grocery, Parcel & courier services, Pharmaceutical, and Furniture & appliance |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Logistics, Aramex, DHL, DoorDash, DPD, FedEx, GrubHub, Postmates, UPS, and USPS |

| Additional Attributes | Dollar sales by delivery mode (drones, vans, bikes), regional demand trends, competitive landscape, buyer preferences for speed versus cost, integration with AI-based route optimization, innovations in autonomous delivery vehicles, robotic systems, and crowd-sourced delivery platforms. |

The global last mile delivery market is estimated to be valued at USD 197.0 billion in 2025.

The market size for the last mile delivery market is projected to reach USD 352.7 billion by 2035.

The last mile delivery market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in last mile delivery market are vans & trucks, drones, robots and two-wheelers.

In terms of type, non-autonomous segment to command 58.7% share in the last mile delivery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Last Mile Delivery Software Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Electric Last Mile Delivery Vehicle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Elastomeric Coating Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Tube Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Elastic Film Market Size and Share Forecast Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Elastic Laminate Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastisols Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA